- Startseite

- / Insights

- / Artikel

- / US Renewable Energy MA Review 2023 Outlook 2024

U.S. Renewable Energy M&A: Review of 2023 and Outlook for 2024

-

22. Mrz 2024

HerunterladenDownload Article

-

Entering 2023, renewable energy mergers and acquisitions (“M&A”) faced significant headwinds, including sustained high interest rates, inflationary pressures, supply chain constraints, government support program uncertainty and grid reliability. As a result, renewable energy deal volume declined significantly in 2023 from 2022 levels. Despite these challenges, investor optimism grew during the back half of the year with easing supply chain bottlenecks and legislative clarity on the $369 billion energy and climate spending earmarked by the Inflation Reduction Act (“IRA”). New direct pay and tax credit transferability options under the IRA, combined with the continued rollout of federal grant and loan programs such as those available through the Department of Energy (“DOE”) Loan Program Office (“LPO”), offered additional benefits to investors willing to brave the macroeconomic headwinds.

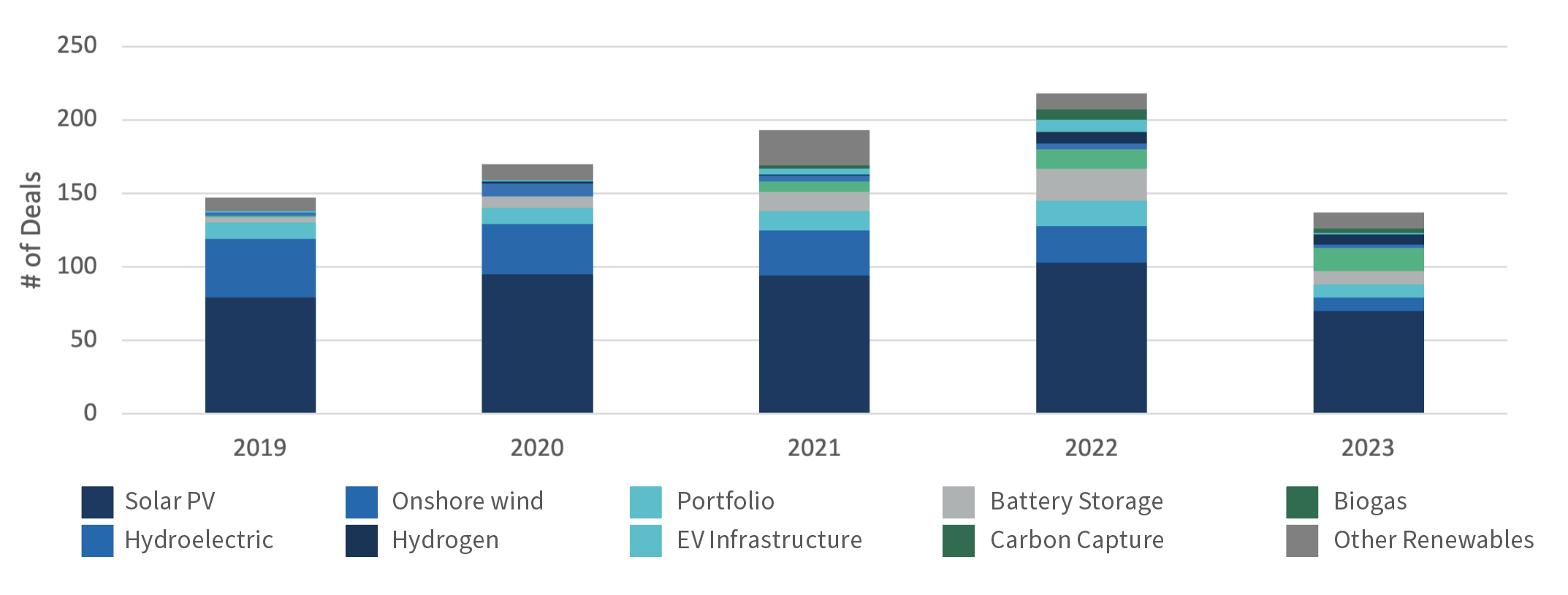

Figure 1 – Renewable Energy M&A Volume1

Private Equity Consulting Learn more

Established renewable technologies continued to dominate M&A volume, with over 60% of transactions comprising wind, solar or portfolio sales.2 In a departure from the trends of 2021 and 2022, there was a significant decline in renewable platform M&A activity, with fewer marquee developers remaining independent and interest rates driving a wedge between potential buyers and sellers on valuation.3 While selective platform transactions did occur, the more notable trend was the sale of major renewable energy businesses and portfolios, including Duke’s sale of its renewables business to Brookfield for $2.8 billion.4 Year over year, transaction activity for each renewable technology declined in volume, with one notable exception: Renewable natural gas (“RNG”) and biogas transactions continued to increase, indicating further progress towards mainstream adoption of a once-niche renewable energy sub-sector. Meanwhile, 2023 also marked a resurgence of traditional nuclear M&A, including the sale of Westinghouse Electric Company to Brookfield and Cameco Corp for $7.9 billion.5 Although some market participants have typically viewed nuclear generation outside the sphere of “clean” energy, there is increasing market conviction that nuclear will play an important role in the evolving U.S. energy landscape — both as a provider of available transfer capability (“ATC”) power to critical digital infrastructure, as well as a flexible resource alternative through development of small modular reactors (“SMRs”).

