Preventing Attacks from Activist Investors Through Transparent Forecasts

-

March 24, 2022

-

Activist investors are becoming increasingly active in Germany, and listed companies should prepare for this. One way to prevent attacks is to be more transparent about the estimated future performance of the company. In an empirical study, FTI Consulting Strategic Communications and the WHU – Otto Beisheim School of Management found out that a lack of financial forecasts is associated with an increased risk of becoming the target of an attack from activist investors.

For some years now, both scholars and practitioners in companies, investment banks, and corporate law firms in Germany have been looking at activist shareholders and their reasons for buying into companies and demanding change. An empirical study by FTI Consulting and WHU – Otto Beisheim School of Management indicates that accurate financial forecasting is essential for preventing cases of shareholder activism.

Activist Investors on the Rise

Activist shareholders are ramping up their efforts in Germany and they’re pushing for change through increasingly high-profile campaigns. Once activist shareholders have found their target, management is often confronted with radical demands, including calls for special dividends, or the spinoff of certain divisions of the company. Activists are also increasingly raising environmental, social, and governance (ESG) issues. All in all, activist investors aim to influence management decisions, often through a seat on the supervisory board, in order to increase value and thus extract higher profits for shareholders.

A Two-step Defense Against Shareholder Activism

The best defense against an activist attack involves two steps. The first step for every listed company is a regular internal analysis of weaknesses and potential areas for criticism. To do this, the company must take on the role of an activist to critically examine its own strategy, business model, capital structure, and growth prospects, in order to determine how they can add shareholder value. It’s essential to show how their strategy and business model will impact the businesses profitability – in both the current financial year, and longer term.

The More Transparent the Forecast, the Lower the Risk of Attack

The second lever against attacks by activist shareholders lies in the forecast, which is a key component of building confidence in capital market communications. In a joint study, FTI Consulting and WHU – Otto Beisheim School of Management examined whether there is a correlation between the existence of a transparent short, mid, and long-term financial forecast and the likelihood of becoming a target of attack by activists.

The authors of the study examined 33 public attacks by activist shareholders in Germany from the last ten years that revolved around companies listed in the four stock indices DAX, MDAX, TecDAX, and SDAX at the time of the attack. The authors analyzed how many of the attacked companies gave a forecast for the current fiscal year, the following year, and beyond.

The same question about the existence of a short, mid, and long-term financial forecasts was examined in a control group of randomly selected companies from the DAX indices. The results of the two groups were then compared.

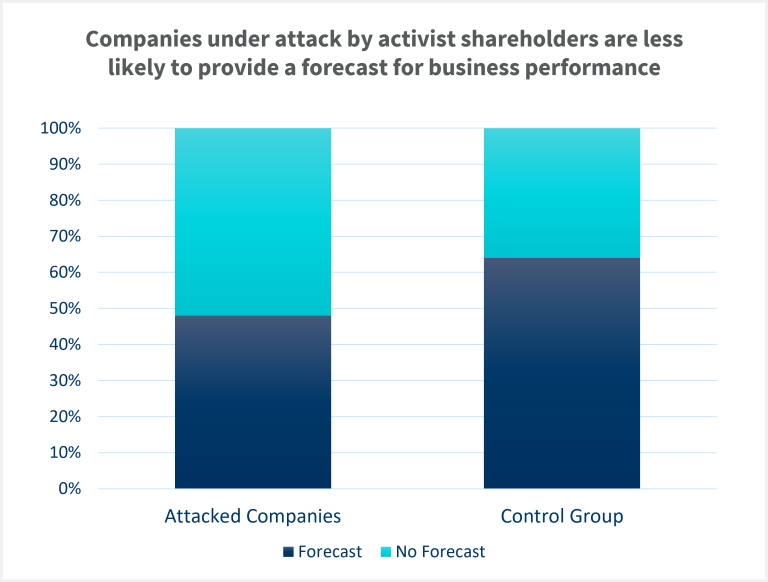

The study showed that there is a direct link between inadequate financial forecasts and the risk of being targeted by activist investors. The randomly selected companies in the control group gave a financial forecast in 64 percent of all cases where it was possible. The challenged companies gave a financial forecast in only 48 percent of the cases. This means that the companies that became the target of campaigns by activist investors had given their shareholders significantly less guidance regarding their expected financial ratios.

The study shows that both attacked companies and randomly selected companies generally provide a forecast for the current year, both in terms of sales and in terms of some form of profit or cash flow (94 and 97 percent, respectively). Only 27 percent of the companies in the test group that were later attacked and 45 percent of the randomly selected companies in the control group include information on the following year – even if it is only sales information. For the time period beyond the next year, 30 percent of the companies in the test group and 48 percent of the companies in the control group make a sales forecast.

Showing the Way to Excess Return

The correlation between providing a forecast and the likelihood of becoming the target of an activist attack is clear, but what other factors could be at play? The size of the company or the sector could also have an impact.

It is conceivable, for example, that groups in cyclical sectors such as mechanical engineering both give less accurate forecasts and become the target of attacks more often. The authors of the study therefore checked whether the correlation remained when the effect of company size and sector was excluded. The result: it remained. The fact that these two possible variables were controlled suggests a causal correlation. In other words, companies that practice straightforward expectation management and transparently inform their investors about the key figures they are aiming for are less likely to be targeted by activist shareholders as a result.

This study confirms broader international surveys – and fits with industry expectations. Investors expect their companies to generate returns above opportunity costs, i.e., above-market growth. In communicative terms, this means that a corporation must show investors how it creates value for them. “The more transparent a group’s financial forecast, the fewer gaps management leaves between presumed and realized value.”, comments Christian Andres, Professor of Corporate Finance at WHU – Otto Beisheim School of Management. “And if you leave no gap between the presumed value and the value realized in capital markets, you give an activist investor little room to argue that the company is underperforming”.

Co-author Florian Bamberg, Director Strategic Communications at FTI Consulting, adds: “Especially companies with many direct, listed competitors, such as the automotive industry, must dare to look not only into the near but also into the longer term future. Otherwise, investors will buy their peers – leading to a weak share price and thus leaving the door wide open for an attack by an activist shareholder, who in this case can secure the support of the remaining shareholders relatively easily.”

Ideally, the company formulates a forecast for the current financial year as well as for the mid and long-term – regarding both sales and profit or margin.

The challenge is that it is difficult to predict the potential impact of external factors such as the global economy, interest rate development, or raw material costs. Therefore the forecast should be constantly reviewed and the targeted key figures should be updated accordingly, using ranges or minimum values. When longer time periods are considered, companies can use qualitative factors and directional statements.

Methodology of the Study

The authors of the study examined 33 attacks by activist shareholders in Germany from the last ten years. In each case, it was analyzed whether the companies attacked gave a short-term, mid-term, and long-term forecast on the company’s financial performance. In each case, points were distributed so that a company under investigation could receive zero to three points. Short-term was defined as the current financial year, mid-term as the following financial year, and long-term as everything following the following financial year. For the short-term forecast, both a statement of the sales target and the profit or cash flow target were necessary for one point to be distributed. Also, either a specific number had to be given or a basis to calculate it (so for the profit target, for example, a sales margin in percent). For mid- and long-term sales, the criteria are less rigid. Thus, the mid- and long-term forecast can be either sales or profit/cash flow to count. Also, on these two timelines, approximate data, such as a minimum value or a growth rate, suffice.

Published

March 24, 2022

Key Contacts

Key Contacts

Managing Director

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About