KSA Economic Transformation

Overview of FTI Consulting’s Roundtable Discussion in Riyadh

-

January 23, 2024

DownloadsDownload Article

-

We had the pleasure of hosting a roundtable discussion at the end of 2023 for a selection of our corporate banking and financial services clients based in Riyadh. As we focus our attention on 2024, we have summarized below some of the key messages from that roundtable discussion. Whilst a wide range of topics were covered during our discussion, we have focused this paper on macro-economic trends, the construction sector, key demographic considerations and finally, the banking sector.

We look forward to hosting a similar discussion again soon, and more importantly, to working with all of our clients in 2024 and supporting the continued growth and economic transformation / diversification of the Kingdom.

Positive Momentum, Despite Headwinds

Saudi Arabia’s transformative social and economic journey, driven by the Kingdom’s Vision 2030 plan, remains strongly on course. That said, the Kingdom has still had to navigate some challenging macroeconomic headwinds in the recent past, driven by global events. No question: tightening monetary policy and geopolitical tension have created an increase in business uncertainty, which will have tempered confidence. Whilst there will be increased attention on certain sectors over the coming months, the overall trends for 2024 and beyond remain positive, with underlying confidence within the Kingdom for continued progress towards Vision 2030 a key contributor.

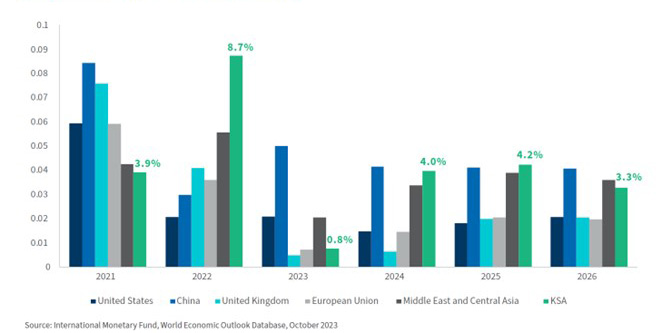

The Kingdom can look back on the nearly eight years since launching Vision 2030 with justifiable pride and look forward to the years ahead with optimism for further progress. Rebounding from the global effects of Covid-19, Saudi Arabia’s GDP growth reached 8.7% in 2022, the highest for any large economy. Indeed, after a projected slowdown in 2023, GDP growth is anticipated to outpace most developed economies over the next three years.

Chart 1: Forecast GDP Growth (Selected Markets)

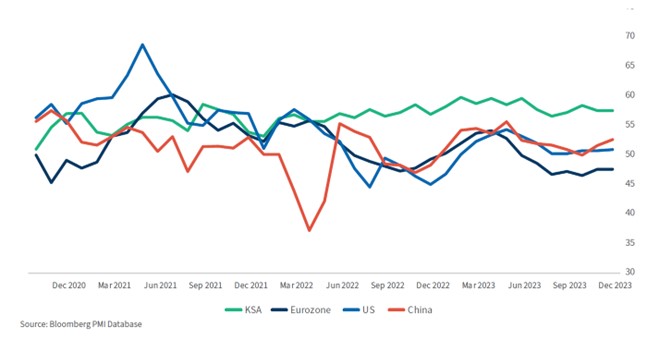

In addition, global Purchasing Managers Index (PMI) data underscores the Kingdom’s resilience when compared with other major economies, with Saudi Arabia’s PMI score running close to 60 through the majority of 2023 (noting that a PMI score above 50 reflects expectations of economic expansion). Fluctuation and uncertainty in the global oil market is expected to cause a drag on growth in 2023, but the strengthening non-oil sector, including government-related activity around the Kingdom’s giga projects, will still support the Kingdom’s forward momentum. Key growth drivers outside of the oil sector include transport, storage, communications, trade, restaurants, and hotels.

