Retail Distress is Making a Comeback

-

March 04, 2024

DownloadsDownload Article

-

Denim jackets. Crop tops. Retail bankruptcies? While it seems that many fashion styles are revived every 20 years or so, just often enough for a new generation to discover them for the first time, distress in the retail sector is staging a comeback after a two-year reprieve. Lest we forget, many large retail chains were struggling before COVID, not necessarily at an existential level but certainly from a profitability perspective, as omnichannel retailing radically altered the calculus of running a consumer-facing business.

COVID-19 disrupted that narrative for a while and created a new mix of winners and losers among retailers, depending on what they sold and how they sold it. As consumer shopping patterns and preferences return to normal after a most unusual three-year period that upended the ways we shop, these old-school challenges are back in fashion again. We’re not limiting this discussion to apparel and include any product sold to consumers primarily in a store-based setting. In fact, the growing list of retail names getting recent media attention as bankruptcy candidates runs the gamut of product categories and store types.

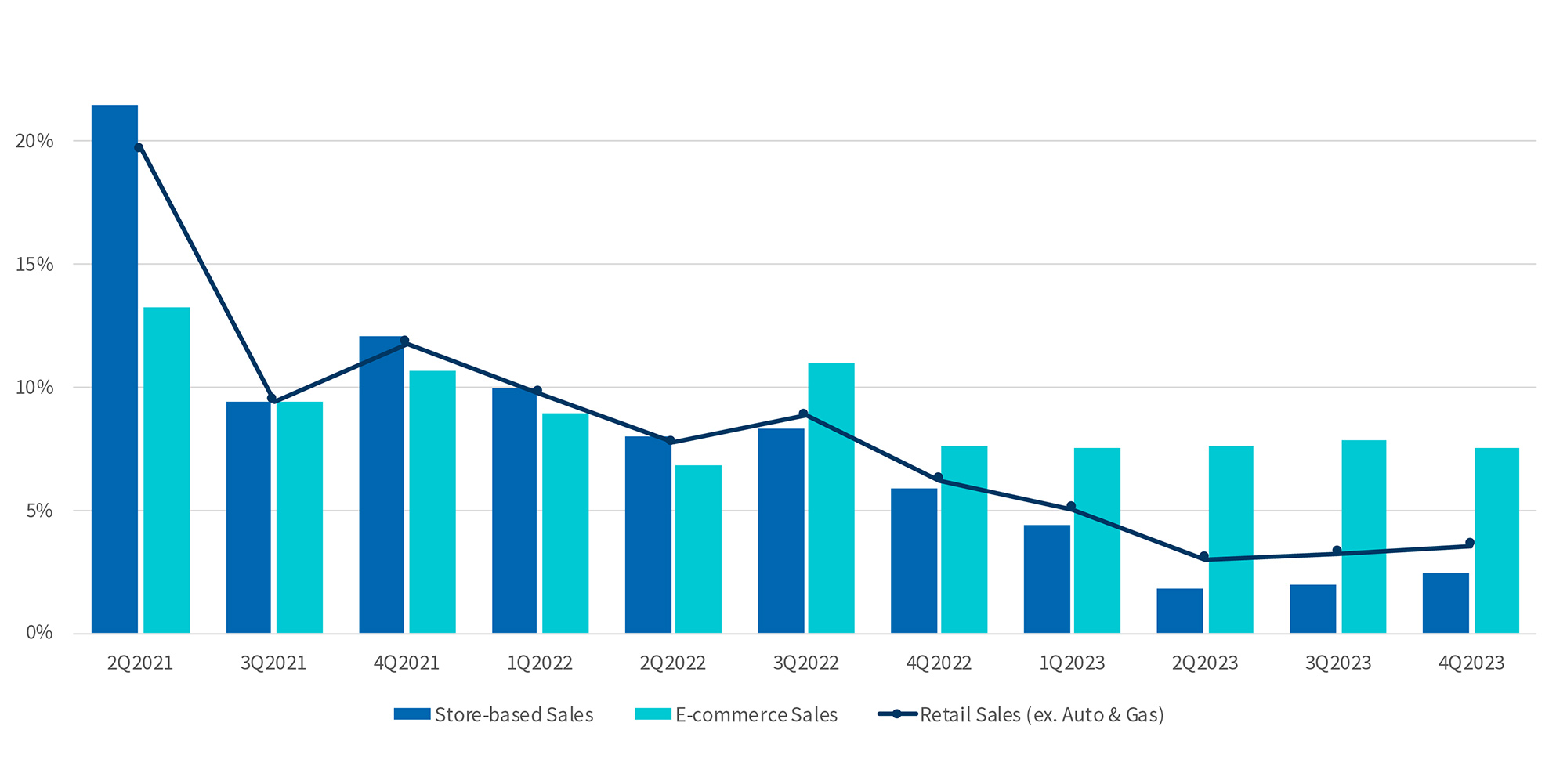

Store-based and omnichannel retailers caught a break in the aftermath of COVID-19, as shoppers returned to stores in large numbers still loaded with most of their COVID-fueled cash hoard intact following a lengthy hiatus from in-store shopping. For the first time since the advent of online shopping, total store-based sales growth (YoY) outpaced online sales growth for five