- Home

- / Insights

- / White Papers

- / Power Market Forecasts Should Shape Your Energy Efficiency Strategy

Power Market Forecasts Should Shape Your Energy Efficiency Strategy

Why relying on static assumptions can lead to misallocated capital — and what to do about it

-

August 29, 2025

DownloadsDownload Whitepaper

-

Introduction

Efficiency planning is stuck in the past.

Many tools still rely on average utility rates and emissions factors to value upgrades, ignoring how quickly power markets are evolving.

Why it matters:

Making 10 to 20-year planning decisions based on static price and emissions assumptions can turn what should be strategic investments into costly miscalculations.

Our analysis exposes the gap:

Pairing the National Renewable Energy Laboratory’s (“NREL”) ComStock1 building simulations with FTI Consulting’s long-term power market forecasts reveals the startling degree to which static models can overstate or understate savings depending on location, timing, and policy changes.

Keep reading to learn:

- Why static models consistently mislead decision-makers

- How dynamic forecasts transform investment planning

- Why scenario analysis has become a competitive necessity

The Hidden Costs of Static Assumptions

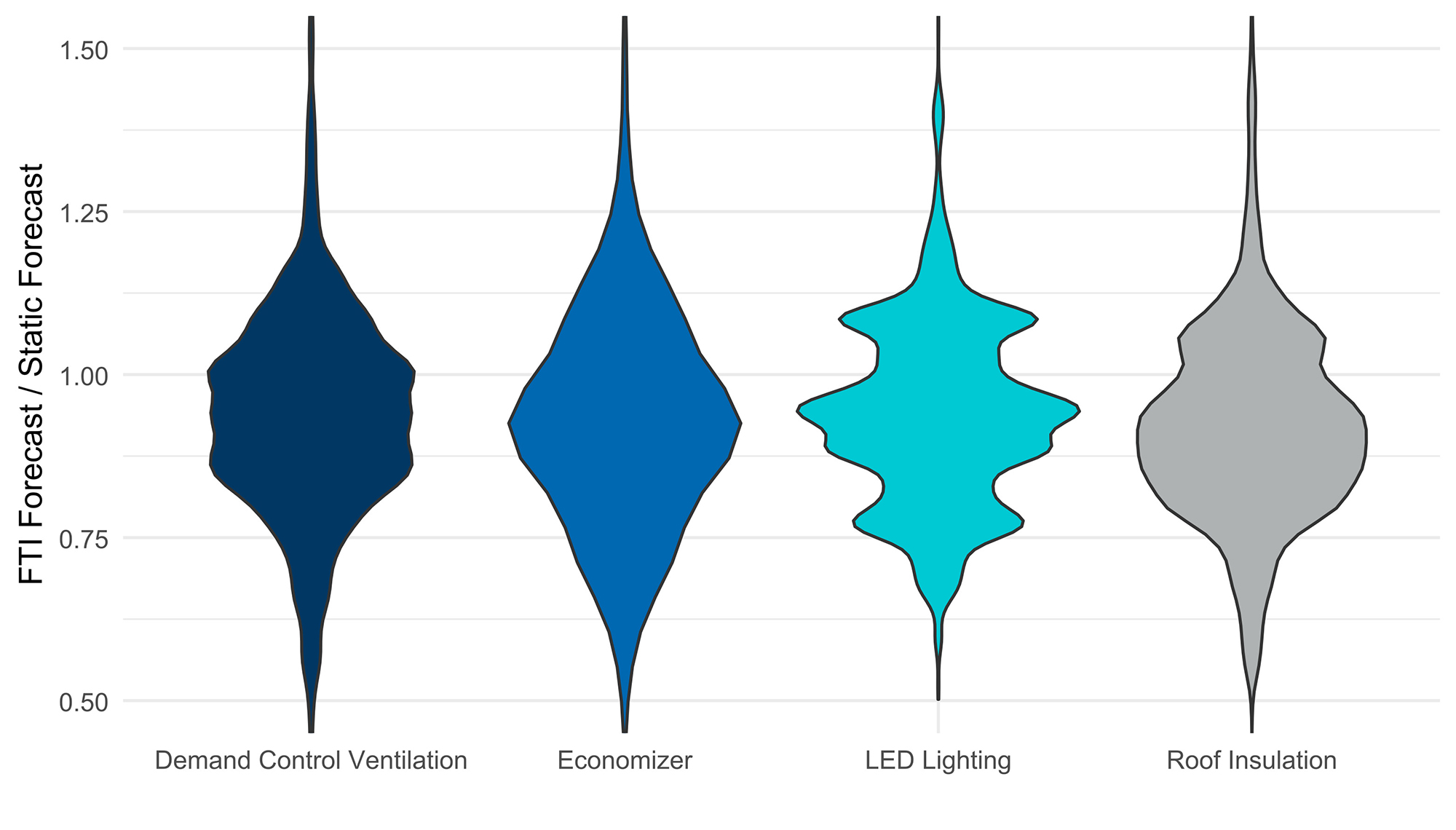

Most commercial tools take a simplistic approach to efficiency planning, calculating cost savings and emissions impact using a single fixed price or emissions factor applied uniformly over the entire investment horizon. This approach ignores a fundamental reality: electricity prices are not static, and neither is the grid's carbon intensity. The scope of this oversight becomes clear when we examine real-world data.

Figure 1 compares expected cost savings across the country using a static 2025 price forecast versus FTI Consulting's dynamic, long-term forecast for four energy efficiency building upgrades applied to retail standalone buildings. The results are striking: in most cases, the static model overestimates long-term savings, sometimes substantially, because it fails to capture declining power prices projected in many regions.

