The Year That Was — and Wasn’t

-

December 07, 2021

DownloadsDownload Article

-

If someone had predicted a year ago that a large majority of Americans would get vaccinated for COVID-19 in the upcoming year but an additional 450,000 Americans would die of COVID-related causes as a new strain of the virus ran amok, yet the broader economy would surpass pre-pandemic activity levels ahead of schedule while financial markets would soar to all-time highs — who would have believed it?

A year ago, it seemed reasonable to assume that the road back to normal in 2021 would be a smooth but gradual glide tied closely to vaccine availability and uptake, a continued reopening of the economy and our resumption of an exterior life. Then President-elect Biden set an initial goal of 100 million shots in arms in his first 100 days in office, a goal that was reached in 58 days. President Biden then revised that target to 200 million shots within his first 100 days, a goal that was hit with a week to spare. But seven months later, just under 200 million Americans are fully vaccinated while 62 million remain unvaccinated1. This year of recovery hasn’t conformed to a tidy script; rather, it has progressed in fits and starts. Few could have imagined that herd immunity would remain elusive, or that public resistance to the vaccine itself and vaccine mandates would be as sizeable or animated as it has been, especially as the Delta variant of the virus raged across much of the country, or that millions of workers would still be avoiding the office a year later.

We’d venture to say that once a vaccine rollout began back in late December 2020, many of us expected the COVID-19 episode would be mostly behind us a year hence. Instead, much of America is contending with a fourth wave of the COVID virus, including more than 85,000 new cases daily and a steady count of 1,100 COVID-related deaths per day (that’s nearly 400,000 annually!) as winter approaches. Several European nations are also dealing with a surge in new cases and deaths, with some reimposing lockdowns or other tough restrictions. As year-end approaches, it’s clear that the battle against COVID-19 is hardly over; however, the willingness of many Americans to endure ongoing pandemic-related restrictions or self-imposed exile is wearing thin, so we are learning to live with a virus that probably won’t be eradicated but is very unlikely to hospitalize or kill us either. Next year surely will mark another year of progress against the COVID virus, especially if a COVID-19 treatment pill receives FDA approval, but many thousands still will die needlessly. Above all, everyday life will continue to move along on its jagged path towards normal.

The Year That Was

Irrepressible financial markets: Last year amid a viral pandemic, the S&P 500 rose 16% for the year (and 68% from its March nadir) as investors anticipated a more rapid economic recovery and a faster return to normal life. So, after that huge run-up, it was time let reality catch up to expectations in 2021, right? Not a chance, with the S&P 500 rising another 25% to date and most major market indices hitting all-time highs in 2021. Just about any economic news was perceived as good news as far as markets were concerned — weak economic readings meant that the Fed would keep filling the punch bowl, while stronger data meant that the recovery was proceeding above plan. It was, in essence, a no-lose market for investors. In fairness, stronger-than-expected earnings account for much of the rise in the S&P 500 this year, while the expansion of valuation multiples has been modest. But trading at an earnings multiple of nearly 24x EPS with moderate expectations for earnings growth in 2022, the Index is inarguably lofty by any historical comparison. Leveraged credit markets also remain in party mode with respect to issuance and market yields.

Ongoing Fed asset purchases in 2021 have supported bullish credit market sentiment even as an impending phase-out of these purchases is a near certainty. U.S. high-yield bond issuance will shatter its all-time high with nearly $500 billion of new issuance while leveraged loans have enjoyed another strong year, though not record-breaking. U.S. CLO capital raises will also hit an all-time high this year, with that money earmarked for more leveraged loans. Consequently, LBO activity has enjoyed one of its best years since 2007, with record-high purchase price multiples and leverage multiples for new deals. Red-hot credit markets have encouraged sponsors and other dealmakers, both buyers and sellers, to get deals done now.

Rising inflation rates in 2021 have made real returns on Treasury securities even more negative and have further eroded real yields on corporate debt, yet nominal rates and spreads have not increased commensurately to offset higher inflation, even as fewer experts opine that the inflation uptick will prove to be transitory. That will change should higher inflation hang around awhile, which looks increasingly likely.

Beyond the bubbly broader markets, investing insanity around meme stocks, SPACs, NFTs, IPOs by money-losing companies, dubious cryptocurrencies (exactly how many cryptocurrencies do we need?) and collectibles in 2021 leaves nearly everyone but millennials in slack-jawed disbelief while “serious” market analysts resort to pretzel logic to justify some absurd valuations. Party on, Wayne and Garth!

