- Articles

- / At a Crossroads: Why Medical Groups Must Act Now to Ensure Financial Sustainability

At a Crossroads: Why Medical Groups Must Act Now to Ensure Financial Sustainability

-

juillet 14, 2025

-

The pressure intensifies for medical groups to deliver exceptional, innovative and patient-centered care while maintaining fiscal sustainability. The stakes have never been higher. Based on a recent MGMA survey, a staggering 92% of medical groups faced increased operating costs in 2024.1 For physician-owned practices, operating expenses rose by 7.6%, while hospital-owned groups saw a sharp 19.9% increase in just one year.2

Further illustrating the financial strain, a recent AGMA survey revealed that health systems are now investing an average of $249,000 per physician — a figure projected to climb in 2025 and beyond, intensifying the pressure on operating budgets.3

Fueling this upward trend are labor shortages, stagnant reimbursement rates and mounting technology and supply costs.4, 5 Compounding the challenge, inconsistent practice standards across expanding networks have led to bloated corporate G&A costs, strained staffing models and misaligned compensation structures and incentives.6 These sobering figures are more than just statistics, they signal a pivotal opportunity.

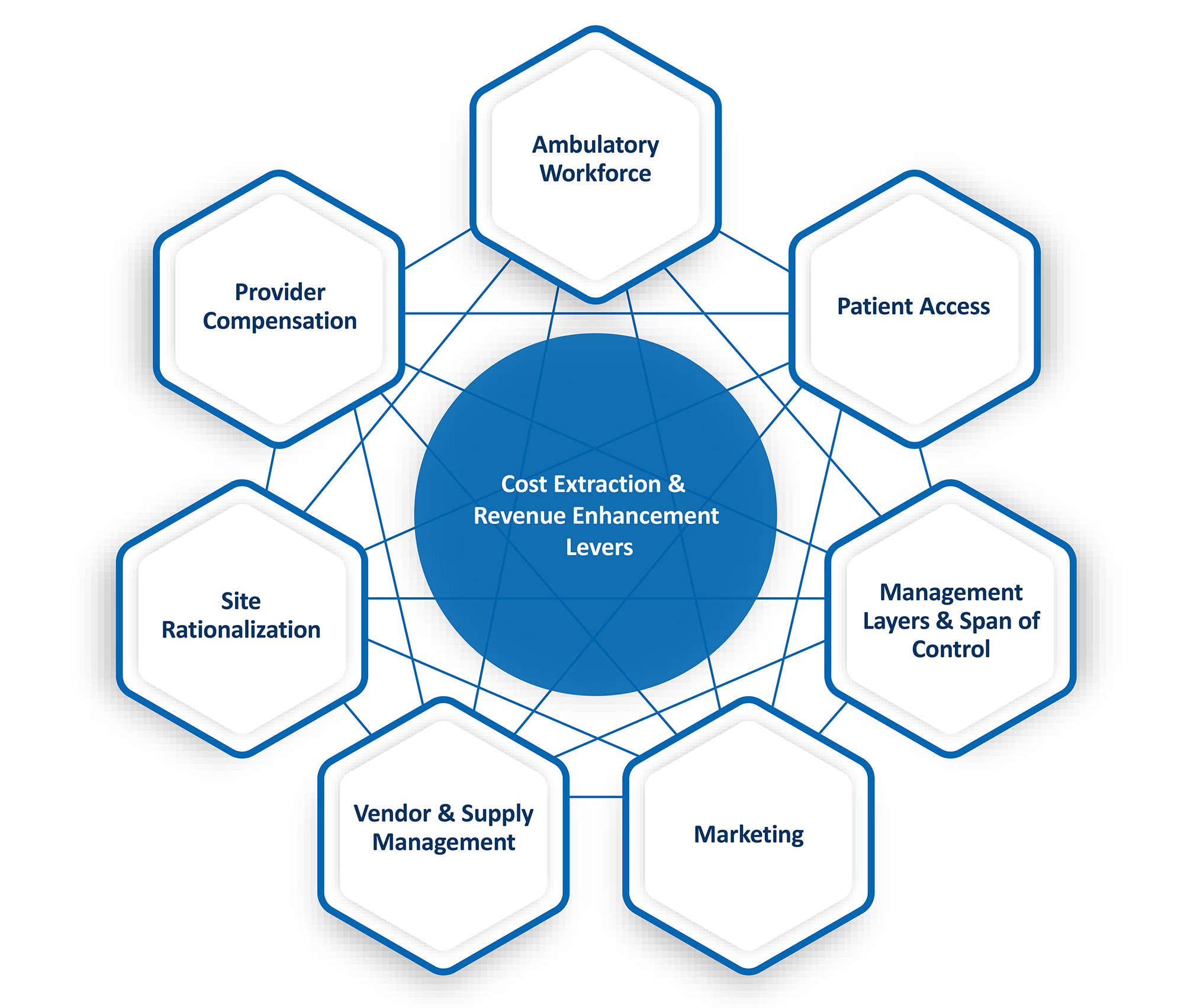

The path forward? A strategic shift toward operational excellence. To remain competitive and financially viable, medical groups must act decisively to extract costs and unlock new revenue streams. Leading organizations are identifying underperforming sites of care, analyzing cost and productivity metrics and addressing inefficiencies head-on.

