Turbulent Waters – Current Developments in the U.S. Offshore Wind Industry

-

February 05, 2024

DownloadsDownload Article

-

A relative newcomer to the global offshore wind market, the United States has set an ambitious goal for the development of the industry with strong support at both federal and state levels. While important milestones have been achieved and several large projects are now under or approaching construction, the industry is facing substantial headwinds, including significantly increased costs, supply chain constraints and challenges with executed offtake contracts that have set revenue streams, among other factors. Most recently, project developers’ efforts to renegotiate power purchase agreements (“PPAs”) and the well-publicized cancellation of several major U.S. offshore wind projects have brought concerns over the future direction of the U.S. offshore wind industry to a head.

Current State

A state-mandated procurement fueled by broad federal support, enhanced tax incentives and technological advancement has driven the industry forward since the first offshore wind farm (Block Island Wind Farm off the coast of Rhode Island) commenced commercial operations in December 2016.1

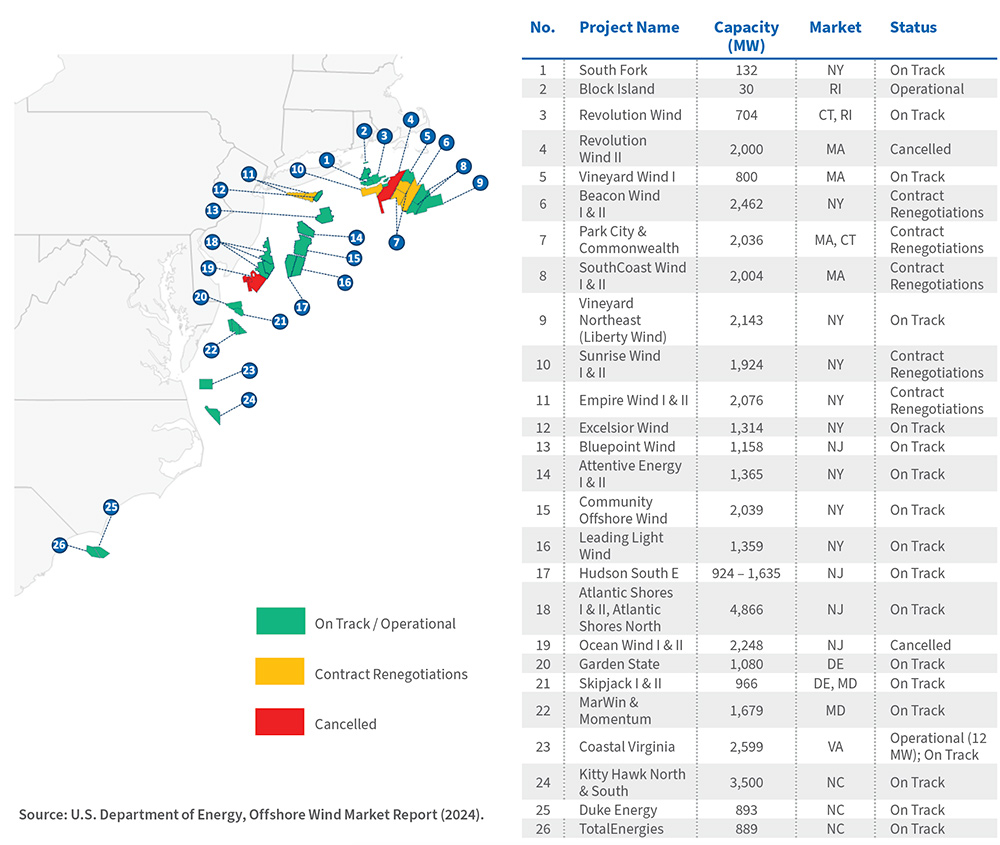

Offshore wind development gained momentum following the Biden administration’s ambitious target of 30 gigawatts (“GW”) and up to 15 GW of floating offshore wind by 2030.2 At least 10 states have publicly announced procurement targets, totaling nearly 81 GW of cumulative capacity.3 Although only 42 megawatts (“MW”) are currently operating in the United States, over 20 GW of projects are in the permitting stages and are nearing final approvals.4 East Coast states have over 43 GW of offshore wind capacity in various stages of development, as shown in Figure 1, which depicts the status of U.S. East Coast offshore wind projects.

