Energy Brief: Administered Price Caps

Is This the Beginning of the End of Administered Price Caps (APC)?

-

August 03, 2022

DownloadsDownload Article

-

Why was the APC triggered recently?

When the average price of wholesale electricity over a week reaches heights that are likely to cause financial distress, the Australian Energy Market Commission’s (AEMC’s) $300 a megawatt hour (MWh) APC is triggered. It stays in place until the price falls below the trigger threshold.

This occurred in most National Energy Market (NEM) regions on 12–14 June 2022 as spot market prices soared in the previous week, driven by:

- significant constraints on the NEM’s thermal (coal and gas) fleet, including outages and logistics issues (for example, blocked railway lines prevented coal from reaching generation plants)

- global fuel scarcity resulting from the Russia–Ukraine war, leading to extreme operating costs for generators and a need to reserve fuel

- cold front, resulting in higher-than-usual demand.

Market failure or investment signal?

High spot price events are not a sign of market failure, but rather an investment signal. When the market experiences short, frequent wholesale electricity prices of $15,100/MWh, it is a signal to investors that they can earn money by building responsive generators and storage like batteries.

But the APC prioritises the short-term financial resilience of market participants – preventing the collapse of the retailers that supply energy consumers, including businesses and households – over the need to send investment signals.

As a safeguard, the APC was originally designed to be triggered during extremely rare events – and thus have minimal impact on investment decisions. But the factors that triggered the APC recently could be repeated.

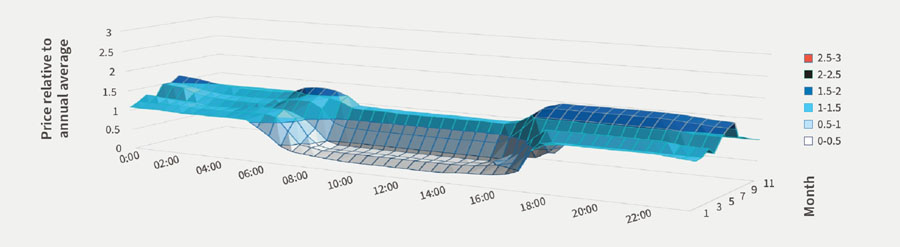

In particular, winter is expected to become the most expensive period in the spot market, with low outputs from renewable energy coinciding with increased household heating driving up demand – see Figure 1, FTI Consulting’s projected monthly price shape for 2035.

Figure 1 - FTI Consulting’s NEM-LAB market modelling – 2035 prices indexed to average prices

How would a battery operate under the APC?

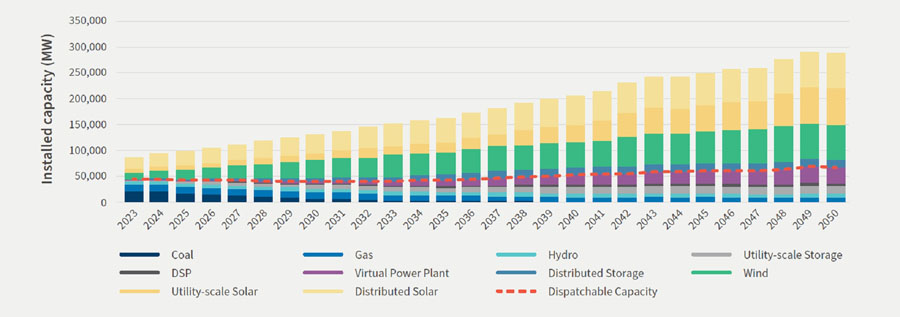

With several coal plants due to be retired over the next decade, replacement dispatchable capacity needs to be developed. Energy storage, particularly batteries, is expected to be the dominant technology that replaces coal (see Figure 2).

Batteries can produce several revenue streams. However, a significant contributor to revenue, particularly for longer duration storage, is energy arbitrage. This involves buying energy and charging when prices are low (supply is high) and selling energy and discharging it when prices are high (supply is low).

Figure 2 - Australian Energy Market Operator’s (AEMO) Integrated System Plan (ISP) 2022 - Projection of dispatchable capacity under step-change scenario

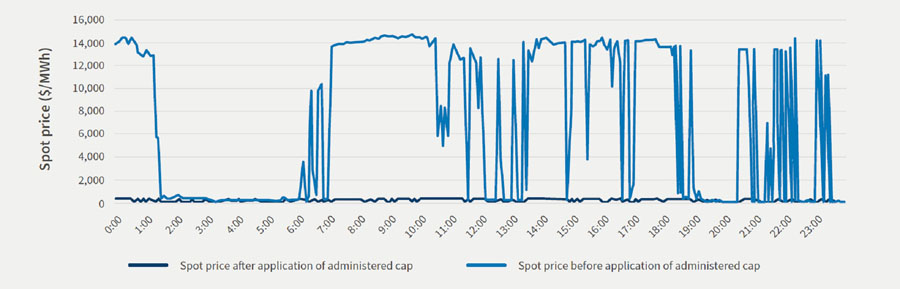

During administered price periods (after the APC has been triggered), there are no price signals to incentivise battery participation in the energy market. For example, Figure 3 shows Victorian pricing during the APC. Without the APC, storage facilities would have been incentivised to charge overnight and then discharge to support the market during the day. However, under the APC, battery operators would have lost money because while their purchase and sale prices were equivalent, they typically incur additional costs from efficiency losses, degradation from discharge, and transmission costs when charging.

Figure 3 - Victorian spot prices before and after administered pricing (14 June 2022)

Short-term and long-term issues with the APC

The APC is not fit for a future energy market dominated by batteries. Under its current design, when it is triggered it will result in short-term failed market operations. It will also have longer-term impacts on investment.

Short-term issue: Failed market operation is likely to lead to market suspension

The triggering of the APC is likely to deter potential battery operators from participating in the energy market. Future heavy reliance on batteries to meet demand means that any deterrent to operations risks market failure. AEMO may have no choice but to intervene and suspend the market anytime the APC is triggered to ensure adequate supply. This occurred on the 14 June after the APC had been triggered.

The AEMC’s compensation scheme1 could solve this problem because it considers the electricity used by batteries as a fuel. However, during the June 2022 APC occurrence, many generation and storage operators chose to forgo this route due to uncertainty over compensation and the administrative burden, leading to the eventual market suspension.

Long-term issues: Softening signals for the investment needed to avoid high prices

Once an APC event has passed, the effects will linger in the form of muted investment signals. Our market is designed asymmetrically: generators receive low prices while risking over-investing in their assets, but the risk of under-investing in assets is not passed onto them due to the application of the APC.

So, triggering the APC will also reduce investment that would otherwise have occurred if prices had been left uncapped. This prioritises the short-term issue of containing prices over the longer-term solution needed to address them.

Is this the end of the APC?

In its current form, the APC is beginning to impede efficient market operations and is a barrier to the investment needed for the energy transition. To be effective, it will either need to be adjusted to include storage technologies, or replaced with a fit-for-purpose mechanism.

Footnotes:

Related Insights

Related Information

Published

August 03, 2022