Robust but uneven economic growth — mostly consumer-driven: After contracting by a record 35% (annualized) in 2Q20, real U.S. GDP surpassed its pre-pandemic level in 2Q21, which was two to three quarters ahead of what most economists expected back in mid- to late 20202. That’s an impressive feat, but what is often overlooked is that two-thirds of the comeback in economic activity occurred immediately, in 3Q20, once strict lockdowns ended and a reopening was underway. GDP growth since 3Q20 has been robust but spotty, with two stellar quarters (thank you, American Rescue Plan) and two mediocre ones, including a marked growth slowdown to 2.0% in 3Q21.

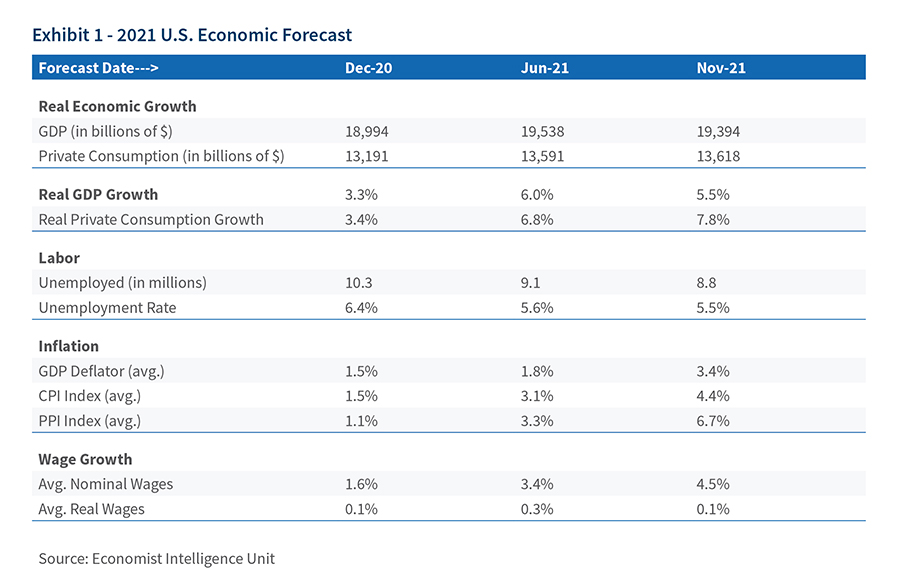

Real economic growth for the year will register a strong number (5.0% or better), much of it consumer-driven (Exhibit 1), with much of that spending fueled by various financial assistance provided to Americans. It remains to be seen how economic growth will fare in 2022 now that federal pandemic aid has all but ended, but GDP growth seems most likely to slow next year, given the withdrawal of this stimulus even as the recovery naturally progresses. However, the recently passed Infrastructure Investment and Jobs Act will offset some of the growth slowdown, as stepped-up investment spending compensates for slower consumer spending.

Labor market rebounds — workers winning wage gains: As expected, the U.S. labor market has mounted a strong comeback in 2021, but it’s not as impressive as the headline numbers suggest. The official U.S. unemployment rate has dropped to 4.6% from a peak of 14.8% in April 2020 and a pre-pandemic rate of 3.5%. However, the size of the U.S. labor force has shrunk by more than 3.0 million working-age Americans since the pandemic struck, while 4.7 million fewer Americans in the labor force have full-time jobs. Consequently, the labor force participation rate remains near a multi-decade low of 61.6% compared to a pre-pandemic rate of 63.4% — itself at the low end of a declining 20-year trend3. In short, a contributing factor to the falling unemployment rate is that several million working-age Americans have exited the labor force and aren’t counted among the unemployed, even though they are jobless. Lingering COVID anxiety and childcare issues have contributed to the shrinking labor force this year, and it’s unclear whether these exits are permanent.

Perhaps the best news for workers this year is wage gains, with average hourly wages jumping by 4.9% (YOY) in 2021. Stories abound about sizeable wage hikes paid by employers to fill job vacancies, and wage gains paid to attract new hires are also working their way to in-place workers.

(Unfortunately, an inflation spike has negated most of these gains in nominal wages.) Job-quitter numbers and rates are at an all-time high, a sign that workers are confident they will find better employment in this marketplace.

Accelerating inflation: After two decades of near dormancy, the spike in inflation in 2021 is arguably the business story of the year. We’re not talking about 1970s-style inflation (it’s not even close to comparable…yet) and some of the recent media coverage has over-dramatized the issue, but this is no tempest in a teapot either. Efforts by the Fed and some economists to label the recent surge as transitory are increasingly being drowned out. The “transitory” argument for inflation rests largely on the premise that supply-chain disruptions, labor shortages and other supply-side constraints are its primary cause, as if surging demand for goods has nothing to do with a 35% increase in the money supply, a doubling of the size of the Fed’s balance sheet, and boatloads of federal financial assistance paid to individuals and businesses since March 2020.