Figure 1: Per-building energy cost savings ratio between FTI Consulting and static forecasts

The modelling in Figure 1 relies upon FTI Consulting’s Q125 forecast — before the passage of the One Big Beautiful Bill. The legislation's provisions could reverse declining price trends in some areas, meaning static models might instead underestimate cost savings of upgrades. The takeaway remains the same: when market dynamics are in constant flux, yesterday's assumptions become tomorrow's costly mistakes.

Forward Forecasts Guide Smarter Investment

The solution lies in integrating an hourly view of energy use savings with location-specific market forecasts. This approach transforms how energy managers evaluate building upgrades over time and across geographies, moving beyond simple kilowatt-hour metrics to answer the strategic questions that drive real value:

- Where will efficiency investments across my building portfolio save the most money now and as the grid evolves?

- Which investments have the strongest financial or emissions impact over time?

- How should capital be allocated across a diverse building portfolio?

Consider roof insulation upgrades. Figure 2 reveals how average savings vary widely across market zones, even within the same Independent System Operator (“ISO”). Some Pennsylvania-New Jersey-Maryland Interconnection (“PJM”) zones see average savings six times higher than others, driven by hourly price patterns and future regional grid conditions that static models may completely miss.

Figure 2: Average annual roof insulation building cost savings by market zone

Without dynamic forecasting, these critical differences — and the opportunities they represent — are difficult, if not impossible, for decision-makers to see.

Scenario Planning is Essential for Competitive Advantage

Markets are volatile. Whether driven by fuel price swings, rapidly evolving policies or demand growth, future conditions are rarely projected to match today’s baseline.

