Five Priorities for Life Sciences Service Providers

-

2025年9月19日

-

Contract Research Organizations (“CROs”) and Contract Development and Manufacturing Organizations (“CDMOs”) are a critical backbone in the life sciences ecosystem, delivering research, development and manufacturing capabilities that innovators rely on. They accelerate timelines, reduce capital burdens for drug innovators, and bring specialized expertise that can make — or break — the path from lab to patient. But when client drug pipelines stall, regulatory requirements shift or markets tighten, these organizations can be left exposed. (Source – Contract Pharma)

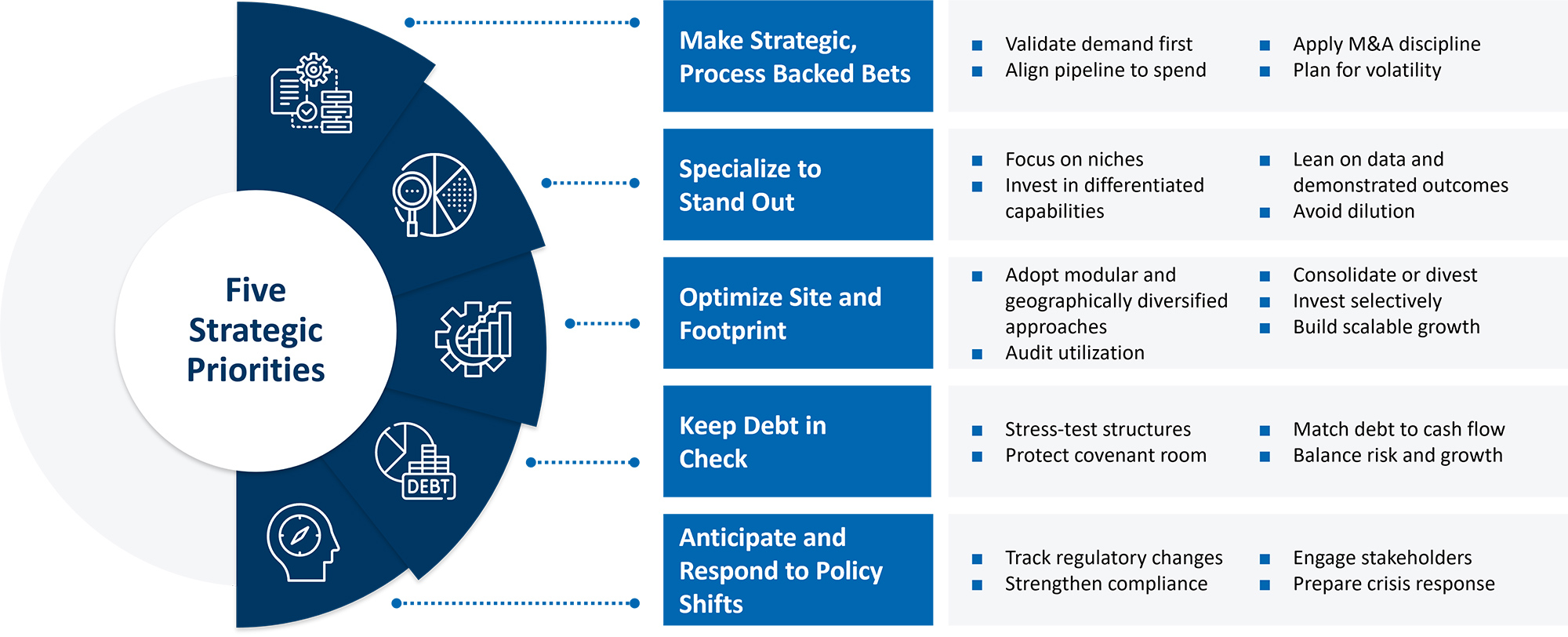

Several critical areas stand out for CRO and CDMO leaders and investors in 2025. For many, the focus will be balancing growth ambitions with the need for operational discipline and strategic focus. These priorities reflect the challenges and opportunities we’ve seen CROs and CDMOs navigate across shifting demand, funding droughts, operational hurdles, and global expansion.

