ESG: A New Lens for Value Creation

-

April 08, 2022

DownloadsDownload Article

-

At FTI Consulting, Environmental, Social and Governance (ESG) discussions are more popular than ever. From private equity funds looking to drive portfolio value and engage their partners to companies utilizing ESG screens to de-risk operations, our clients are embracing ESG as a powerful tool rather than a passing fad. We continue to deliver strategic, tailored advice that creates authentic value, both operationally and financially. We are increasingly utilizing ESG tools to drive enterprise value, de-risk investments and portfolios, and engage key stakeholders.

Financial Benefits

Demonstrating adherence to ESG targets can provide financial benefits to public and private companies in a variety of sectors. Benefits include lower-cost capital generated through a larger, more diverse investor pool, improved credit ratings with ESG-driven decreases in enterprise risk, revenue growth through diversification of business lines, and stronger sales through customer engagement. We see the green bond market gaining steam as a vehicle for driving environmentally responsible projects, and banks are increasingly setting out net-zero goals for their financing portfolios, nudging the capital markets toward preferential terms for those projects that satisfy sustainability goals. A recent example of this banking trend is HSBC, which announced that it believes “power generation is where the majority of sector emissions occur through the use of fossil fuels as a source of energy” and that it intends to align financed emissions to net zero by 20501.

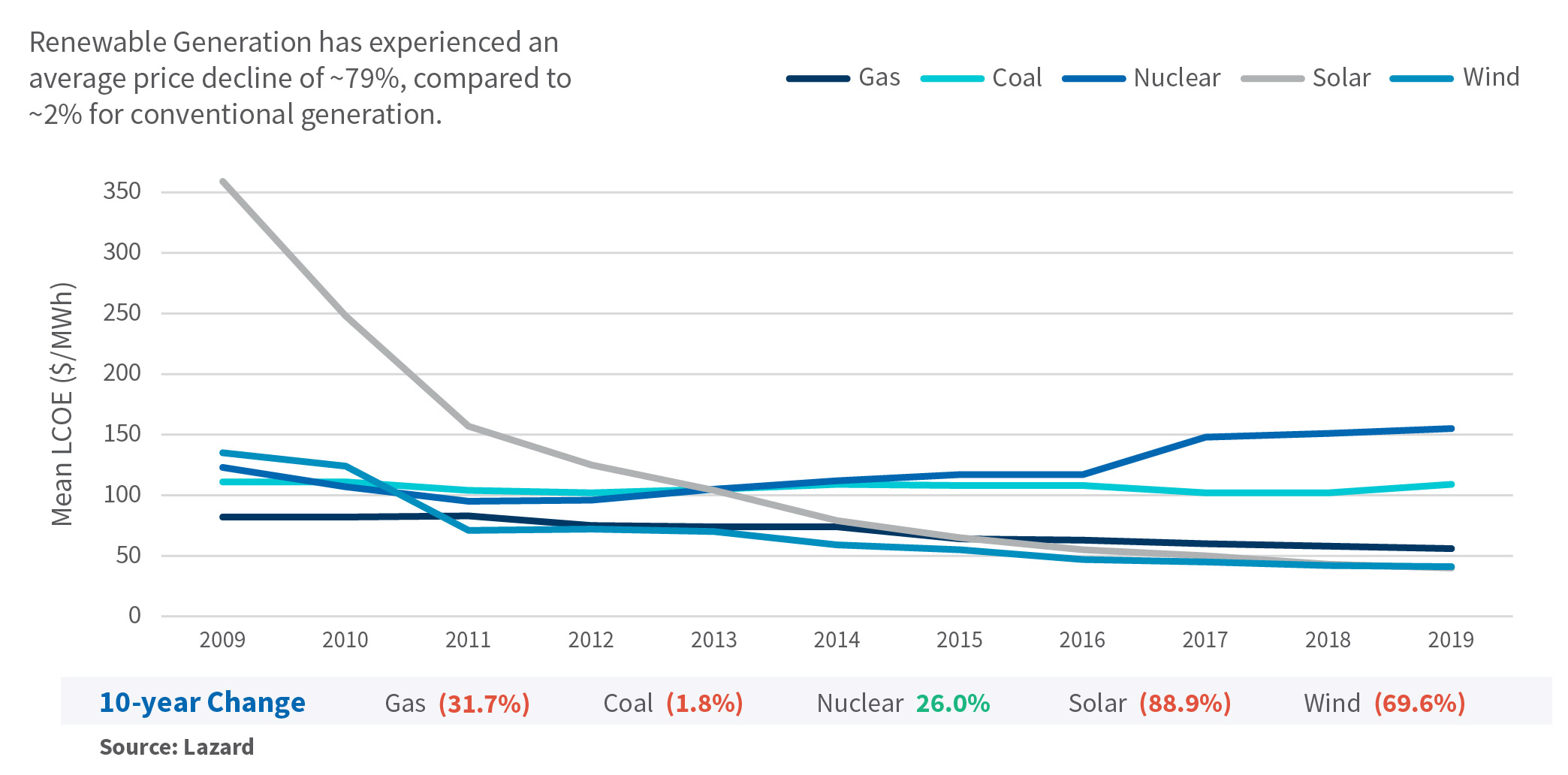

The price of solar and other renewables has fallen precipitously over the past decade, making it more beneficial than ever to move away from fossil fuels, especially as renewable energy capacity increases. The U.S. Energy Information Administration expects “solar additions to account for nearly half of new electric generating capacity in 20222,” and the U.S. Department of Energy anticipates a decline in the price of solar of up to 60% by 20303. Customers are also demonstrating that they are willing to pay more for products and services from companies that support net-zero emissions goals, often referred to as a greenpremium or “greenium.” This trend will only continue to increase, and companies that focus attention on their ESG goals will benefit.

