- Home

- / Insights

- / FTI Journal

Nowhere To Hide

-

November 03, 2021

-

In today’s global business environment, a corporation may scatter its data and information across multiple continents and house it in a variety of mediums for convenience. But suspect actors can also exploit such a scenario.

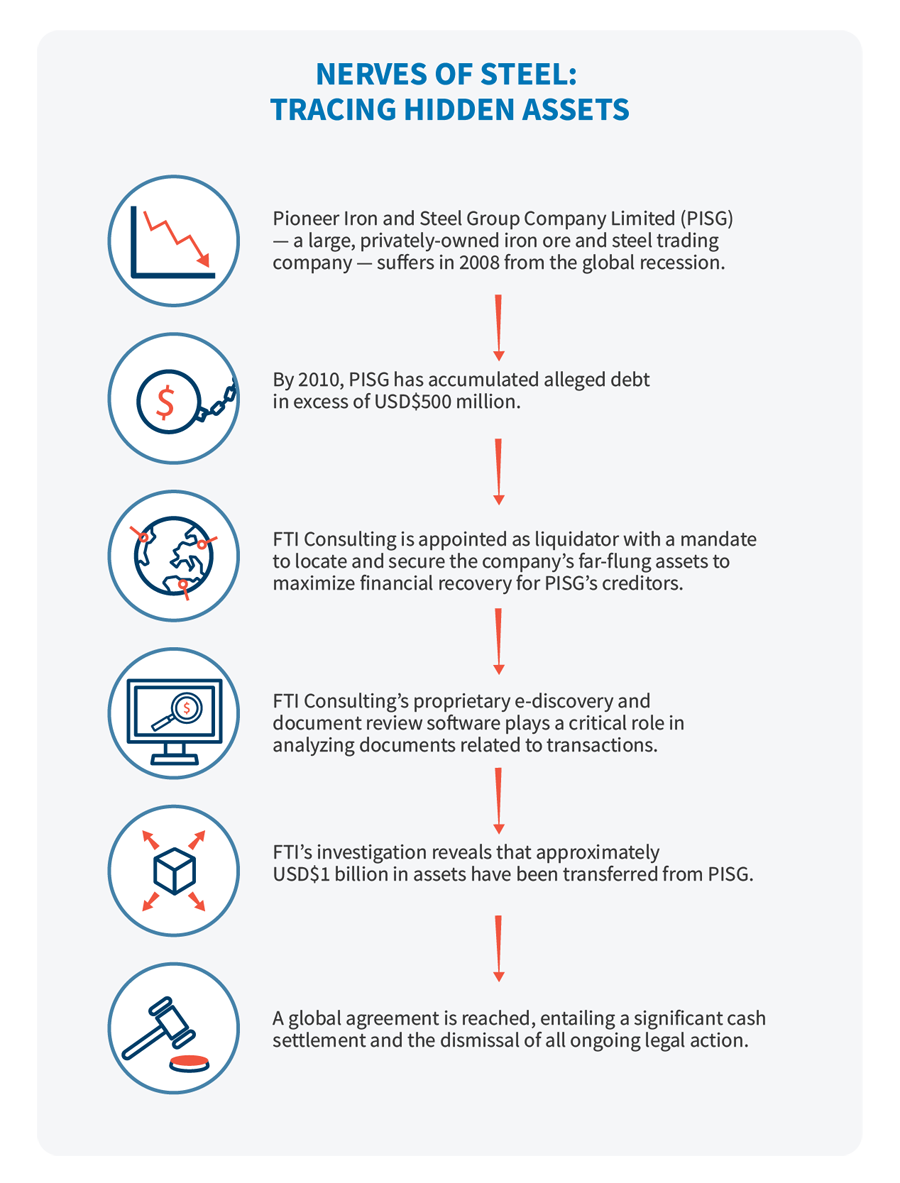

Our tale begins in 2008 following a sharp downturn in the global shipping market. For Pioneer Iron and Steel Group Company Limited (PISG) — a large, privately-owned, diversified iron ore and steel trading company based in China but registered in the British Virgin Islands — the change rang a death knell. By 2010, the company had accumulated alleged debt in excess of USD$500 million.

That same year, the company’s sole shareholder, a high-profile Chinese billionaire living in Hong Kong, placed PISG into voluntary liquidation — a resolution similar to a Chapter 7 bankruptcy filing in the United States. FTI Consulting was appointed as liquidator with a mandate to locate and secure the company’s far-flung assets to maximize financial recovery for PISG’s creditors.

As the liquidator, FTI took control of a large number of PISG subsidiaries and the company’s books and records to uncover and track down company assets. Preliminary investigations quickly revealed substantial assets belonging to PISG in Australia, Hong Kong and mainland China. FTI experts began taking steps to recover those assets, such as placing a halt on the trading of shares of a listed Australian mining corporation and demanding that a Chilean mining company repay a USD$7 million debt owed to PISG.

As a result of findings uncovered during an investigation into PISG’s dealings, FTI experts concluded that assets had been intentionally transferred from PISG to shield them from creditor claims. Further, the action had contributed to the rapid deterioration of PISG’s financial position.

Subsequently, FTI began asset tracing with the support of its Technology segment and Global Risk & Investigations Practice. The investigation revealed that approximately USD$1 billion in assets had been transferred from PISG, including, significantly, substantial shares in a Mongolian mining company listed on the Shanghai Stock Exchange.

FTI experts determined the mining shares had been shifted directly to the sole shareholder of PISG and to a family member. Ultimately, FTI experts asserted that the shares were grossly undervalued at the time of the deal and that the transfers themselves represented a breach of fiduciary trust.

Throughout the engagement, PISG provided the bare minimum of information, documentation or records of its business affairs. Yet, FTI experts were able to build a solid case against PISG’s shareholder. How? They accomplished it through dogged pursuit and the use of FTI proprietary e-discovery and document review software. The software’s data-mining capabilities played a critical role in analyzing documents related to transactions among the complex web of subsidiaries the shareholder had created — subsidiaries that were designed to conceal assets from creditors through share transfers and the creation of trusts.

Clearly, such an extensive and prolonged legal challenge can be very costly. And when the case involves multiple jurisdictions, it can be even more so. But by focusing on investigative leads that are most likely to yield a positive outcome, costs can be managed. In this case, FTI Consulting experts obtained external funding from a London-based specialist litigation funder to carry them through to the finish line.

In the end, a global agreement was reached entailing a significant cash settlement and the dismissal of all ongoing legal action. PISG’s unsecured creditors received a substantial dividend in the range of 34 cents to 40 cents to the dollar. Steps are being undertaken to finalize the wind up of the company even as this article goes live.

© Copyright 2021. The views expressed herein are those of the author(s) and not necessarily the views of FTI Consulting, Inc., its management, its subsidiaries, its affiliates, or its other professionals.

About The Journal

The FTI Journal publication offers deep and engaging insights to contextualize the issues that matter, and explores topics that will impact the risks your business faces and its reputation.

Published

November 03, 2021