Corporate Investment in the U.S. Healthcare Industry

Cross-Government Inquiry Draws Widespread Public Criticism

-

August 13, 2024

-

On March 5, 2024, the U.S. Department of Justice, Federal Trade Commission and Department of Health and Human Services launched a joint cross-government public inquiry into corporate ownership in the U.S. healthcare market.1 The agencies issued a Request for Information (“RFI”) to solicit public comments on the effects of transactions involving healthcare companies conducted by private equity funds or other asset managers, health systems or private payers.2 The agencies planned to use these comments to help identify “enforcement priorities and future action, including new regulations, aimed at promoting and protecting competition in health care markets and ensuring appropriate access to quality, affordable health care items and services.”3

FTI Consulting analyzed the comments from regulations.gov to understand who submitted the comments, what topics they covered and what major themes might stand out to the agencies.

FTI Consulting used large language models to assist in its review of the immense amounts of textual comment data. For more information about how FTI Consulting built, refined and tested the tool to maximize its impact for this analysis — or for more information about how FTI Consulting is using AI across its services — you may learn more here or please reach out to Dr. Claudio Calvino, Senior Managing Director, Global Head of Data Science, FTI Consulting.

Executive Summary

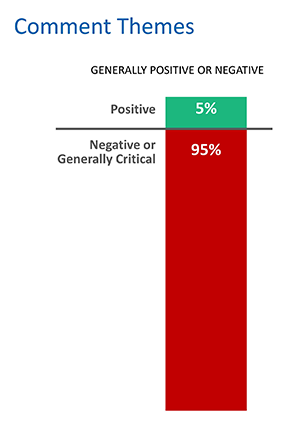

Over 2,100 comments were submitted in response to the government’s inquiry. These came from a diverse array of individuals and organizations including healthcare providers, payers, patients, pharma, and industry associations. Approximately 95% of comments were critical toward private equity and corporate ownership in medicine, touching on multiple topics including affordability, access, and quality of care. The remaining 5% offered defenses for private investment in medicine and/or cautioned against overly burdensome regulation.

Background

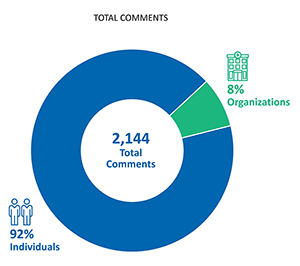

The RFI comment period was open from March 5, 2024, through June 5, 2024.4 In total, 6,179 comments were submitted, of which 2,144 comments were posted to the regulations.gov website and available for public review.5

Who Submitted the Comments?

Approximately 8% of the comments — 165 in total — were submitted by organizations. These included healthcare provider or pharmacy organizations, trade groups and associations associated with the healthcare and private equity industries, think tanks, academia and patient advocacy groups.

- Organizations’ comments tended to include attached reports providing detailed analysis and commentary on the topic.

- A link to the comments submitted by each organization is provided in Appendix 1 below.

The remaining 92% of comments — 1,979 in total — were submitted by individuals.

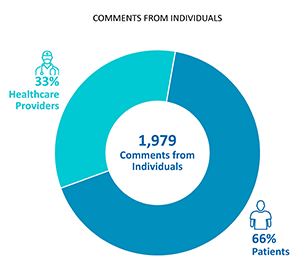

- The majority of the individual comments — about two-thirds — came from individuals who described their experiences as patients, caregivers and citizens.

- Approximately one-third of comments were from healthcare providers — including physicians (of various specialties, including emergency medicine, internal medicine, surgery, ophthalmology, OB-GYN and radiology), registered nurses, therapists and others. Many described their direct experience working in a practice that had been approached or acquired by private investors.

- In addition, a small number of comments came from healthcare administrators or managers, including revenue cycle specialists, pharmacy owners, hospital administrators and employees of healthcare insurance companies.

What Topics Did The Comments Cover – And What Might Stand Out to the Agencies?

A small number of comments — approximately less than 5% — had an overall positive sentiment regarding corporate investment and/or consolidation in healthcare.

