2024 Digital Infrastructure M&A in the Middle East

Perspectives on the Current Industry Landscape and Prevailing M&A Trends

-

November 26, 2024

DownloadsDownload Article

-

The telecom landscape in the Middle East is transforming: TowerCo penetration has soared, driving a wave of passive infrastructure M&A, while an emerging data center market presents new growth opportunities for operators and digital infrastructure investors.

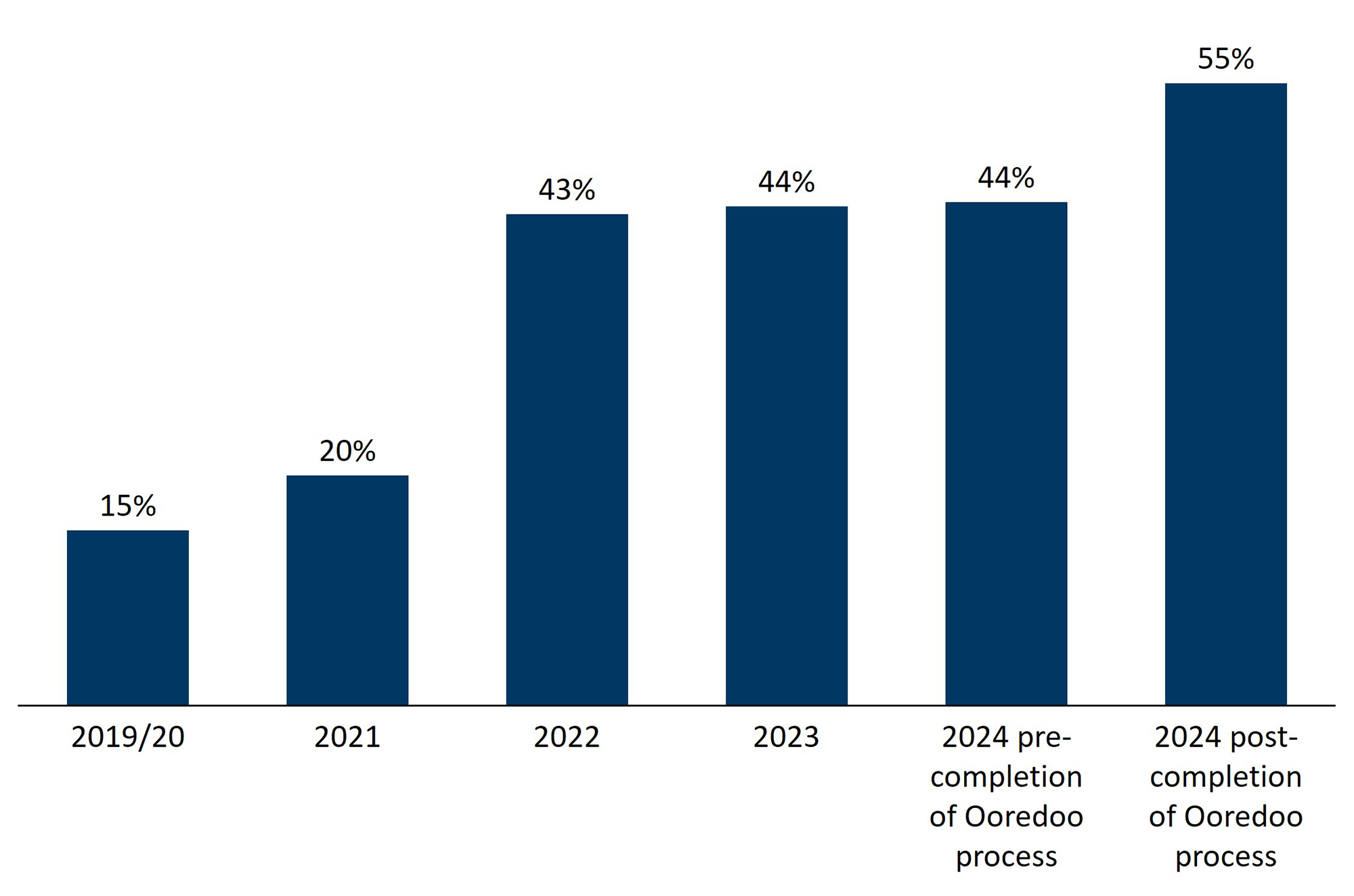

State of the Tower Market

After more than a decade of total silence, the tower market in the Middle East has been completely transformed in just three short years, shifting rapidly from a dormant state to one of the most dynamic regions globally for tower infrastructure M&A. TowerCo penetration levels have skyrocketed from negligible to over 44% today,1 a clear indicator of the swift evolution of the market.

