Residential Building Completion Date — Through VAT Lens

-

May 17, 2023

DownloadsDownload Article

-

The UAE's real estate market has been a bright spot in an otherwise challenging global economy, with record-breaking transactions and new highs in the sector. As the country positions itself as a top destination for living and investing, it is important for the UAE based developers to understand their VAT obligations, particularly as the input VAT on construction spends are significant and appropriate charge and recovery of such input VAT is important from a cash flow and cost perspective.

The applicability of VAT on real estate transactions depends on the nature of the property being supplied — VAT at the rate of 5% applies on the sale or lease of commercial properties and related services, while supply of residential properties is either zero-rated or exempt. Although the treatment of VAT on supply of residential properties may seem to be straightforward, several considerations need to be placed on determining whether a supply should be zero-rated or exempt under the Federal Decree-Law No. 8 of 2017 (‘UAE VAT Law’).

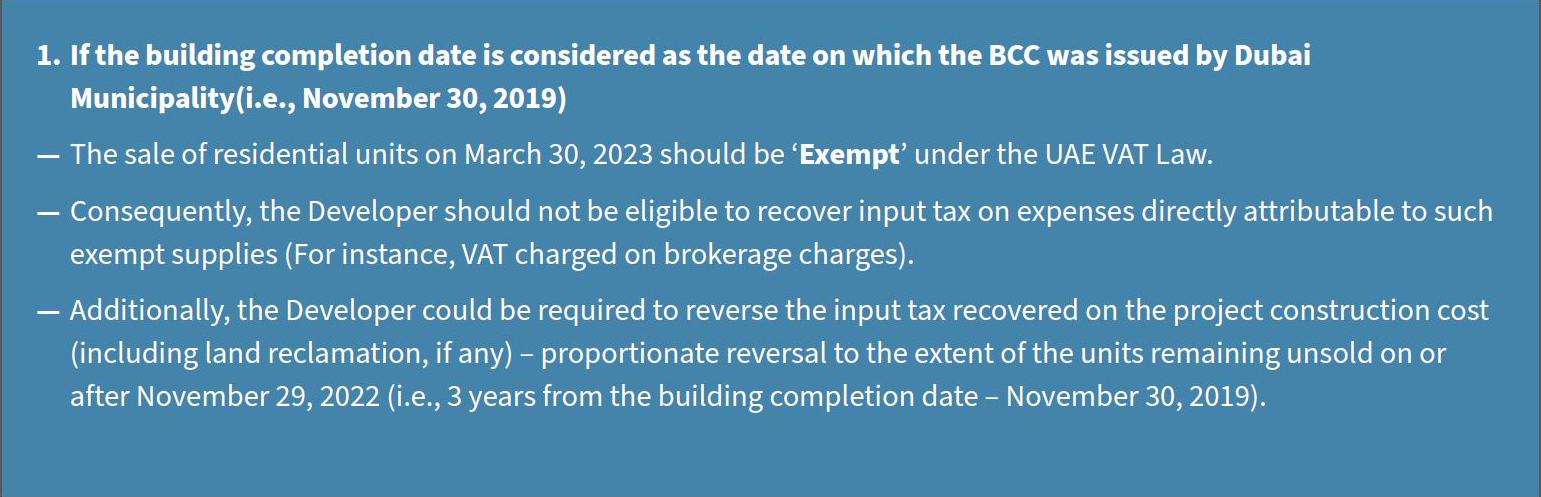

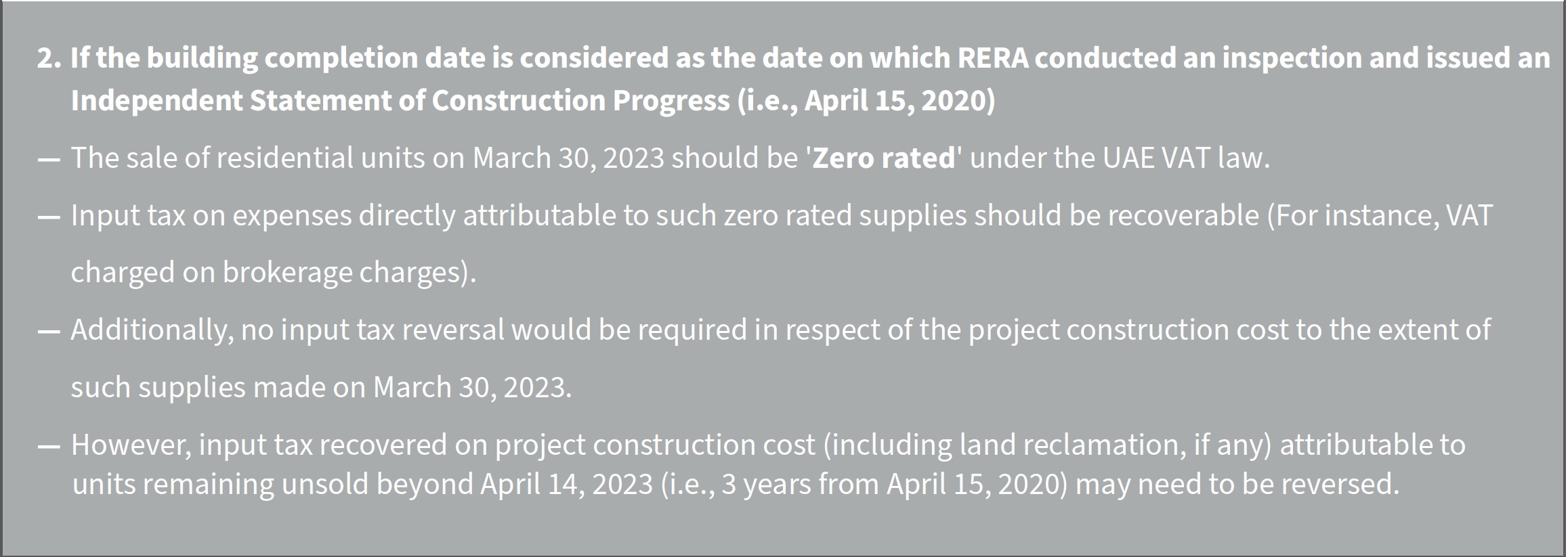

As per article 45 (9) of the UAE VAT Law, only the first supply (i.e., sale or lease) of residential buildings within 3 years of its completion should be zero-rated and any supplies thereafter shall be exempt from VAT. The term ‘completion’ has neither been defined nor any basis for determining the date of completion is provided in the UAE VAT Law and the Executive Regulation of the Federal Decree-Law No. 8 of 2017 on Value Added Tax (‘Executive Regulations’). The FTA did attempt to clarify the ambiguity in the Real Estate VAT Guide (‘the Guide’) — Para 3.2 of the Guide states that the completion date of a building is normally the date the building is certified as complete by an ‘appropriately qualified party’. It goes on to state that the date on which the building is occupied should be considered as the completion date if the building is occupied prior to receiving the completion certificate. Interestingly, the Guide mentions ‘appropriate qualified party’ without identifying any specific person/entity/authority.