consecutive quarters from 2Q21 through 2Q22 (Figure 1). During this time, retail bankruptcies plummeted from pre-COVID norms and profitability briefly improved across the sector, a much-needed break for struggling chains. Inflation benefitted many retail chains that were able to pass on these higher costs, and then some, to customers. Some industry watchers hoped that consumers had rediscovered their love of in-store shopping after being limited to mostly online transacting during the pandemic. Eh, not really — it was more of a dalliance than a rekindled romance. The script has since flipped once again, as total store-based sales growth (YoY) has weakened consistently over the last six quarters and now is marginally positive while online sales growth hovers in the high single-digits (Figure 1) compared to the low double-digits prior to COVID. The purported comeback of store-based shopping lasted about as long as the 3D movie craze, while ROI has trended lower across most retail segments since a COVID-induced peak in early 2022.

Figure 1 – Quarterly Retail Sales Growth (YOY)

Source: U.S. Census Bureau

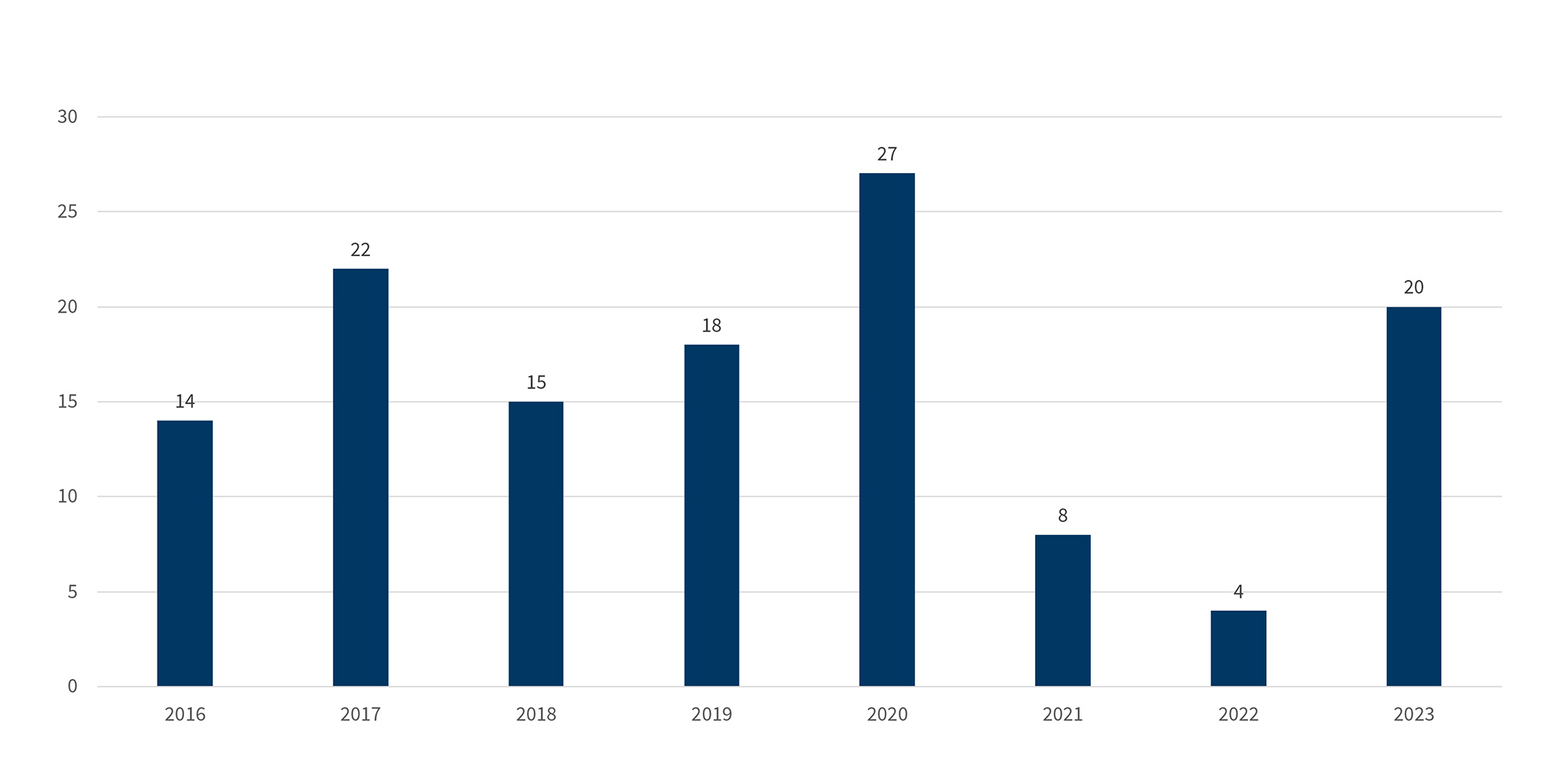

Further compounding recent concerns about the retail sector, many more shoppers are indicating they are tapped out financially, having burned through most of the COVID savings windfall. Whether you want to call it a reversion to the mean or a new cycle of retail distress, retailing restructurings picked up notably in 2023 (Figure 2) while business headlines focused on the likely restructuring of some well-known retail chains are again getting more than their share of ink in recent months.

