The Shape of the Fourth AI Inflection in 2025

Managing Hype, Expectations and Changing Business Models with AI Driven Transformation

-

January 27, 2025

-

From boardrooms to living rooms, AI has changed the conversation. Rarely does one get to live through a truly revolutionary cycle that makes us fundamentally reconsider not just the future of technology and business, but also the future of society and what it means to be human.

In an article two years ago we saw the current moment as an inflection point in this revolutionary cycle, which we called the fourth AI inflection.1 Since then, our experts have been involved in hundreds of wide-ranging projects, discussions and explorations with a broad spectrum of constituents, including Fortune 100 enterprises and startups, AI researchers and technologists, venture capital and private equity firms, teachers, lawyers and regulators. The hype we saw in the summer of 2023 persists – but looking past it we see exciting new research and compelling developments in how organizations are using AI for business transformation and innovation.

Where will AI take us tomorrow and in the years ahead? This article offers a distillation of the key developments that are occurring and continue to rapidly evolve, along with insights on the direction and continued pace of change for those interested in a strategic, long-range perspective across the business, technology and investment landscape. Our analysis covers four broad areas: 1) how AI is being used for business transformation and innovation; 2) the state of AI model development and the direction of future research; 3) which indicators will prove most relevant to the investment community; and 4) key emerging concerns and risk factors for boards and business leaders. This article will examine the first topic; we will address the others in subsequent articles.

The Coexistence of Hype and Potential Value

“Human expectations rise and fall at a greater rate than how the natural world behaves and reacts.”

