H.R. 1 and the Energy Transition

H.R. 1 Implications for Developers, Investors and Utilities

-

July 16, 2025

DownloadsDownload Article

-

H.R. 1, the “One Big Beautiful Bill Act” signed into law by President Trump on July 4, 2025, marks a dramatic shift in U.S. energy policy with accelerated phaseout of the wind and solar tax credits established under the Inflation Reduction Act of 2022. The rollback of long-term incentives is expected to significantly slow the pace and scale of renewable energy development and increase uncertainty for investors and developers at a time of rising electricity demand and mounting grid challenges. The sweeping changes under H.R. 1 will have wide-ranging effects across the U.S. economy, particularly in the energy sector, compelling many developers, investors and asset owners to reassess their strategies and investment plans.

Initial Market Reactions to H.R. 1

On July 4, 2025, President Trump enacted into law House Resolution 1 (“H.R. 1” or the “Act”), a bill designed to extend expiring provisions of the 2017 Tax Cuts and Jobs Act while reducing major tenets of the Inflation Reduction Act (“IRA”).1 H.R. 1’s initial passage in the House on May 22 (215-214-1)2 and narrow passage in the Senate on July 1 (51-50, with the Vice President breaking the tie)3 sent shockwaves through the U.S. energy industry.

The U.S. stock market has reacted swiftly to the bill’s legislative progress. Days before the bill’s Senate passage, draft text was released detailing an excise tax on wind and solar projects with Chinese-manufactured components.4 This provision caused clean energy stocks to tumble.5 However, the Senate’s final bill text released on July 1 did not include the excise tax language, and clean energy stocks rebounded.6 To a large degree, private investment has slowed across the renewables sector due to tariff and policy uncertainty,7 and is at risk for further decline due to the enactment of H.R. 1.8