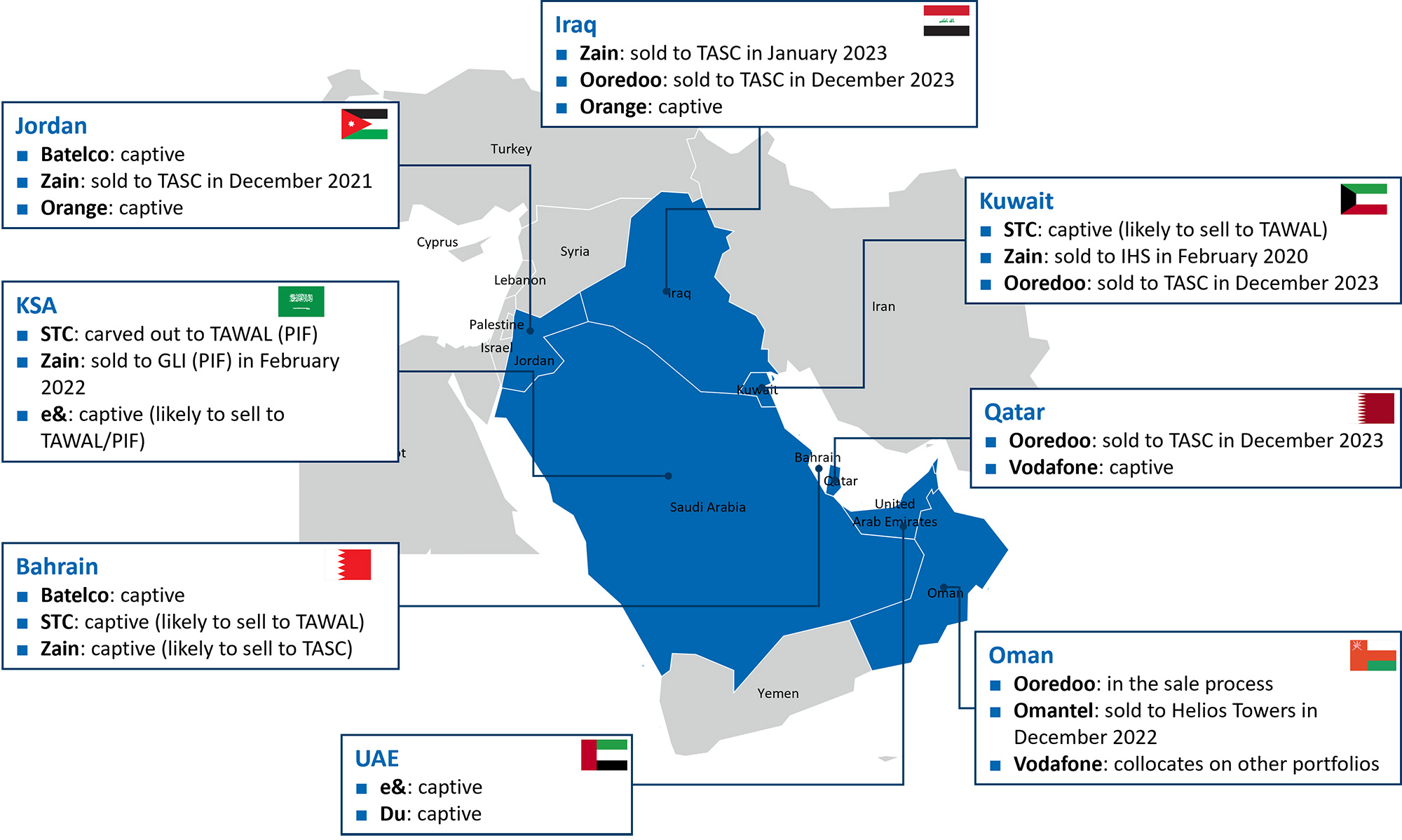

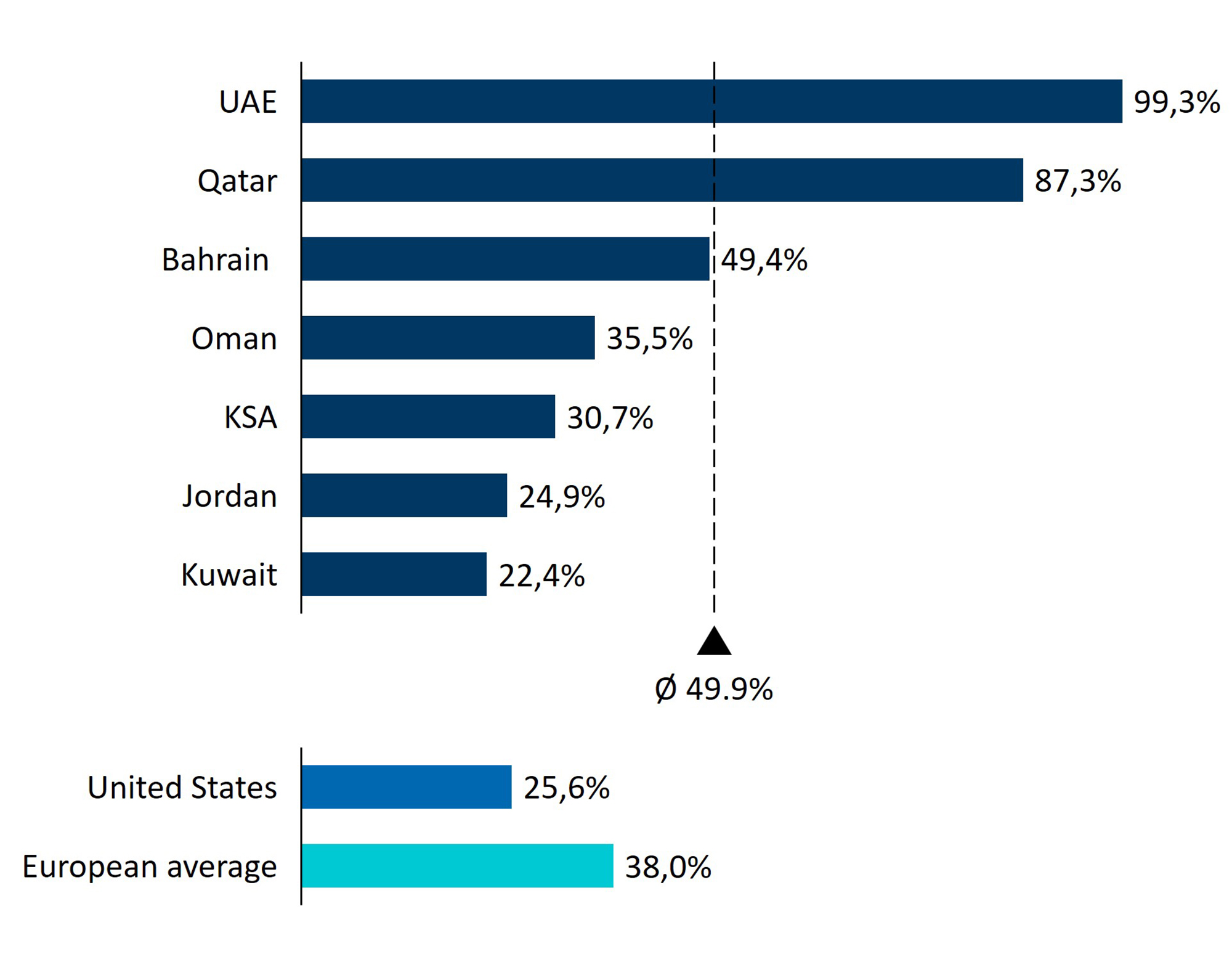

Figure 1 — Percentage of Towers Owned by TowerCos Across GCC Countries (incl. Jordan)1

Source: TowerXchange

Unlike other global regions where mobile network operators (“MNOs”) saw incentives to monetize tower assets earlier, the majority of operators in the Middle East took a different stance at the back of market conditions and financial flexibility. With relatively high margins, minimal debt and abundant cash reserves, they did not initially see a pressing need to pursue tower sale–leaseback deals. Additionally, the operational need for it was limited. Unlike in Africa or Asia, Middle Eastern markets boast healthy power grids, which reduced the need for driving energy efficiencies.

However, the recent shift signifies a strategic change in mindset. As MNOs continue to evolve from traditional connectivity providers to more expansive technology and solution-driven players, there is growing recognition of the strategic value inherent in sharing passive infrastructure assets like towers.

What Are the Market Dynamics Today?

Distinctly from other regions in the world, MNO players in the Middle East have almost exclusively built their tower strategies around captive TowerCos.

