How the Current GB Wholesale Market Design Fails to Make Best Use of Flexible Assets: the Curious Case of Batteries Flip-Flopping in the BM

Much of the Rema Debate Has Been on Problems with Interconnector Scheduling but Some Batteries May Exhibit the Same Problem

-

December 11, 2024

DownloadsDownload Report

-

Flexible assets connecting to the GB power system, such as interconnectors, batteries and pumped hydro storage should be hugely beneficial to consumers and to achieving net zero in the energy system. They can provide crucial flexibility at both the national and local levels – either by making up shortfalls in periods of low electricity production by renewable technologies or, conversely, by utilising surplus electricity when renewables production is high.

However, flexible assets’ potential to support the transition depends on how they are used, which in turn depends on the price signals electricity markets send to them. The current Review of Electricity Market Arrangements (REMA) has identified that the current market design has significant shortcomings, including that the national wholesale price frequently leads to “wrongly” scheduled interconnectors aggravating rather than relieving intra-GB congestion.

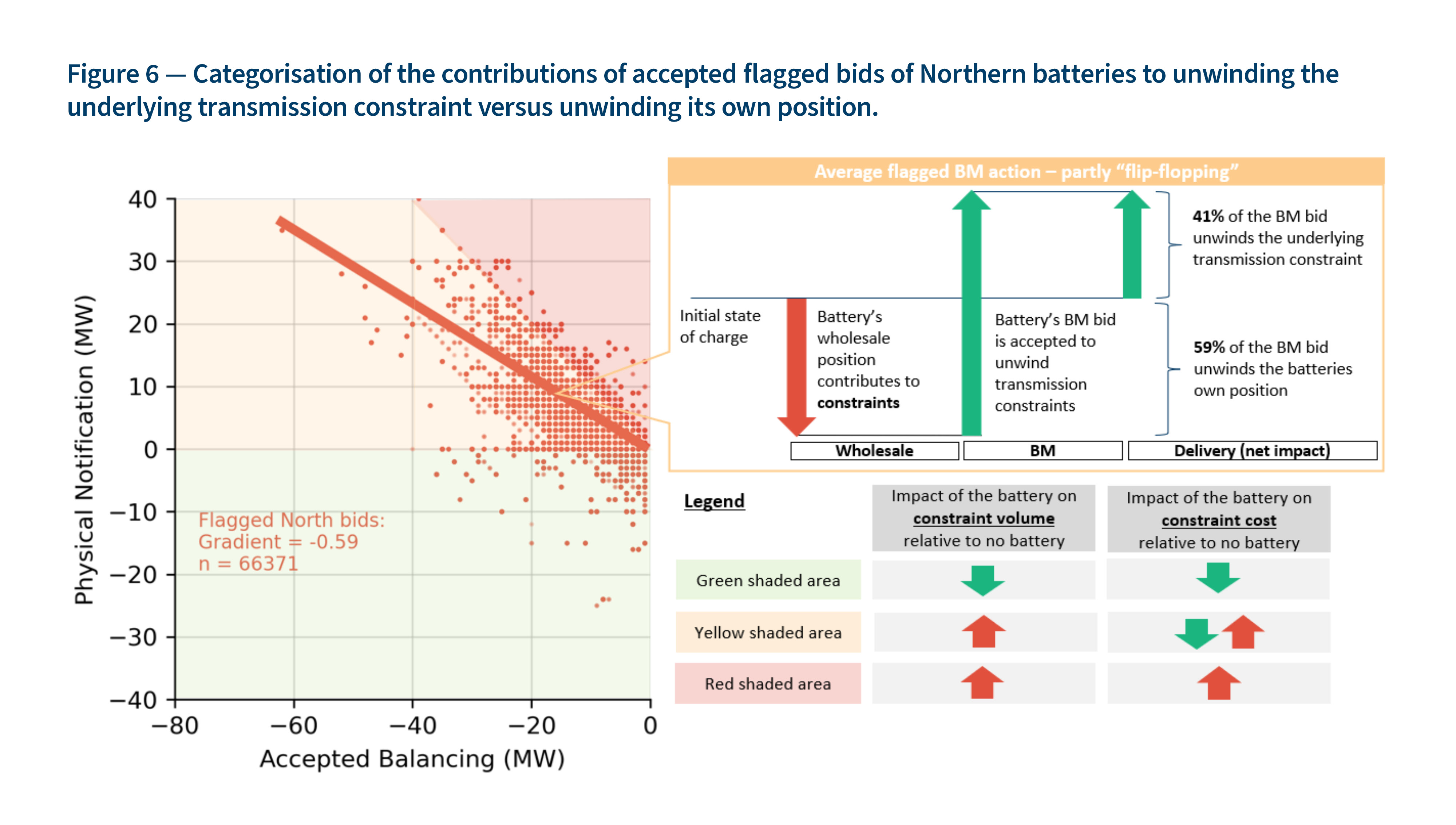

Using data from April to September 2024, we find strong evidence that this can be as well the case for batteries. For a battery located in the north of GB, 59% of all actions categorised (or “flagged”) by the system operator as needed to unwind a transmission constraint are simply to reverse the batteries’ intended output given the price signal it received in the earlier wholesale market. We refer to such actions as “flip-flopping”. This likely causes additional cost to be incurred by GB consumers as, having paid the battery to discharge electricity in the wholesale market, the battery pays a typically much lower (or even negative) price to reduce its discharging position or charge instead.

We are concerned that policymakers could introduce increasingly stringent regulations that restrict battery operators’ freedom to operate their assets with the aim to address this issue. In turn, as we have already seen for some proposed interconnectors, this could endanger the business case for storage assets (which are extremely valuable, when receiving efficient price signals). An alternative solution is to introduce zonal wholesale electricity prices which, by sending the right price signal to batteries in the first place would ensure that flexible assets can bring maximum value to the GB electricity system at lowest cost to consumers.

Published

December 11, 2024

Key Contacts

Key Contacts

Senior Managing Director

Senior Managing Director

Senior Director

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About