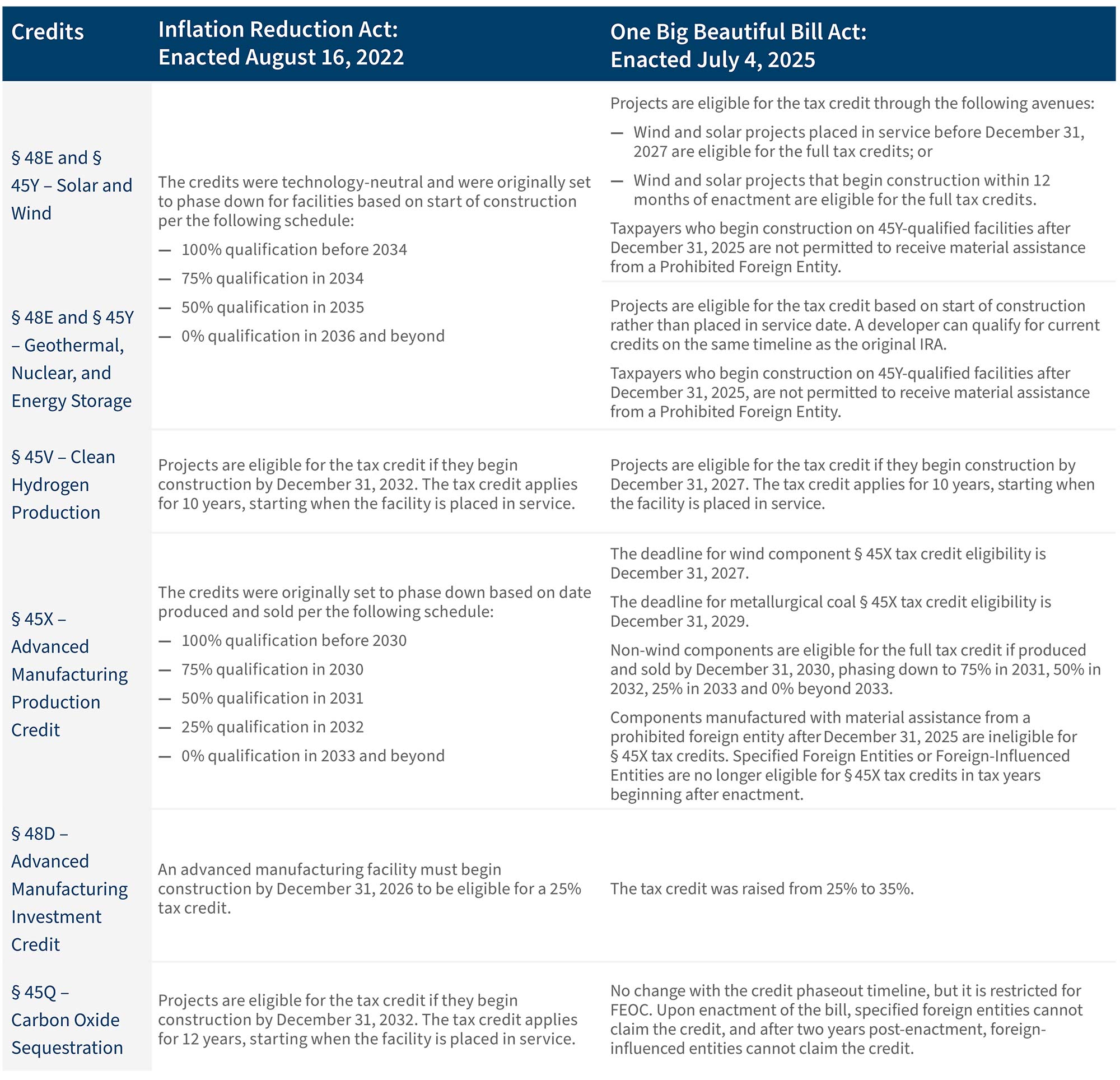

One Big Beautiful Bill Act: Energy Provisions

The Act represents a “sea change” from the energy-related provisions in the IRA.9 Solar and wind facilities qualifying for the Investment Tax Credit (“ITC”) and Production Tax Credit (“PTC”) (§ 48E and § 45Y) must either begin construction before July 4, 2026 to achieve safe harbor status, or be placed in service by December 31, 2027.10 The Act retains tax credit transferability, the mechanism that allows companies to sell tax credits to an unrelated taxpayer for cash.11 The Act restricts tax credit eligibility for Foreign Entities of Concern (“FEOC”)12 under a “material assistance” cost ratio threshold for Sections 45Y, 48E and 45X (total costs minus total costs attributable to an FEOC, divided by total costs),13 unless they start construction by December 31, 2025.14

Table 1 — Energy Tax Credits Qualification: IRA (2022) vs. H.R. 1 (2025)15, 16

Implications of the Act

The Act accelerates the phase-out of key federal tax credits, including the technology-neutral Clean Electricity PTC (§ 45Y) and the ITC (§ 48E).17 We conservatively estimate that more than 320 proposed wind and solar projects with a total capacity of over 100 GW18 would no longer be economically viable, making it significantly harder, if not impossible, to attract capital and meet key development milestones.

Per an Executive Order issued by President Trump on July 7, 2025, the U.S. Secretary of the Treasury will strictly enforce the deadline to begin construction within 12 months post-enactment and foreign entity restrictions for wind and solar facilities under the Act. The U.S. Secretary of the Interior must also review and revise regulations to eliminate preferential treatment for wind and solar facilities compared to dispatchable energy sources.19 Developers must ensure strict adherence to the Act’s deadlines by securing the necessary permits in advance.