STC formed TAWAL between 2019 and 2021 following the carve-out of its tower assets, with the intention of creating a regional champion with global aspirations. In July 2024, STC shareholders approved PIF’s acquisition of a 51% stake in TAWAL. PIF will consolidate TAWAL and Golden Lattice — a vehicle that was used to acquire Zain KSA’s towers in 2022 and 2023 — into a new merged entity. This move will consolidate the KSA market under one umbrella. Beyond local consolidation, TAWAL is also used as a vehicle for international expansion, evidenced by the acquisition of AWAL, a small TowerCo in Pakistan, in 2022 and United Group’s portfolio of 4,800 towers in Central Europe in 2023 — signalling an ambition for a larger mark on the industry beyond the Middle East.

In a similar fashion, Zain Group and Ooredoo Group have created a TowerCo JV: “New TASC” Towers, operating across six markets in MENA. Ooredoo and Zain are leveraging overlapping portfolios across the footprint and an already established TowerCo platform with experienced management to reap the benefits of cost optimization and synergies. The end goal, however, appears to be limited to obtaining the operational benefits a TowerCo could offer to the MNOs and improving the ROIC for the operators.

Oman has a strong likelihood of an immediate tower transaction, as Ooredoo Oman was intentionally excluded from the landmark Ooredoo–Zain–TASC deal. Ooredoo is following a standalone tower monetization process in this market, likely due to the existing presence of Helios Towers and potential tangible interest from other players.

Figure 2 — Tower Ownership by Operator in the Middle East

Source: FTI Capital Advisors, Operator Announcements

The only major exceptions to captive TowerCo preference outlined above have been Omantel selling its portfolio to Helios Towers in 2021 and Zain Kuwait selling its towers to IHS in 2020. However, both transactions occurred prior to “New TASC” Towers formation and TAWAL’s international growth, and both are now at risk of in- market consolidation, as discussed below.

What possible M&A opportunities are there in the region?

With the majority of large-scale tower portfolios in key markets in the Middle East now under the control of TowerCos, the pace of new M&A activity is expected to slow. However, several bright spots still appear on the radar for potential consolidation or external acquisition.

Bahrain remains a completely untouched market, with Batelco not yet unveiling any infrastructure monetization strategies, and with Zain and Viva’s (“STC”) towers remaining captive.

