Contact Centers at an Inflection Point

-

December 03, 2021

DownloadsDownload Article

-

The Institute for Healthcare Improvement’s (IHI) framework for optimizing health system performance, known as the Triple Aim, includes improving the health of populations and the patient’s experience of care (quality, satisfaction) and reducing the per capita cost of care1. “Patient experience encompasses the range of interactions that patients have with the health care system2.” As technology evolves and patients pay a higher proportion of out-of-pocket costs, their experiences increasingly parallel those of retail consumers. Patient access increasingly matters to patient choice; dissatisfaction may lead to an alternative provider and loss of market share.

Consumerism also affects brand equity (loyalty), “the commercial value that derives from consumer perception of the brand name of a particular product or service, rather than from the product or service itself3.” Brand equity has five discernable components: “awareness, relevant differentiation, value, accessibility and emotional connection4.” Opportunities exist to build brand equity via contact centers.

In this article, we highlight the role of emerging technology and the potential of contact centers to provide clinical support.

Call Center Rebranding as Contact Center

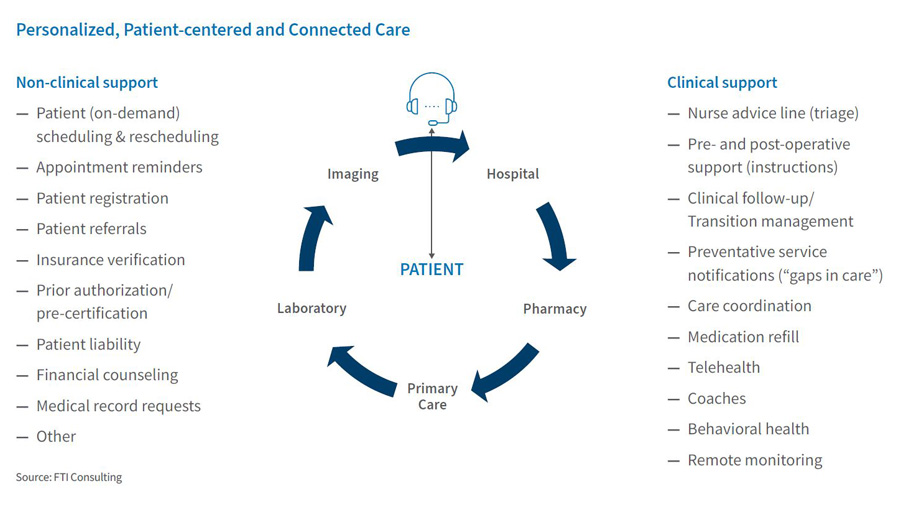

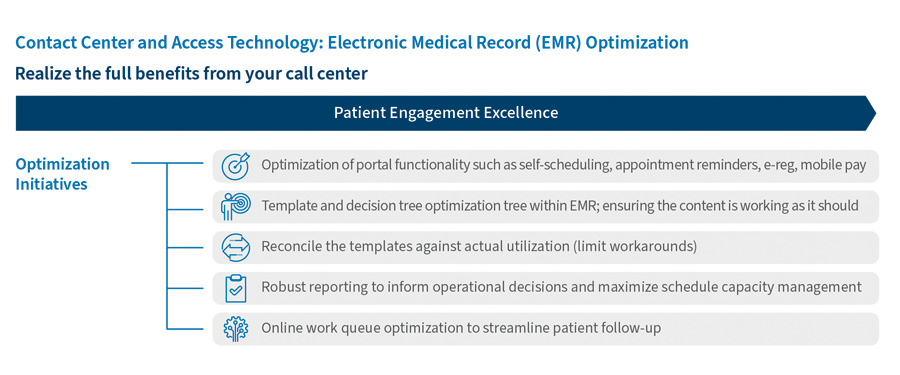

Contact centers, formerly known as call centers, have evolved over the past thirty years from primarily receiving inbound calls (e.g., appointment scheduling, physician answering service) and placing outbound calls (e.g., appointment reminders) to include nursing triage and other clinical support functions. Contact centers provide a single point of contact for customers, improve access to all service offerings and enhance the customer experience. Supplemental electronic medical records (EMRs) such as MyChart from EPIC, when utilized, provide direct access via the web to a patient’s health history, medication list, test results (lab, imaging), upcoming appointments and other information.