Domino Effects on the U.S. Grid

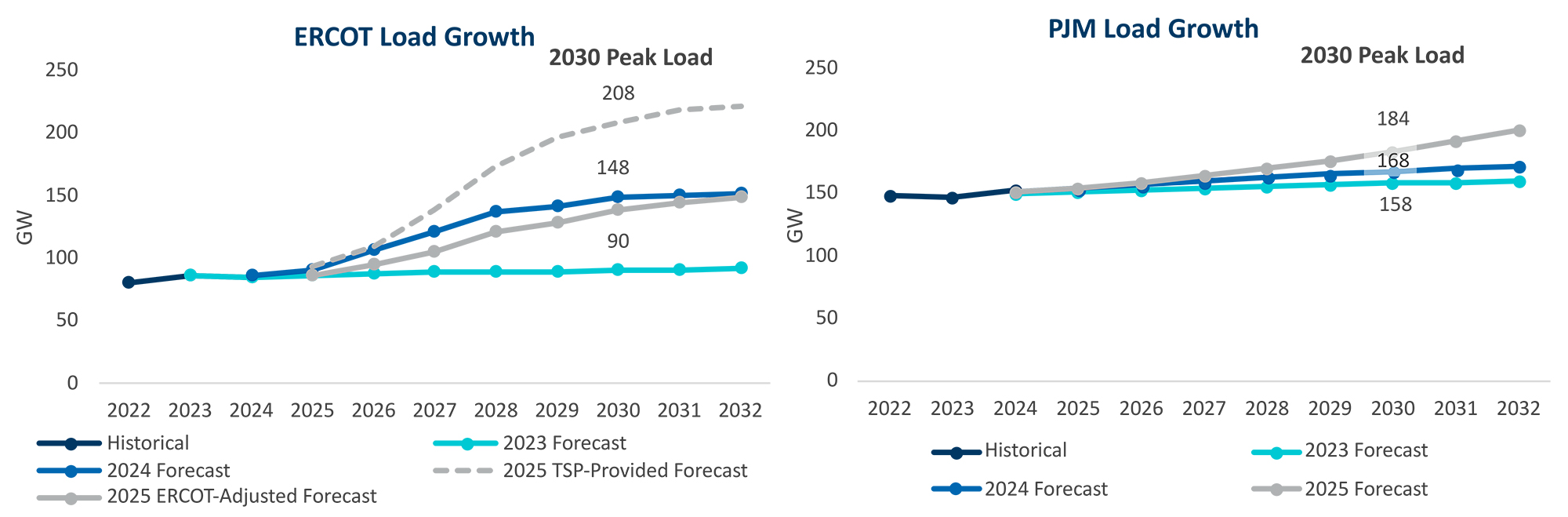

The Act threatens to derail critical infrastructure deployment at a time when the U.S. power grid faces elevated capacity and energy risks. Despite surging electricity demand from artificial intelligence (“AI”) data centers and the onshoring of advanced manufacturing, development of new generation resources faces regulatory and policy headwinds. Amidst capacity shortfalls, grid operators in ERCOT and PJM project record-setting load growth of 53 GW and 37 GW (63% and 25% of 2023 observed peak load, respectively) through 2030.21 Such expected load growth in ERCOT and PJM highlights the urgent need to accelerate generation capacity expansion to support economic activity.

The Act’s accelerated phaseout of tax credit eligibility could strand wind and solar investments under development. We estimate that over 100 GW of planned utility-scale solar and wind projects could be jeopardized by the accelerated phase-out of ITCs and PTCs, recognizing that historically, less than 20% of the power projects requesting interconnection reached commercial operations.

Figure 1 — ERCOT and PJM Load Forecasts20

Table 2 — Potentially Impacted New Solar and Wind Capacity22

The removal of planned projects from the development pipeline at a time when reserve margins are shrinking, and capacity shortfalls loom may undermine the grid’s ability to support the U.S.’ AI and manufacturing ambitions. The resulting supply constraints are likely to drive up wholesale power prices, placing additional strain on utilities as they aim to balance rapid load growth with maintaining reliability and customer affordability as they face higher power prices. As the supply of new Renewable Energy Certificates (“RECs”) becomes increasingly limited, and demand remains stable or continues to grow, REC prices are expected to climb. This upward pressure on prices will be especially pronounced in regions with high clean energy targets or stringent compliance requirements.