CEOs of several retail chains opined on the future of retail in a recent CNBC article1 entitled “What Will Retail Look Like in Five Years?” — and it seems that an unending series of backflips and contortions will be required of retailers in order to stay relevant to customers. The store as “retail-tainment” (yes, that’s a term), the store as a distribution center, the store as a showcase, the store as a billboard, omni stores — everything except the store as a self-contained profit center, because many won’t be. These CEOs sounded up to the challenge given the strength of their brands and positioning, but many others that lack the brand relevance, hip factor or omnichannel infrastructure likely aren’t as ready.

Figure 2 – Large Retail Bankruptcy Filings (>$50 million of Liabilities at Filing)

Source: BankruptcyData.com

One passage in the article really seemed to strike at the heart of the challenge. Jens Grede, CEO of Skims, commented,

At a macro-retail level, that sentiment conveys a discouraging reality for the industry, as most stores that dot our landscape are B and C locations. Just as all children can’t be above-average students, all of a large chain’s retail stores can’t be A-type locations. This is a fairly immutable variable. Where does that leave the others for a chain with hundreds of locations? This goes back to the issue of retail over-storing, which was widely recognized and discussed prior to COVID. It would be a mistake to believe the slight culling of store locations that has occurred since COVID has meaningfully addressed that problem. If anything, the COVID-19 episode accelerated the online/omnichannel transition and has placed more pressure on store-level economics and performance. This core issue for most retail chains moved to the back burner in 2020-2021 as stores scrambled to adjust to the disruption of the pandemic while landlords were more accommodating during that stressful time, but it is once again the front-and-center issue.

The demands on omnichannel retailing are manifold, requiring large ongoing investment in online capabilities, implementation of these initiatives, and integration with in-store strategy and operations. Now retailers will need to configure AI capabilities into their online offerings. There is no finish line in this race. All in all, it is a heavy and expensive lift for large retailers and not all chains do it equally well, while customers can be unrelenting in their expectations of retailers and unforgiving when those expectations aren’t met. Moreover, shopping is no longer the leisurely activity for most of us that it once was. The CNBC article addressed the topic of purposeful shopping. Consumers today thoroughly research a product online prior to purchase, and know exactly what they want should they choose to buy it or pick it up in a store. Consequently, the opportunity for browsing, discovery or impulse buying within the four walls of a store is diminished without stepped-up efforts by retailers to hold customers’ attention, further pressuring store-level performance even as store traffic recovers.

The challenges confronting much of the retail sector are not acute across the board, so let’s try to zero in on where the vulnerability is greatest. Affluent Americans are doing just fine and still spending plenty, so high-end and luxury brands and retailers are not hurting for business. Stalwart names such as Williams-Sonoma, Lululemon and Ralph Lauren selling to better-off customers are still thriving even without a COVID tailwind and are not overly concerned about a consumer spending pullback. Furthermore, the online side of most high-end businesses is often very evolved and seamlessly integrated with stores. Many smaller and savvy (mostly) online retailers (with a limited store footprint) selling branded lifestyle products to a targeted demographic audience are also excelling. Ironically, some of the largest retail chains selling to down-market customers but which have the scale and pricing flexibility to be responsive to penny-pinching shoppers are also doing fine, even as their customer base trades down or makes other spending compromises.

It is the huge, soft middle where the biggest exposure lies for the retail sector, that is, mid-sized chains selling nondescript or lower-end brands of discretionary or non-essential goods to middle-income shoppers. These retailers are rarely destination stores but instead rely on the weekend flow of customer traffic to the nearby strip center or shopping mall to catch a rush. That is the bullseye for retail distress in 2024 and beyond. Let’s be honest: we could name a dozen struggling retail chains that could disappear from the retail landscape without being badly missed by shoppers, and with that sales void quickly filled by others. They are fungible businesses without a distinct value proposition that languish from year to year with no apparent purpose other than survival, failing to engage or excite customers or to generate adequate returns for owners or shareholders. Naming names here would do us no good, but we could all draw up similar lists. For them, the clock is ticking once again.

Footnotes:

1: Gabrielle Fonrouge and Melissa Repo, “What Will Retail Look Like in Five Years? Top Industry Executives Share Their Predictions,” CNBC (February 16, 2024)

2: Ibid.

Related Insights

Published

March 04, 2024

Key Contacts

Key Contacts

Global Chairman of Corporate Finance

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About