Consumers saved like crazy last year when the pandemic injected huge uncertainty into the economy but are working off some of their savings now that such a doomsday scenario has passed. Likewise, businesses that showed spending restraint in 2020 now are loosening the reins. Inflation always has been and always will be a monetary phenomenon. We have yet to hear prominent economists say that, with the benefit of hindsight, the federal government’s response to the COVID-19 episode in the form of financial assistance was likely overdone and we are now paying the price for it — quite literally. This story isn’t going away in 2022.

Civilian space travel: At a time when the vast majority of Americans can’t afford a business class airline ticket, we are supposed to marvel that a few very rich guys traveled to the closest edge of space for a couple of minutes to experience weightlessness and recite platitudes about the fragility of our planet from afar. Over-the-top media coverage of these launches in 2021 gave them all the reverence of a pioneering event that would usher in the age of civilian space travel, but who are we kidding here? It’s hard to see these launches as anything other than the ultimate amusement park ride for billionaires. The prospect that the rest of humanity will ever benefit in any way from these joyrides is negligible. Somebody had to say it.

The Year That Wasn’t

Restructuring boom to bust: The restructuring boom was already fading by late 2020, but few expected this year to be such a snoozer. When the books are closed on 2021, most measures of restructuring activity will be down 50% or more compared to 2020. Moreover, a highly disproportionate share of filing activity this year were smaller cases ($50 million to $100 million) compared to prior years, making 2021 one of the more disappointing years for our profession in recent memory. It seems simplistic to attribute the falloff in activity to credit market rescues, but that is much of the story in a nutshell. On a brighter note, Chapter 11 filing activity has picked up a bit in the last couple of months, and it’s hard to imagine that restructuring activity can drift much lower from current levels, with S&P’s distressed debt ratio currently at a 14-year low. It’s always sobering when the best thing you can say about something is that it can’t get any worse but that seems to be where we’re at. There is little evidence to support an argument that a meaningful uptick in business distress is in the offing. President Biden’s recently announced reappointment of Fed Chair Powell should keep financial markets pleased and appeased.

Herd immunity: Epidemiologists knew early in the pandemic that once a COVID-19 vaccine was developed and administered, vaccination rates would have to be very high to achieve herd immunity, given how highly transmissible the virus was; many experts pegged requisite vaccination rates at 75% or more to get there. With vaccination rates now topping 70% of U.S. adults over age 18 and 60% of the eligible vaccine population — not to mention those with natural antibodies from having had the virus — there is little talk of reaching herd immunity these days.

The Delta variant has changed the calibration, as have larger-than-expected numbers of breakthrough cases among the vaccinated. Instead, the conversation has changed to waning immunity, booster shots for the foreseeable future, and fear of more virulent strains to come as the virus persists and mutates. Few experts now believe the COVID virus can be eradicated any time soon, if ever — especially with more than 60 million adult Americans remaining unvaccinated. More likely, the virus will continue to lurk among more vulnerable segments of the population as a much more lethal version of influenza, and more Americans now seem resigned to that outcome.

Return to the office: Once mass vaccination rollouts began in early 2021, most large businesses and their employees were expecting work-from-home (WFH) arrangements would gradually end and a return to office life would begin by Memorial Day, at which time most Americans would be vaccinated. That “penciled in” return date was later pushed out to Independence Day, then Labor Day and beyond. Today, even as millions of workers slowly resume the commuting grind, WFH policies continue in some form for most white-collar workers even though vaccination rates for this cohort far exceed the national rate. In New York City, MTA subway ridership remains 47% below pre-pandemic levels. The Delta variant of the COVID virus certainly has complicated and delayed return-to-office plans, but it would be naïve to believe that this is all about fear of COVID.

The COVID-19 pandemic changed lifestyle priorities, with most office workers deciding that a five-day-a-week trek into the office didn’t comport with these new priorities.

Then PwC stunned the business world in September when it announced that all 40,000 of its U.S. client service professionals would have the option of working remotely indefinitely but for three days monthly, and it expects about one-third of its eligible workforce to accept that option4. PwC views hybrid or flexible work arrangements as a work model that will retain and attract talent. Not all large businesses agree with that premise, particularly Wall Street firms, but many others are adopting some version of flexible work arrangements on a permanent basis. It appears that the days of the daily commuting grind for everyone may be over, but the long-term implications of these profound changes on workplace culture and creativity, office real estate in major locales, and local businesses that depend on all these commuters have only just begun. The pulse of daily life in midtown Manhattan is not an encouraging sign.

Related Insights

Related Information

Published

December 07, 2021

Key Contacts

Key Contacts

Global Co-Leader of Corporate Finance & Restructuring