Depending on how the Oman tower sale plays out, it is feasible that TASC towers will be incentivized to take over the portfolios of Helios in Oman, as well as IHS in Kuwait, further consolidating the market — although interest from TAWAL cannot be discounted.

With presence across several markets, Vodafone and Orange retain substantial regional tower assets that could eventually be consolidated, although this is unlikely in the near term as both currently prioritize European and African markets when it comes to tower monetization processes.

e& Group is the only incumbent player that continues to own and operate 100% of its passive infrastructure and is yet to come up with a group-wide tower strategy. However, given the substantial variety in the markets in which it operates, we would expect that the strategy will ultimately be carried out on a country-by-country basis rather than as a top-down strategic push. In particular, Mobily in KSA and PTCL in Pakistan are particularly susceptible to tower transactions, given the tower market consolidation wave in the former and the need to repay debt after the Telenor merger in the latter.

What Is the Expected Market End-State?

Given the substantial concentration of tower portfolios in TAWAL and TASC, it appears improbable that an entirely new tower player could viably enter the Middle Eastern market at this stage. Opportunities to grow meaningful scale organically are minimal. As such, following operationalization and commercial ramp-up of secured assets, TAWAL and TASC will likely pursue subsequent monetization via IPOs on local stock exchanges in KSA and the UAE. This would allow them to capitalize on both markets’ ongoing IPO momentum while crystallizing shareholder value.