Contact centers provide a range of non-clinical and clinical support services

Period of Rapid Technological Change

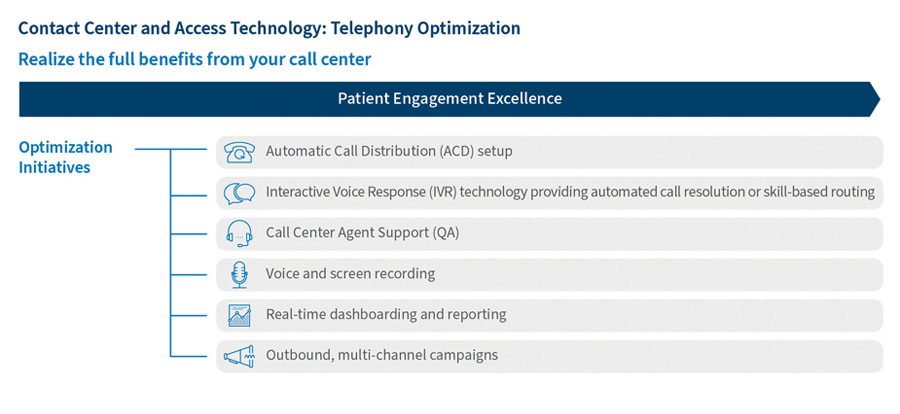

An omnichannel, unified contact center approach involves voice, mobile, web, video, e-mail, social media and chat bot technologies. Patients demand self-service as well as other options to quickly access the services they need. Automatic call distribution (ACD) and interactive voice response (IVR) are two technologies that have been utilized for many years to have customers direct themselves to the correct place. Emerging technologies include the growing use of chat bots, voice analytics (key words, sentiment, etc.) and automated clinical decision trees to further support this self-service experience. In all cases, self-service technologies are particularly applicable to high-volume, low-complexity transactions.

Enhanced Functionality |

||

|

Virtual Agent |

Multi-channel |

Speech Analytics |

|

Source: FTI Consulting |

||

Opportunities for Clinical Support

With the U.S. population rapidly aging, emerging remote-monitoring capabilities offer an opportunity to provide clinical support in potentially managing a patient’s pre-operative and post-operative status, transitions of care and chronic disease. Proactive outreach is critical to manage high-risk patients. Telehealth has a role in low-acuity conditions as well as in chronic disease management, inclusive of medication refills. Electronic medical record optimization with the contact center has become essential.

Identifying and monitoring the appropriate key performance indicators (KPIs) and objectives are important to ensure excellence in the customer experience along with operational efficiency. Among the most important (tactical) operational efficiency KPIs are (1) abandonment rate, the percentage of calls terminated between the IVR and the moment an agent answers the call; (2) average speed of answer, the average time agents take to answer inbound calls excluding the IVR; (3) average hold time, the time a customer is put on hold during a call with an agent; (4) average talk time, the length of time that an agent spends talking to customers; and (5) service level, the percentage of calls answered within a predefined threshold (e.g., 20 seconds) after arriving in a queue and excluding the IVR5. The Healthcare & Life Sciences industry performs relatively well against these metrics, with the exception of service levels — at 78.6%, this metric is three to six percentage points below other industries6. The addition of clinical support functionality to the contact center requires outcome-centric KPIs. Patient satisfaction, financial performance and market position are other (strategic) metrics of interest.

Enhanced Functionality |

||

|

Fast Pass |

Nurse Triage |

Automated Payments |

|

Source: FTI Consulting |

||

Organizational Challenges Are Plentiful

Multiple stakeholders have an interest in a contact center, including operations, marketing, finance (revenue cycle), physicians and advanced practice clinicians, nursing and IT. Policies are required to ensure non-licensed staff do not deal with clinical issues. Technological updates present a challenge given existing infrastructures, rates of evolution, the need for interoperability and acquisition costs. Clinical support functionality requires a perspective on population health and value-based care, and a willingness to alter the process-of-care.

Bottom Line

Contact centers are gaining importance as consumerism becomes ingrained into the minds of patients. At the same time, population health management principles suggest opportunities for clinical outreach.

A strategic vision combined with an operational roadmap is necessary as the healthcare system continues to evolve.

KPIs and other performance indicators require tracking to ensure continuous quality (process) improvement. Technology acquisition is critical as mobile, text, robotic process automation and other technologies facilitate self-service.

The vendor landscape is complex. There are full-service companies offering comprehensive solutions, inclusive of outsourcing the entire functionality. Point solution companies also exist, though they require integration. In certain instances, it may be better to focus resources, thereby driving integration, accountability and performance.

It’s important to know your patients and how they prefer to communicate.

Footnotes:

1: IHI Triple Aim Initiative. Institute for Healthcare Improvement. 2021. https://www.ihi.org/Engage/Initiatives/TripleAim/Pages/default.aspx

2: What Is Patient Experience? Agency for Healthcare Research and Quality. June 2021. https://www.ahrq.gov/cahps/about-cahps/patient-experience/index.html

3: What is Brand Equity? Bolimini; June 16, 2019. https://www.bolimini.us/blog/What-is-Brand-Equity-.5a24e.php#:~:text=Brand%20equity%20is%20the%20commercial,the%20product%20or%20service%20itself

4: The measures of brand equity. The marketing sage. April 26, 2020. https://www.themarketingsage.com/brandinsistence-how-to-measure-brand-equity/

5: 2020 Talkdesk Contact Center KPI Benchmarking Report. Talkdesk. October 2021. https://www.callcentrehelper.com/images/resources/2020/talkdesk-contact-center-kpi-benchmarking-whitepaper-201012.pdf

6: Ibid

Related Information

Published

December 03, 2021

Key Contacts

Key Contacts

Managing Director

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About