Figure 1. U.S. East Coast Offshore Wind Project Status (January 2024)5

Over 80% of the U.S. development pipeline is dominated by fixed-bottom projects. However, new floating technologies will be critical to developing the seabed along the Gulf of Maine and Pacific coasts.6

The U.S. Department of the Interior’s Bureau of Ocean Energy Management (“BOEM”) oversees Outer Continental Shelf (“OCS”) development, manages the permitting process for offshore wind farms and oversees seabed lease auctions.7 Successful winners of seabed lease auctions then have ability to permit, construct and operate projects on the continental shelf.8 BOEM announced that at least seven auctions will take place between now and 2025.9

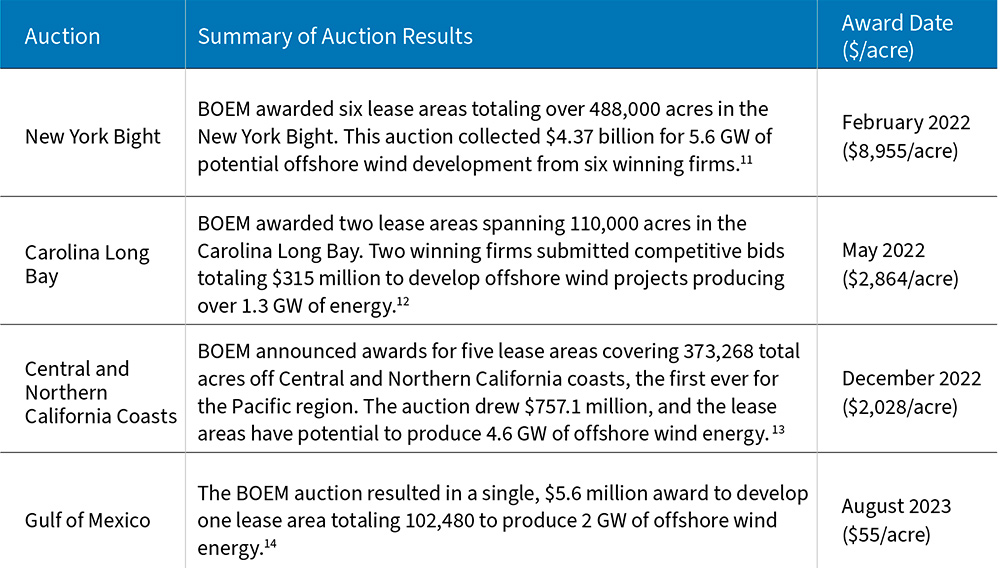

Four major U.S. seabed lease auctions were held between 2022 and 2023, with mixed bidding results as described in the table below. Factors influencing pricing in these auctions included capital expenditures, federal and state tax incentive eligibility, labor availability, supply chain needs, site considerations, project capacity factors, offtake certainty, PPA prices and both offshore and onshore transmission complications.

BOEM Seabed Lease and Offtake Auctions (2022-2023)

In early 2022, the New York Bight auction resulted in the highest bids ever recorded in a U.S. seabed lease auction.10 Fourteen bidders competed for six lease areas with the potential to develop 5.6 GW off the coasts of New Jersey and New York.15 While the New York Bight auction may have reflected initial optimism, subsequent auctions were influenced by the specific characteristics of each site and emerging challenges within the offshore wind industry.

The subsequent Carolina and California auctions saw fewer bidders and lower bid values compared to the New York Bight, as developers along both coastlines faced challenges. The primary offtaker in North Carolina, Duke Energy Corp., had not yet codified its commitment to offshore wind in its Integrated Resource Plan nor had it indicated the possible contract mechanism that would be available to a potential project by the start of the auction.16 In California, despite a strong regulatory framework and favorable tax incentives, offshore wind developers faced technological challenges deploying new floating technologies in the Pacific Ocean along with transmission constraint issues specific to the Northern California points of interconnection for the projects.