As we look forward to 2024, we anticipate various factors will drive increased M&A activity in the renewable energy sector. Relative to previous years, a higher cost of capital, influenced by both base rates and widening lender margins, will continue to put pressure on project viability and investor returns. Smaller developers, which are more affected by elevated rates and more susceptible to increased cost and delays, may be forced to sell projects, portfolios, or their entire platform as they seek liquidity or an outright exit. Investors and established incumbents with stronger balance sheets may take this opportunity to invest, acquire and structure creative solutions, further driving consolidation in the sector. Finally, we anticipate corporates continuing to take a more active role in the energy transition. As decarbonization and electrification come to the forefront, oil and gas players will continue to actively invest in the sector, while technology companies may take a more direct approach to investing in the energy transition as they seek to realize ambitious decarbonization targets.

Platform M&A Slows

Platform M&A activity evident in recent years slowed in 2023. This, in part, reflected consolidation in the sector, where fewer independent renewable energy developers of scale remain, as well as prevailing investor appetite and the broader interest rate environment which impacted valuations. While there were several platform acquisitions, including the acquisition of Amp US by Fiera Infrastructure and Palisade, overall platform activity was well below that seen in 2021 to 2022 and primarily noted in the distributed energy sector, including commercial and industrial (“C&I”) and community solar, where specialist developers that were not acquired in the earlier wave of consolidation were targeted.6

Previously, platform investments were pursued as a higher-risk and potentially higher-return alternative to asset and portfolio investment. With both volume and pricing down across the renewable energy M&A spectrum, prospective returns impacted by the interest rate environment and many of the marquee development names already spoken for, the impetus for platform deals proved less compelling in 2023, with investors demonstrating greater discipline when valuing and pursuing remaining early-stage development pipelines.

Strategic Divestitures of Renewables Portfolios

Conversely, the sale of unregulated renewable businesses noted in 2022, including Con Edison’s $6.8 billion divestment of its unregulated clean energy segment, continued at an accelerated pace in 2023, with utilities such as AEP, Algonquin, Avangrid, Eversource and Duke Energy announcing their intentions to sell their renewable portfolios (Figure 2).7

