- Home

- / Insights

- / FTI Journal

A Radically Changing Landscape

-

August 12, 2020

DownloadsSubscribe to Series

-

The FTI Journal continues its look at opportunities for private equity in distressed M&A given the pandemic-affected economy. Here is a snapshot of industrials.

Recent COVID-19 mandates forced many intellectual property (IP) companies to a work-from-home (WFH) business model, with several barely missing a beat in terms of productivity. Many industrials — especially those that operate closer to end-customers — have not enjoyed the same luxury. And they most certainly have not experienced the same results.

Manufacturing, machinery, construction companies — many of these industries are feeling the brunt of reduced industrial output and a stubborn economic downturn. This has forced industrial companies of all stripes to rethink their core businesses while steeling themselves for more slowdowns and supply disruptions that may be on the horizon.

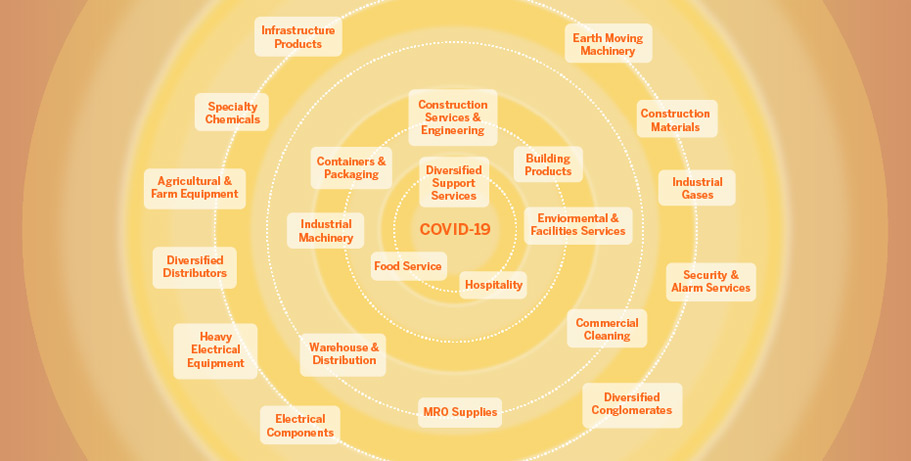

The economic effects of COVID-19 are rippling through segments of the industrials sector across the world.

However, there are companies that have adapted to this new climate, thanks to agile mindsets and strong balance sheets. Ecommerce is on the rise and direct-to-consumer volume is increasing. Also rising is the demand for warehousing and packaging solutions. Demand for sanitation, cleaning and PPE supplies will continue to grow.

Not faring so well: companies serving distressed industries like construction, hospitality and food service. These companies will need to explore new capital solutions, debt restructurings, or realignment of their business strategies.

For investors, this presents opportunities for strategic acquisitions at discounted valuations. Whether it's food industrial automation, non-core asset carve-outs or warehouse and distribution, as these large cap companies refine their strategies, investors will be primed to acquire attractive assets at favorable prices.

Read the full introduction to the series "Creative Destruction vs. Created Destruction." To learn more about specific distressed M&A opportunities in industrials, visit our Distressed M&A Outlook Series.

© Copyright 2020. The views expressed herein are those of the authors and do not necessarily represent the views of FTI Consulting, Inc. or its other professionals.

About The Journal

The FTI Journal publication offers deep and engaging insights to contextualize the issues that matter, and explores topics that will impact the risks your business faces and its reputation.

Published

August 12, 2020

Key Contacts

Key Contacts

Senior Managing Director