Financial Markets Won’t Take No for an Answer

-

February 02, 2024

DownloadsDownload Article

-

Like a petulant child determined to get their way no matter how many times their parents say no, financial markets continue to rally in anticipation of imminent rate cuts that Uncle Jerome and other Federal Open Market Committee (“FOMC”) officials have signaled they aren’t yet ready to give. Perhaps if they just hold their collective breath long enough, the adults in charge of monetary policy will give in to their wishes.

Arguably, the tactic has worked before — namely with the famous Taper Tantrum of 2013, which delayed and diminished the Fed’s withdrawal of unprecedented (at the time) QE stimulus, and the sharp (and nameless) market sell-off in late 2018 in response to Fed tightening.1 In the latter case, the markets recovered entirely within the first few months of 2019 once the Fed backed away from further tightening and then began cutting the funds rate by mid-2019. In both instances, fierce market sell-offs expressed the markets’ displeasure with Fed policy actions and likely influenced subsequent Fed decisions to some degree. This time, it’s the opposite: markets have rallied sharply across the board since September in anticipation of the Fed opening the cookie jar after nearly two years of snacking deprivation — and effectively are daring the Fed not to disappoint.

Admittedly, it sounds odd to attribute such deliberate motives to an inanimate actor like “the markets,” but there have been several instances in the last decade or so when it seemed that the tail was wagging the dog with respect to financial markets and Fed policy. Despite its reputation (indeed, its mandate) as an independent and apolitical institution for implementing monetary policy, the notion that reactions of financial markets hold no sway over Fed policy decisions has become a harder argument to make ever since 2009. And financial markets definitely know what they want: a perpetual sugar high.

The rally across U.S. financial markets since September reflects a growing conviction that Fed rate hikes are done, inflation has been tamed, a domestic recession has been averted and monetary easing is coming soon. Fair enough, as the worst economic expectations for 2023 never materialized while inflation has moderated. But given various comments by FOMC officials that there is no rush to cut rates,2 and that inflation remains elevated despite slowing and more evidence would be needed before the Fed concludes that its 2% target is achievable,3 investors’ rates expectations — implied by the Fed Funds futures curve for six rate cuts in 2024 beginning in March and a 3.75% Fed Funds rate by year-end — seem unrealistic. So does the growing belief that the Fed will end or severely curtail its $95 billion monthly securities run-off by mid-year or sooner.

Furthermore, the U.S. economy’s impressive ability to withstand cumulative rate hikes to date without undue negative effects on the labor market, consumer spending or corporate earnings suggests that the current interest rate regime is tolerable, even if less than ideal for businesses and consumers. That should remove any pressure for the Fed to reverse course prematurely, as the consequences of resurgent inflation from pivoting too soon far exceed the risks to the economy of cutting too slowly. Indeed, it could be argued that the surge in markets set off by the mere prospect of monetary easing is reason enough for the Fed to proceed slowly or risk reigniting the speculative excesses we saw in 2021.

So why are financial markets so insistent in the belief that aggressive quantitative easing (“QE”) is right around the corner? In a word: conditioning. The storyline we’ve seen increasingly in recent months is that a whole generation of financiers, money managers and professional investors, including some in senior-level positions now, have spent their entire working lives in a market environment juiced by huge monetary stimulus and highly managed interest rates. Massive QE and its lingering effects on markets and the financial system seem perfectly normal, because that is all they have ever known. The notion that the current interest rate environment is no outlier and is far closer to normal compared to pre-2008 historical data may seem irrelevant to them. (The “LIBOR” base rate for most loans averaged 4.75% from 2005 to 2007, while 10-year Treasuries averaged 4.55% and BB corporate bond yields averaged 7.2% in that three-year period.) Investors have come to expect Fed policy actions that will be market-friendly even if they create excessive liquidity and an abundance of moral hazard. That mindset is reemerging now that this pesky inflation episode seems mostly behind us.