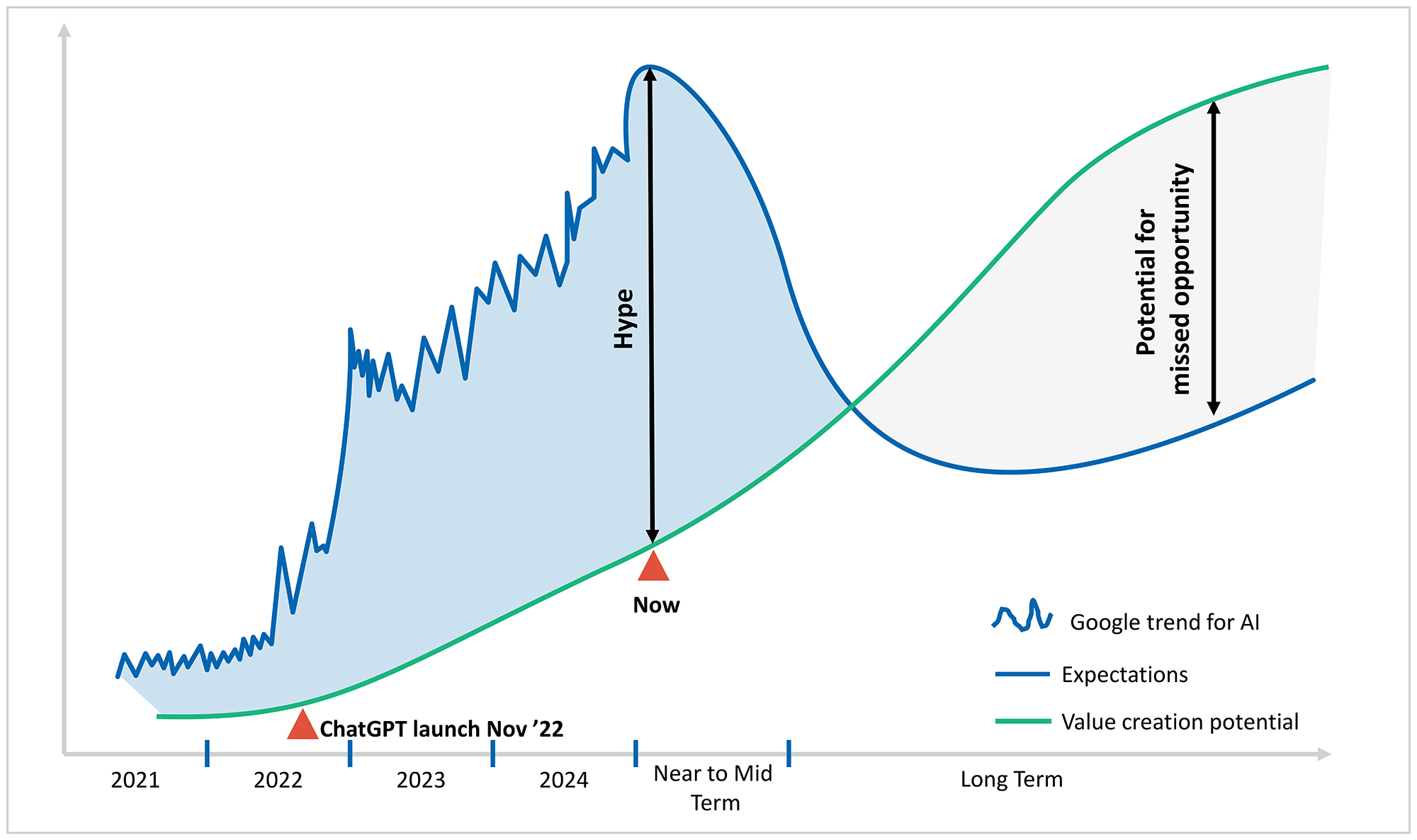

How much of what we hear about AI is just hype? This essential question, asked by business leaders and investors, is no less relevant now at the start of 2025 than it was in 2023, when we first wrote about the current inflection point. The current excitement about AI illustrates a larger truth: human expectations rise and fall at a greater rate than how the natural world behaves and reacts. When expectations about a technology significantly exceed the value it creates at that moment in time, we enter a hype cycle. Increasing inflation of asset bubbles, seen in steeply rising AI-driven stock market valuations,2 point to one aspect of these high expectations. Another AI excitement-related phenomenon is AI washing,3 in which companies externally misrepresent AI capabilities to customers, shareholders and regulators to enhance their value and reputation, and internal teams do the same to their leadership in an effort to seek budget.

Expectations vs Value Creation Curve

Source: FTI Consulting

An unfortunate consequence of this is developing resistance and blind spots to the potential value that the technology can unlock. Hype and the potential for real transformation can and often do coexist, as we saw during the internet era. And when expectations dip below the potential for value creation, we see businesses missing opportunities or having to play catch-up, often accompanied by struggles among legacy companies and startups as they strive to adapt under new business conditions resulting from advances in technology. This happened in the wake of the dotcom bust and, in our view, may soon happen again as further advances in AI may result in another inversion of the value creation and expectation curves.

Where Is the Impact Being Felt?