Exhibit 1 - Levelized Cost of Energy Comparison

Stakeholder Engagement

Companies with strong ESG commitments accrue benefits from being good stewards of the communities in which they operate, starting with their employees. It has become more common for employees to consider a company’s social and environmental commitments, with 58% of employees considering these factors and engaging at a higher rate with firms they consider to be more purpose-driven4. Additionally, over 80% of Millennials expect employers to make a public commitment to good corporate citizenship5. In order to attract, engage and retain employees, especially in today’s tight labor market, companies must clarify and demonstrate commitment to their ESG priorities and communicate how individual employees can play a role in the process.

Companies that require buy-in from communities to build or grow can pave the way to governmental and community support when they have a track record of being good citizens. They can strengthen their image and brand by reducing or eliminating negative impacts on the surrounding area and investing in their local communities. By considering these stakeholders and building trust with them based on real, tangible support, businesses can gain community support for future projects, reduce the risk of pushback, and gain a wider pool of potential employees and customers. Building a firm’s social capital in this way helps to insulate the business from negative shocks. Engaged stakeholders are less likely to obstruct expansion projects and may help pave the way with regulators. Additionally, many municipalities offer incentives for environmentally friendly projects, with easier regulatory reviews and permitting processes. Businesses can also look to influence incoming regulation by listening to and supporting all of their stakeholders and showing alignment between the company’s actions and larger policy goals.

Operational Efficiencies

An effective ESG program can identify cost-saving opportunities, including energy efficiency retrofits, long-term contracts for the direct procurement of renewable energy, and safety programs that reduce employee downtime. FTI Consulting recently completed an ESG implementation with a pre-IPO oil and gas company in an effort to organize operational efficiencies and build on environmental and social strengths. These were financially modeled to determine sustainability and investment ROI, and support value generating opportunities, including cost savings.

As companies continue to focus on cleaning up their operations and supply chains, the demand for carbon negative and neutral assets will continue to rise. By focusing on energy efficiency early, companies can lock in rates through power purchase agreements (PPAs), thus stabilizing the predictability of their cash flows. Businesses can ensure competitiveness by upgrading legacy equipment and installing more efficient alternatives, thereby reducing energy consumption, downtime and workplace accidents. Through business transformation, firms can divest dirty assets and invest in renewable technologies. An added benefit of selling off carbon-intensive assets is that it frees up capital for lower-carbon expansions and investments. This transformation can reduce enterprise risk and provide long-term growth opportunities.

De-risking the Business

A robust ESG strategy is a key component of enterprise risk management, and investors recognize this. Companies that build resiliency into the organization fare better when disaster strikes and are better able to respond to black swan and gray rhino events7. During the Covid-19 pandemic, companies that focused on their supply chains and approached partnerships with a long horizon were much better placed to manage through the disruptions. ESG efforts can create operational stability in areas of energy supply as well by reducing exposure to price volatility in the market. We have seen political, natural disaster and forced-labor concerns disrupt business, driving up operating costs and jeopardizing companies’ ability to fulfil customer orders. When companies proactively identify and mitigate these risks, they are able to operate and thrive when others cannot. De-risking the business not only helps mitigate costs but can also mitigate potential reputation damage by avoiding operational failures. Since the release of the proposed SEC climate rule, de-risking now includes data management and data integrity best practices. FTI Consulting recently engaged with a global transportation provider to map the origins of its ESG data, assessing controls and building processes that enable the consistent and transparent reporting of its ESG data to stakeholders, including investors. This work forms the basis for all future reporting and goal-setting.

Transitioning to a cleaner form of energy is one of the most tangible ways a company can decrease not only its environmental impact but also key operational risks. By shifting away from fossil fuels and embracing renewable energy solutions, companies can build resilience. The geopolitical risk of relying on oil and gas for power generation has become all too clear. Concentrating supply chains and over-reliance on single sourcing creates outsized risk that, for stability and resiliency, should be diversified away.

Conclusion

Companies focused on ESG opportunities and sustainability goals are better prepared to weather storms that occur in the market, in the environment or in the community. Investing in a robust ESG program in which a company identifies material risks and opportunities and sets forth a plan of action is a key component of maintaining and growing enterprise value. Companies will see the benefits throughout their organizations and with key stakeholders, as ESG drives value, mitigates risk and engages stakeholders.

At FTI Consulting, we combine our professionals’ deep expertise in areas ranging from the energy transition to data governance and diversity, equity and inclusion to deliver insightful ESG assessments and strategic roadmaps that set our clients on a path to real value creation.

Published

April 08, 2022

Key Contacts

Key Contacts

Senior Managing Director, Global Leader of Environmental, Social and Governance (ESG) and Sustainability

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About