AI Takes Center-Stage for Value Creation in Private Equity Firms

How the Strategic Deployment of AI Is Transforming Value Creation for Portfolio Companies

-

October 23, 2024

-

FTI Consulting’s survey, AI Radar for Private Equity, explores the transformative impact PE executives are seeing from AI on value creation, dealmaking and strategy. This survey of PE executives is the first in a series of in-depth analyses that will delve into transformative applications of AI and sector-specific advancements, providing actionable insights for PE firms.

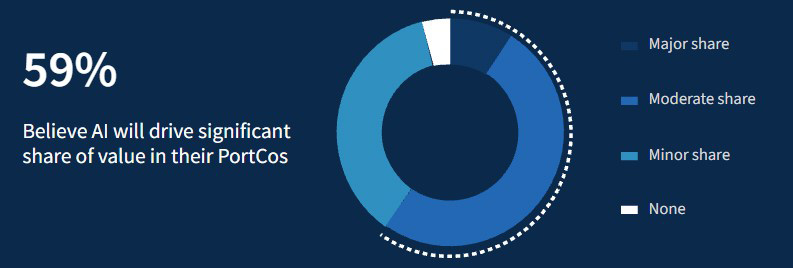

AI is Now a Driving Factor in Value Creation

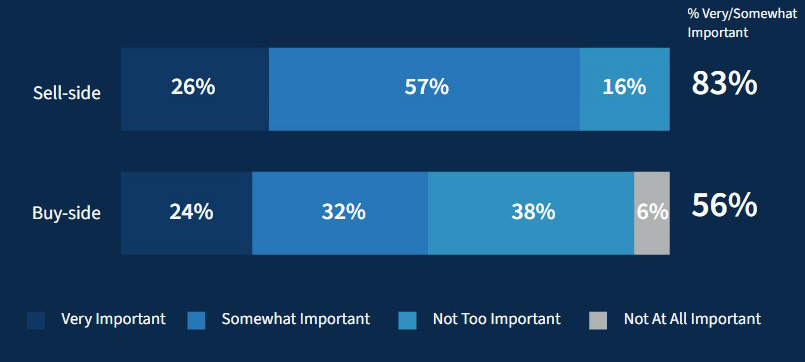

Several levers influence value creation for portfolio companies (“PortCos”), but AI will loom large as one of the most prominent ones. The majority of firms surveyed expect AI to drive a significant share of total value relative to other levers driving value creation. While AI is important on both sides of deal execution, it has an outsized impact on the sell-side, as it can drive up the valuation of PortCos.

AI is Expected to Drive Significant Value Creation Relative to Other Levers

Source: FTI Consulting Survey: AI Radar for Private Equity 2024.

Importance of AI in Sell-Side and Buy-Side Diligence

Source: FTI Consulting Survey: AI Radar for Private Equity 2024.

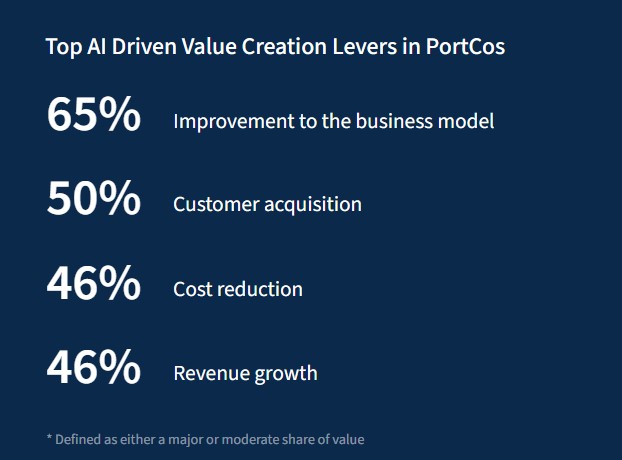

PE respondents expect the largest value creation among PortCos to come from improvement to the business model, implying an expectation of wide-ranging transformative effects rather than incremental gains to margin through revenue growth or cost reduction. This illustrates a key shift in thinking around value creation, from a focus on cost or revenue metrics to a realization that AI could have a multidimensional impact on the business if properly applied.

Top AI-Driven Value Creation Levers in PortCos

Source: FTI Consulting Survey: AI Radar for Private Equity 2024.

