Navigating Risk in Asia Amidst the Polycrisis

Why Asia Remains Central to Global Growth While Business Leaders Confront the Polycrisis

-

September 16, 2025

-

Thinking about the state of the world can quickly become overwhelming, considering the impact of climate change, ongoing wars, tariffs, policy shifts, energy security and persistent inflation. Despite this, the global economy tells a different story, with pragmatic financial systems and effective policymaking sustaining steady global economic growth.

Based on the number of adverse geopolitical mentions in major English language media, coverage of geopolitical risks is currently 30% higher than the long-term average.1 Businesses no longer face one crisis at a time. The phenomenon of facing multiple, simultaneous crises that now seems the norm is increasingly being described as the polycrisis. This refers to far-reaching crises that are interconnected, ultimately amplifying their overall impact.2 Faced with the polycrisis, today’s business leaders must address complex, existential issues and adapt quickly.

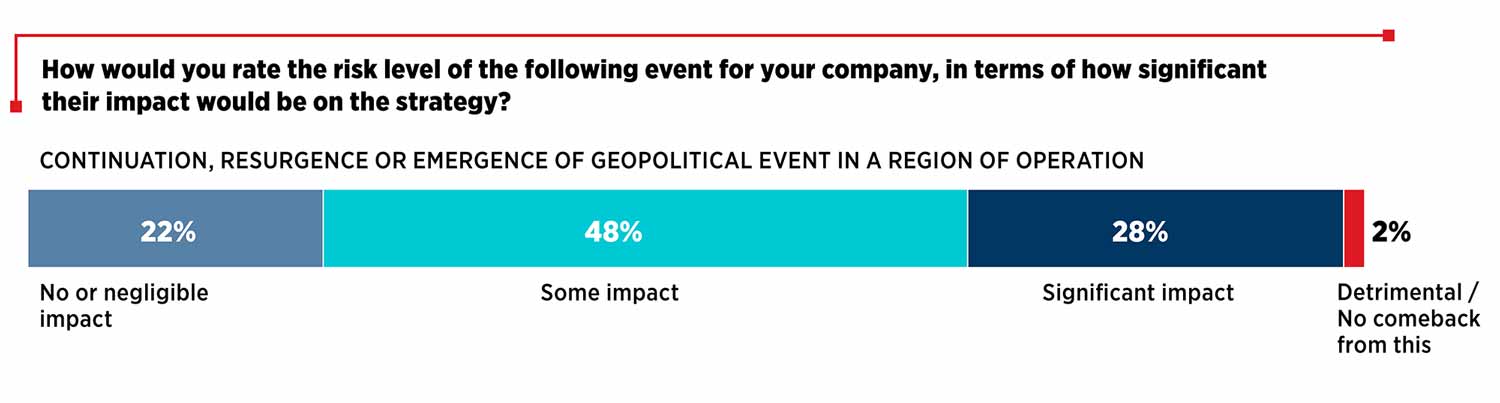

FTI Consulting’s 2025 What Directors Think survey found that 48% of directors at companies with international exposure see geopolitics as having some impact on their business strategy, with 30% viewing it as posing a significant or detrimental risk.3 Similarly, among US leaders, a Thomson Reuters report found that 82% of C-Suite leaders expect geopolitical instability to have at least a moderate effect on their businesses over the next five years, with 40% of leaders expecting a high or transformative impact.4

Figure 1: FTI Consulting, What Directors Think, A Changing Risk Landscape (2025)

Source: FTI Consulting, What Directors Think, A Changing Risk Landscape (2025)

Whether turning on the TV, opening up a newspaper or scrolling social media, it takes only minutes to feel like the world is in an unprecedented state of crisis. Yet, at the same time, the global economy is consistently moving forward with many investment accounts likely to show consistent positive returns. The rise of social media populism does not reflect the pragmatism of the underlying financial system.

