- Home

- / Insights

- / FTI Journal

Is Latin America Ready to Binge?

-

August 24, 2019

-

Video consumption and streaming platforms are on the rise in the region. Tapping into the market now is key to reaping rewards tomorrow.

If Netflix were to produce an original movie about the Latin American television industry it might start with a flashback to the U.S. TV landscape a decade or so ago. Back then, viewers were largely tied to traditional linear TV, with at best a DVR or DVD player to supplement the viewing schedule. What happened next is a story we all know well — a flood of new user experience and content options, at lower cost, resulted in mass adoption of streaming video. The U.S. television industry continues to grapple with the disruption.

Cut to Latin America where the TV landscape is now on the verge of a similar transition. Driven by a number of converging factors, streaming video consumption in the region is booming. More consumers than ever are online. Mobile data connections have soared to over 450 million.1 About 70 million households in the region now have fixed broadband, a number that continues to rise steadily.2

Growth is also fueled by economics. The Latin American middle class has surged by 35 percent in the past 10 years to 186 million3 and is wielding newfound purchasing power despite recent economic turmoil in some markets.

All this creates a huge appetite for streaming video. By next year, nearly 20 percent of Latin American households will have at least one video-on-demand (VOD) subscription — a fourfold increase from 2014.4

Streaming services have taken notice. Eager to seize the moment, some U.S. streamers — many of whom helped disrupt the U.S. market — have parachuted into the Latin America market with licensed content and a growing inventory of local original programming. Examples include Netflix, Amazon Prime and HBO. Large Latin American TV providers such as Globo, Bandeirantes and Claro have also rolled out homegrown streaming channels to compete.

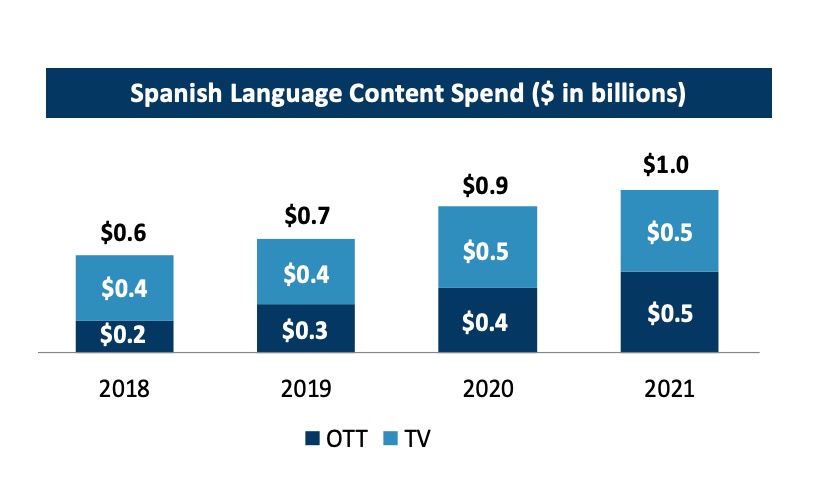

As in the United States, this proliferation of content and intense competition for eyeballs has resulted in higher quality programming. In two years, investment in original Spanish language video content by all streaming services is expected to hit $1 billion (see chart), matching spending by linear TV networks for the first time.5

Regional Challenges

For all this potential and resemblance to the U.S. market of a decade ago, a number of circumstances unique to the region present obstacles for streaming services to enter and thrive. Across several dimensions, the market remains in a “chicken-or-egg” paradox in which businesses cannot justify investment without consumer adoption, and consumer adoption cannot take off without business investment. Among the obstacles are:

By 2022 nearly 20 percent of Latin American households will have at least one VOD subscription — a fourfold increase from 2014.

Affordability and Pricing

Netflix disrupted the U.S. pay-TV industry partly through pricing. At about $8 per month, consumers were eager to adopt a service that represented only about one-tenth of a monthly cable package (today about $85).6 In Latin America, where the average pay-TV subscription costs only US$21 per month, the streaming subscription price point (lower than in the United States) is not as disruptive. Additionally, much of the population remains unbanked or without credit card, which makes collecting monthly subscription fees a challenge. For many streaming services, this means going to market via the fragmented and often regionally oligopolistic telecom providers.