Figure 2 – Notable Divestitures of U.S. Renewables Portfolios in 2023

| Target | Date | Status | Buyer | Seller | Summary |

|---|---|---|---|---|---|

| Duke Energy Renewables Business Sale8 | 10/25/2023 |

Closed |

Brookfield Renewables |

Duke Energy Corporation |

Brookfield Renewables acquired Duke Energy’s renewable portfolio of roughly 4.1 GW of net ownership and 10GW pipeline. |

| Duke Energy Commercial Distributed Generation Sale9 | 10/4/2023 |

Closed |

ArcLight Capital Partners |

Duke Energy Corporation |

ArcLight Capital Partners acquired a portion of Duke Energy’s distributed generation business for $364M. |

| Eversource Offshore Lease Area Sale10 | 9/7/2023 |

Closed |

Ørsted |

Eversource Energy |

Ørsted acquired Eversource’s 175,000 acres of developable offshore wind area for $625M |

| AEP Unregulated Renewable Assets11 | 8/16/2023 |

Closed |

IRG Acquisition Holdings |

American Electric Power |

IRG acquired American Electric Power’s 1.4 GW wind and solar generation portfolio, including 14 operating assets in 11 states and seven power markets with the largest assets being the ERCOT-based wind farms, for $1.5B. |

| Algonquin Renewable Energy Group Sale12 | 8/10/2023 |

Announced |

TBD |

Algonquin Power & Utilities Corp. |

Algonquin Power & Utilities Corp to sell 3.9 GW of renewable assets both in operation and under construction. |

| Avangrid Renewables Sale13 | 3/31/2023 |

Announced |

TBD |

Iberdrola |

Iberdrola to sell up to a 50% stake of Avangrid’s renewable portfolio, including roughly 9.6 GW of operational projects and an 18 GW development pipeline. |

In addition to cost-of-capital considerations, other factors underpinned recent renewable portfolio sales. Supply chain constraints, increasing development costs, permitting issues, interconnection delays and shorter tenor offtake agreements have all contributed to an increase in the risk profile of unregulated renewable energy investment for utilities. Consequently, credit agencies have begun to identify large renewable portfolios as possible additions to risk for consolidated utility entities, with the potential for adverse impacts on credit ratings and the possibility of creating additional challenges in rate case proceedings. Given the risks associated with the asset class, major utility investments in renewable energy assets have also adversely impacted utilities’ cost of capital. Because of these challenges, some utilities have stated that the driving factor for unregulated renewables divestment is to maintain investment-grade credit ratings, which are critical to utilities’ abilities to access attractive debt capital and maintain their respective cost of capital.

With cash on the balance sheet, many utilities have pivoted towards grid infrastructure upgrades to serve the ever-expanding needs of electrification programs.

Biogas Growth

Despite the general decline in renewable M&A volume in 2023, biogas continued its 2022 breakout, becoming the only renewable technology to increase transaction volume year over year. In addition to the number of transactions, the diversity of the investor base also widened, with large institutional investors like the Ontario Teachers Pension Plan’s investment in Sevana14 and Ares Management’s investment in Dynamic Renewables.15 A high interest rate environment has been a driver of the increased activity in the biogas space as investors struggling to find opportunities in more established renewable technologies consider investments in technologies that can meet their required thresholds.

The IRA contributes to biogas investments becoming all the more attractive. For the first time, qualified biogas projects will now be eligible to receive Investment Tax Credits (“ITC”) and participate in the tax equity market. Not only has this increased the valuation of existing pipelines, but projects that were previously not able to meet developer return thresholds may also find new life. For investors, the IRA further incentivizes biogas investment and accelerates the mainstream adoption of the business model.

An additional driver of biogas adoption and investment is the mainstreaming of technologies and processes that were considered emerging just a few years ago. Raw gas upgrading technology has become cheaper and more modular. Instead of building custom systems for every site, many developers have found success in smaller, flexible systems that can be deployed based on specific needs. Shortened development timelines and more predictable production yields have all contributed to the adoption of biogas and, in turn, provided access to institutional investors.