The Pragmatic Global Economy

What such sentiments – both in print and on social media – do not capture is that supply chains have proven to be resilient, consumer demand does not drop with every news cycle and firms have become better at absorbing shocks. In fact, overall, it’s been unwavering economically. Since 2011, global GDP has maintained average annual growth of 3%.5 The COVID-19 pandemic is the only event since 2011 to have had a profound effect on economic growth, suppressing global GDP average growth rates to -2.8% in 2020.6 Since 2022, average global economic growth has settled at back at 3%.7

Despite ongoing trade wars and geopolitical volatility, supply chains today are proving their resilience, with the Federal Reserve Bank of New York’s Global Supply Chain Pressure Index showing that current pressure is in line with the 27-year average.8 Companies now dedicate more resources to ensure that their supply chains are run efficiently and effectively. A Gartner survey found that more than 90% of corporate logistics leaders now report to C-Suite executives, showing the recognition of the importance of supply chains.9

Increased government spending has also softened the economic impact of crises. During the COVID-19 pandemic, the average public social spending-to-GDP ratio across OECD countries increased from 20% in 2019 to 23% in 2020, mostly due to government spending.10 In emerging markets, more than 65% of central banks now having inflation-targeting regimes.11 Lower foreign-currency debt and increased reserve buffers have better positioned emerging economies to deal with global shocks.12 During the pandemic, this allowed policymakers to introduce economic relief programmes without undermining market confidence.13

FTI Consulting’s 2025 Global CFO Report found that 77% of CFOs of large companies projected double-digit growth in 2025, driven by improvements in global supply chains and favourable market conditions.14 This optimism shows that, despite the polycrisis, business leaders see growth and opportunity, underpinned by the global economy’s underlying stability.

Doing Business in Asia in the Polycrisis

Understanding geopolitics is especially crucial all over Asia, with every country facing different but interrelated issues, and the region at the forefront of global growth.15 After World War II, the United States accounted for nearly half of the world’s economy; today, it is closer to 25%.16 Meanwhile, Asia collectively represents 46.61% of the global economy, with a projected growth rate of 3.9% in 2025.17 Emerging markets in Asia are projected to see GDP growth of about 4% until 2035, compared to 1.59% in developed economies.18

However, Asia remains an epicentre of geopolitical risk, and businesses must prepare carefully in order to succeed.

Singapore and Hong Kong: Regional Financial Centres

Singapore is a key partner of both China and the United States, its first and third largest trading partners, respectively.19 Singapore is also a launch pad for business expansion across Southeast Asia, with initiatives like the Johor-Singapore Special Economic Zone showcasing the government’s promotion of opportunities for international businesses.20

Hong Kong remains a key hub for trade in Asia, as well as an entry point into mainland China. Hong Kong’s intra-Asia trade is crucial, with projections showing that trade between Hong Kong and major regional players could grow from $861 billion in 2020 to over $1 trillion by 2030.21

While companies using Singapore and Hong Kong as regional hubs need to be cognizant of how future policy shifts could impact their Asia operations, the two economies remain strong, and trade continues to be a critical part of the regional economy.

Indonesia

Indonesia has strong economic ties with China, the United States and the EU. In January 2025, Indonesia joined the so-called BRICS countries (Brazil, Russia, India, China and South Africa), the first Southeast Asian country to do so.22 It also plans to join the OECD, highlighting the Prabowo administration’s push to position Indonesia as a leader on the global stage.23 Joining the OECD would increase investor confidence, as membership goes alongside economic reforms and anti-corruption efforts.24 If successful, Indonesia will be the first country to be a member of both BRICS and the OECD.

Indonesia’s government has recently restructured state-owned enterprises under one sovereign wealth management agency, in a move to drive economic growth and promote foreign investment, though there are concerns on the potential impact on competition and governance.26 Firms operating in Indonesia need to understand how to navigate changes to the business environment as a result of its establishment, and remain mindful of their business partners.

