- Articles

- / AI in Private Equity: Three Plays for Driving Value Creation in 2025

AI in Private Equity: Three Plays for Driving Value Creation in 2025

-

Dezember 04, 2024

-

AI is playing a larger role in creating value in private equity (“PE”) portfolio companies (“PortCos”), and in 2025, this role will likely continue to increase. From our experience working with both PE firms and their PortCos, successful value creation using AI is emerging in three plays: utilizing AI for transforming the core business model, centralizing the orchestration of AI at the firm level and building AI transformation into the sell-side narrative and buy-side target diligence.

Play 1: Using AI to Reshape the Core Business Model for the PortCo

Recent survey results from FTI Consulting’s AI Radar for Private Equity1 reveal that an increasing number of PE executives are shifting their AI focus from incremental improvements towards a business model evolution, but this transformation can be challenging to implement. While it is well-known that AI can drive operational efficiencies, cost reductions and product feature development, these investments have emphasized point solutions to serve singular use cases and bring incremental revenue or cost improvements.

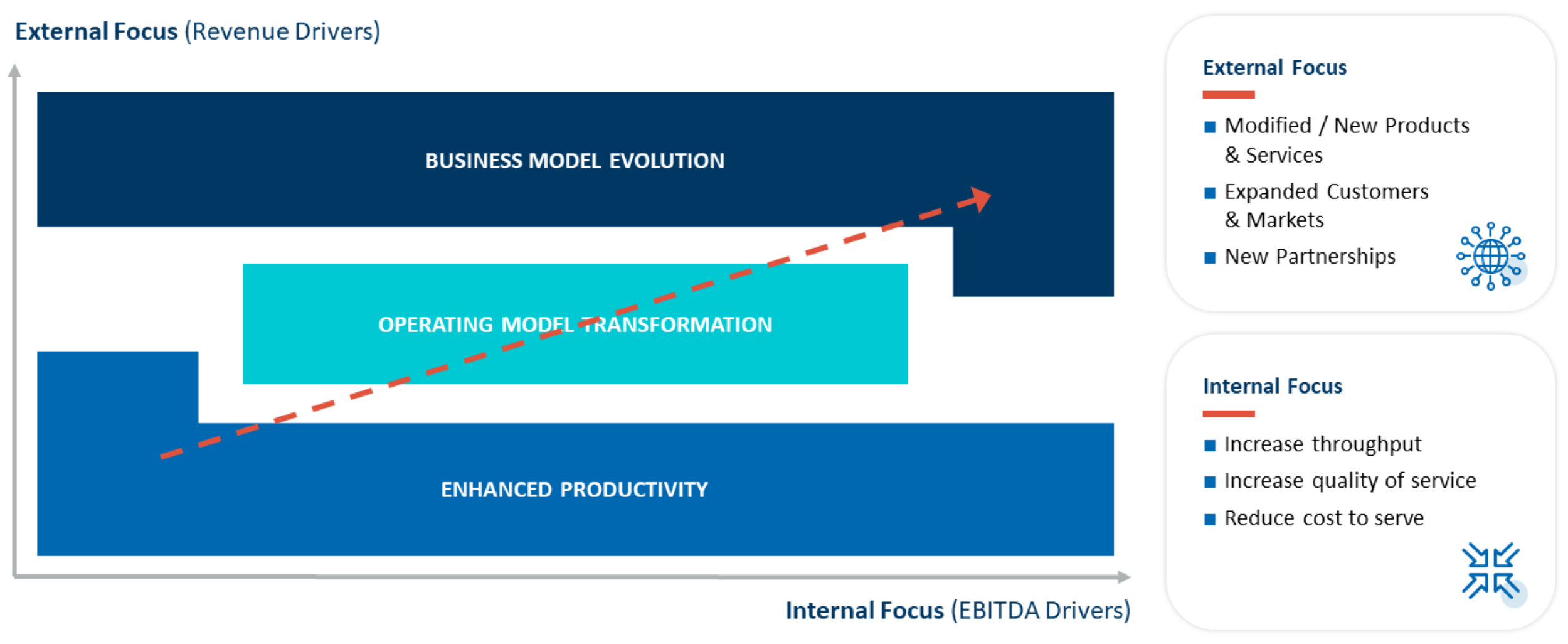

Expanding Lens of AI Value Creation

Expanding beyond productivity levers to operating model transformation and business model evolution:

