Playing Offense and Defense With AI Investments in M&A

A Strategic Playbook for Evaluating AI Assets in Today’s M&A Landscape

-

August 26, 2025

-

The Current AI Investment Context

AI is driving a significant shift in enterprise value creation, impacting business model and operating model considerations while rapidly transforming industry sectors.1 Technical innovation has continued at a blistering pace over the past 24 months, democratizing access to AI technologies, dramatically lowering costs at an unprecedented rate and changing the economics of what’s possible.2 Today, there is a race to invest in the customer- and user-facing application layer, in contrast with the more foundational infrastructure investments we’ve seen in recent years.

Venture capital investments alone are growing 58% in Q1 2025 — a rate that outpaced the already hot AI investment streak of 2024.3 But beyond growth in early-stage investments, a more secular rise in investor interest has emerged, focusing on companies with proprietary AI, AI-enabled technology or unique assets that leverage AI to provide a competitive advantage. Broad investment in AI — along with bullish sentiment — has pushed many companies to either build their businesses entirely around core AI systems, develop new AI platforms to enable specific functions within their firms or reimagine their entire enterprise through an AI-enablement lens. As a result, many overlapping technologies have been overdeveloped and will see consolidation as they become ripe for merger or acquisition.

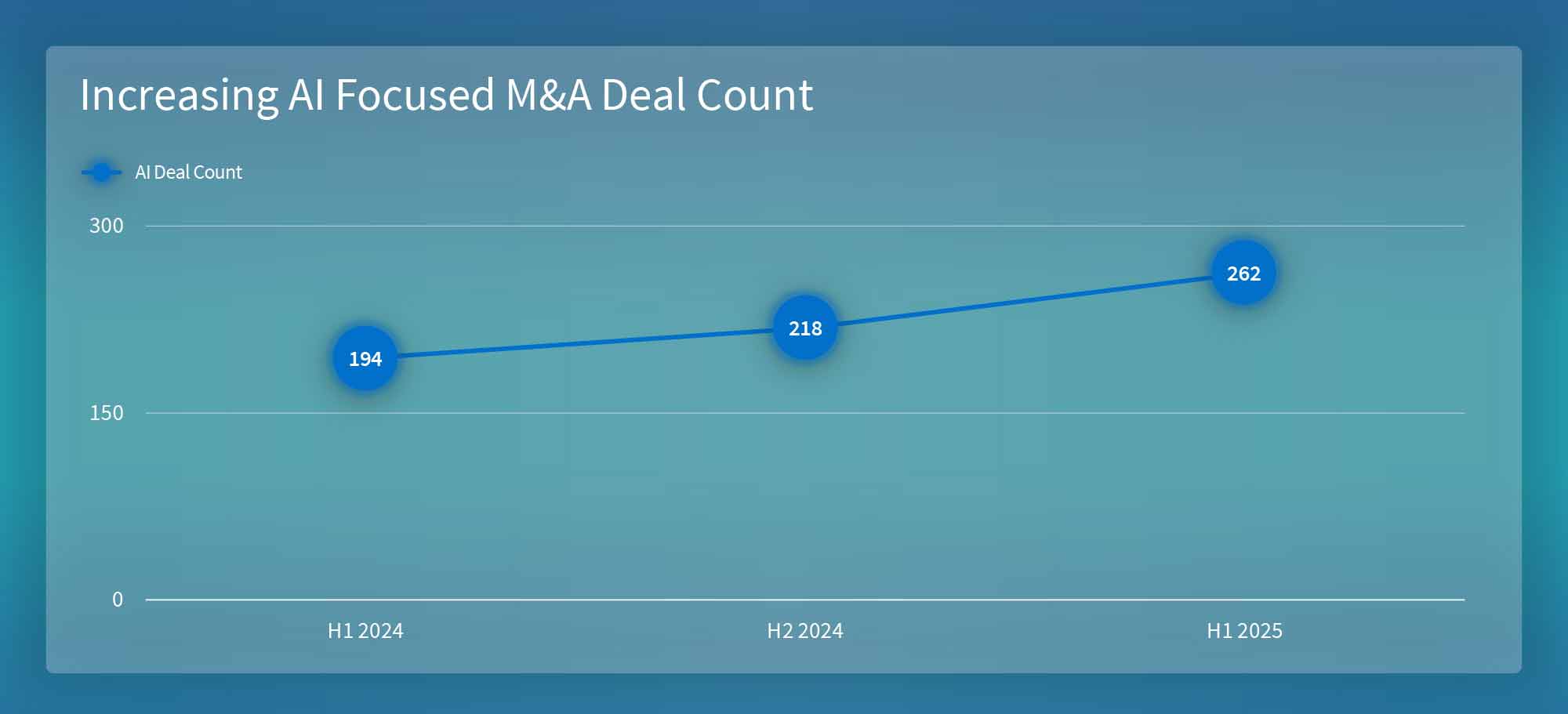

Source: Crunchbase H1 2025 Data4

It is in this environment that corporates are looking to bring in AI tech and talent at an unprecedented pace to preserve or build competitive advantage, particularly in sectors at most risk for disruption. Private equity firms (“PEs”) are looking to do the same as hold times increase and exits remain challenging, with great focus on value creation. We predicted at the start of this year an increase in AI-related M&A activity going into 2025, and so far this has turned out to be the case with a 35% increase YoY.5 More M&A deals should be expected.

