The CSRD Delay Buys Time—Use It To Get Ahead

-

July 18, 2025

-

The Corporate Sustainability Reporting Directive (“CSRD”) delay offers a critical window to reflect and sharpen your sustainability strategy. Standing still isn’t neutral—it’s a missed opportunity. Now’s the time to get your house in order.

Background

Last April, the European Parliament voted to “stop the clock”1 on the application of CSRD and the EU Taxonomy for companies that have not yet started reporting, part of the larger EU Omnibus package.

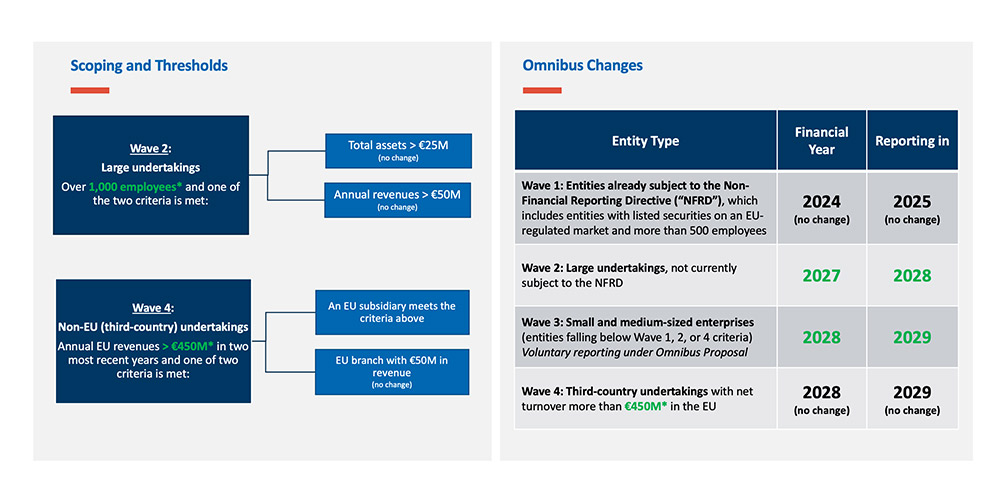

The table below provides a summary of the proposed Omnibus changes to CSRD implementation timelines and scoping thresholds.

CSRD: Omnibus Scope & Application Determination

The proposed Omnibus changes came at an interesting time as many companies were well underway preparing for their CSRD disclosure, particularly Wave 2 companies. This pause begs the question: What should those companies – and those in waves 3 and 4 – do now as they wait?

Given the breakneck pace of regulatory compliance over the past few years, the temptation to hit the brakes is understandable.

However, doing so is a mistake.

Sustainability compliance remains a looming requirement, not just in the EU but also across the globe. This pause is an unexpected opportunity to strategically assess where you are, what needs to be done, what gaps need to be filled and what other financial and employee resources will be needed to comply. Leveraging this opportunity will help companies avoid an eventual scramble to meet CSRD requirements and make critical progress on business transformation projects that would need to occur regardless. Below are three key recommendations for keeping your momentum going.

Recommendation #1: Leverage Existing Compliance Initiatives to Your Advantage

It’s important to avoid treating regulatory compliance as a series of one-off requirements. Instead of managing separate reporting efforts, proactively map disclosures to each other. This minimizes duplication and reveals where efficiencies can be gained.

Take California’s upcoming climate regulation,2 which is set to take effect in early 2026. By investing the time and effort now to ensure your climate reporting is thorough and accurate, you can effectively leverage that same output for your CSRD disclosure—thereby saving time, reducing duplication and building consistency across regulatory frameworks. Not to mention, audit readiness is applicable across regulatory frameworks, meaning the work you do to comply with one regulatory framework can often be immediately leveraged for another. California’s regulation is part of a global shift—so use it to prepare for what’s coming next.

Recommendation #2: Work on Priority CSRD Gaps Identified During the Double Materiality Assessment (“DMA”)

As EU legislators take the time they need to settle on revisions to the current CSRD requirements, meaningful progress can occur. No one wants to deal with fire drills at the eleventh hour.

Wave 2 and Wave 3 companies that have already begun preparing for CSRD have spent tremendous time and effort engaging and collaborating with internal experts, customers and investors. Pausing creates the risk of losing some of the hard-earned institutional knowledge that organizations have gained thus far – especially if they see turnover in key internal stakeholders. Those who have gone through CSRD’s DMA process already know that could be a costly mistake.

Completing the DMA is just the first step in CSRD compliance. Companies then have to determine what policies, processes and data they do not have in order to complete their required disclosure. If a company has not completed this step, it’s time to start the process. For those that have, these companies need to be using this time to their advantage to begin closing some of these gaps. However, it’s important to prioritize compliance gaps in a strategic manner that creates value for the business beyond CSRD compliance. Areas where companies may prioritize these gaps include:

- Items that can create value for the business outside of sustainability reporting (e.g., conducting a climate-related scenario analysis may help inform business strategy)

- Items that are necessary for other reporting obligations (e.g., ongoing voluntary reporting and framework alignment, or other regulations such as California’s climate disclosures)3

- Items that are unlikely to go away in the next Omnibus update

Although it remains uncertain which requirements will be removed from the European Sustainability Reporting Standards (“ESRS”), the European Financial Reporting Advisory Group (“EFRAG”) has indicated4 that it will look to substantially decrease the number of mandatory datapoints, prioritizing quantitative datapoints over narrative disclosures. This means that you now have an opportunity to focus on key quantitative data points. Ask yourself: Do you have this data available? Do you trust the data? How can you access this information more easily on a consistent basis?

Recommendation #3: Implement Software and Data Solutions

Compliance will be an annual exercise, so it’s prudent for companies to assess technologies and software that drive long-term solutions for reporting. Establishing data collection protocols, not to mention those that abide by limited assurance standards, is an ongoing challenge for corporates. The answer will be to implement an ESG software solution.5 Relevant software and data solutions can serve as a project management tool to track compliance gap closures and collect information on a yearly basis in a way that is consistent, reliable and accurate. This pause is the perfect time to evaluate which solutions will best fit a company’s needs and operationalize them.

Conclusion: Use This Extra Time Wisely

Despite delayed reporting for Wave 2 and Wave 3 companies, this is certainly not the time to take your foot off the gas. If you’re impacted by CSRD, you likely still have a lot of work to do, and it would be wise to keep the momentum going. Kicking the can down the road can only result in one thing: a last-minute sprint. Instead, you can start strategically undertaking work to comply, understanding that although certain requirements may change, your early action will pay off.

Footnotes:

1: European Parliament, “Sustainability and due diligence: MEPs agree to delay application of new rules,” European Parliament (April 3, 2025).

2: Bryan Armstrong, Alanna Fishman, Robert Kaineg, Chris McIlwaine, Lukas Kay, “Climate Transparency Doesn’t End With California,” FTI Consulting (June 16, 2025).

3: Ibid.

4: European Financial Reporting Advisory Group, “ESRS revision: work plan and timeline,” European Financial Reporting Advisory Group (April 25, 2025).

5: Mary K. Pratt, “CIOs turn to ESG tech as part of sustainability leadership,” TechTarget (May 15, 2025).

Published

July 18, 2025

Key Contacts

Key Contacts

Senior Managing Director

Senior Director

Senior Director

Senior Director

Senior Director

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About