Source: FTI Consulting

The ability to move beyond incremental improvements requires adjusting the AI lens to a wider, multidimensional focus on key elements of the PortCo’s core business model. In our experience working with PE firms and their portfolio companies, PE firms need to thoroughly examine three key dimensions of value creation to realize the transformational benefits of AI: how you sell, what you sell and how you create products and services. Doing so will uncover new strategies for addressable market expansion, product and service evolution and operating model transformation to guide operational planning and investment decisions for portfolio companies. Enabling these strategies is a paradigm shift in technology and data strategy that prioritizes the development of advanced interconnected AI agents rather than sophisticated application design.

Top AI-Driven Value Creation Levers in PortCos

Source: FTI Consulting Survey: AI Radar for Private Equity 2024

To transform how you sell, PE firms should encourage their operators to focus on AI use cases that increase sales reach, velocity and win rates. Reducing time to quote is a key lever for sales growth and competitor positioning in many industries. In financial services, for example, businesses can utilize AI to enable faster (or automated) loan decisioning and more accurate assessment of applicant risk. Similarly, in deregulated energy markets where customers can choose their provider, AI can help by accelerating deal pricing and improving pricing accuracy (for both new customers and renewals) based on historical usage data. Both of these use cases improve overall sales volume and win rates.

Harnessing the power of proprietary datasets can unlock value for portfolio companies by transforming what you sell into differentiated products and services that create competitive moats that protect market share and maintain profits. In digital publishing, for example, companies are leveraging historical datasets to create intelligent AI copilots to power the article content creation process. These copilots can generate content that is specific to the author’s voice or the tone and style used by other authors on similar topics and then tailor that content accordingly to audience preferences. These value-added features can increase a customer’s willingness to pay for the expanded set of publishing products and services. For enterprise marketing and communications leaders, these newly included features help to shift spend from non-owned channels back towards owned communication channels, improving EBITDA.

Capturing value from how you create products and services can be achieved by integrating AI into core operations and back-office functions. Across industries, companies are developing AI tools for enterprise functional areas (e.g., finance, HR/payroll, IT and software development). In asset-intensive industries (e.g., industrial manufacturing, mining, etc.), AI is unlocking material improvements in EBITDA, and companies are developing AI tools to improve predictive maintenance systems, optimizing equipment configurations/process control settings to improve throughput from industrial processing operations, and deploying advanced industrial internet of things technologies to improve logistics and warehousing functions. Based on our client experience, we have calculated EBITDA gains from 5% up to 25% across industries where such AI tools can be deployed.

To successfully enable these capabilities throughout the PortCo, technology leaders need to transform the enterprise data and integration design across enterprise applications and foster the development of AI agents within the organization. The benefit comes from the seamless flow of data across the business and from communication between customer-facing (including internal users) tools and backend databases.

Play 2: Centralizing the Orchestration of AI at the Firm Level

PE firms that implement a unique operating model to drive AI value creation activities at a particular PortCo may find that these activities are not easily extendible to the other PortCos without first modifying the overall strategy and approach. FTI Consulting recently found that 40% of PE firms are managing AI investments at the portfolio company level, which we classify as a “Decentralized AI Operating” model. Given the industry challenges most companies face in formulating their unique AI-focused strategy, battling for sparse talent and deploying AI tools in an acceptable time frame, this decentralized model may prove insufficient. As PE firms increase their focus on AI value creation, they should consider moving from decentralized models towards centralized models to efficiently scale and exploit AI learnings across their portfolio companies.

AI Implementation Challenges

Respondents were asked to select up to three of their biggest challenges.

Source: FTI Consulting Survey: AI Radar for Private Equity 2024.

In our experience, the AI operating models that PE employs with their PortCos fall into four categories depending on the extent to which the PE firm chooses to centralize ownership of AI: a fully “Decentralized” model, a model where one or more PortCos serve as a “PE Center of Excellence (“COE”),” a more concentrated or “Fund-Specific” model and finally a truly “Centralized AI” model. Across each category, there are nine key components that PE executives or PortCo operators can address, which are a mix of organizational, people and partners, business process and technology factors, as seen in the graphic below. Value creation from AI at the portfolio level will largely depend on how well a PE firm can utilize the knowledge, talent and potential synergies gained from a single PortCo and then leverage them across other PortCos. Therefore, the more that a PE firm can move from left to right, from a decentralized model to a more centralized one, the better positioned the firm will be to unlock value creation across portfolios.