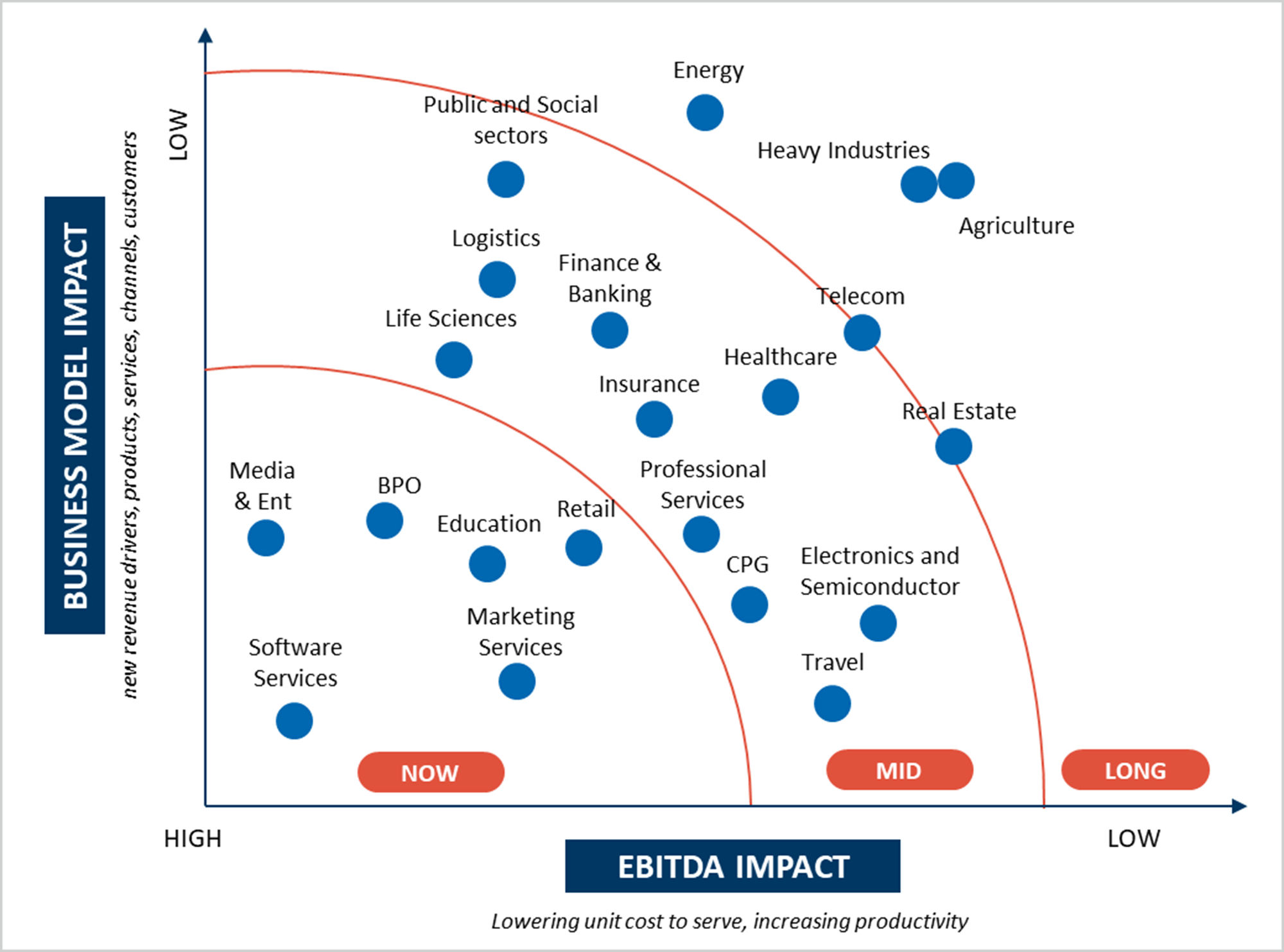

So how is this unfolding and where are businesses headed? FTI Consulting research points to clear sentiment4 that AI will broadly impact business models. But the impact, while significant, will be uneven across business functions, and the time to realized value will vary by industry sector. Currently, the greatest impact is on functions that involve human-to-machine or human-to-human interaction because the current class of generative AI (“GenAI”) models excel at simulating such behavior.

Industry sectors heavily reliant on content creation, as well as work in sales and marketing, service operations, repeatable business operations, software development, research and analysis and synthesis (including many white-collar professions) will be most impacted in the near- to medium-term. For these sectors, effects are being felt from both external, revenue impacting drivers and internal, cost impacting drivers. Externally, AI is driving an examination of what companies in these sectors sell and how they sell (i.e., new or expanded products, services, customer segments, pricing models and channels) as they grapple with changing customer behavior and expectations. Internally, AI is driving a reconsideration of how these companies operate and fulfill their services (i.e., improving productivity, speed and quality while lowering cost to serve).

Other industry sectors, such as heavy industrials, may be more impacted by internal operating model shifts and will see a more gradual, yet still significant disruption curve. A slower pace of adoption and transformation is also expected to be true for industries like healthcare and select financial services sectors – outside of specific machine learning use cases already prevalent today, such as credit decisioning and fraud detection – due to regulatory considerations that will act as a damper. An AI worker offering healthcare and financial services advice will need to cross a much higher bar than a retail AI representative recommending the latest fashion. Nevertheless, the overall pace of change even in such regulated industries is expected to be faster than in the past, especially with the progress on active research on tools and techniques designed to make the decision-making processes of deep learning AI models more transparent and interpretable.

Source: FTI Consulting

Bending the Cost and Revenue Curves

“We expect a significant bending of the cost-to-serve curve through operating model transformations to happen sooner and at a somewhat predictable pace.”

We expect a significant bending of the cost-to-serve curve through operating model transformations to happen sooner and at a somewhat predictable pace. The cost-to-serve impacts have already been significant for some industries because the functions involved are repeatable, predictable and of relatively lower complexity. Some business process and customer service operations firms have been able to replace the lower performance quartile of their headcount by AI agents over the last 18 months, reducing unit cost to serve by more than 20%. Fintechs – like those that provide buy now, pay later services – have deployed AI to reduce costs to a level where their revenue per employee has grown by more than 70% in 2024 alone.5 AI tools are also accelerating the software development process, enabling teams to more quickly develop new features and customer configurations. This allows companies to manage and scale technology platforms without scaling their development teams.