These comments identified multiple potential benefits of such investment and consolidation — including improved access to capital, increased innovation, improved administrative efficiencies and a leveling of the playing field (e.g., by consolidating, larger health systems or provider groups can increase their negotiating power relative to payers). Several of these comments also expressed caution that overly broad or reactionary regulation could stymie healthcare companies’ ability to evolve and provide higher quality care. For example:

- A private equity industry association advocated that private equity investment provides much-needed capital, operational efficiency and technological support to the healthcare industry and highlighted the industry’s positive impact in the hospital, nursing home and physician practice management sectors.

- An independent primary care provider group with more than 4,000 provider employees touted the benefits of private investment to primary care physicians attempting to adopt innovative value-based care models.

- An OB-GYN physician praised the benefits of his practice being acquired by a private equity group, saying that the invested capital provided necessary resources to provide higher quality care and that the partnership afforded the practice better negotiating leverage with large insurance companies.

But the majority of comments — more than 95% — expressed varying degrees of criticism or negative sentiments towards the corporate ownership of medicine. Our review identified these top seven issues across the comments:

- Profit maximization/greed: The most common theme by far was a general frustration with perceived greed in the healthcare market and a sense that the ethical incentives to provide high-quality healthcare are at odds with the profit incentives of corporate ownership.

- Patients impacted by rising costs: Commenters complained about rising prices and lack of affordability across the healthcare spectrum (including hospital services, pharmaceuticals, emergency room visits, and physician services) and placed the blame on corporate or private equity investment and consolidation.

- Patients impacted by declining healthcare quality: Commenters consistently cited frustrating experiences in different healthcare settings and often blamed them on profit maximization — including longer wait times, reduced face time with physicians, deteriorating facility conditions and issues stemming from reduced staffing levels.

- Patients impacted by reduced access: Many commenters protested that consolidation pushes healthcare providers to offer fewer services, cut unprofitable service lines that may be beneficial to certain patients and close facilities, which can disproportionately impact rural areas and underserved communities.

- Physicians feeling squeezed: Numerous physician commenters complained about their experiences working under profit-seeking corporate owners — including frustrations with a perceived emphasis on productivity over quality, a lack of scheduling autonomy, their physician decision-making being eroded by administrators and non-medical personnel, and not being able to spend more time with patients.

- Frustrations with private equity in the emergency department: Several hundred comments singled out private equity ownership and involvement in the emergency room. Comments ranged from general outrage (e.g., “I don’t like private equity firms staffing ERs!”) to detailed testimonials from patients and providers about quality concerns, increased wait times and the amount of care provided by non-physician providers versus physicians.

- The effect of PBMs on the pharmaceutical market: More than 200 comments mentioned pharmacy benefit managers (“PBMs”). Commenters complained that PBMs impact patients’ choices of and access to affordable medicine. Many independent pharmacists also submitted comments about the increasing difficulty of operating their businesses because of PBMs’ market power and influence on reimbursement levels.

To access and review specific public comments please see Appendix 1 here.

What More Do You Want To Know?

If you have a question about a specific issue in the comments, or you are curious about whether an organization was named in the comments or submitted a comment, please reach out to Tucker Green, Senior Director, Healthcare Risk Management & Advisory, FTI Consulting.

Footnotes1: "Justice Department, Federal Trade Commission and Department of Health and Human Services Issue Request for Public Input as Part of Inquiry into Impacts of Corporate Ownership Trend in Health Care”, United States Department of Justice Office of Public Affairs (March 5, 2024).

2: “Request for Information on Consolidation in Health Care Markets”, Department of Justice, Department of Health and Human Services, and Federal Trade Commission (February 29, 2024).

3: Id.

4: Request for Information on Consolidation in Health Care Markets, Docket ID FTC-2024-0022.

5: The number of comments posted can be lower than the number of comments received because agencies may choose to redact or withhold certain submissions, such as those containing private or proprietary language, inappropriate language, or duplicate examples of mass-mail campaign. See https://www.regulations.gov/docket/FTC-2024-0022/document.

Published

August 13, 2024

Key Contacts

Key Contacts

Managing Director

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About