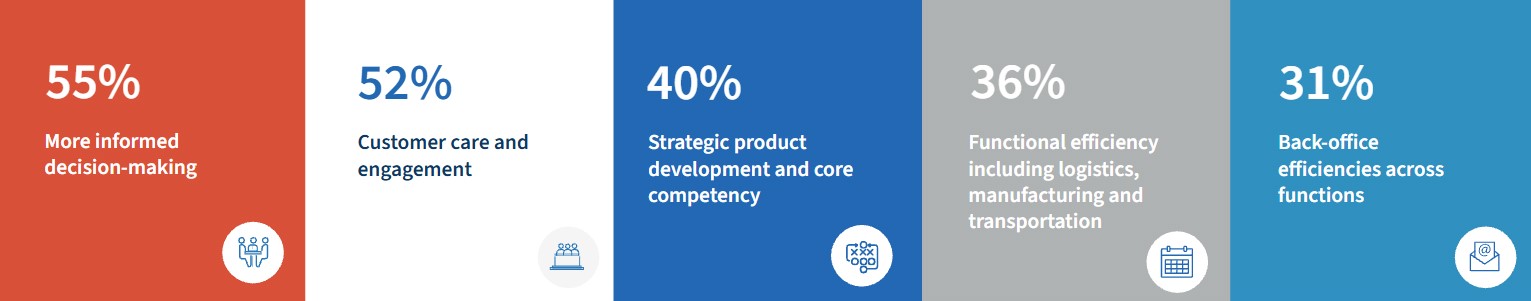

Areas of High Potential for AI-Driven Value

Share of respondents who indicated AI has a high potential to drive value creation in the next 18-36 months. Respondents were asked to assess each functional area for potential impact.

Source: FTI Consulting Survey: AI Radar for Private Equity 2024.

Consistent with this expectation, the functional areas in which AI is seen as most impactful on value creation are those with a more holistic and strategic focus — precisely those areas with the potential to have a more transformative impact. These areas include improved or enhanced decision making capabilities, as well as customer-facing functions. Though at a slightly lower potential, respondents indicate that PE expects AI to improve service and product offerings more than operations and back-office functions.

Source: FTI Consulting Survey: AI Radar for Private Equity 2024.

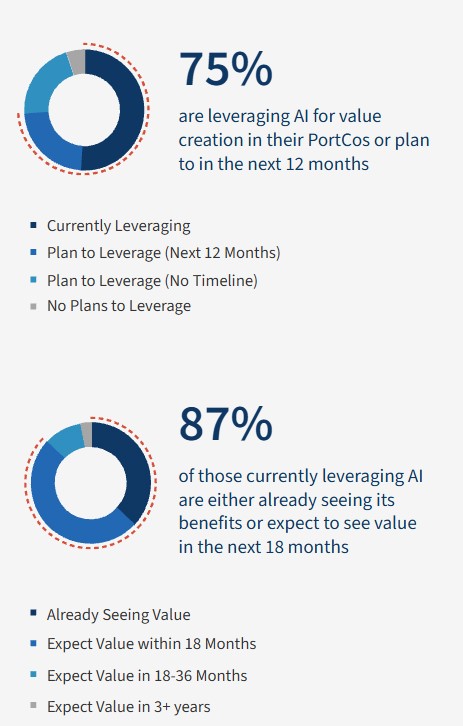

AI Investment Has Already Begun and Early Evidence of Value Creation Is Tangible

The majority of PEs are already investing in AI or are getting ready to invest in the near-midterm, and most are anticipating seeing value in the next 18 months.

Interest and investment in AI is already widespread, with approximately half of PE respondents saying they are currently leveraging AI in their PortCos. Furthermore, one quarter say they are planning to use AI in their PortCos within the next 12 months. AI is still in the early stages and more use case validation is needed. However, current investment has momentum, and intended investment levels are high as early signs of material value are visible.