The following components are to be viewed from the PortCo perspective, starting with the top of the list as the first and most essential areas to consider consolidating at the firm level, down through to the bottom of the list, where these components are likely still better managed at the PortCo level.

- Define AI Policy and Governance: establish policies and guidelines for risk, security, trust, and privacy to ensure responsible AI deployment

- Align AI Strategy with Leadership: collaborate with PortCo leadership to leverage experience and manage the performance of AI enablement supporting the investment theses

- Centralize Investment and Priority Decisions: closely monitor the identification, prioritization and investment in AI-driven use cases to improve performance

- Leverage Data Federation: manage the level of internal/external data federation between PortCos on a per-case basis to drive competitive advantage in AI applications

- Apply Foundational AI Models: apply general models to their own AI use cases that are highly relevant to their company and share knowledge with other PortCos

- Evaluate Custom AI Models: for custom-trained or fine-tuned models, evaluate knowledge gained from implementation results for use in other PortCos

- Optimize AI Architecture and Tools: identify compute/GPUs, storage, orchestration infrastructure, vertical and horizontal AI applications for best performance

- Include in a Partnership Ecosystem: share product engineering, technology advisors and additional partner advisors as a wider partnership ecosystem

- Apply an AI-Driven Operating Model: use the existing playbook for deploying AI: workforce evolution, change management and user adoption and apply to other PortCos

Play 3: Building AI Transformation Into the Sell-Side Narrative and Buy-Side Target Diligence

AI is increasingly becoming a critical component in the diligence activities on both sides of the transaction. PortCos that have already implemented AI based on well-defined use cases and shown evidence of value creation may benefit from an “AI multiplier” from the initial purchase price. In the aforementioned digital publishing example, by widening the AI value creation lens, AI operators were able to revise their estimate of Total Addressable Market (“TAM”) up to 3x, which significantly impacted the valuation multiple. In order to fully capture this created value, PE firms will need to demonstrate how AI has improved along the dimensions we’ve described: how they sell, what they are able to sell and how they can now create products and services. This AI-enabled transformation has real impacts on addressable market size, channel expansion and the evolution of product development, and it should drive the value narrative for the future results of the PortCo.

On the buy-side, PE firms that have a higher level of AI maturity, either in one of their PortCos or, ideally, have moved from “Decentralized” to “Centralized” AI operating models, will be better positioned to evaluate potential targets. Their own AI use case formation and development and performance in AI initiatives will help them better evaluate the AI readiness or impact of a potential target company. These PE firms will, simply put, see the AI potential in targets more clearly. For example, a PE firm we worked with evaluated an MSP target with a low AI maturity and identified a potential 10% EBIDTA increase if AI tools were applied. In another case, a PE firm identified a target that had invested in building a data platform that can be readily used as a platform play for enabling AI use cases across this firm’s other portfolio assets and made this factor the cornerstone of their investment theses.

Conclusion

PE firms and their PortCos are certainly aware of the transformative value of AI, but their challenge will be managing the journey to value creation. According to FTI Consulting’s recent survey, of the PE firms that currently have an AI strategy, 36% have no specific milestones or KPIs for measuring and managing the AI impact on value creation. Defining a clear roadmap, outlining the priorities of well-formed AI use cases and orchestrating the performance of AI strategy will be critical to the overall valuation of the PortCo.

For each PE firm, the priorities and objectives for AI will differ for each PortCo as they have to align with the overall value creation thesis and balance with the firm-level strategy for orchestrating the AI execution. Unifying these goals and creating tangible value will likely be a challenge for many PE firms in 2025 amid the broader backdrop of the changing technology landscape of AI.

Footnotes:

1: Sumeet Gupta, Jiva J. Jagtap, “AI Takes Center-Stage for Value Creation in Private Equity Firms,” FTI Consulting Report, Oct. 24th 2024.

Related Insights

Related Information

Datum

Dezember 04, 2024