- Accueil

- / Publications

- / Reports

- / Risks and Priorities in Public Affairs: 2025 Versus 2023

Risks and Priorities in Public Affairs: 2025 Versus 2023

What Keeps Public Affairs Leaders Up at Night?

-

23 janvier 2026

TéléchargezDownload Report

-

Back in 2023, Public Affairs leaders told us that their biggest external challenges were economic headwinds, regulatory pressures and macropolitical uncertainty. Today, the political and regulatory environment is equally complex to navigate.

Our latest report, “Risks and priorities in Public Affairs - 2025 versus 2023”, reveals meaningful shifts in what leaders view as their principal risks and in how they are adapting to manage those risks. Below, we set out ten key findings.

Key Stats

Policy and Regulatory Changes Remain the Key Issue for Respondents

Easily the biggest trend Public Affairs leaders saw for 2025 was policy and regulatory fragmentation across markets. This reflects that government regulation is still the dominant issue – potentially, all the more so given the increase in political volatility in recent years and the willingness of politicians to propose disruptive policy solutions. Over 8 in 10 thought their company and/or industry would be affected by policy and regulatory change, a slight increase on 2023 and 68% saw regulatory and compliance issues as a major business risk. For 87% of respondents, managing political and regulatory change would be a priority for the coming year – which is not a surprise given that this tends to be the principal function of a Public Affairs team. But the minority who saw this as not a priority, though still important, increased, from 3% in 2023 to 13% in 2025.

Macropolitical Challenges Continue To Cast a Long Shadow

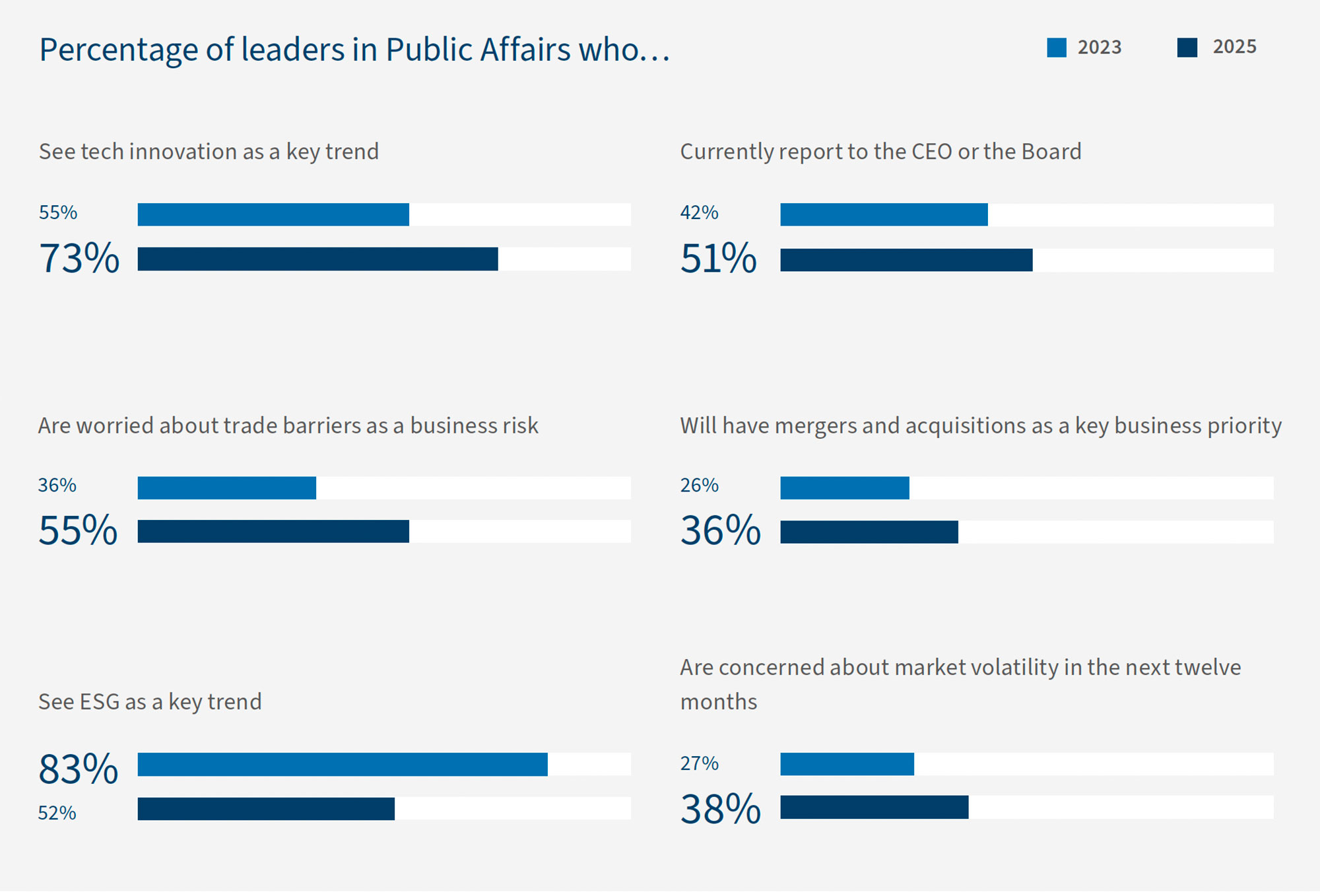

Reflecting the trade disputes and tariffs that have been a feature of the last twelve months in politics, the largest upward change in risk identified by Public Affairs leaders was trade barriers – with 55% seeing it as a key challenge to manage, versus 36% in 2023. The potential for supply chain disruption, an obvious corollary to this, continues to be a significant sectoral risk. In addition, over four in ten leaders continue to see political change as a further risk for their companies. This is very much in line with our view of the geopolitical picture as a source for continued tensions, as global tensions show few signs of abating and leaders strive to manage the twin challenges of shifting diplomatic relations and increasingly fractious domestic electorates.

