- Articles

- / How Boards Can Navigate Crises in an Era of Upheaval

How Boards Can Navigate Crises in an Era of Upheaval

-

février 24, 2025

-

As 2025 unfolds, boardrooms worldwide face heightened complexities. Uncertainty, compounded by decisions on tariffs, supply chain pivots, conflicting regulatory approaches across key markets, rapid tech leaps and game-changing geoeconomic tensions, demand that boards be crisis-ready in extraordinary times. It’s not about micromanaging every detail—it’s about the board harnessing their unique ability to see the bigger picture and anticipate both risks and opportunities. However, a recent Economist Impact survey of 600 primary legal decision-makers sponsored by FTI Consulting shows only 23% of boards currently oversee their organisation’s crisis management processes. In today’s unpredictable and high-stakes environment, it is crucial for boards to take an active role in crisis planning and preparation—not just to support senior leadership but to ensure the organisation is proactive, agile and resilient. In this article, FTI’s EMEA Chairman, Lars Faeste, provides expert insights for companies facing uncertainty and unique complexities.

Robust crisis governance goes beyond ticking off continuity plans or assessing team readiness. It calls for boards to leverage their expansive perspective to evaluate the organisation’s overall strategic direction. When a crisis strikes, the board is there for support but also to challenge senior executives to ensure they are acting in the interest of stakeholders. After a crisis, it is the board’s role to consider what happened, conduct reviews to determine what could have been prevented, draw lessons and advise on the changes that will improve resilience and reduce future risks. This will help to transform crisis handling into a hallmark of strength and stability.