Entry Points (Hardware)

Streaming services hoping to penetrate the Latin American market have relatively few entry points into the home. A leading device for streaming video consumption is actually the pay-TV set-top box; however, only 40 percent of households subscribe to pay TV. The adoption of low-cost connection devices so popular with U.S. consumers (e.g., Roku, Apple TV, Amazon Fire Stick) is slow. A further challenge is the higher cost of these devices in comparison with the United States. In Brazil, for example, the average price of an Apple TV is some 50 percent higher than in the United States due to inefficient retail distribution and high tarrifs.7

Entry Points (Software)

Also challenging market entry is the technical difficulty of launching apps in Latin America. In addition to the onerous business deals they demand, the region’s telecom providers have at times created their own software development kits (“SDKs”) for streaming services. This adds additional development expense and complexity for streaming services. Given this high cost and complexity amid a small scale of adoption and investment, the region has seen fewer app development vendors as well.

The Missing Ad Maker

The advertising ecosystem in Latin America is caught in a similar chicken-or-egg dilemma. Because there are so few streaming video services, ad inventory remains small, and advertisers do not allocate budget to it. But few ad-supported services are willing to launch into a market that provides inadequate monetization. In many countries, the ad industry is controlled by relatively few companies, which have little incentive to innovate on advertising products that would disrupt the status quo. In the United States, it took more than 15 years to cultivate an advertising market for streaming video (and some would argue it remains vastly subscale relative to potential). Outside of YouTube, Latin America is just beginning this journey.

A LatAm Inflection Point?

Led by the region’s largest markets (Mexico, Brazil, Colombia, Chile and Argentina) and, in particular, U.S. streaming majors (Netflix, Amazon), the video landscape in Latin America now appears to be at an inflection point. The next five years are likely to see large-scale increased investment by Netflix, Amazon, Disney+, HBO and Viacom-PlutoTV, as well as a likely expansion into the region by Hulu, Apple+, Warner and NBC Universal. Incumbent Latin American media companies, already mildly shaken by Netflix and Amazon, will be forced to respond with more significant investments into streaming services and most likely will leverage their live content rights. Economic recovery in some markets (e.g., Brazil) will further catalyze investment and change.

Potential market opportunities include:

Vertical integration

Latin America may take a cue from U.S. telecom and media counterparts by vertically integrating. Objectives could include lowering the cost of capital and execution risk of expanding streaming services, developing better app experiences and app development environments for set-top boxes, and achieving critical mass in addressable advertising. Related to the last point, a key objective could be to give advertisers a compelling, scaled advertising market before Facebook and Google absorb all the market growth (as is the case in the United States).

Market entry

For global media companies offering differentiated viewing experiences, few periods in history have offered similar market entry opportunities. Partnering with regional telecoms could create a win-win scenario — solving collection issues for the media company and providing content (on relatively empty set-top box app environments) for the telecom. Several years of financial investment may be inevitable prior to gaining scaled adoption, as was the case in the 1990s during the growth of satellite channels.

Creative windowing

Linear television channels in Latin America likely have a unique opportunity to pivot business models in a risk-mitigated manner. While streaming adoption is still low, and early entrants such as Netflix seek local originals, local media companies can develop a premium studio model while negotiating carve-outs for their own linear channels. They may also wish to explore various coproduction options in conjunction with this. In this way, they can offset most or all of their cost of production while producing high-quality originals for their existing linear audiences. Customer segregation between (younger) streamers and (older) linear audiences in the near term likely means audience reach is additive with minimal cannibalization. This near-term tactic could also have long-term benefits to the media company’s own streaming services.

In 10 years, the state of the Latin American television market will be closer to what U.S. consumers — and some U.S. media companies — enjoy today. Global media companies are getting a revealing preview of that future today. If they want to get in on that original movie, they should act now before the credits start rolling.

Footnotes:

1: FTI Analsyis. source: PWC.

2. FTI Analysis. source: IDGConnect: "A look at the mobile ecosystem in Latin America." Jan. 23, 2018.

3. Inter-American Development Bank. "Latin American and Caribbean register middle class growth." Oct. 24, 2016.

4. FTI Analysis. source: PwC.

5. ibid.

6. ibid.

7. FTI Analysis. source: Quartz. "A history of Netflix US price hikes, charted." Jan. 15, 2019.

© Copyright 2019. The views expressed herein are those of the authors and do not necessarily represent the views of FTI Consulting, Inc. or its other professionals.

About The Journal

The FTI Journal publication offers deep and engaging insights to contextualize the issues that matter, and explores topics that will impact the risks your business faces and its reputation.

Published

August 24, 2019

Key Contacts

Key Contacts

Senior Managing Director

Senior Managing Director, Leader of Media & Entertainment