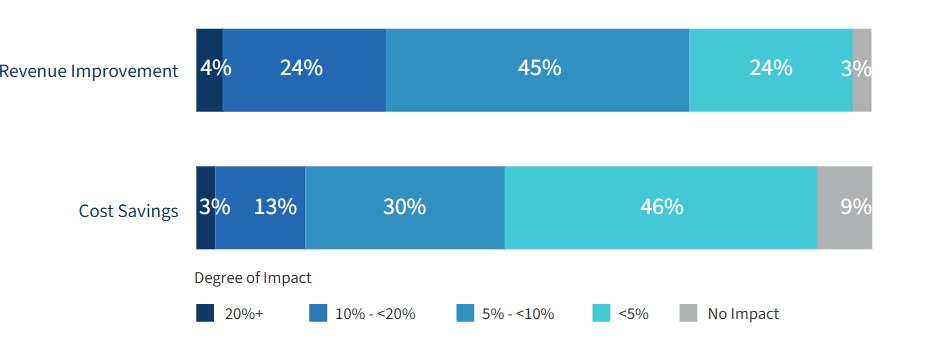

With the recent rapid advancement in AI and high expectations for future progress, value creation won’t lag far behind. The majority of PE respondents are either already seeing the value of AI, or expect to see value within the next 18 months. AI adoption is expected to have greater impact on revenue growth compared to cost savings, although positive impact is expected on both.

Estimated Financial Impact From AI Implementation

Source: FTI Consulting Survey: AI Radar for Private Equity 2024.

While a majority of respondents expect AI initiatives to be funded by the individual PortCo, nearly 4 in 10 are considering funding AI through some level of centralization, either utilizing a fund from across their PortCos or a center of excellence at the PE firm. Centralizing resources at the PE portfolio level could help to ameliorate some of the more common challenges around strategy development and talent recruitment.

Finding the Right Talent and Developing the Right Strategy are Key Challenges

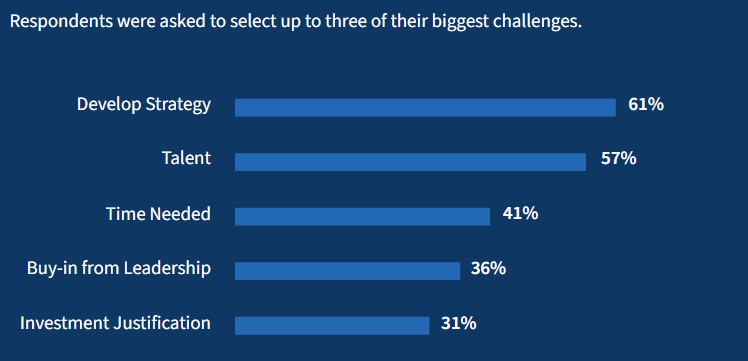

A key hurdle for PortCo operators is creating the appropriate AI strategy and securing the necessary talent to effectively implement it.

A majority of PE firms point to developing a strategy and finding the right talent as the biggest challenges in AI value creation implementation. Centralizing sources of funding for AI could be one path towards addressing some of the common challenges as executives could execute investment decisions at the firm level. As with any other investment, getting buy-in and having a strong business case with a higher ROI is important. However, given the general consensus around the transformative potential of AI, justification may prove easier than for other initiatives.

AI Implementation Challenges

Source: FTI Consulting Survey: AI Radar for Private Equity 2024.

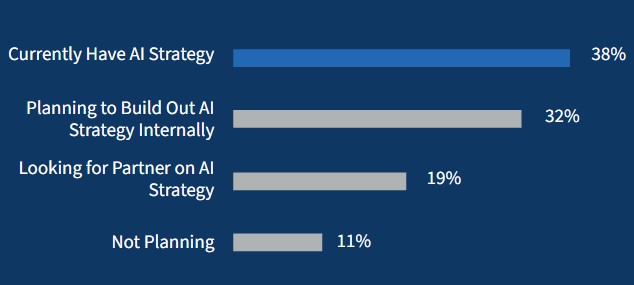

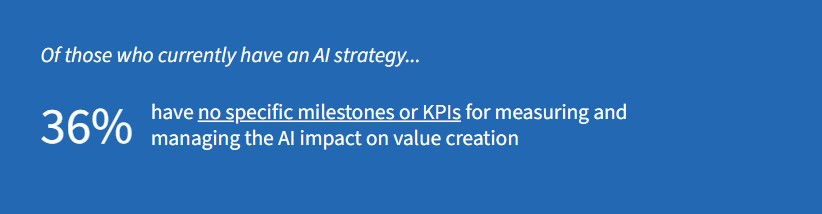

Despite the high interest in AI and available investment funds, PE firms may not be adequately prepared for implementing AI, with less than half having a formal strategy or roadmap currently in place. Even among those with a formal strategy, more than one-third don’t have specific mechanics to track progress.