BOEM’s August 2023 Gulf of Mexico auction was the weakest of the four auctions held since the Biden administration took office. The auction resulted in a single award to develop one lease area off the coast of Louisiana; two other lease areas off the coast of Texas received no bids. Developers did not have offtake certainty in Texas or Louisiana, states without offshore wind procurement targets. Furthermore, the underlying fundamentals of the BOEM seabed lease areas created additional challenges given site specific considerations including wind-speeds and estimated capacity factors that are relatively low for offshore wind.17 Further complications from rising interest rates, inflation and supply chain challenges deterred developers from participating in the Gulf of Mexico auction. These industry headwinds, described below, may influence the outcome of upcoming BOEM seabed auctions in the Central Atlantic, Pacific Northwest and the Gulf of Maine.

Challenges Facing the U.S. Offshore Wind Industry

Industry Headwinds

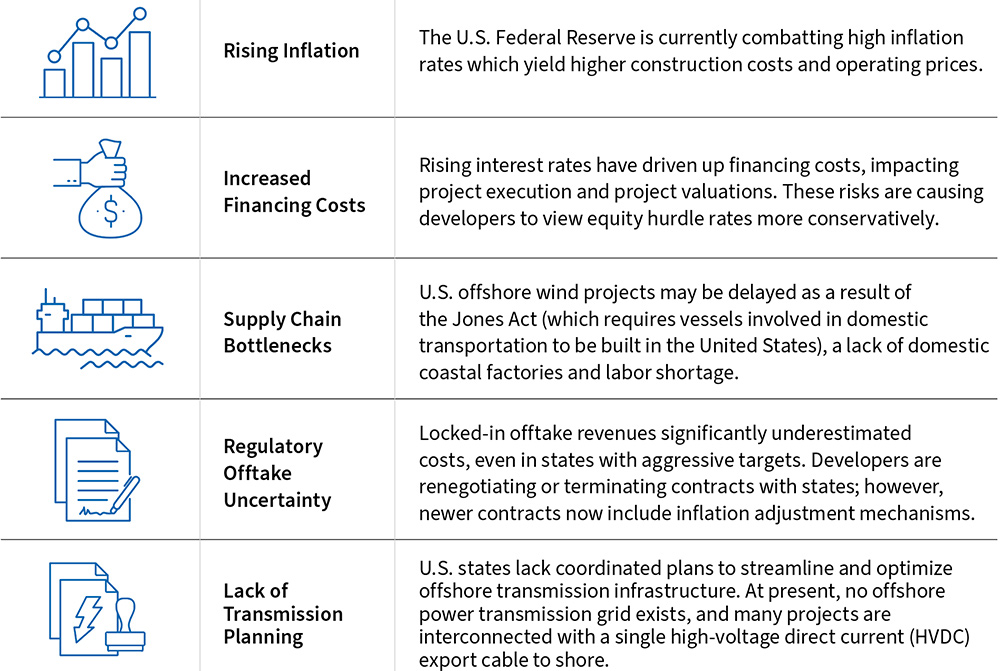

Multiple offshore wind projects on the East Coast are no longer financially viable. Surging inflation has resulted in higher capital costs and financing costs, and thus reduced or negative profit margins. The U.S. supply chain faces a shortage of compliant vessels, domestic factories and a qualified labor force. Some developers are rebidding offtake terms with their counterparties, and in some instances, terminating their contracts. Further, no U.S. markets have a definitive path towards an offshore transmission network that will allow for the most efficient injection of power into the mainland grid.

Current and future offshore wind projects must navigate the following obstacles:

Increasing financing costs and levelized cost of energy (“LCOE”) due to inflation

The COVID-19 pandemic in 2020 and the Ukraine crisis in 2022 created a perfect storm of inflationary pressures in the United States. These unanticipated and extraordinary economic events yielded higher prices of goods and services and a tighter labor market.18 Developers who finalized offshore wind offtake contracts prior to the COVID-19 pandemic no longer have a sufficient fixed revenue stream to combat higher costs from inflation and subsequent rising interest rates.