Nuclear Revival

Looking beyond renewables to clean energy, 2023 marked a significant increase in nuclear energy M&A. Historically, opportunistic institutional investors have not played a role in this segment given the high capital requirements, long return timeframes, permitting uncertainty and low return prospects. Over the last year, three major nuclear transactions shifted this paradigm.

| Target | Date | Status | Buyer | Seller | Transaction Value ($000) |

|---|---|---|---|---|---|

| Westinghouse Electric Company sale16 | 11/7/2023 |

Closed |

Cameco, Brookfield Renewable Partners |

Brookfield Renewable Partners |

$7,900 |

| NRG Energy Nuclear Project sale17 | 10/30/2023 |

Closed |

Constellation |

NRG Energy |

$1,750 |

| Energy Harbor sale18 | 3/6/2023 |

Announced |

Vistra Corp. |

Energy Harbor |

$6,763 |

The increased interest in nuclear energy M&A coincides with favorable legislation under section 45U of the IRA. Like other clean technologies, existing nuclear energy power plants are now eligible for a 10-year Production Tax Credit (“PTC”), providing a substantial boost to project economics.

2024 Outlook

While the M&A market tries to shake off a lackluster 2023, we believe several factors will drive increased deal activity over the next 12+ months. Most importantly, we cannot escape the fact that the cost of capital remains high. While the Federal Reserve has indicated a series of interest rate reductions is expected in 2024, a return to an interest rate environment just north of zero is not anticipated anytime soon, as we settle into a new normal with more stabilized pricing levels. This interest rate environment, while likely to improve, will continue to apply pressure on project economics and may help drive two outcomes in renewable energy M&A over the next few years.

- Smaller developers may not be able to secure capital, even with generous government incentives, at a cost that drives attractive returns. These smaller developers may be forced to sell projects, portfolios or their entire platforms to larger entities that can make the numbers work.

- On the demand side, larger players, having either greater operational diversity or public equity as an attractive currency, may be more creative, taking on risk or offering a different value proposition to capital-starved developers that cannot achieve scale. Look for consolidation in the middle market as these dynamics play out.

The year ahead will also see many federal energy-related programs finally receive overdue articulation, application and scale. The U.S. government has begun allocating $110 billion of available grant money earmarked by the IRA with pools of capital such as the $27 billion Greenhouse Gas Reduction Fund yet to be fully rolled out. Separately, the Treasury Department is finalizing language on new tax credit programs and transferability, potentially accelerating utility-scale wind and solar development and helping de-risk emerging technologies upon commercialization. At the same time, the DOE LPO, eyeing the November presidential election over its shoulder, has accelerated the approval and funding of debt capital to myriad new technologies and companies that are supporting the broader energy transition. The DOE LPO is making capital available to a wide swath of related manufacturing entities setting up shop in the United States who are supporting the supply chain and accelerating the reshoring of the clean energy industry. The significant state-specific decarbonization goals needing to be met and the sheer volume of funding and incentives from the U.S. government sector could have a seismic effect on the U.S. energy sector and the economy as a whole over the next 12-24 months.

Alongside the U.S. government, corporate America will continue to raise its influence in the energy transition. The increasing demand for power from leading technology players, especially zero-carbon energy, may grow significantly over the next few years as the usage of generative A.I. expands across every economic sector. This level of demand will affect not only energy procurement but also location, technology and delivery. As noted in a few recent megadeals, “big oil” will continue to make efforts to diversify its energy mix with strategic investments and acquisitions. A recent example is B.P.’s investment alongside Fortescue and Mitsubishi Heavy Industries in Electric Hydrogen’s $380 million series C round , pushing investment over the $1 billion valuation mark. With immediate needs for diversification and carbon-reducing strategies, large corporates will look to play an increasing role in the energy transition, propelling mergers and acquisitions in their quest.

Early developments in the new year indicate that these predicted market trends are taking hold, and 2024 will make up lost ground from the relatively low level of M&A activity seen in 2023.