Vietnam

At one point, Vietnam faced one of the highest tariff rates imposed by the United States. However, the two countries reached a deal in July 2025.27 As the third country in the world and the first in Asia to secure a tariff deal with the United States, Vietnam’s agreement is likely to be a benchmark for the region and could give Vietnam a competitive advantage over its neighbours.

Domestically, Vietnam’s anti-corruption campaign under the former General Secretary led to the dismissal of thousands of civil servants, causing delays in policymaking and political uncertainty. Following the death of Nguyen Phu Trong in 2024, leadership changes included the appointment of a new General Secretary and President.28

Vietnam has pivoted towards high-tech development and is now regarded as a rising digital powerhouse in Southeast Asia, with its digital economy experiencing the highest levels of growth in Southeast Asia between 2021 and 2023.29 The sector had double-digit growth in 2024, and Vietnam is projected to be a leading regional digital market.30

India

In May 2025, military tension between India and Pakistan escalated to the highest levels in years. The threat of further military escalation remains between the two nuclear powers.31 Despite the headlines, conflict in May 2025 appears to have had more impact on investor perception than market performance, as equity and debt net portfolio flows remained positive.32

According to International Monetary Fund (IMF) projections, India is set to overtake Japan as the world’s fourth largest economy by the end of 2025.33 India’s growth is above the global average, recording 6.5% in 2024.34 The size of the market makes it too significant for investors to ignore, but the future of the India-U.S. relationship and the impact of tariffs are important for business leaders to monitor.

China

Tariffs, regional tensions, property market challenges, an ageing population and weaker consumer spending have led to a more cautious approach when doing business in China.35 China’s regional influence cannot be understated, as it is the largest trading partner for many of the region’s largest economies.

China has strong exports to Europe, Latin America and Asia. Domestically, government stimulus measures have cushioned the effects of the property bubble bursting.36 As of August 2025, China supplied about 90% of the world’s rare earths and led the production of many critical minerals.37 This gives China a strategic advantage in international negotiations and highlights the importance of having a comprehensive China strategy to proactively address concerns while taking advantage of China’s investment opportunities.

Navigating Risk in the Polycrisis Era

FTI Consulting’s 2025 What Directors Think survey found that while 79% of respondents with international exposure viewed geopolitical risks as a threat to their business strategies, less than 10% prioritised managing geopolitical risk.

Understanding how major global crises effect on-the-ground operations is essential to long-term success in Asia. Leaders must understand the reality of the business and political environment, engage with key stakeholders and develop strategies that ignore short-term reactions in favour of fundamental goals, strategy and operations. Risk assessments – with scenario mapping, threat identification and embedding geopolitical and regulatory risk – and comprehensive due diligence should be in place from the start, rather than being implemented as and when a crisis hits. This will allow companies to deal with crises more effectively and help them emerge stronger on the other side.

The combination of the polycrisis and a resilient economy means that business opportunities remain strong. But organisations must have geopolitics at the forefront of their business strategies and be prepared to effectively navigate crises. Only then can an organisation fully take advantage of opportunities and fare better in future turmoil.

Footnotes:

1: World Economic Forum, The Global Risks Report 2025; Caldara, Dario and Matteo Iacoviello, Geopolitical Risk (GPR) Index (Aug. 4, 2025).

2: Lawrence, Michael et al., Global polycrisis: the causal mechanisms of crisis entanglement, Global Sustainability (Cambridge University Press Jan. 17, 2024); War, geopolitics, energy crisis: how the economy evades every disaster, The Economist (Jul. 15, 2025).

3: What Directors Think: A Changing Risk Landscape, FTI Consulting (2025).

4: Thomson Reuters Institute 2025 C-Suite Report, Thomson Reuters (2025).

5: GDP Growth (annual %), World Bank Group (Aug. 6, 2025).

6: Ibid.

7: Ibid.

8: Global Supply Chain Pressure Index (GSCPI), Federal Reserve Bank Of New York (Aug. 6, 2025).