Many U.S. offshore wind projects face a fundamental cost-revenue mismatch: offtake revenues that developers “locked in” are not sufficient for the actual costs driven by extraordinary events. Historically high inflation rates are causing construction costs and operations and maintenance cost estimates, which had been steadily declining prior to the COVID-19 pandemic and the Ukraine crisis, to increase sharply. According to BloombergNEF, the levelized cost of energy (LCOE, or the lifetime project costs) of a U.S. offshore wind project was $77.30 per megawatt hour in 2021. That value rose to $114.20 in 2023 due to increased capital expenditures, operational expenditures and interest rate increases.19

Supply chain challenges

The 30 GW target by 2030 necessitates a significant investment in domestic manufacturing, ports, vessels and labor. A domestic supply chain could manufacture all major components by 2030, but at present, domestic production is nascent. Meanwhile, the international supply of steel, copper and aluminum is constrained by increased demand. The Ukraine crisis in 2022 also increased demand for renewable energy and caused further shortages and price increases for materials.20

Additionally, U.S. projects in the pipeline are at risk of being delayed beyond 2030 owing to limited port and vessel infrastructure. The Jones Act requires vessels involved in transporting goods between domestic ports to be built and flagged in the United States and crewed with U.S. labor. Currently the industry has found solutions, albeit expensive ones, to work around the Jones Act requirements. Dominion Energy chartered the nation’s first Jones Act-compliant wind turbine installation vessel (“WTIV”), which was originally scheduled for delivery in 2024 but has been delayed to 2025. The National Renewable Energy Laboratory estimates that four to six WTIVs are needed to meet the 30 GW target.21

In November 2023, Siemens Gamesa cancelled plans to build a $200 million turbine blade factory in coastal Virginia.22 The factory would have supported major U.S. offshore wind projects. In New York, a planned turbine tower factory at the Port of Albany has not commenced construction three years after the project was announced, and its costs have doubled from $350 million to $700 million.23

According to a 2022 report from the U.S. National Renewable Energy Laboratory, the average annual offshore wind industry employment required to meet President Biden’s target of 30 GW installed by 2030 is between 15,000 and 58,000 full-time positions per year. At present, the domestic workforce does not have enough qualified workers or development programs to meet the federal target.24

Regulatory offtake uncertainty

Due to increasing financing costs and cost-revenue mismatches, developers are seeking to renegotiate their contracts, even in states with aggressive offshore wind targets.

In July 2023, the developers of all four offshore wind projects in New York filed petitions asking for an “inflation adjustment,” or higher payments due to economic conditions, and some sought longer contracts. New York regulators rejected the developers’ request to renegotiate power supply terms. The fate of the four projects remains uncertain.

Meanwhile, other developers have terminated their contracts altogether and face financial penalties. In November 2023, Ørsted announced a $4 billion write-down and cancelled development of Ocean Wind 1 & 2 off the New Jersey coast. In July 2023, Avangrid agreed to pay $48 million to pull out of a PPA for the 1,223 MW Commonwealth Wind project in Massachusetts. Shell and Ocean Winds North America attempted to terminate their PPA for the SouthCoast Wind project in Massachusetts, with expected penalties of at least $60 million. Developers plan to re-bid the projects in future offtake procurements.25

However, there are signs that state regulators are attempting to address inflation concerns, and future offshore wind offtake solicitations will likely include inflation provisions. In Connecticut, a solicitation for proposals allows indexing prices to economic factors, such as inflation, up to 15%.26 Three 25-year contracts for projects in New York (Attentive Energy One, Excelsior Wind and Community Offshore Wind) will include inflation adjustment mechanisms to recoup changes in construction costs until final investment decisions have been reached.27

Despite strong state offshore wind policies, including state-facilitated offtake contracts and favorable incentives for offshore wind, East Coast developers still face project challenges. Developers in the Gulf of Mexico, where coastal states do not have offshore wind targets or mandates, may face greater uncertainties.

Lack of regional transmission planning

U.S. states lack coordinated plans to streamline and optimize offshore transmission infrastructure. At present, no offshore power transmission grid exists, and most projects utilize a radial HVDC interconnection. For transmission developers to take advantage of economies of scale, they must obtain construction permits from federal, state, local and tribal jurisdictions. It is also unclear how costs, ownership and tax burdens will be allocated across jurisdictions.

Longer-term interregional planning and shared infrastructure networks are necessary to reduce investor risk. Projects utilizing single radial connections are unsustainable, from both a grid congestion and a financial perspective. Major American developers such as Anbaric Development Partners have proposed connected “ocean grids” in New York, New Jersey and New England.28 The concept of a unified transmission network may gain more traction in the future.

These headwinds, taken together, have proved insurmountable for certain projects. Ørsted cited “high inflation, rising interest rates, and supply chain bottlenecks”29 in its decision to cancel development of Ocean Wind 1 & 2. Though macroeconomic trends may persist in the near future, developers and state policymakers can be proactive and renegotiate flexible offtake contracts or coordinate regional transmission plans.