The passage of H.R. 1 could be deemed a force majeure event under existing offtake agreements, allowing utilities to default on contracts for projects rendered economically unviable. Utilities will need to seek alternatives less affected by H.R. 1 to bridge capacity shortfalls. Without coordinated policy and regulatory support, however, the risk remains high that the U.S. power grid will not be able to support the next wave of technological and industrial expansion.

Dim Outlook for Solar

The Act establishes a major rollback of solar sector tax incentives with implications for both residential and utility-scale solar. Under the Act, the clean electricity production and investment tax credits (§ 45Y and § 48E) would phase out based on a “placed in service” date (after December 31, 2027), unless the projects begin construction within 12 months of the Act’s enactment.23 The Act also eliminates the residential solar ITC (§ 25D) after December 31, 2025, targeting rooftop solar directly and undermining one of the sector’s core economic drivers.24

These provisions disrupt the solar value chain at multiple levels. The proposed changes would significantly erode customer economics in residential solar, likely causing a sharp drop in demand, especially in regions where policy or rate reforms such as net metering changes have already weakened solar economics. This decline would ripple through installer networks, financing platforms and third-party sales channels. At the same time, commercial and utility-scale developers would face a compressed timeline for permitting, interconnection and equipment procurement. Delaying construction beyond July 2026 would mean the loss of full tax credit eligibility. In addition, the proposed FEOC restrictions on material assistance introduce supply chain uncertainty. Together, these changes threaten to reduce investment and slow deployment.

Turbulence in the Wind Sector

The Act would significantly disrupt the wind energy sector by phasing out the § 45Y and § 48E credits on an accelerated timeline.25 Given the complexity of wind project development, including environmental permitting, transmission interconnection and turbine procurement, this compressed window creates substantial risk that large portions of the planned project pipeline will not meet eligibility deadlines.

The policy shift introduces added uncertainty for onshore developers navigating interconnection queues and land-use challenges. Offshore wind developers, already grappling with cost inflation, supply chain bottlenecks and federal permitting delays, face even greater exposure. Many offshore projects have multiyear lead times and depend heavily on long-term revenue visibility. The loss of tax credit support could further impair project viability and financing, particularly for those without firm contracts or that are still in early-stage development. Against this backdrop, the proposed changes would likely dampen investment appetite across the wind sector and threaten momentum at a time when deployment targets already appear at risk.

An Uncertain Future for Hydrogen

The Clean Hydrogen Production Tax Credit (§45V), which offers up to $3 per kilogram for eligible green hydrogen projects, is now subject to a significantly accelerated phase- out. Under the new law, only projects that commence construction before December 31, 2027, will remain eligible for the credit.26 This marks a substantial contraction from the original IRA deadline of January 1, 2033, reducing the eligibility window by five years.

This abrupt policy shift reduces a foundational incentive for clean hydrogen development, fundamentally undermining the economic viability of projects that depend on §45V support. As a result, many industry participants are expected to cancel, postpone or substantially scale back investments in new green hydrogen facilities, setting back the momentum of the U.S. clean hydrogen sector.

Absent from the Act is a previously considered $10 million fee for expedited permitting for hydrogen and carbon dioxide pipeline developers, a provision that could have accelerated essential hydrogen infrastructure.27 Instead, only natural gas pipelines retain a similar fast-track process, leaving hydrogen and CO₂ projects to navigate slower, traditional permitting.

While § 45Q benefits are available for projects pairing hydrogen production with carbon capture,28 standalone electrolyzer facilities and renewable-powered hydrogen must start construction before 2027 to qualify for § 45V. Hydrogen projects that can leverage § 45Q may gain a competitive advantage, accelerating a market shift away from electrolytic hydrogen.