Exploiting external drivers to impact revenue will likely follow a more irregular pattern. It will require businesses across sectors to invest more effort in product and business model innovation.6 Furthermore, companies can leverage their proprietary data to enable new AI-driven product and service offerings. For example, media and publishing companies are monetizing their archives of historical content to provide co-pilot tools that are hyper-personalized based on genre, topic, content creators’ previous work and more. To succeed, these businesses will need to follow changing customer expectations, behavior and consumption patterns, and then understand their impact on shifting value chains, spending resources and effort on research and development in order to experiment, test, learn and innovate in the market.

The Shift from Infrastructure to Value

The last several years of GenAI investment and resulting value creation have focused on the infrastructure to develop, train and deploy foundational models (e.g., GPT, Claude3 and Llama). Doing so has largely involved the infrastructure side of the value chain, from physical components and computational power to the models themselves and the orchestration tools required to make deployment useful.

As companies focus on leveraging AI to bend the cost and revenue curves, there will be an increasing shift in focus and in value creation fundamentals, from model training to inferencing. Companies will shift focus from AI infrastructure aimed at building better foundational models to scaling use of those AI models within businesses by building applications that handle increasingly more complex – and more high-value – tasks.

As the current state of model scaling approaches the higher reaches of the innovation S-curve, the share of value creation will start shifting to specializing the infrastructure for high-value, domain-specific use cases; enhancing the user experience; addressing the rapidly evolving future of consumer consumption; and optimizing enterprise and human workflows. A s during the internet revolution and more recent mobile revolution, this shift will likely involve a complete reimagination of how business is conducted.

But the scale will be greater and deeper for this AI shift than for those events – and faster, too. Take the impact of AI on search as a dramatic example, where the sophistication, interactivity and comprehension of AI-generated search answers has led to new consumer engagement patterns, showing an early shift from Google to AI search applications and signaling an early threat to Google’s dominance in the technology consumer services space. In a recent survey, SearchGPT was the top search provider for 5% of respondents, up from 1% in June.7 According to the survey, 78% of respondents said their first choice was Google, down from 80% in June. In an industry where a 1% share of search traffic represents billions of dollars in revenue, this represents a significant shift in such a short period of time.

AI Workers Move from Talk to Action

“The shift now is moving from interesting natural language processing or actions like low-grade accounting tasks or IT glitch fixes to making high-stakes forecasting decisions”