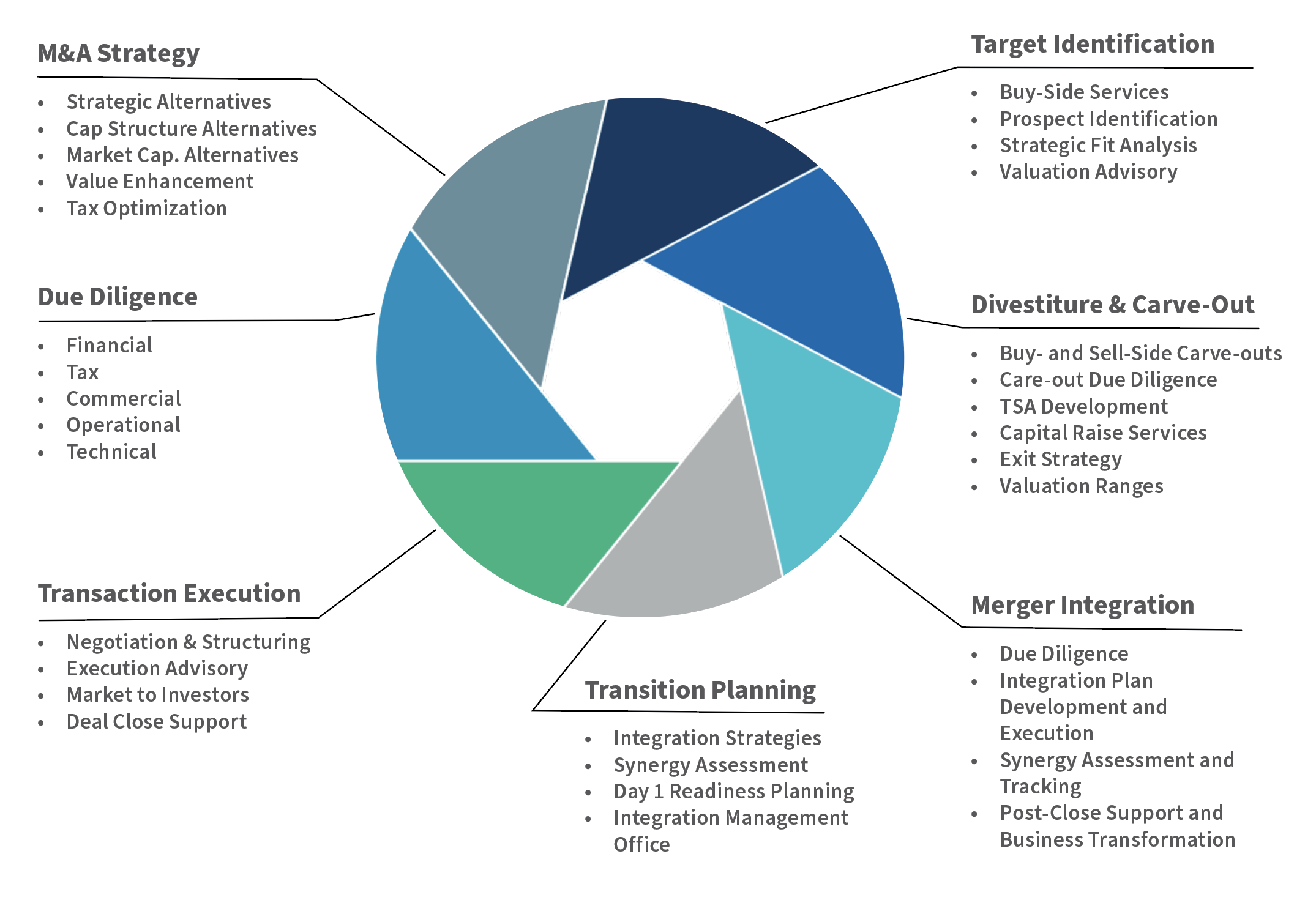

How FTI Consulting’s Power, Renewables & Energy Transition Team Can Help Effectively Navigate

FTI Consulting’s Power, Renewables & Energy Transition professionals have functional expertise across the life cycle of renewable energy participants. Our seasoned team provides tailored services for strategic and financial investors, creditors and corporates, and has deep experience with renewable energy platforms, projects and portfolios.