AI Strategy or Transformation Roadmap

Source: FTI Consulting Survey: AI Radar for Private Equity 2024.

Navigating AI Value Chain Complexities

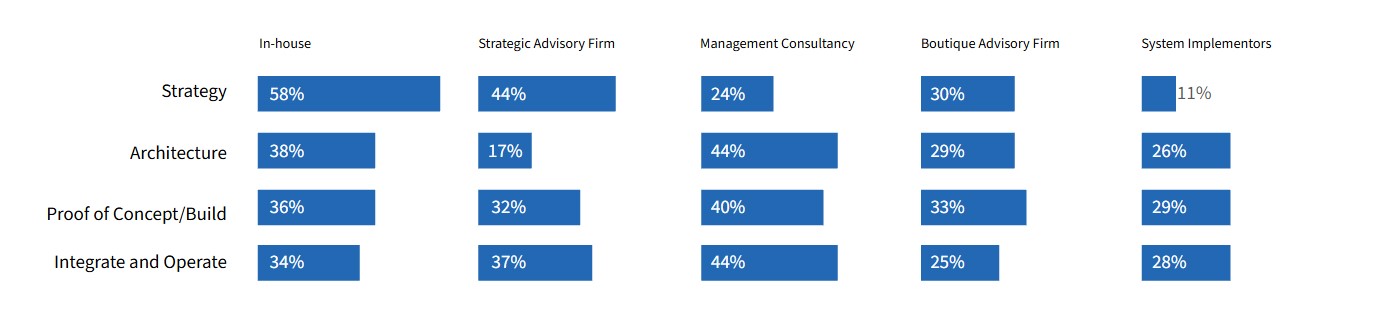

Many respondents are formulating their AI strategy initially with in-house teams while bringing in external expertise as they move along the AI maturity curve of AI deployment. Two-thirds report seeking external support with proof-of-concepts, developing target state enterprise and data architecture, or integrating AI into their operations. When they seek external support, the preferred model is largely with strategy and management consulting firms. This suggests that the endeavor is currently considered to be relatively complex vs. a more steady-state scaling exercise that is typically accomplished through system implementors.

AI Partner Ecosystem

Source: FTI Consulting Survey: AI Radar for Private Equity 2024.

