- Home

- / Insights

- / Service Sheets

- / Real Estate: Transaction Tax Advisory Service Sheet

Real Estate: Transaction Tax Advisory Service Sheet

-

1月 19, 2024

ダウンロードDownload Service Sheet

-

FTI Consulting’s Transaction Tax Advisory team adds value across the real estate investment lifecycle. The evolving complexities of global tax law have a critical impact on business decisions impacting your real estate transactions. Whether you are a sponsor or investor, you must navigate the ever-changing landscape of the real estate sector in order to protect and enhance the after-tax return on your investments.

Our Strategic Differentiators

- Dedicated team of professionals free from audit-based conflicts of interest and focused exclusively on transaction support

- Senior led teams with deep experience across the sector and the capacity to focus on serving clients when we are needed most

- Practical, collaborative and solution-oriented approach to client service with a track record of delivering the highest-quality results

- Client advocates capable of navigating complex situations and disruptive events with an unwavering focus on service and delivery

- Commercial approach, which is flexible and tailored, to address each unique client and the applicable situation at hand

- Diverse team with unique perspectives resulting from experience working in management consulting, accounting, law and industry

Specialized Focus Beyond Transaction Tax Advisory

- Global Tax Consulting & Compliance

- State & Local Tax

- Tax Workflow Automation

- Transfer Pricing

- Private Client Services

- Bankruptcy & Financial Restructuring

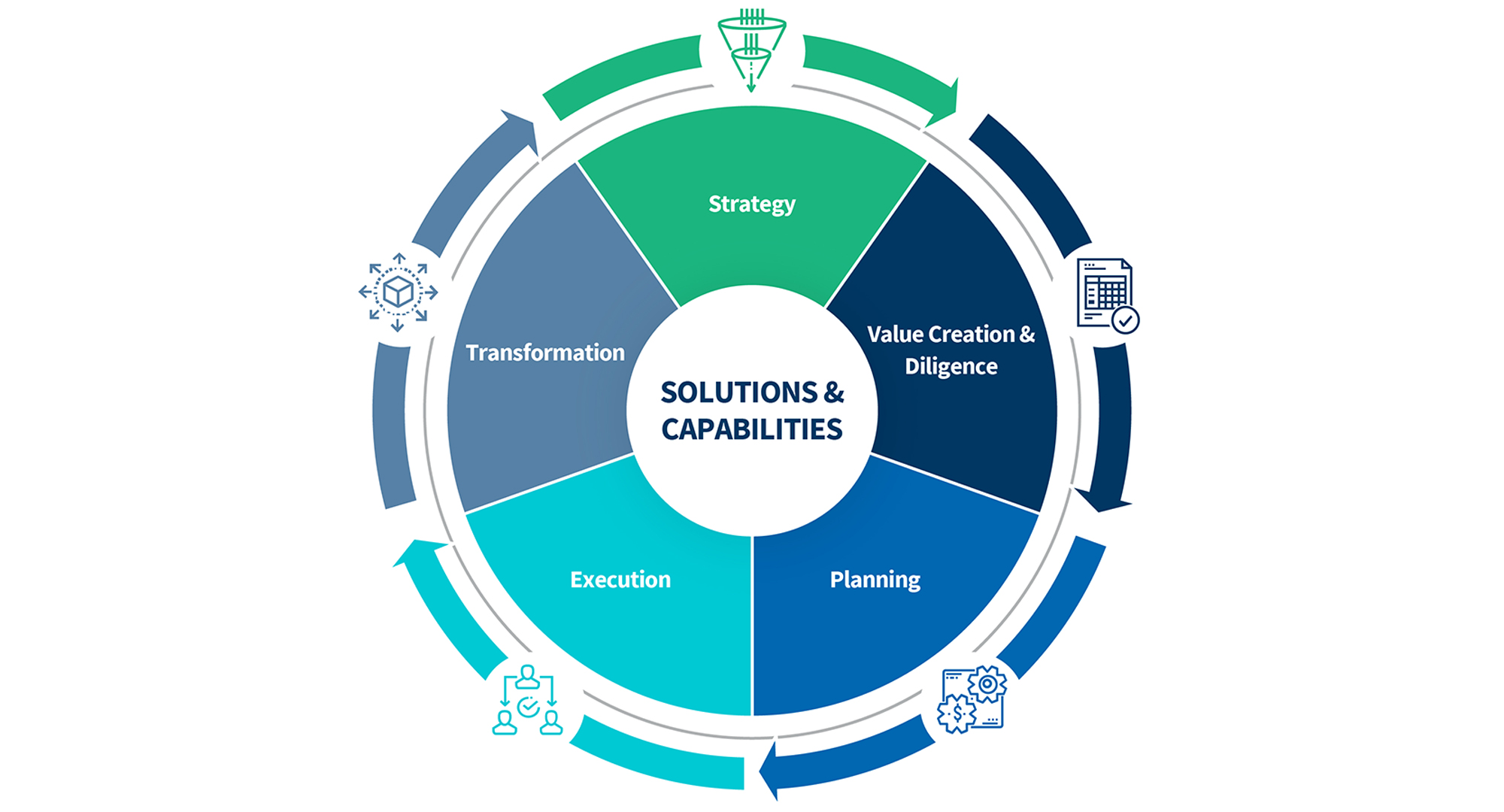

Solutions & Capabilities

Strategy

- Investment Vehicle Structuring

- Tax Leakage Impact Modeling

- Investor After Tax IRR Modeling

- Investor Side Letter Support

- Tax Underwriting Strategy

- Tax Due Diligence Readiness

Value Creation & Diligence

- Buy-Side Tax Due Diligence

- Sell-Side Tax Due Diligence

- Transaction Structuring, Including Steps

- Tax Purchase Price Adjustment Valuation and Negotiation Support

- Purchase and Sale Agreement Drafting and Negotiation Support

- Transition Services Agreement Drafting and Negotiation Support

Planning

- Pre-Closing Steps Design and Execution

- Taxable Income Modeling, Including Investor Allocations

- Tax Basis and Recovery Modeling, Including Basis Adjustments

- Transfer Tax Planning and Reporting

- Indirect Tax Planning and Reporting

- Withholding Tax Holdback Quantification

- Documentation of Key Tax Issues

- Tax Function/Process Assessment

- Tax Compliance Calendar Design

- Interim Tax Function Management and

- Transaction Resources Support

Execution

- Post-Closing Steps Execution

- Post-Closing Tax Reporting

- Post-Closing Tax Purchase Price Adjustment Finalization

- Tax Purchase Price Allocations

- Tax Withholding/Reporting

- Tax Data Transfer/Integration

Transformation

- Restructuring Steps Execution

- Legal Entity Rationalization

- Tax Function Process Improvement

- Cash Tax Recycling Strategies

- Tax Investor Relations Support

- Ongoing Tax Planning

Related Information

出版

1月 19, 2024

主な連絡先

主な連絡先

Senior Managing Director, Leader of Real Estate Tax Advisory

Senior Managing Director, Leader of Real Estate Tax Compliance