Typically, the Municipality in the respective Emirate issues Building Completion Certificates (‘BCC’). The BCC could also be issued by authorities, akin to municipalities. For instance, the relevant authority for issuing BCC for properties located in Dubai South is Dubai Aviation City Corporation (‘DACC’). Additionally, Real Estate Regulatory Authority (‘RERA’) in Dubai also issues an ‘Independent Statement of Construction Progress’, a report detailing the progress of construction after independently inspecting the progress/fitness of the property (i.e., whether the construction is 100% complete or not). Generally, such statement is issued by RERA on a date after the receipt of the BCC from the Municipality or similar authorities.

A question here arises (especially for properties located in Dubai) as to which date should be considered as the building completion date for computing the 3 year period for zero rating the supply of residential accommodation —

- The date on which the BCC is issued by Dubai Municipality or similar authority; or

- The date on which an independent inspection is undertaken by RERA (i.e., the date mentioned on the ‘Independent Statement of Construction Progress’).

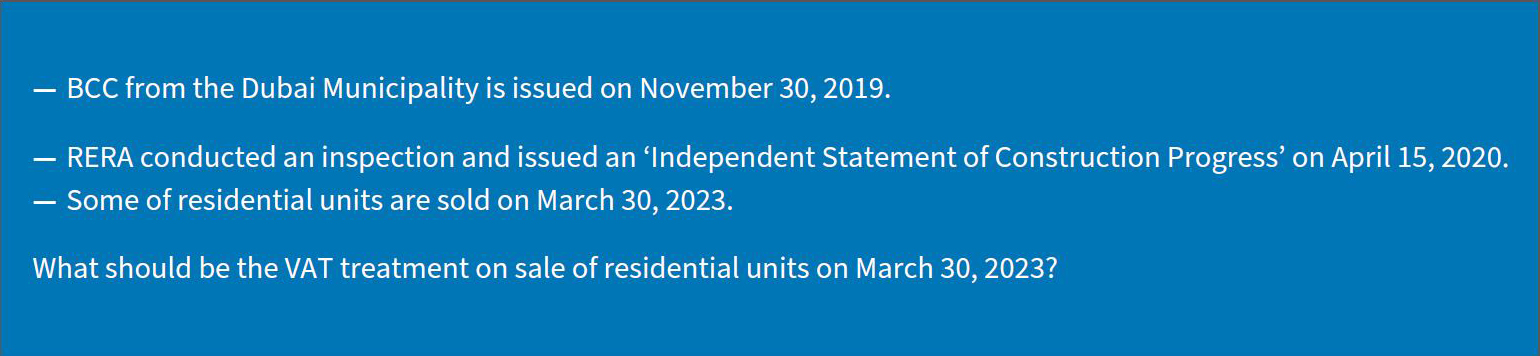

The VAT implications arising out of the above could have major financial and compliance impact on the developers. The same is explained by way of an illustration below —

Under current practice adopted by the real estate developers, both the views are prevalent in the UAE. Considering the BCC issued by Dubai Municipality as the building completion date for determining the 3 year period for zero rating the supply of residential units seems like a prudent approach. However, specific facts and circumstances surrounding the project need to be examined on a case-to-case basis and there may be enough basis to adopt the building completion date as the date on which RERA conducted an inspection and issued an Independent Statement of Construction Progress.

For a discussion on this industry issue, please contact the FTI Consulting Middle East Tax Team, who can assist in appropriately analysing the VAT implications and providing practical solutions on a case-to-case basis.

Published

May 17, 2023

Key Contacts

Key Contacts

Senior Managing Director

Senior Managing Director

Senior Managing Director

Director

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About