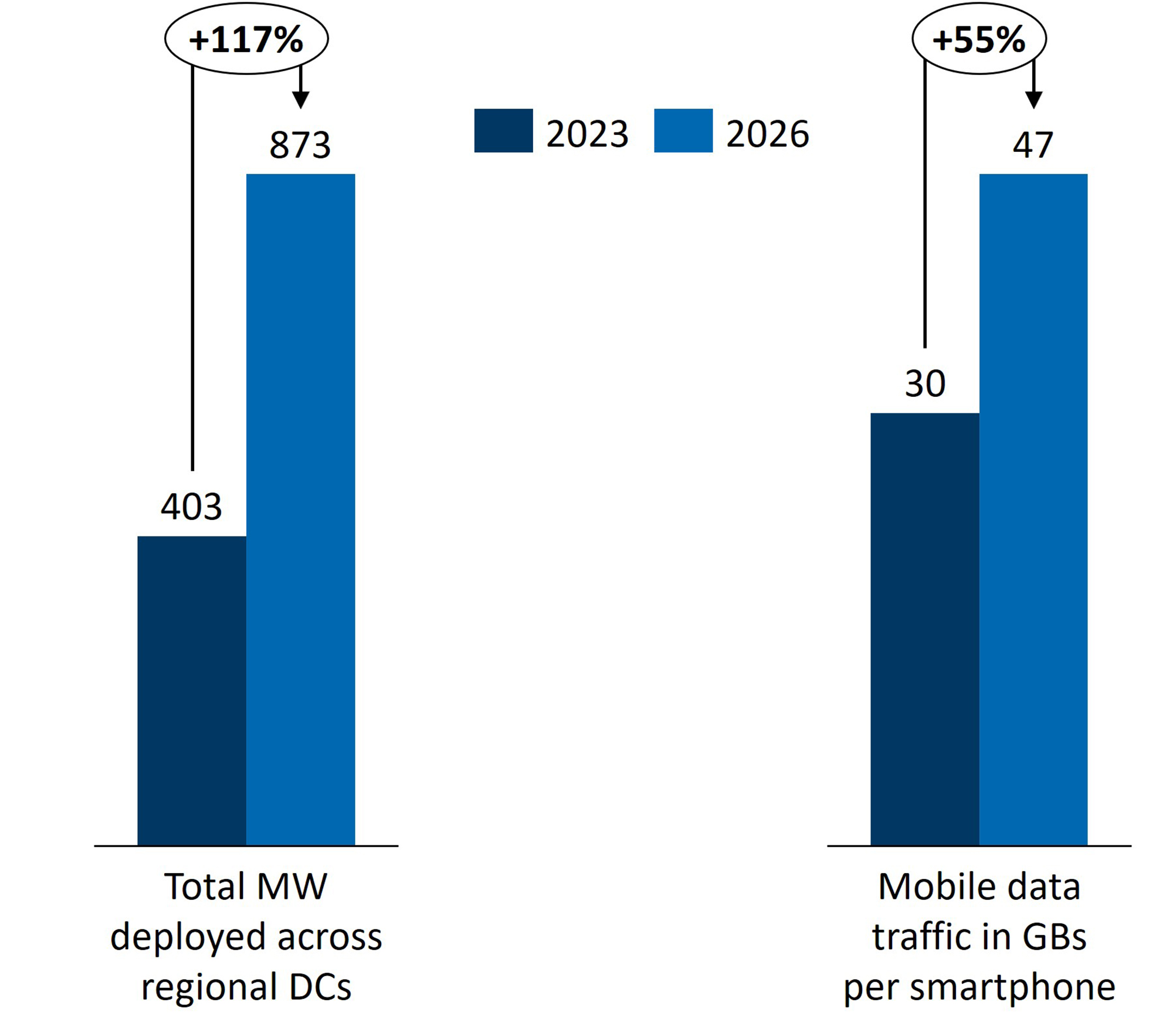

State of the Data Center Market

Beyond towers, data centers (“DCs”) now represent a major potential growth area for infrastructure players in the region. Growing demand for Data centers is driven by a confluence of factors, including enterprise and public sector digitalization needs, data localization/sovereignty policies, and substantial rises in data consumption from institutional and retail clients. This surge is further accelerated by the proliferation of AI, which requires substantial computational power and storage capacity. Additionally, the region’s abundant and stable power supply, with countries such as the UAE having excess capacity, is attracting substantial data center investment. Together, these factors are pushing the industry to localize data center infrastructure within the region.

Figure 3 — High Growth Rates Are Expected in Both Data Center Demand and

Data Consumption2, 3

Source: Ericsson, broker reports

What Operating Models Are Players Adopting in the Data Center Space?

Unlike the tower market, the data center sector in the Middle East is significantly more fragmented, with the expansion driven mostly by financial and infrastructure players that occasionally partner with telcos to develop sizable Data center platforms. Other actors, from dedicated Data center specialists to sovereign wealth funds and infrastructure funds, also play a role in the region.

MNOs view investments in data centers as imperative to securing future growth engines. STC formed a standalone entity, Center3, to house its Data center assets separately. e& partnered with Khazna and transferred its Data center assets to create a leading regional player. Ooredoo and Batelco are pursuing greenfield Data center builds to increase capacity. Zain has yet to announce its Data center strategy.

Market growth, strategic location and access to cheap energy are also attracting traditional global Data center players like Equinix and Quantum Switch (“QS”) to the region. With three Data centers already built in the UAE, Equinix is investing over $100 million to open its fourth Data center, which has a footprint of 12,000 sqm, making it Equinix’s largest Data center in the region. QS, on the other hand, partnered with KSA-based Tamasuk to form a Data center JV, QST.

On the other end of the spectrum, governments are bidding to become the regional data hub and are investing heavily in the sector. PIF and DigitalBridge formed a partnership aiming to develop Data centers in KSA and across the GCC. Neom formed a $500 million joint venture with EzdiTek — later named ZeroPointDC — to develop and operate Data centers in the new city.

Finally, several independent players are also attempting to capture a slice of the market. These range from Edgnex, created by Damac, a construction and real estate player that seeks to diversify its portfolio, to existing ICT players like Qatar’s Meeza, which operates its own Data center assets locally.

What Are the Prospects for M&A in the Sector?

At present, over 75 new data center facilities are confirmed to be in various stages of planning and construction across the Middle East. New supply and fragmentation will drive consolidation of the market.