Outlook

There is currently a cloud hanging over the U.S. offshore wind market, and clear skies are not on the horizon yet. Projects that locked in revenue streams via Offshore Wind Renewable Energy Credit (“OREC”) or PPA contracts without appropriate hedging arrangements face eroding profit margins. Additionally, many projects on both the East and West Coasts secured seabed lease auctions with high bonus bids, under the assumption that component and construction costs would decrease in the future – an assumption that has not held true. Thus, with the benefit of hindsight, there is an unexpected “valley of death” for projects that were executing offtake contracts in the 2017-2019 time frame to now, where contracted revenue isn’t sufficient to cover the newly recalculated development costs. As offshore wind projects are cancelled, we can expect to see the bullwhip effect throughout domestic supply chain development projects. The construction of factories, vessels and workforce development programs are typically predicated on having some certainty in future revenue streams, such as contracts for parts or services executed by project developers. In the short term, we may see distress in these domestic supply chain development projects as they scramble to secure new contracts for their goods and services among the limited offshore wind project developments still progressing.

Despite the current headwinds, all is not lost in the U.S. offshore wind market. There continue to be green shoots of activity for projects initiated prior to significant inflation and interest rate pressures, including ongoing construction of Vineyard Wind 1 and South Fork Wind, domestic supply chain development in cables, foundations and monopiles, workforce development and Dominion’s Jones Act-compliant WTIV. Further, states still have a vested interest in maintaining the momentum of the offshore wind industry to meet their policy targets. The creation of a domestic supply chain for the industry and the construction of offshore wind projects result in thousands of jobs and billions of dollars in investment and state tax revenue over the long term. To maintain momentum, federal and state policymakers will need to keep the long term in mind and avoid overreaction to short-term turbulence. This will require new and evolving offshore wind offtake contracts (either OREC or PPA) facilitated by the states, with more flexible payment calculations to absorb at least a portion of the inflation risk, as well as continued and possibly expanded support to supply chain development.

Offtake solicitations have progressed during this uncertain time, and states continue to adapt the procurement mechanism to address the everchanging landscape. Massachusetts, Connecticut and Rhode Island have banded together to allow developers to bid a project into multiple state auctions simultaneously and for the states to each participate in a portion of the offtake. Connecticut and New York have included inflation protection provisions in recent auction solicitations. These innovative approaches give us hope that the industry will continue to evolve amidst short-term challenges. That said, states must continue to support the development of a domestic supply chain, for multiple reasons. First, the Inflation Reduction Act’s domestic content bonus provision will continue to encourage project developers to look to domestic supply first; that is, the long-term demand for domestic supply of components will continue. Second, the domestic supply chain for components is likely to undergo some short-term pressure as development projects are delayed or cancelled, thus putting downward pressure on short-term demand. If the domestic supply chain is allowed to contract, the result will be few suppliers for individual components, thus concentrating significant supplier power in the few that do survive. In this case, suppliers with significant pricing power would be able to capture an outsized proportion of the Investment Tax Credit (“ITC”) benefits and upward price protection mechanisms incorporated into OREC or PPA contracts. Should this consolidation of pricing power occur, the result would be a continued upward pressure on OREC and PPA rates, potentially to the point of the industry losing public and political support. Thus, states must continue to support the development of a domestic supply chain to reduce the barriers to entry for component manufacturing and provide a competitive market environment for all components.

While we expect the LCOE for offshore wind to decline, as it has with onshore wind, solar and countless other technologies over time, the trajectory has reversed course for the time being. But several factors indicate that the prospects are bright for offshore wind: turbines continue to grow larger, strengthened by new foundation designs and installation methods, along with a future offshore grid with existing onshore points of interconnection for offshore wind projects, and a competitive domestic supply chain is being developed. It just may take more time than we expected to get there.

How We Can Help

FTI Consulting’s Power, Renewables and Energy Transition practice can deliver holistic, comprehensive solutions across all phases of the offshore wind development lifecycle. FTI Consulting has advised global developers and investors and designed comprehensive risk-minimized market entry and participation models, combining expertise across commercial, financial, market, and technical dimensions. FTI Consulting’s offshore wind experts can help developers prepare for an auction and offer live auction support. FTI Consulting also assists clients in managing and delivering winning bid packages in state- and utility-led offtake solicitations.