Through our wholly owned investment banking subsidiary, FTI Capital Advisors, we provide tactical strategic advice, buy- and sell-side advisory and capital-raising services. Our seasoned investment bankers have significant transactional experience in developing solutions and executing assignments in the U.S. capital markets for a wide variety of clients. As an independent investment bank, we are free of conflicts, enabling us to provide clients with unbiased and uncompromising advice and execution capabilities, besides being uniquely supported by a broad team of industry experts servicing consulting clients across the renewables value chain.

FTI Consulting team members have developed and applied best practices in strategic market entry, transaction advisory, due diligence, and operational transformation. We assist leading strategic and financial investors across all stages of the transaction life cycle, including strategy, diligence, and the pre-sign, sign-to-close, and post-close phases of merger integration and carve-out transactions. Our team customizes the scope of our engagement models to provide solutions tailored to our clients’ needs, from full-scale transaction execution to specific PMO or functional subject matter expertise, always working in partnership with leadership and key stakeholders.

Figure 3 – FTI Power, Renewables and Energy Transition Service Offerings

Footnotes:

1: Infralogic Transaction Data, FTI analysis.

2: Ibid.

3: Ibid.

4: “Duke Energy to sell utility-scale Commercial Renewables business to Brookfield for $2.8 billion,” Duke Energy (June 12, 2023).

5: “Cameco and Brookfield Complete Acquisition of Westinghouse Electric Company,” Cameco Corporation (November 7, 2023).

6: “Fiera Infrastructure and Palisade Infrastructure Group to Acquire Amp US,” Fiera Infrastructure Inc. (February 21, 2023).

7: “CON EDISON FINALIZES SALE OF ITS CLEAN ENERGY BUSINESSES,” Consolidated Edison, Inc. (March 1, 2023).

8: “Duke Energy Renewables Business Sale (2023),” Infralogic (October 25, 2023).

9: “Duke Energy to sell commercial distributed generation business to ArcLight for $364 million,” Duke Energy (July 5, 2023).

10: “Eversource Energy Announces Agreement to Sell Interest in Uncommitted Offshore Lease Area,” Eversource Energy (May 25, 2023).

11: “AEP COMPLETES SALE OF UNREGULATED RENEWABLES ASSETS,” American Electric Power (August 16, 2023).

12: “Algonquin Power & Utilities Corp. Will Pursue Sale of Renewable Energy Group Following Strategic Review; Announces 2023 Second Quarter Financial Results,” Algonquin Power & Utilities Corp. (August 10, 2023).

13: “Avangrid Renewables Assets Sale (Minority Stake) (2023),” Infralogic (March 31, 2023).

14: “Ontario Teachers’ Pension Plan announces partnership and capital commitment with Sevana Bioenergy,” Ontario Teachers’ Pension Plan Board (March 28, 2023).

15: “Dynamic Renewables Receives Strategic Investment from Ares Management,” Dynamic Renewables (July 26, 2023).

16: “Westinghouse Acquisition by Brookfield and Cameco Complete,” Westinghouse Electric Company (November 7, 2023).

17: “NRG Completes Sale of its Interest in South Texas Project,” NRG Energy, Inc. (November 1, 2023).

18: “Vistra Announces Acquisition of Energy Harbor,” Vistra (March 6, 2023).

19: “Electric Hydrogen Raises $380 Million to Transform the Economics of Green Hydrogen Production,” Electric Hydrogen (October 3, 2023).

Related Insights

Datum

22. Mrz 2024

Ansprechpartner

Ansprechpartner

Global Practice Leader Power, Renewables & Energy Transition (PRET)

Managing Director

Managing Director

Managing Director

Herunterladen

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About