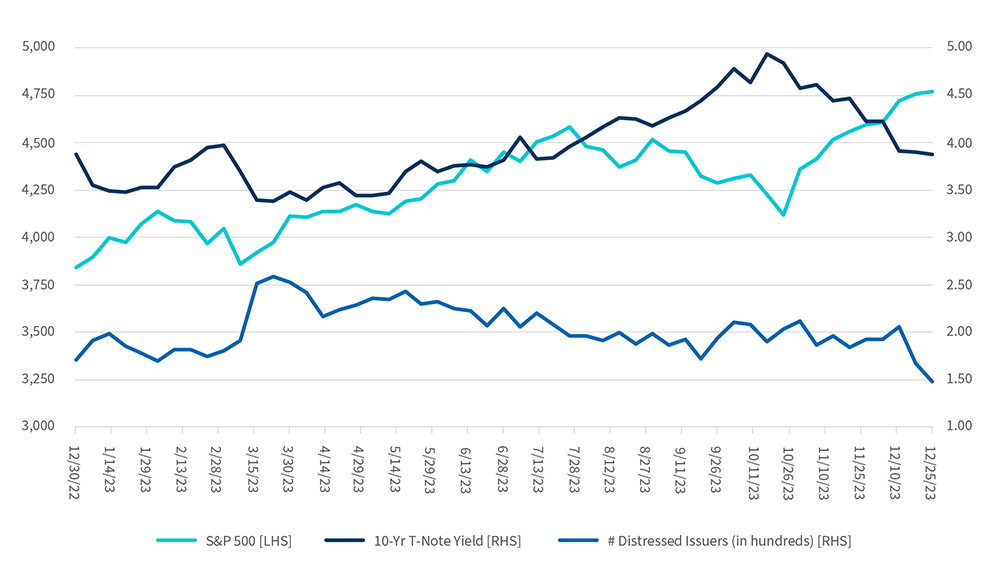

The S&P 500 soared 24% in 2023, about one-half of that coming in the final quarter, while 10-year Treasury rates fell by nearly 100 basis points in 4Q23 and the number of distressed corporate debt issues fell by 30% (Figure 1). This even as domestic economic growth expectations for 2024 remain tepid, the war in Ukraine enters its third year with little sign of resolution, and the conflict in Gaza shows signs of widening regionally and is now impacting global shipping in the Red Sea. No matter, this market rally has extended into the new year. Now that is persistent optimism.

Figure 1: S&P 500 vs. 10-Yr. T-Note Yield and # of Distressed Debt Issuers

Source: Bloomberg

FTI Consulting’s Leveraged Loan Market Survey

One group that doesn’t share this unbridled optimism is the leveraged lending community. We know this because we just completed our sixth annual Leveraged Loan Market Survey,4 with nearly 250 responses from senior professionals in leveraged loan and workout functions at large lending institutions (both bank and non-bank lenders). Their responses reflected some cautious optimism that the year ahead will show modest to moderate improvement over 2023 in most respects, but nothing approaching the enthusiasm reflected in financial markets currently. Some of their more noteworthy responses include the following:

- Recession risk subsides but remains elevated: Approximately 42% of respondents said that the probability of a U.S. recession in 2024 was material (34%) or likely (8%), a notable improvement from the prior-year survey when more than two-thirds of respondents said the chance of a recession within 12 months was material or likely. Nonetheless, the percentage of respondents saying the chance of recession this year was greater than negligible or minor remains elevated amid a relatively benign economic backdrop.

- Inflation has eased but will remain above the Fed’s 2% target: Two-thirds of respondents said inflation will remain above 3% by year-end, with most (61%) in the 3%-5% range. Only 25% of respondents say inflation will be below 3% by year-end.

- Financial markets are underestimating the risk posed by high interest rates: A plurality of respondents (46%) say the persistence of high interest rates in 2024 is the risk most underestimated by financial markets — far more than any other risk factor, including geopolitical events and inflation.

- Leveraged lenders remain cautious: Only 21% of respondents expect leveraged credit market conditions will ease/loosen in 2024 while just 12% expect more lax loan underwriting standards. Pluralities expect leveraged loan market conditions and underwriting standards this year will remain much as they were in late 2023.

- Loan default/workout activity will stay busy: More than two-thirds of respondents said that new default/workout activity in 2024 will be slightly higher (47%) or substantially higher (24%) than last year — which saw a significant increase in loan defaults and workouts.

- No big rebound for leveraged M&A activity: 42% of respondents said that the challenging macro environment will keep leveraged M&A activity depressed for another year, while another 38% expect a modest improvement in such activity compared to 2023. Non-bank lenders were more likely to expect an increase in leveraged M&A activity this year than bank lenders.

- Yields on leveraged loans won’t change much this year: 47% of respondents said all-in yields on leveraged loans in the primary market will contract slightly in 2024 while 45% said such yields will widen slightly; just 8% expected either significant contraction or widening of yields. Non-bank lenders were more likely to expect yield contraction this year than bank lenders were.

- Recovery rates on defaulted senior secured debt will remain below historical norms: Approximately 58% of respondents said recovery rates on defaulted senior secured debt will remain below historical averages for the foreseeable future due to high deal leverage and heavy reliance on senior secured debt in recent years, while 23% said it was premature to assume the trend of depressed recoveries will continue, and 19% said that recovery rates will revert toward historical norms as the economy improves.

Overall lender responses in our survey don’t square with the buoyant expectations of financial markets. It’s possible that some respondents were reluctant to openly express optimism for the year ahead following a most challenging and topsy-turvy year in leveraged credit markets. But it is far more likely that facts on the ground currently don’t support the wide-eyed optimism built into financial markets’ expectations unless the Fed soon deviates from its own script and starts to feed the beast once again. We’re inclined to take them at their word.

Restructuring activity has slowed since November and is off to a sluggish start in 2024 as stronger leveraged credit issuance in recent months has extended a lifeline to some issuers. However, our survey of leveraged lenders is telling us they are mostly circumspect about prospects for the year ahead. Really, the entirety of this conversation comes down to this: Who are you going to believe?

Footnotes:

1: Jamie McGeever, “Taper Tantrum Ripples, 10 Years On,” Reuters (May 22, 2023).

2: “Fed’s Waller Advocates Moving “Carefully” With Rate Cuts,” CNBC (January 16, 2024).

3: “Minutes of the Federal Open Market Committee,” Board of Governors of the Federal Reserve System (December 12-13, 2023).

4: An Executive Summary of the 2024 Leveraged Loan Survey is available here.

Related Insights

Related Information

Published

February 02, 2024

Key Contacts

Key Contacts

Global Chairman of Corporate Finance

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About