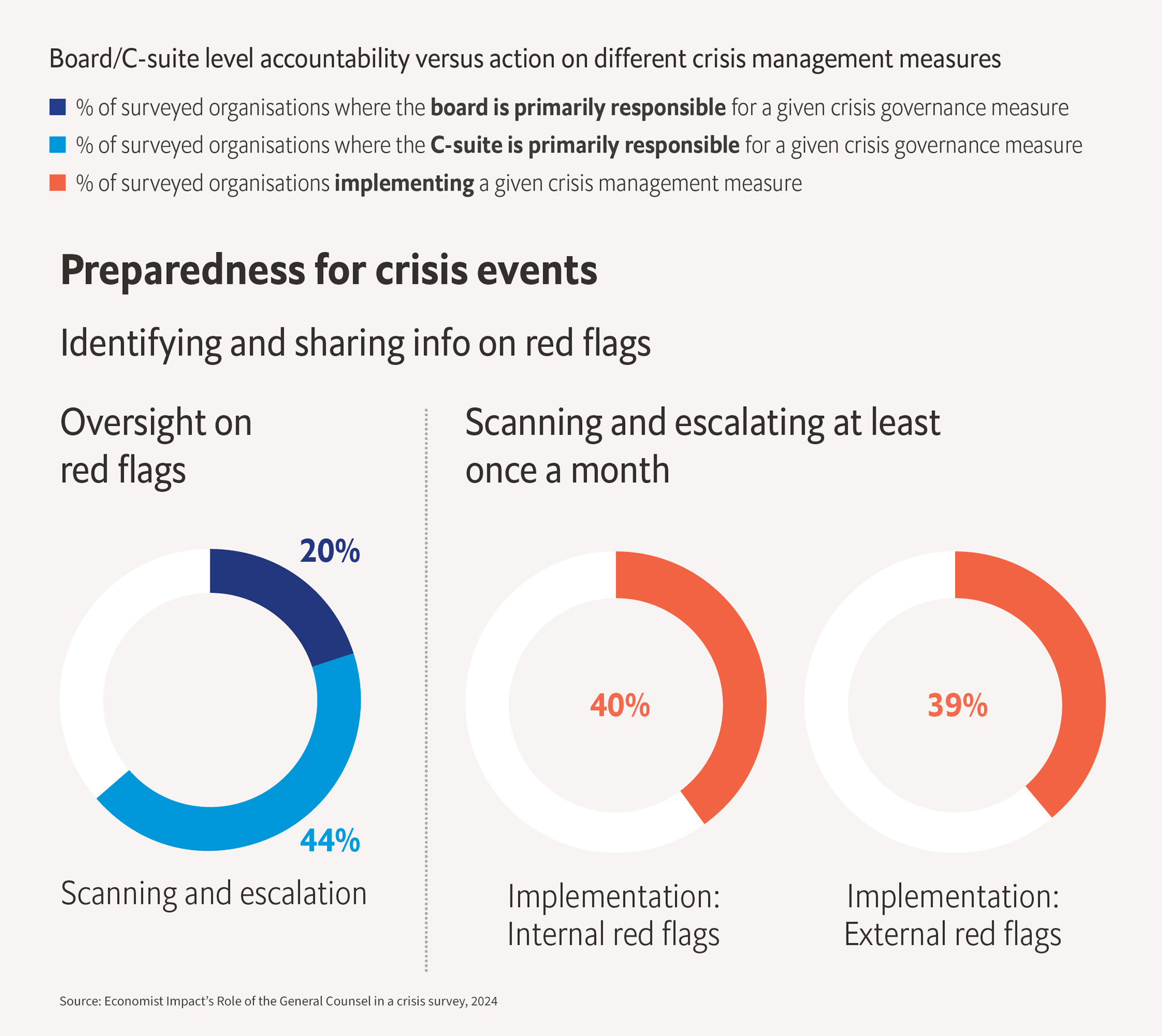

Turn Red Flags Green

With transatlantic relations entering a new era, there has never been a more urgent need for boards to actively monitor geopolitical red flag that may quickly escalate, affecting access to markets, corporate reputation and investor confidence. According to recent data, many organisations fail to consistently monitor for red flags with their operations or their strategic partners. Three-fifths of surveyed organisations said red flags are escalated less than once a month, and if recent years have taught us anything, it’s that businesses can no longer afford to be reactive.

By rigorously testing assumptions and challenging findings to ensure potential problems are addressed early, boards can help senior leaders mitigate risks, adjust risk tolerance and provide crucial insights to manage situations before they escalate. Their broad, strategic view enables them to help organisations fostering a culture of strategic vigilance that radiates from the boardroom to the post room.

Command and Control

More than 40% of surveyed organisations cited having a well-rounded crisis response team as a top priority. Boards should assess the composition of this team to ensure that it aligns with the organisaton’s risk profile and pulls in a range of skills and perspectives. And if a board member is to play an active role, be clear about what that should be.

Communication is another area of board oversight. While boards and the C-suite handle crisis communications in the majority of surveyed organisations, only 30% have prepared a crisis communications playbook for internal and external messaging. Having communications ready to roll out for a variety of incidents as part of a recovery plan saves time.

Working closely with the corporate affairs and communications teams, board members should support the CEO with high-level stakeholder engagement, while resisting the temptation to get too involved. Their insights can be especially valuable when they have strong connections to institutional or government stakeholders from their previous roles.

