Gone With the Wind?

-

January 17, 2025

DownloadsDownload Article

-

Since the passage of the Inflation Reduction Act (“IRA”), the U.S. wind industry, especially manufacturing, has been enjoying a renaissance. Nacelle manufacturing capacity, which fell from an all-time high of 15.0 GW/year in 2018-2020 to roughly 12.3 GW/year in 2021, grew to 14.9 GW/year in 2023, buoyed by advanced manufacturing tax credits and wind energy tax credits that provide bonuses for domestic content.1

That growth is now in question, as just this week, President-elect Trump stated that he plans to ensure “no windmills” are built during his term in office. Following this statement, the share prices of publicly traded wind project developers and wind turbine manufacturers fell sharply, down as much as 7.4% in a single day.2

This comes as more domestic manufacturing had been expected, with roughly 15 “new, re-opened, or expanded” land-based wind manufacturing facilities announced since the IRA was passed, including an expansion of GE Vernova’s Pensacola, Florida nacelle facility.3, 4

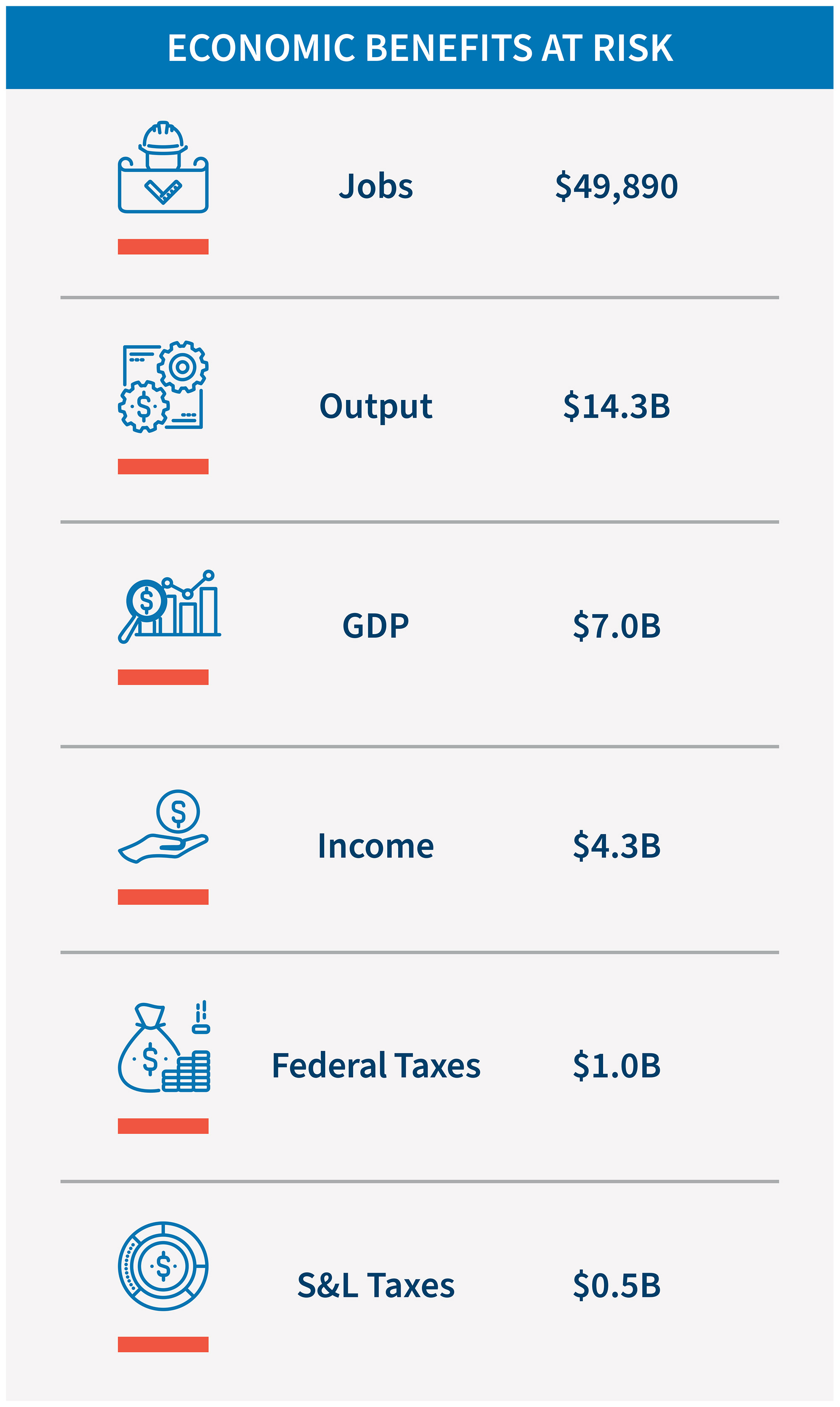

Over the long term, a total pause in wind development would have significant impact not only on near-term projects, but on the overall U.S. economy. We estimate that, on average, roughly 50,000 jobs are at risk each year developing and constructing wind projects, manufacturing and transporting their components, in the supply chain, and through consumer spending related impacts. Additionally, more than $14 billion in annual economic output would be eliminated, reducing federal and state and local tax receipts by more than $1 billion and $500 million, respectively, each year.

The U.S. Energy Information Administration (“EIA”) indicates that roughly 22.2 GW of planned land-based wind capacity is still in early development and could presumably be affected by an outright ban on wind project development.5, 6 Much of this expansion will be supported by domestic manufacturers of nacelles, blades and towers. Based on capital cost estimates from the National Renewable Energy Laboratory (“NREL”), that amount of land-based wind capacity represents a total investment of nearly $44 billion.7 Capital deployment of that magnitude would result in significant economic and fiscal impacts.

FTI Consulting used a land-based wind component cost breakdown from NREL to estimate the total spending on equipment, materials such as steel and concrete, construction labor and other components that would arise from developing and constructing 22.2 GW of land-based wind capacity and transformed these values into inputs to the IMPLAN model.8, 9