Footnotes:

1: Tatiana Schlossberg, “America’s First Offshore Wind Farm Spins to Life,” The New York Times (December 14, 2016).

2: “Biden-Harris Administration Announces New Actions to Expand U.S. Offshore Wind Energy,” The White House (September 15, 2022).

3: “Offshore Wind Market Report, 2023,” American Clean Power.

4: “Offshore Wind Market Report, 2023 Edition,” U.S. Department of Energy.

5: Ibid.

6: “Offshore Wind Market Report, 2023,” American Clean Power.

7: “Renewable Energy Program Overview,” U.S. Bureau of Ocean Energy Management.

8: Ibid.

9: “Offshore Wind Leasing Path Forward 2021-2025,” U.S. Bureau of Ocean Energy Management (October 2021).

10: “Winners of the New York Bight Lease Battle Revealed,” 4C Offshore (February 28, 2022).

11: “New York Bight,” U.S. Bureau of Ocean Energy Management.

12: “Carolina Long Bay,” U.S. Bureau of Ocean Energy Management.

13: “California Activities,” U.S. Bureau of Ocean Energy Management.

14: “Gulf of Mexico Activities,” U.S. Bureau of Ocean Energy Management.

15: “Winners of the New York Bight Lease Battle Revealed,” 4C Offshore (February 28, 2022).

16: Abbie Bennett, “NC Offshore Wind Auction Pits Ambitious Federal Goals vs. Hesitant State Policy,” S&P Global Market Intelligence (May 9, 2021).

17: “Pivot potential: A deep dive into offshore wind in the Gulf of Mexico,” White & Case (August 28, 2023).; “Offshore Wind in the US Gulf of Mexico: Regional Economic Modeling and Site-Specific Analyses,” U.S. Bureau of Ocean Energy Management (February 2020).

18: Laurence M. Ball, Daniel Leigh, and Prachi Mishra, “Understanding U.S. Inflation During the COVID Era,” National Bureau of Economic Research (October 2022).

19: Atin Jain, “Soaring Costs Stress US Offshore Wind Companies, Ruin Margins,” Bloomberg New Energy Finance (August 1, 2023).

20: Ron Bousso, “Ukraine War to Accelerate Shift to Clean Energy, BP Says,” Reuters (January 30, 2023).

21: Matt Shields, Jeremy Stefek, Frank Oteri, Matilda Kreider, Elizabeth Gill, Sabina Maniak, Ross Gould, Courtney Malvik, Sam Tirone and Eric Hines, “A Supply Chain Road Map for Offshore Wind Energy in the United States,” National Renewable Energy Laboratory (January 2023).

22: Ben Finley, “Siemens Gamesa Scraps Plans to Build Blades for Offshore Wind Turbines on Virginia’s Coast,” AP News (November 10, 2023).

23: Benjamin Storrow, “Not Made in America: Factory Shortage Stalls Offshore Wind,” E&E News by Politico (September 29, 2023).

24: Jeremy Stefek, Chloe Constant, Caitlyn Clark, Heidi Tinnesand, Corrie Christol and Ruth Baranowski, “U.S. Offshore Wind Workforce Assessment,” National Renewable Energy Laboratory (October 2022).

25: Shadia Nasralla and Ron Bousso, “Shell Exits US SouthCoast Wind Farm Contract, Agrees to Pay Penalty,” Reuters (November 2, 2023).

26: Diana DiGangi, “Connecticut 2 GW offshore wind RFP acknowledges financial challenges for developers,” Utility Dive (October 30, 2023).

27: Adrijana Buljan, “New York’s Three New Gigawatt-Scale Offshore Wind Projects to Bring USD 15 Billion in In-State Spending,” OffshoreWind.biz (October 25, 2023).

28: “Regional Proposals,” U.S. Bureau of Ocean Energy Management.

29: “Ørsted Ceases Development of Ocean Wind 1 and Ocean Wind 2 and Takes Final Investment Decision on Revolution Wind,” Ørsted (October 31, 2023).

Related Insights

Published

February 05, 2024

Key Contacts

Key Contacts

Global Practice Leader Power, Renewables & Energy Transition (PRET)

Senior Managing Director

Managing Director

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About