ESG Is Markedly Less of a Priority

ESG was the area that received the starkest deprioritisation from 2023. Though just over half of respondents still saw it as continuing to be a key trend, two years ago that figure was 83%. Climate change was viewed as a key business risk by only 20% of leaders, down from 36% in 2023; while for ESG compliance, those figures were 23% and 41% respectively and the number of leaders for whom it was a business priority also fell by 11%. Energy transition, cost and security remained a salient issue, but, again, was perceived as less of a risk and also less of a trend. This change is significant and is likely to reflect the changes in approach of new administrations in the US and elsewhere.

Leaders Are Increasingly Conscious of the Challenges Posed by Tech

Technological innovation, including AI, was the second largest trend identified by respondents, after policy and regulatory fragmentation; notably, this was up by 18% on 2023. Additionally, almost a third still identified “understanding data and digital” as a missing capability within in-house Public Affairs teams – a smaller number than in 2023 but one that indicates a skills gap within the industry. As new tech and AI products come onto the market and as governments worldwide continue to work out the right regulatory response is to these developments, Public Affairs will need to get even more tech-savvy – both in understanding its implications for their businesses and in deploying it internally. Indeed, 74% of respondents saw digitalisation as a priority for the year ahead.

There Are Mixed Views on the Global Economic Outlook

Respondents’ economic perceptions revealed a complicated picture. The proportion of Public Affairs leaders who saw market volatility as a significant risk they are likely to face rose from 27% to 38%. But concerns about inflation and government / financial institution responses to inflation, fell from 47% to 38%, with a similar decline in those who saw inflation as a major trend of 2025. Perhaps most interestingly, the prospect of M&A activity is moving up the agenda. This was seen as a key business priority by 36% of respondents this year, up from 26% in 2023.

Public Affairs Functions Are Increasing Their Internal Visibility

Since 2023 we have seen a small but definite uptick in how Public Affairs teams have grown their senior colleagues’ awareness of what they do within their organisations. More (51% vs 42%) Public Affairs leaders are now reporting to their CEOs or boards; fewer (44% vs 56%) feel they will need to prioritise increasing their internal recognition over the coming year; and the proportion of respondents who felt their senior colleagues do not fully understand what they do has fallen from 40% to 26%.

Real Challenges Remain About Demonstrating Value Add

The traditional difficulties Public Affairs teams face within their organisation remain. Specifically, leaders recognised there is more to do in terms of driving a strategic approach, collaborating with other teams and measuring the impact of the Public Affairs function. Demonstrating that value add remains difficult. Public Affairs impact is notoriously hard to track and quantify (a sentiment with which 84% of leaders agreed) and fewer numbers of respondents this year thought they had clear KPIs (57% vs 75%) or that that those KPIs were consistently measured (50% vs 60%). However, fewer than one in ten respondents were using consultants to help measure impact, highlighting a potential gap in the market.

Controlling Costs

In addition, Public Affairs practitioners increasingly have to manage commercial realities in a world of doing more with less. This year, lack of resources and budget was once again identified as the biggest internal risk. In addition, Public Affairs leaders felt a bigger push to drive revenue than they did in 2023 and are also allocating a greater priority to controlling costs. Implicitly, for a Public Affairs practitioner, being able to demonstrate bang for buck and the value you add has seldom been more important.

Collaborating Across the Business

Working closely with affiliated teams within your business is an integral part of in-house Public Affairs and vital to improving visibility and securing buy-in. Communications, marketing and legal are teams traditionally close to the Public Affairs function, but increasingly collaboration with functions such as investor relations, product development, sustainability and corporate strategy find fruitful points of alignment. Although, as noted above, leaders in Public Affairs do feel they are growing understanding of their function within the wider business, cross-function collaboration remains patchy. For six out of ten respondents, improving that collaboration will be a priority over the next year, a slight increase on 2023.

Gaps in Team Capabilities Continue To Create Opportunities for External Consultants

The largest internal gap leaders identified for 2025 is the ability to design and implement effective multi-stakeholder campaigns. Consistency in monitoring political, policy and regulatory developments was also highlighted as an area where in-house teams struggled, relying instead on external consultants (with 61% of respondents outsourcing this function). Consultants also helped with mapping stakeholders, engagement, events and, to lesser degrees, analysing political risk and designing strategies. However, fewer than 15% of respondents used consultants for data analytics and evidence building, under 10% used consultants to help them measure the impact of Public Affairs activities and 8% did not use consultants at all.

A lire aussi

Related Information

Date

23 janvier 2026

Contacts

Contacts

Senior Managing Director, Head of Americas Public Affairs

Senior Managing Director, Head of UK Public Affairs

Senior Managing Director, Head of Brussels

Senior Managing Director

Managing Director

Téléchargez

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About