The hydrogen sector also faces uncertainty amid inconsistent federal policies. Over half of the U.S. Department of Energy’s (“DOE”) seven designated “Hydrogen Hubs,” regional hydrogen production networks established under the 2021 Bipartisan Infrastructure Law, now face potential funding cuts.29 DOE Secretary Wright indicated that the department aims to make final investment decisions on multiple hydrogen projects currently under review by September 2025;30 however, investors may hesitate amid the U.S. hydrogen market’s shifting policy landscape.

Conclusion

The enactment of H.R. 1 could significantly slow the current pace of the U.S. energy transition and undermine the renewable energy investment and development landscape. The scale of tax credit eliminations is considerable and poses a serious challenge for companies reliant on tax credits to support economic viability. H.R. 1 sends a warning to all stakeholders in the energy transition ecosystem regarding legislative volatility.

For firms committed to multi-year projects, the Act would force a reassessment of profitability and operational strategies, as reduced incentives make it harder to justify continued investment in emerging technologies. Investors, faced with increased risk and diminished returns, would likely scale back new capital commitments. Utilities seeking to diversify and decarbonize their power generation fleet would face a lengthy process to shift capital projects toward more traditional delivery channels.

Equally concerning to energy transition stakeholders is the prospect that the Act may signal the start of a broader shift in federal energy policy. The current administration has multiple policy levers, such as permitting reforms, restrictions on entity ownership and operational guidelines that could further impact the pace of the energy transition.

The President’s Executive Order issued on July 7th signals tightened regulations on the renewables and non-dispatchable energy sectors. While we will have to review forthcoming guidance from the U.S. Treasury, it’s unlikely that any changes to the safe harbor provisions would be retroactively applied, but the onus will be on the taxpayer to ensure compliance with the law. For now, the Act offers stakeholders in the energy transition sector both the relative certainty and a path forward needed to make final investment decisions on near- and medium-term projects.

Footnotes:

1: “Tax Provisions in H.R. 1, the One Big Beautiful Bill Act: House-Passed Version,” Congress.gov (June 10, 2025).

2: Jordain Carney, “Senate GOP preps for ‘one big, beautiful’ rewrite,” Politico (May 22, 2025), Benjamin Guggenheim and Jordain Carney, “‘It will fail’: Megabill changes have Republicans doubting July 4 timeline,” Politico (June 17, 2025).

3: Lamar Johnson, “House-passed budget bill sparks concerns from clean energy industry,” ESG Dive (May 27, 2025).

4: Juan Carlos Arancibia, “Clean Energy Stocks Tumble As Tax Bill Sunsets Credits; This Stock Plunges 40%,” Investor’s Business Daily (May 22, 2025).

5: Nisha Gopalan, “Solar Stocks Sink as Senate Maintains Full Removal of Clean-Energy Tax Credits,” Investopedia (June 17, 2025).

6: Emma Penrod, “Policy uncertainty could trigger ‘recession’ for renewables, analyst says,” Utility Dive (April 30, 2025).

7: Lamar Johnson, “House-passed budget bill sparks concerns from clean energy industry,” ESG Dive (May 27, 2025).

8: Tim Shaw, “Clean Energy Credit Repeals May Rattle Industry, Tax Sector Expects,” Thomson Reuters Tax and Accounting (June 24, 2025).

9: Zack Hale, “Trump signs sweeping budget bill unwinding historic US climate investments,” S&P CapIQ (July 3, 2025).

10: “H.R.1 - To provide for reconciliation pursuant to title II of H. Con. Res. 14,” Congress.gov (July 3, 2025).

11: Ibid; the transferability mechanism is prohibited for taxpayers which are Specified Foreign Entities: those which appear on certain government registries and/or and have relationships with China, Iran, Russia or North Korea.