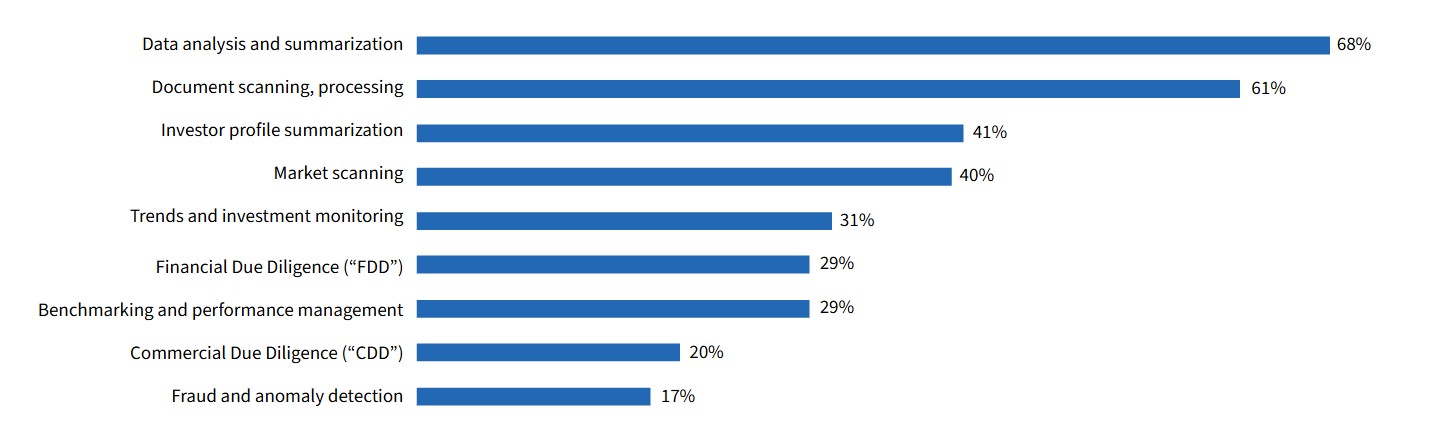

AI is Improving Efficiencies Across the Deal Lifecycle

AI’s impact is not limited to PortCos. All but a small minority of PE respondents are leveraging AI internally in the deal lifecycle. The most common use cases include data analysis/summarization and document scanning, but PE firms are also expanding the use of AI for additional use cases such as investor profile summarization, market scanning and trends and investment monitoring, among others.

AI-Leveraged Activities

Respondents were asked to select multiple activities

Source: FTI Consulting Survey: AI Radar for Private Equity 2024.

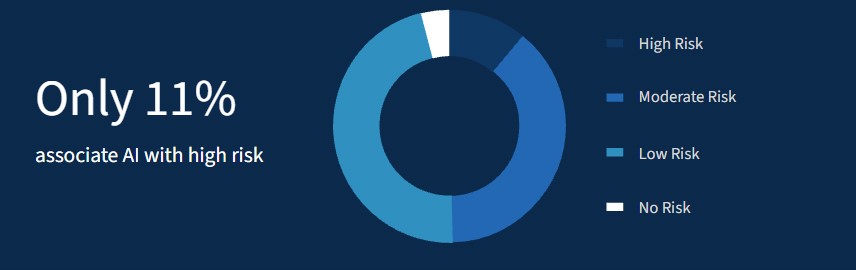

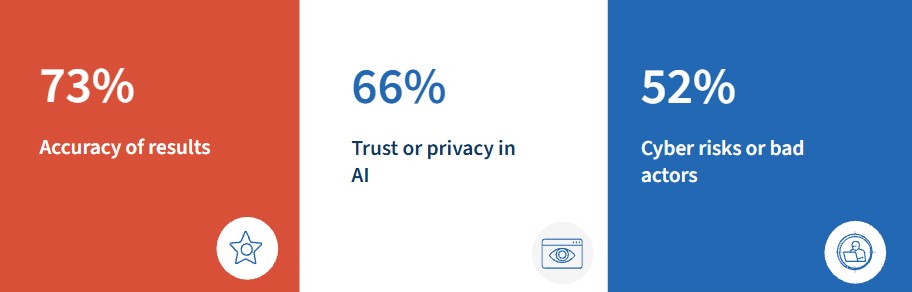

PE Recognizes AI Risks, Yet Considers Them Manageable

There are risks within AI, but PE firms are already evaluating the potential consequences and consider these risks low or moderate at best.

Few PE firms see the risks associated with AI as concerning but remain bullish about the industry’s ability to surmount them. A significant majority of respondents perceive AI risk as low or moderate, likely because the associated risks are clear and well-defined, while unforeseen risks have yet to emerge. The most commonly cited risks include accuracy of results and trust/privacy in the context of AI. Cyber risks are also a concern, but less top-of-mind compared to accuracy and trust.

Perceived AI Level of Risk

Source: FTI Consulting Survey: AI Radar for Private Equity 2024.

Top 3 Risk Areas

Survey respondents were asked to select their top three responses, the percentages represent their top choices:

Methodology

This research was conducted online by FTI Consulting’s Digital & Insights team, among n=208 respondents working at private equity firms and meeting the following requirements:

- Full-time employees in senior positions including managing partners, operating partners, principals and vice presidents

- Involved in investment and operation decision-making for their firm

- Works at a firm in either the North America, Europe or Asia Pacific regions, with an average AUM totaling $22.3 billion

All research was conducted between the dates of July 25th to August 27th 2024. Per the standard convention of rounding, some totals may not add up to 100%.

For any questions relating to the survey methodology, please contact Julija.Simionenko-Kovacs@fticonsulting.com.

Published

October 23, 2024

Key Contacts

Key Contacts

Senior Managing Director, Leader of AI & Digital Transformation

Senior Managing Director, Global Leader Private Equity

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About