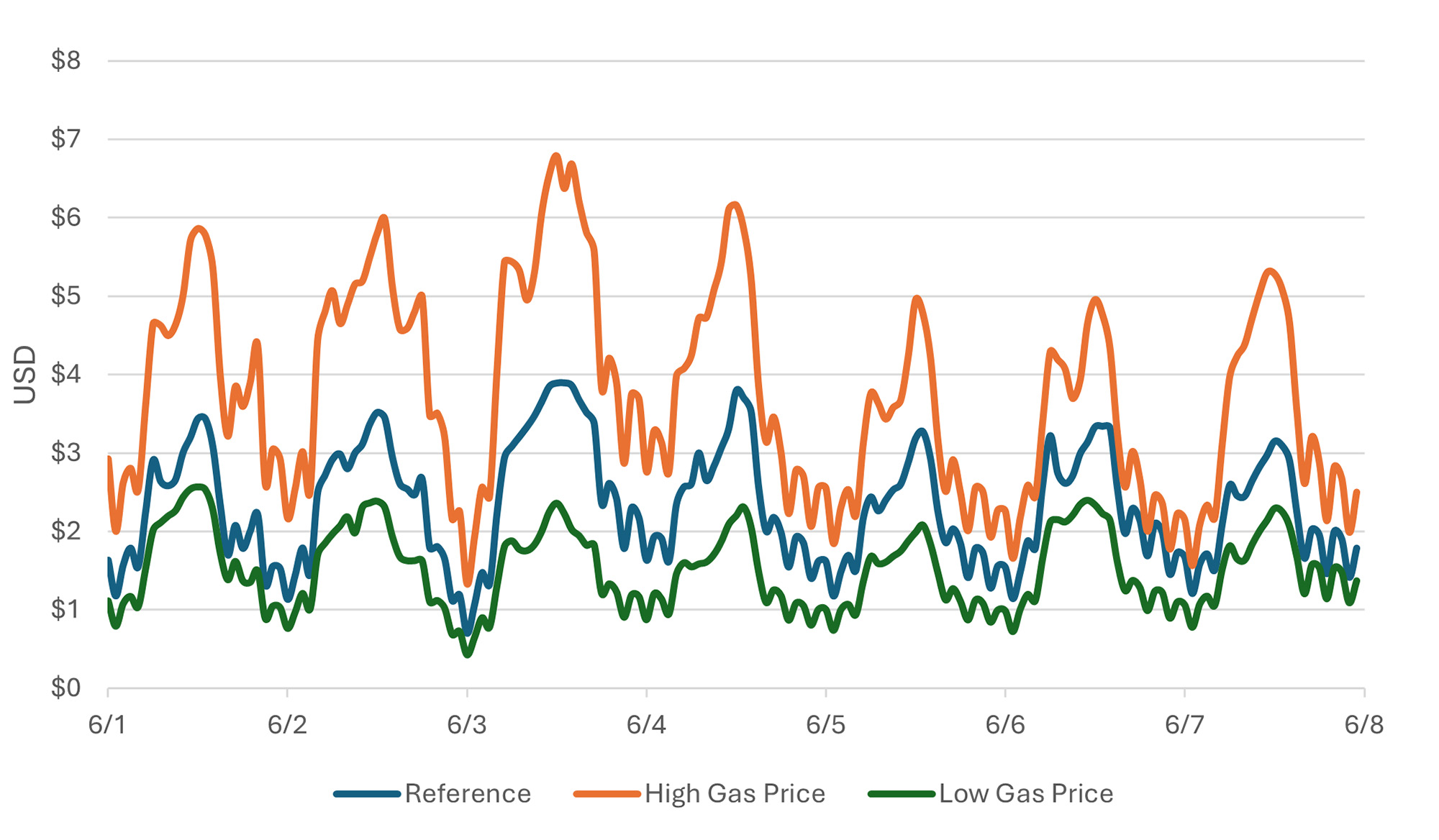

This is where scenario analysis becomes invaluable. Figure 3 demonstrates how a single building’s upgrade savings vary across different market scenarios with outcomes driven by factors like carbon policy, technology costs, and extreme weather risk.

Figure 3: Building hourly energy cost savings by scenario

For long-term planning, this matters. Companies need to consider the range of potential outcomes, not just a single-point estimate, and structure their investments accordingly.

Efficiency Planning Demands a Forward View

Static models can’t capture what’s coming next. When grid conditions, prices, and emissions factors are shifting at unprecedented speed, relying on today’s averages leads to blind spots, missed opportunities or misallocated capital.

Organizations that align detailed building simulations with robust, forward-looking market forecasts gain the ability to:

- Value upgrades accurately across time and location

- Prioritize projects based on future avoided costs and emissions

- Stress-test strategies against multiple policy and market scenarios

The energy efficiency landscape is transforming rapidly, and the window for competitive advantage is narrowing.

Click here to download the full whitepaper

Footnotes:

1: Andrew Parker, et al., “ComStock Reference Documentation,” National Renewable Energy Laboratory (2023)

Related Insights

Published

August 29, 2025

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About