12: Under the definition of Foreign Entities of Concern, Prohibited Foreign Entities include both Specified Foreign Entities (“SFEs”) and Foreign-Influenced Entities (“FIEs”). SFEs appear on certain government registries and/or and have relationships with China, Iran, Russia or North Korea. FIEs are entities in which an SFE has a quantifiable degree of ownership or authority over the entity.

13: “H.R.1 - To provide for reconciliation pursuant to title II of H. Con. Res. 14,” Congress.gov (July 3, 2025).

14: Ibid.

15: “H.R.5376 - Inflation Reduction Act of 2022,” Congress.gov (August 16, 2022).

16: “H.R.1 - To provide for reconciliation pursuant to title II of H. Con. Res. 14,” Congress.gov (July 3, 2025).

17: “H.R.1 - To provide for reconciliation pursuant to title II of H. Con. Res. 14,” Congress.gov (July 3, 2025).

18: FTI Consulting analysis based on data sourced from: “Queued Up: Characteristics of Power Plants Seeking Transmission Interconnection,” Lawrence Berkeley National Laboratory (April 2024), https://emp.lbl.gov/queues. Estimates are based on data through the end of 2023; we anticipate that more potentially impacted projects have been added to the interconnection queue in 2024 and H1 2025. Estimates for the number of projects and potential GW affected assume that 40% of wind and solar projects scheduled to be placed in service in 2028, 2029 and 2030 are now at risk of economic nonviability. We acknowledge that historically less than 20% of power projects requesting interconnection reached commercial operations.

19: President Donald J. Trump, “Ending Market Distorting Subsidies for Unreliable, Foreign Controlled Energy Sources,” U.S. Executive Order (July 7, 2025).

20: FTI Consulting analysis based on data sourced from: “2025 Monthly Peak Demand and Energy Forecast,” Electric Reliability Council of Texas (April 8th, 2025), and “Load Forecasting Supplement and 2025 PJM Load Forecast Report,” PJM Interconnection (May 27, 2025).

21: ERCOT’s load growth is informed by its Transmission Service Provider (“TSP”)-provided forecast, which includes TSP-reported contracts and requested interconnection agreements. 2025 TSP-Provided Load Forecast is substantially higher than what was submitted in 2024, with most of the new Load attributed to future data center load growth attested to by TSP Officers. ERCOT adjusts this forecast to account for anticipated interconnection delays and historic reductions in requested versus actual load amounts. See ERCOT Board of Directors Meeting, April 7-8, 2025.

22: FTI Consulting analysis based on data sourced from: “Queued Up: Characteristics of Power Plants Seeking Transmission Interconnection,” Lawrence Berkeley National Laboratory (April 2024), https://emp.lbl.gov/queues. Numbers may not add due to rounding. Estimates are based on data through the end of 2023; we anticipate that more potentially impacted projects have been added to the interconnection queue in 2024 and H1 2025. FTI Consulting analysis assumes a 2- to 4 -year construction window between start of construction and placed in service dates.

23: “H.R.1 - To provide for reconciliation pursuant to title II of H. Con. Res. 14,” Congress.gov (July 3, 2025).

24: Ibid.

25: Ibid.

26: Ibid.

27: Kelsey Brugger, Garrett Downs and Nico Portuondo, “House OKs megabill after major energy, environment changes,” E&E News by Politico (May 22, 2025).

28: “Primer: 45Q Tax Credit for Carbon Capture Projects,” Carbon Capture Coalition (November 2023).

29: “US weighs funding cuts to four of seven hydrogen hubs,” Reuters (March 26, 2025).

30: “DOE Secretary Defends Business-Like Approach to Hydrogen Hub Funding Amid Political Concerns,” Fuel Cells Works (May 8, 2025).

Published

July 16, 2025

Key Contacts

Key Contacts

Global Practice Leader Power, Renewables & Energy Transition (PRET)

Senior Managing Director

Senior Managing Director

Senior Managing Director

Managing Director

Senior Managing Director

Managing Director

Director

Director

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About