Chart 2: PMI Data Demonstrates Resilience in Non-Oil Sector

Construction Remains a Key Sector

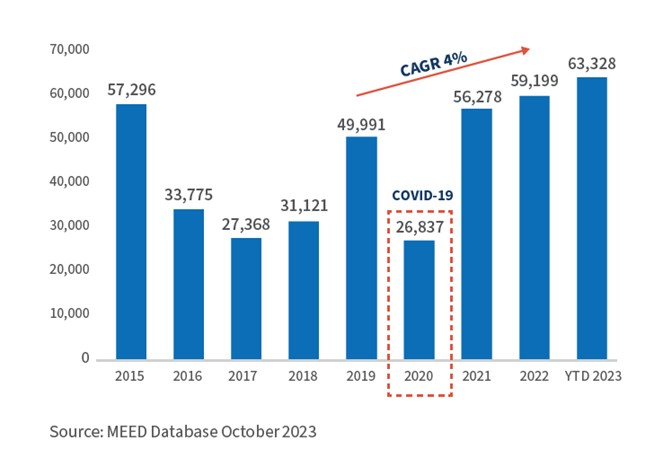

The Kingdom’s burgeoning construction industry stands front and center in this economic and social transformation, in part driven by the significant capital requirement of the various giga projects. Many of these projects are in the early stages of development and there is an expectation that the awarded contract values will continue to increase as these projects develop in the coming years. By Q3-2023, the value of contracts awarded was already 7% higher than full year 2022, demonstrating the level of activity growth in the sector.

The scale of the investment in these projects is evidenced by the fact that approximately 68% of the $179bn contracts awarded in KSA between 2021 and YTD 2023 (being Q3-2023) were from just 15 core projects / developments. We also note that the projects continue to attract significant engagement from outside the Kingdom, contributing to non-oil foreign investment. Contractors for these projects include both Saudi and international companies (indeed, the top contractors in the Kingdom for contracts awarded between 2021 to YTD2023 are evenly split between KSA and international players).

Chart 3: Value of KSA Contracts Awarded

Urban Drift

Outside of economic activity, there are other trends in the Kingdom that are worth watching. Recent Saudi census results show several interesting social and demographic trends: the Kingdom is growing, the population remains young, and it is drawing steady numbers of expatriate workers to its cities as it invests in infrastructure, and job opportunities.

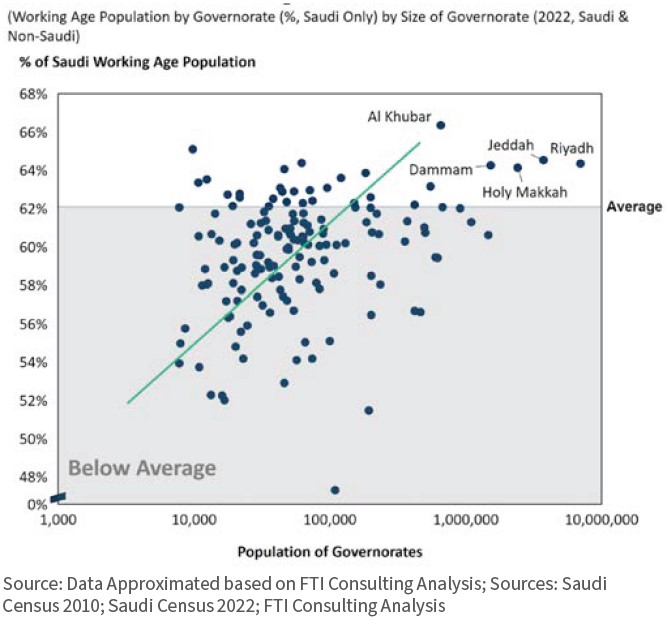

The Kingdom’s population has surged from 24.0 million to 32.2 million, marking a remarkable 34% growth from 2010 to 2022. Demographically, the Kingdom is still strikingly youthful: the median age in the Kingdom is 22 years (up from 19 years in 2010); by contrast, the median age is around 38 years in the US and Australia. True, fertility rates have dropped somewhat, and the population is aging as life expectancy grows, but neither are at rates comparable to countries like the US or Australia. Migration has been broadly steady as the expatriate population has increased to 13.4 million from 9.9 million in 2010 (~34%), and more of this population is moving to the Kingdom’s urban centers: the country’s five major urban areas have registered a 45% population increase, outstripping the national average of 34% (and a greater percentage of this migration includes those of working age). This urban drift, which is especially pronounced amongst the youth, may point to an underlying shift in societal structures and preferences worth considering over the next few years.

Chart 4: Workforce is Gravitating Towards Urban Centres

The Wider Economy / Banking Sector

The Saudi population has yet to experience the full force of the macroeconomic headwinds buffeting Europe and other global economies, but the pressure may increase along with continued geopolitical tensions, fluctuations in energy prices, and globally tight monetary policies. Central banks have tightened monetary policy to combat widespread inflationary pressures, and whilst these appear to have peaked, it is expected that elevated rates will take some time to lower over the course of the next 12-24 months. The combination of inflation and higher costs of capital globally will put greater pressure on some Saudi sectors more affected by tightened consumer wallets or needing leverage – for example, retail, hospitality / leisure, real estate, the industrial sector and transport / logistics.