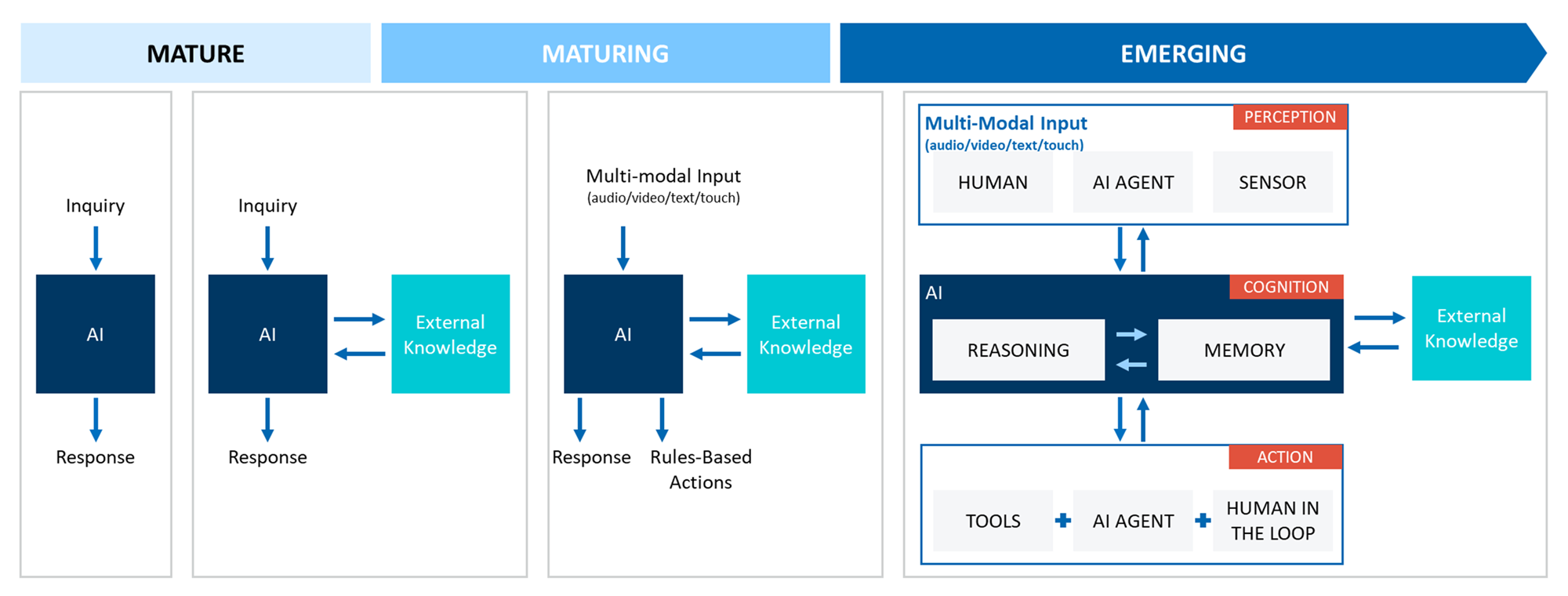

Behind this disruption is a rapid evolution of how AI is deployed. Much interest was generated after the fall 2022 launch of ChatGPT, by poking large language models (“LLMs”) to elicit interesting poetry and apparent manifestations of sentience. The shift now is moving from interesting natural language processing or actions like low-grade accounting tasks or IT glitch fixes to making high-stakes supply chain forecasting decisions or supporting lead-to-cash workflows.

The most sophisticated manifestation of this shift is the rise of what is known as agentic frameworks, which can be more simply described as “AI workers.” These are applications that go beyond using GenAI models as simple input/output engines and instead draw on complex instructions to plan and take on increasingly autonomous decisions and actions. Unlike a foundational AI model itself, which is largely stateless and does not persist information (i.e., maintain context and historical data) across calls or queries to the AI system, AI agents store and maintain contextual information as memory for multi-step interactions with the world. They use foundational AI models to reason, self-critique, plan, access external knowledge sources and perform actions through external tool calls, human-in-the-loop tasks and multi-agent collaboration to enable end-to-end workflows.

Enabling this shift towards AI workers is an evolutionary step forward in enterprise AI architecture design, characterized by the development of specialized AI tools. To tackle complex problems, they need to be intelligently broken down into tasks that can be delegated to specialized AI tools for processing. Various types of AI (e.g., generative, deterministic, etc.) may be employed, and the responses intelligently collected and presented back to users. This approach enables rapid development, iteration and refinement to key parts of the AI workers.

A proliferation of open-source and proprietary agent frameworks such as OpenAI Swarm, AutoGen and LangGraph are already making it easier to experiment and address such complex problems and novel use cases.