For now, partnerships and fundraising remain the dominant focus as players try to establish footholds in this rapidly forming market. Over time, once the construction boom decelerates, the stage may be set for consolidation. However, consolidation remains unlikely to accelerate noticeably for at least another 12-18 months. Until scaled portfolios exist in unique metro areas, acquisition economics rarely outweigh standalone development.

State of the Fiber Market

The region lacks legacy broadband infrastructure, which has allowed countries in the Middle East to bypass legacy network deployment and scale-up fiber coverage in urban areas. Fiber ownership is typically concentrated among incumbent telcos and government-backed entities which have deployed passive infrastructure, with independent players usually taking on a smaller role in the market. However, there are signs of increased FiberCo penetration with governments promoting participation to broaden access, enhance competition, and meet growing demand for digital services and cloud computing.

In the UAE, MNO incumbents e& and du have adopted infrastructure-sharing agreements which have helped the country achieve one of the highest global FTTH/B penetration rates, leaving little room for further fiber build-out. Similarly, in KSA, the market is consolidated among incumbent telecom operators. However, KSA also boasts one of the few independent FiberCos in the region following divestment of fiber assets from the Integrated Telecom Company (Salam) to Technical Links Services (“TLS”) and subsequent lease-back.

Qatar has one of the highest global levels of FTTH/B coverage and penetration, attributed to large-scale passive infrastructure deployment by the government- backed Qatar National Broadband Network (“Q.NBN”), supported by Ooredoo and Vodacom. While further build- out opportunities are limited, there is some consolidation taking place, with Q.NBN and Gulf Bridge International (“GBI”) announcing a merger in October 2024 that will combine Q.NBN’s domestic fiber with GBI’s subsea and terrestrial cable networks.

Kuwait has low fiber penetation, with mobile internet penetration playing a more important role. Zain and Ooredoo hold dominant positions; however, the market is set to see an increase in third-party involvement, particularly with the launch of government-backed tender for fiber deployment across the country. The initiative will allow private partners to collaborate with the government to deploy high-speed networks in underserved areas.

Figure 4 — FTTH/B Penetration in Selected Middle Eastern and Other Developed Markets4

Source: FTTH/B Global Ranking, September 2023, FTTH Council Europe

Notably, incumbent operators like STC, Ooredoo and Zain are excluded from participating.

In Oman, government-backed Oman Broadband owns and operates a large portion of passive fiber infrastructure, which has contributed to coverage expansion in Oman. The company signed a collaboration agreement with Dawiyat in March 2024, with a key aspect of the partnership involving fiber build-out to enhance terrestrial connectivity between Oman and KSA. Ooredoo and Omantel also own large fiber networks and provide direct-to-customer services.

What Are the Prospects for M&A in the Sector?

At present, there is limited evidence of fiber carve- outs and industry consolidation in the Middle East, a trend likely to persist in the short to medium term. However, opportunities are expected to emerge as governments in lower-penetration markets aim to expand fiber infrastructure in underserved areas, with this expansion likely to be supported by co-investment from the private sector.

FTI Capital Advisors’ Position and Future Role

FTI Capital Advisors, with its unparalleled experience in cross-border digital infrastructure M&A, is thus uniquely placed to continue supporting this wave of M&A. We bring together an unparalleled commercial and technical understanding of the subject matter to deliver bespoke advisory support to our clients across the whole decision-making chain, from ideation to execution.

Footnotes:

1: TowerXchange’s Middle East and North Africa guide Q2 2024 update, TowerXchange, 30 September 2024.

2: Mobile data traffic outlook.

3: MENA TMT 2024e outlook, December 21 2023, Arqaam Capital

4: FTTH/B Global Ranking, September 2023, FTTH Council Europe.

Related Information

Published

November 26, 2024

Key Contacts

Key Contacts

Senior Managing Director, Global Co-Lead of FTI Capital Advisors

Senior Managing Director

Vice President

Analyst