Five Strategic Priorities for 2025

Healthcare Quarter

in Review

Read Now

Turning Strategic Priorities Into Action

Make Strategic, Process Backed Bets

CROs and CDMOs operate in high-stakes environments where expansion can quickly become a liability if not rooted in revenue reality. Too often, organizations build capacity or pursue growth on assumptions that never materialize — leaving them with overcapacity, strained balance sheets, and leadership pulled away from core execution. Whether opening a new facility, entering a new market, launching a service, or pursuing an acquisition, every move must be backed by operational and financial rigor. Key levers for disciplined growth include:

- Commercial Diligence: Validate demand before committing capital. Stress-test assumptions with hard market data, assess competitive dynamics, and ensure revenue potential justifies investment.

- Forecasting and Pipeline Management: Many organizations stumble because expected revenue never materializes. Proper commercial forecasting and pipeline oversight, tightly aligned with investment decisions, are essential to avoid stranded assets and overcapacity.

- M&A Discipline: Apply the same rigor to acquisitions as to organic growth. Successful players build integration plans from day one, ensure synergies are realistic and avoid deals that distract from core execution.

- Volatility Planning: Client pipelines shift quickly. Leaders who plan for swings in demand build flexibility into capacity and financing structures, helping them to weather disruptions.

Specialize to Stand Out

In a crowded market, trying to be all things to all clients can lead to mediocrity and underperformance. Leaders should zero in on the services and therapeutic areas where they can truly differentiate.

The strongest players often deepen expertise in high-value niches, whether that’s complex biologics manufacturing, rare disease trials, or specialty dosage forms. Specialization builds a sharper market identity, higher win rates and stronger margins.

Optimize Site and Footprint

Underutilized facilities and idle site capacity don’t just erode profitability, they can erode client and investor confidence.

Optimizing a footprint requires balancing today’s efficiency with tomorrow’s flexibility. The main risks are capacity misalignment, regulatory noncompliance, stranded capital and supply-chain fragility. Providers that adopt modular, scalable and geographically diversified approaches are generally best positioned, and they will better serve a diverse client base without stranding assets or compromising quality.

Key design considerations to optimize size and footprint:

- Modular cleanrooms for fast expansion and reconfiguration.

- Single-use technologies to cut cleaning costs and enable rapid changeovers.

- Digital automation (MES, robotics, digital twins) to boost efficiency in smaller footprints.

- Scalable utilities designed for future capacity growth.

- Hybrid hubs and satellites balancing global scale with local responsiveness.

- Regulatory-first design ensuring GMP compliance and multi-region approval.

- Right-sized support areas with lean labs and storage.

Top-performing CROs and CDMOs are making asset optimization a core discipline, regularly auditing site performance, divesting or repurposing underperforming locations and consolidating operations to reduce fixed costs and boost efficiency. A well-managed footprint not only strengthens financial health but also signals to clients that their provider is disciplined, resilient and built for the long haul.

Keep Debt in Check

Financial leverage can fuel growth, but in this market, it can also magnify vulnerability. For service providers, covenant breaches or bankruptcies can result from aggressive expansions colliding with softer demand.

Disciplined leaders are stress-testing debt structures under adverse scenarios, ensuring covenants provide room to maneuver and avoid financing arrangements that could trigger existential risk from short-term disruptions.

Anticipate and Respond to Policy Shifts

CROs and CDMOs sit at the intersection of science, manufacturing, and regulation — and policy changes can reshape their economics overnight. From tariffs on raw materials to incentives for domestic production and evolving FDA/EMA guidance, the ability to anticipate and quickly respond is critical.

Leaders who integrate public affairs into their planning can better monitor developments and are better positioned to adjust in real time: shifting supply chains, optimizing site locations to capture incentives, and strengthening compliance frameworks as standards evolve. Equally important is comprehensive crisis preparedness. In the event of an unforeseen policy issue or regulatory development, having a robust crisis communications plan, including designated spokespeople and prepared messaging, is critical to responding swiftly and managing public perception during such events.

In a market where investor and client confidence hinge on resilience, proactive policy readiness is as important as operational excellence.

The Bottom Line: Balancing Growth and Discipline

CROs and CDMOs are essential to the success of the life sciences industry, but the margin for error is shrinking. Growth is necessary to meet client demand, but without discipline, it can quickly undermine long-term success.

Innovation depends on service providers who can deliver speed, quality, and reliability — consistently, even when market conditions shift. For CROs and CDMOs, the challenge is clear: pursue growth with discipline, safeguard profitability and remain the partner of choice for innovators.

関連するインサイト

Related Information

出版

2025年9月19日

主な連絡先

主な連絡先

シニア・マネージング・ディレクター

シニア・マネージング・ディレクター

シニア・マネージング・ディレクター

シニア・マネージング・ディレクター

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About