The global dislocation has led to disruptions, but it has also surfaced opportunities for those businesses and sectors nimble enough to identify them and use tools at their disposal to turn them to their advantage. From a banking and debt perspective, the Kingdom is hungry for solutions and has shown an increased willingness to adapt to meet these challenges, attracting outside capital and exploring ways to continue to drive growth. Here, too, the Kingdom’s youth is an asset: providing a source of strength and innovation, bringing an influx of new ideas and a pragmatic willingness to consider not doing things “as they have always been done.” A case in point is the evolving understanding of distressed assets in the Kingdom over the last 4-5 years. Regulatory changes around bankruptcy and asset recovery have been implemented in the Kingdom, and banks and credit providers are increasingly open to new ideas and more innovative solutions to meet the “out of the box” thinking around debt restructuring necessary in today’s shifting economy.

Not surprisingly, then, the Saudi commercial banking sector is worth considering in further detail under these conditions. Saudi banks continue to support the country’s rapid economic growth as part of Vision 2030. The overall claim on the private sector increased from ~SAR 1.6bn in Dec-19 to ~SAR 2.5bn in Jun-23. Importantly, its share in total assets increased by 4ppt from 59% in Dec-19 to 63% in Jun-23. And as of Jun-23, private sector loans comprised around 95% of the total commercial banks loan portfolio, almost equally weighted between personal loans and sector loans (those personal loans will, in part, be driven by the recent increase in home ownership, supported through the Sakani program).

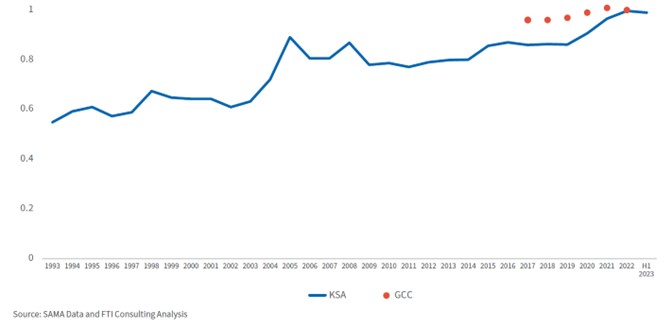

A strong presence, but at the same time, there is a flip side of the story that is worth watching, given the increasing role banks are playing. The loan to deposit ratio (LDR) has shown noticeable growth in recent years, reaching around 100% since 2022 (this is broadly in line with the average for the wider GCC region), which reflects the strong demand for credit in the Kingdom. In addition, between Q1 2019 and Q2-2023 loans and advances have grown, “funded” by an increase in both demand and time / saving deposits, which are typically more expensive than demand deposits. That said, profitability of the banking sector remains robust, with return on assets in excess of 2%, which is favorable compared to many developed banking sectors.

Chart 5: Loan to Deposit Ratio – KSA Banks vs. GCC Average

Concluding Comments

Saudi Arabia’s economic and social transformation will be interesting to witness over the next few years as it brings its own tools, assets, and approaches to mitigate and manage both global challenges and regional / local pressures. The Kingdom’s momentum is fueled by commitments made in their wide-ranging Vision 2030 plan (including the giga projects) and by demographics that unleash strategic human assets in their workforce.

Notwithstanding the positive momentum within the Kingdom, certain priorities were raised during our roundtable discussion, which are worth mentioning and monitoring over the next 12-24 months to see how they develop. These include:

- The increased urbanization of major cities and the subsequent impact on residential developments and associated critical and social infrastructure;

- The significant level of construction activity across the Kingdom, and the potential impact on the supply chain (from provision of raw materials through to labor);

- The increasing demand for credit (both personal and corporate) and whether this creates an opportunity for alternative credit providers to play an increasing role in the credit market;

- The increasing use of the developing bankruptcy framework within the Kingdom, and the potential increase in secondary debt trades as part of debt restructurings / workouts; and

- Increased consideration towards NPL sales as part of overall portfolio / balance sheet management across the banking sectors.

It is likely that key sectors, such as construction and commercial banking, will be bellwethers for wider performance and provide early signs of opportunities and risks. How the Kingdom approaches the business effects of global dislocations, proactive management of distressed assets, restructurings, and M&A activity, will determine whether and to what degree the Kingdom can nimbly seize advantage during these turbulent times. Regardless, it will be interesting to be part of the continued growth and transformation.

Published

January 23, 2024

Key Contacts

Key Contacts

Senior Managing Director, Head of Middle East Corporate Finance & Restructuring

Managing Director

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About