Source: FTI Consulting

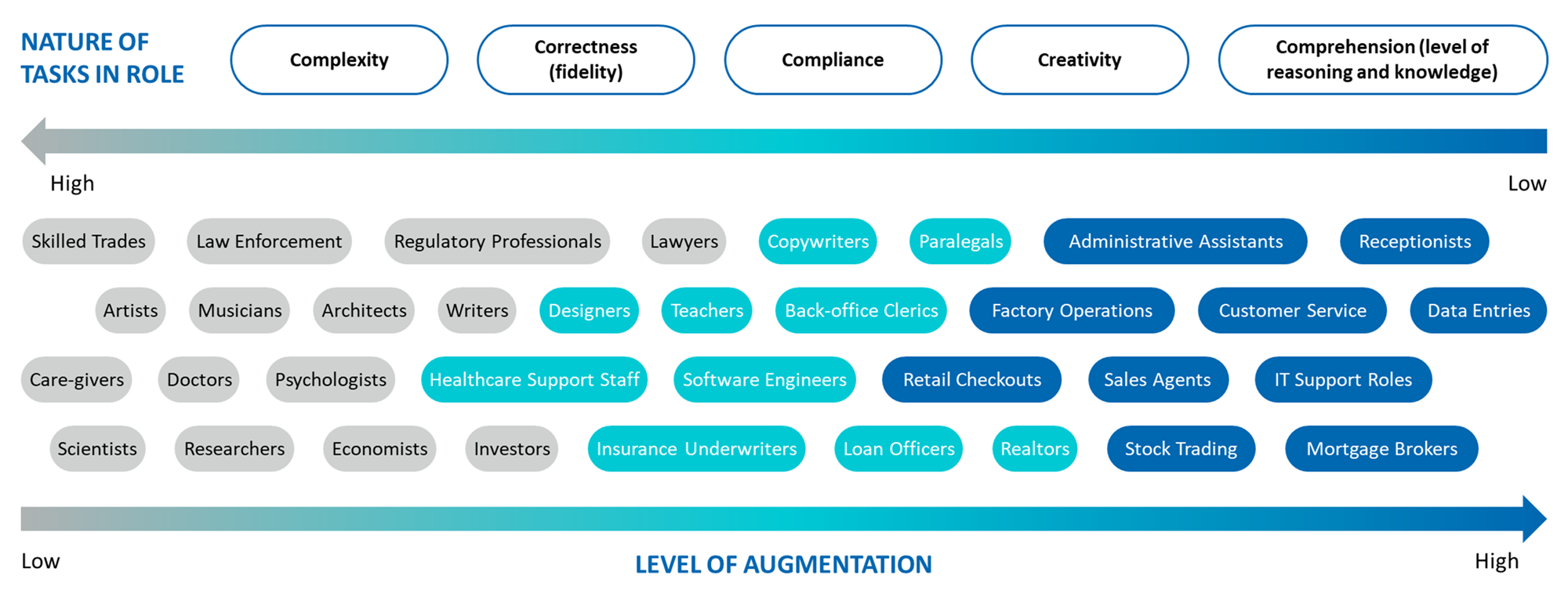

Labor that is fairly repeatable and that requires lower degrees of complexity, creativity, comprehension, correctness and compliance will see a higher degree of augmentation in the near- to mid-term as AI agent sophistication and guardrails mature over time to support higher order functions. We are seeing, for example, the lower quartile of customer service agents being replaced by autonomous inbound and outbound agents who are able to drive better service quality and conversion.

Source: FTI Consulting

The deployment of such forms of AI labor into the enterprise and among the human workforce will no longer present only technology or data science problems, but greater societal and business engineering problems. As the above shifts take place, businesses embarking on an AI-driven transformation should expect to deploy more than 80% of their resources and attention to areas other than technology, data and AI models. Companies will need to develop new AI-first business processes, practices and operating models to capture the benefits from AI augmentation of human workforce. Given the transformative nature of AI-driven augmentation, companies should focus on driving change management and effective communication plans to minimize the risk of value leakage.

So What’s Next?

As this article shows, from reshaped business models to enhanced human and human-machine interactions, AI is set to have a transformative impact on today’s businesses. Although past innovations around the internet and the mobile phone offer some hint of the speed and effects of this transformation, this inflection point holds the potential to be much more disruptive and enabling.

The next article in this series will cover the technical research and development efforts around AI models and associated technologies driving the applications discussed here.

Footnotes:

1: Sumeet Gupta, Dr. Claudio Calvino, Madhur Mahajan and Phil Reilly, “The Fourth AI Inflection: How the Latest Class of AI Models Can Add Business Value,” FTI Consulting (June 12, 2023).

2: “Stock Market News, Dec. 11, 2024: Nasdaq Crosses 20000; Inflation Data Boosts Rate-Cut Hopes,” The Wall Street Journal (December 11, 2024).

3: Kelly Miller, Meredith Brown and Claudio Calvino, “AI Washing Erodes Consumer and Investor Trust, Raises Legal Risk,” Bloomberg Law (October 25, 2024).

4: Sumeet Gupta and Jiva J. Jagtap, “AI Takes Center-Stage for Value Creation in Private Equity Firms,” FTI Consulting (October 24, 2024).

5: “Klarna H1 earnings: Compounding growth generates 27% revenue rise, SEK 1.1 billion profit improvement, and over SEK 1 trillion annualized GMV,” Klarna (August 27, 2024).

6: Sumeet Gupta, Steven Fisher and Carl Jones, “Rethinking Business Models With AI,” FTI Consulting (January 8, 2025).

7: Blake Dodge, “ChatGPT’s search market share jumped recently, while Google has slipped, new data shows,” Business Insider (December 6, 2024).

Related Insights

Published

January 27, 2025

Key Contacts

Key Contacts

Senior Managing Director, Leader of AI & Digital Transformation

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About