Medical groups need to standardize their care models, optimize their resources and enhance patient access to transform today’s financial challenges into tomorrow’s growth opportunities.

Here are 7 key focus areas medical groups should focus on to get there:

| Focus Area | Impact Lever | Strategic Initiative |

|---|---|---|

| Ambulatory Workforce |

— Cost Extraction — Ambulatory Skill Mix Standardisation — Clinical & Non-Clinical Scope of Practice |

— Eliminate redundancies, validate roles via job descriptions, observations and stakeholder interviews, ensuring clear delineation of roles and responsibilities — Match clinical roles to licensure and scope of practice, ensuring staff operate at the top of their credentials — Align support staff schedules to meet patient demand |

| Management Layers & Span of Control |

— Cost Extraction — Title Alignment — Governance |

— Ensure a triad partnership exists between Administrator, Physician and Nursing leaders (as necessary) to manage specific programs, service lines or geographic areas — Review layers of management and span of control ratios at the Supervisor, Manager and Director levels to determine need — Assess necessity of extraneous titles within the current structure — Develop labour committee structure to evaluate vacancies as well as new and replacement requisitions |

| Provider Compensation |

— Cost Extraction — Equity & Alignment |

— Align physician compensation model with organisational goals, promoting quality, equity and performance-driven outcomes over traditional FFS models — Benchmark compensation against local, regional and national markets — Establish role of APCs as independent practitioners — Implement real-time data tracking for compensation accuracy, integrity and variance reporting |

| Site & Service Rationalisation |

— Cost Extraction — Service Offerings & Performance |

— Optimise or eliminate underperforming sites using 4-wall financials and year-over-year leading practice indicators (e.g., productivity, labour, supply cost metrics) — Assess geographic density, including provider complement, payer mix, service offerings and patient origin — Analyse provider succession planning, turnover and opportunities for site consolidation |

| Vendor & Supply Management |

— Cost Extraction — Standardisation |

— Standardise and centralise contract management, inventory ordering and management processes — Form a Value Analyst/Analysis Team to optimise drug/supply contract pricing — Evaluate physician preference items and identify opportunities for consolidation |

| Patient Access |

— Revenue Enhancement — Standardisation — Patient Consumerism |

— Audit specialty-specific scheduling templates (Fill Rate, No-Show %, Cancellation %, LWOS, New Patient %) to identify variability in appointment types, durations and scheduling standards — Set standardised ambulatory protocols and safeguards to minimise risks and ensure alignment with established performance targets — Implement automation where feasible, providing clear education and decision-making tools (e.g., EMR logic/decision trees) for schedulers and contact centre agents |

| Marketing |

— Revenue Enhancement — Patient Education & Retention — Digital Health |

— Build targeted marketing plans by site of care and specialty, aligned with organisational goals and patient needs — Perform gap analysis and create mitigation plans to enhance patient education, retention, web presence and referral strategies — Upgrade marketing and digital health tools, such as Epic/EMR-integrated text/email capabilities to enhance patient engagement and streamline post-referral scheduling |

Conclusion

Medical groups are at an inflection point. Variable practice standards, complex scheduling practices and limited performance tracking drive inefficiencies, jeopardizing fiscal viability. However, these challenges offer a transformative opportunity.

Partnering with FTI Consulting, organizations can tap into unparalleled operational expertise and deep industry knowledge in physician enterprise and ambulatory care. FTI Consulting leverages advanced data analytics to improve transparency, drive operational excellence, standardize care delivery models, optimize workforce and vendor strategies, and expand patient access through EMR-integrated digital enablement. Together, we can partner to turn today’s challenges into a strategic advantage, achieving operational excellence and securing long-term success.

Footnotes:

1: “MGMA 2024 DataDive Cost and Revenue Report”, MGMA (June 26, 2024).

2: Ibid.

3: “New Survey Finds Medical Group Operating Costs Continue to Outpace Revenue”, AGMA (December 13, 2023).

4: Ibid.

5: Patsy Newitt, “Physician practice costs keep climbing”, Becker’s Healthcare (December 6, 2024).

6: Ibid.

Related Insights

Related Information

Published

juillet 14, 2025

Key Contacts

Key Contacts

Managing Director

Managing Director

Director