The majority (99.4%) of proposed land-based wind projects on a nameplate MW basis are located in counties that voted for President-elect Trump in the 2024 election,10 implying that the economic impacts could be distributed more heavily in these counties. The states of Wyoming and Texas could be most impacted, accounting for nearly 21% and 19% of near term early-stage wind projects, respectively.

While the incoming administration has not yet defined a concrete plan to restrict wind development in the U.S., the impacts of such a ban could be far-reaching and may go well beyond the high-level estimates presented here. For example, Lawrence Berkeley National Laboratory projects that as much as 62 GW of new land-based wind capacity could be constructed during the next administration. This figure is nearly three times the value projected by the U.S. EIA, meaning the economic benefits at risk are likely a conservative estimate of a ban’s full impact.11

FTI Consulting’s economic and energy market experts support concerned stakeholders with comprehensive impact analysis of potential wind project bans. We assess effects on local economies, electricity prices, renewable energy goals, and capacity needs, providing detailed analysis at state, local, and congressional district levels. For more information, contact Robert Kaineg.

Footnotes:

1: U.S. Department of Energy. (2024). Land-Based Wind Market Report. Washington, DC: DOE. Retrieved from https://www.energy.gov/eere/wind/land-based-wind-market-report

2: Reuters. (2025). European Wind Stocks Take Beating After Trump Calls Turbines Garbage. New York, NY: Reuters. Retrieved from https://www.reuters.com/business/energy/european-wind-stocks-take-beating-after-trump-calls-turbines-garbage-2025-01-08

3: Ibid.

4: GE Vernova. (2023). GE to Invest Over $450 million in US Manufacturing in 2023. Boston, MA: GE Vernova. Retrieved from https://www.gevernova.com/news/press-releases/ge-to-invest-over-450-million-in-us-manufacturing-in-2023-0

5: Energy Information Administration. (2024). EIA-860M Monthly Update. Washington, DC: EIA. Retrieved from https://www.eia.gov/electricity/data/eia860m/

6: Early stage projects are those projects less than 50% constructed at the time of this writing.

7: National Renewable Energy Laboratory. (2025). Cost of Wind Energy Review 2024 Edition. Golden, CO: NREL. Retrieved from https://www.nrel.gov/docs/fy25osti/91775.pdf

8: Ibid.

9: IMPLAN Group LLC. (n.d.). IMPLAN Economic Impact Analysis. Huntersville, NC: IMPLAN. Retrieved from https://www.implan.com

10: McGovern, T. (n.d.). US County Level Election Results 08-24. Retrieved from https://github.com/tonmcg/US_County_Level_Election_Results_08-24

11: Ibid.

Published

January 17, 2025

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About