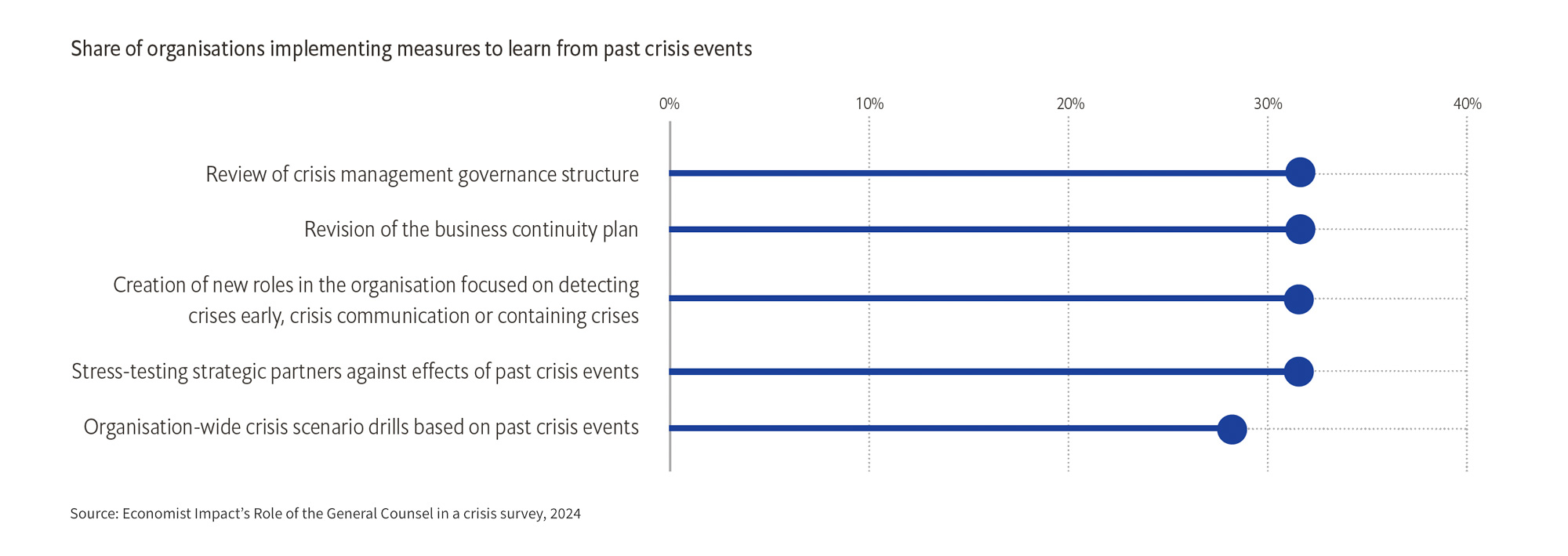

Following a crisis, boards should lead a thorough review and ensure that recommendations are implemented, including improvements to monitoring, training and simulations based on lessons learned. Tabletop exercises and crisis simulations are resource intensive but will significantly strengthen the resilience and readiness of plans, especially when more than seven in ten organisations are not conducting crisis scenario drills based on past events. Boards should work to close this gap.

Another important factor is whether the organisation has enough resources for effective crisis management. How do the current resources compare to what’s actually needed to address the crisis management goals? Are there lessons from similar organisations that could be useful? Additionally, could technologies like artificial intelligence and machine learning play a role to improve the detection and analysis of potential crises?

The Opportunity Ahead

The road ahead demands that boards ask the tough questions, challenge old playbooks and support leaders in taking proactive crisis control actions—while remaining agile enough to pivot as the landscape shifts. The organisations that thrive in times of upheaval and urgent crisis aren’t just better prepared or less exposed; they are the ones who are attuned to the opportunities that “business unusual” events create.

This article is part of the “Mastering Crises” series, a collection of insights on crisis management. This article features Lars Faeste, FTI’s Chairman of the EMEA region. He brings experience from over 15 successful end-to-end transformations and over twenty-four years of experience in the crisis management and transformation sector. Explore the other articles in this series below.

The Role of Law Firms in Crisis Management

Crisis prevention is a priority for organizations. We sponsored a global Economist Impact survey of 600 legal decision-makers to assess progress in this area.

Click here to read the full article.

Operational Resilience: A Cornerstone for Value Creation in Private Equity

The private equity (“PE”) industry drives growth and transformation, but focusing on operational resilience is often overlooked yet vital for PE success.

Click here to read the full article.

Beyond Crisis Management: General Counsel Takeaways in a Changing World

Key crisis management takeaways for General Counsel, who play a vital role in helping organisations navigate fast-changing geopolitical and economic risks.

Click here to read the full article.

Turbulent Waters, Trusted Anchors: The General Counsel’s Evolving Role in Navigating Crises

As the general counsel role evolves into crisis leadership, what measures can organizations take to prepare for more severe events in today’s environment?

Click here to read the full report.

Related Information

Published

février 24, 2025