9: Gartner Survey Reveals Logistics Leaders are Increasingly Embracing Strategic Goals as 90% Now Report to C-Suite, Gartner (May 20, 2025).

10: The rise and fall of public social spending with the COVID-19 pandemic, OECD (Jan. 2023).

11: Duttagupta, Rua and Ceyla Pazarbasioglu, Miles to Go, International Monetary Fund (IMF) Finance & Development (June 2021).

12: Look Forward: Emerging Markets: A Decisive Decade, S&P Global (Oct. 2024).

13: Duttagupta, supra note 11.

14: 2025 Global CFO Report, FTI Consulting (2025).

15: Real GDP growth, International Monetary Fund (IMF) (accessed Aug. 6, 2025).

16: GDP (current US$), World Bank Group (accessed Aug. 6, 2025); Nye, Joseph S., Jr., How World Order Changes, Project Syndicate (Apr 1, 2025).

17: Asia and Pacific: Regional Economic Outlook, International Monetary Fund (IMF) (accessed Aug. 6, 2025).

18: Look Forward: Emerging Markets: A Decisive Decade, S&P Global (Oct. 2024).

19: Singapore’s International Trade, Singapore Department Of Statistics (accessed Aug. 6, 2025).

20: Agreement between Singapore and Malaysia and the Johor–Singapore Special Economic Zone, Singapore Economic Development Board (Jan. 8, 2025).

21: Clearing the Runway for Intra-Asia Trade, UPS (2022).

22: Brazil announces Indonesia as full member of BRICS, Government of Brazil (Jan 6, 2025).

23: Indonesia reaches key milestones in OECD accession process, OECD (Jun. 3, 2025).

24: Ibid.

25: Huld, Arendse, Indonesia Officially Launches New Sovereign Wealth Fund Danantara, Association of Southeast Asian Nations (Mar. 10, 2025).

26: Bangsa, Baginda Muda and Reyhan Noor, Governance risks plague Indonesia’s new sovereign wealth fund, East Asia Forum (Apr. 8, 2025).

27: Vietnam fund managers relieved as US tariffs look “far less severe” after Trump deal, QuotedData (Jul. 7, 2025).

28: Vietnam’s new leadership slate, The International Institute For Strategic Studies (Nov. 2024).

29: e-Conomy SEA 2023: Southeast Asia’s Internet Economy Reaches New Heights, Temasek, Google, and Bain & Company (Nov. 2023).

30: Ibid. See also Vietnam becomes fastest-growing digital economy in ASEAN: HSBC, Vietnamplus (Apr. 25, 2024).

31: Hussain, Abid, Pahalgam attack: A simple guide to the Kashmir conflict, AL Jazeera (May 2, 2025).

32: Hentov, Elliot, and Venkata Vamsea Krishna Bhimavarapu, India in 2025: A tale of contrasting risk perception?, State Street Investment Management (Jul. 9, 2025).

33: GDP, current prices, International Monetary Fund (IMF) (accessed Aug. 6, 2025).

34: GDP growth (annual %) - India, International Monetary Fund (IMF) (accessed Aug. 6, 2025).

35: Banerjee, Ankur, Trade war or not, global investors turn even more cautious on China, Reuters (Feb. 5, 2025).

36: “China--Economy resilient despite strong trade headwinds,” Export Finance Australia (Jun. 2025).

37: Emont, Jon et al., China Is Choking Supply of Critical Minerals to Western Defense Companies, The Wall Street Journal (Aug. 3, 2025); see also Rockwell, Keith, How China is weaponising its dominance in critical minerals trade, East Asia Forum (Feb. 19, 2025).

Related Insights

Related Information

Published

September 16, 2025

Key Contacts

Key Contacts

Senior Managing Director, Leader of Asia and Latin America Forensic & Litigation Consulting

Senior Managing Director

Senior Consultant

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About