But as corporates and PEs alike seek to acquire AI assets, a careful strategic review of such investments will be critical. Such a review should include understanding buyer and lender strategies for such investments, as well as defensive (guarding against downsides) and offensive (maximizing upsides) positioning, and, in our view, it should follow a structured framework covering the key commercial, operational, technology and data considerations for such assets.

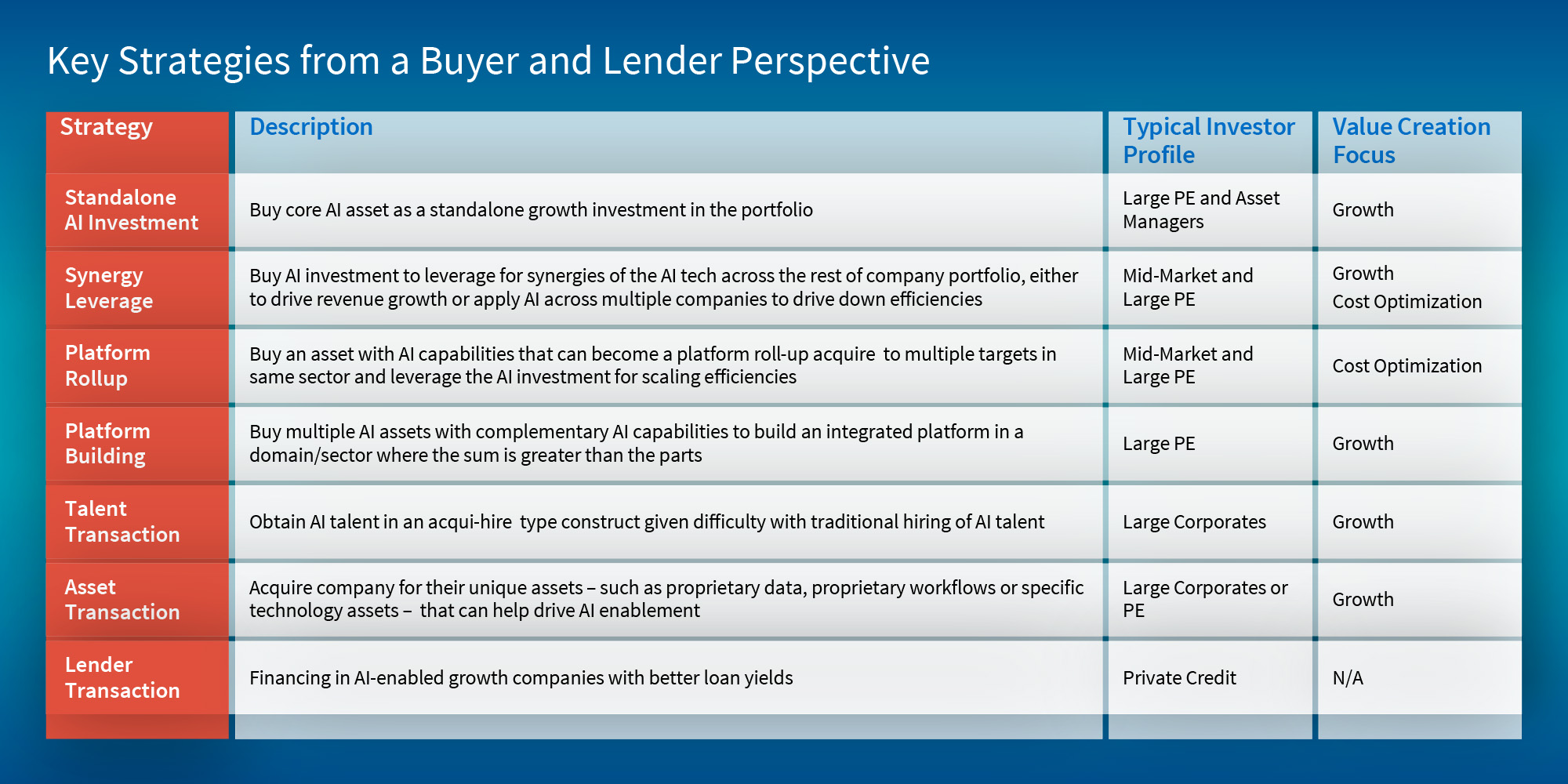

Buyer and Lender Strategies for Investing in AI

Different strategies are unfolding for investing in AI assets, and they vary by investor profile and value creation theses. For each strategy, the sell-side party has mirroring considerations to explain the value creation potential of their asset that aligns with the buyer’s investment thesis and to develop the right strategic narrative and positioning for maximizing valuation and deal terms. Below are some key strategies from a buyer and lender perspective.

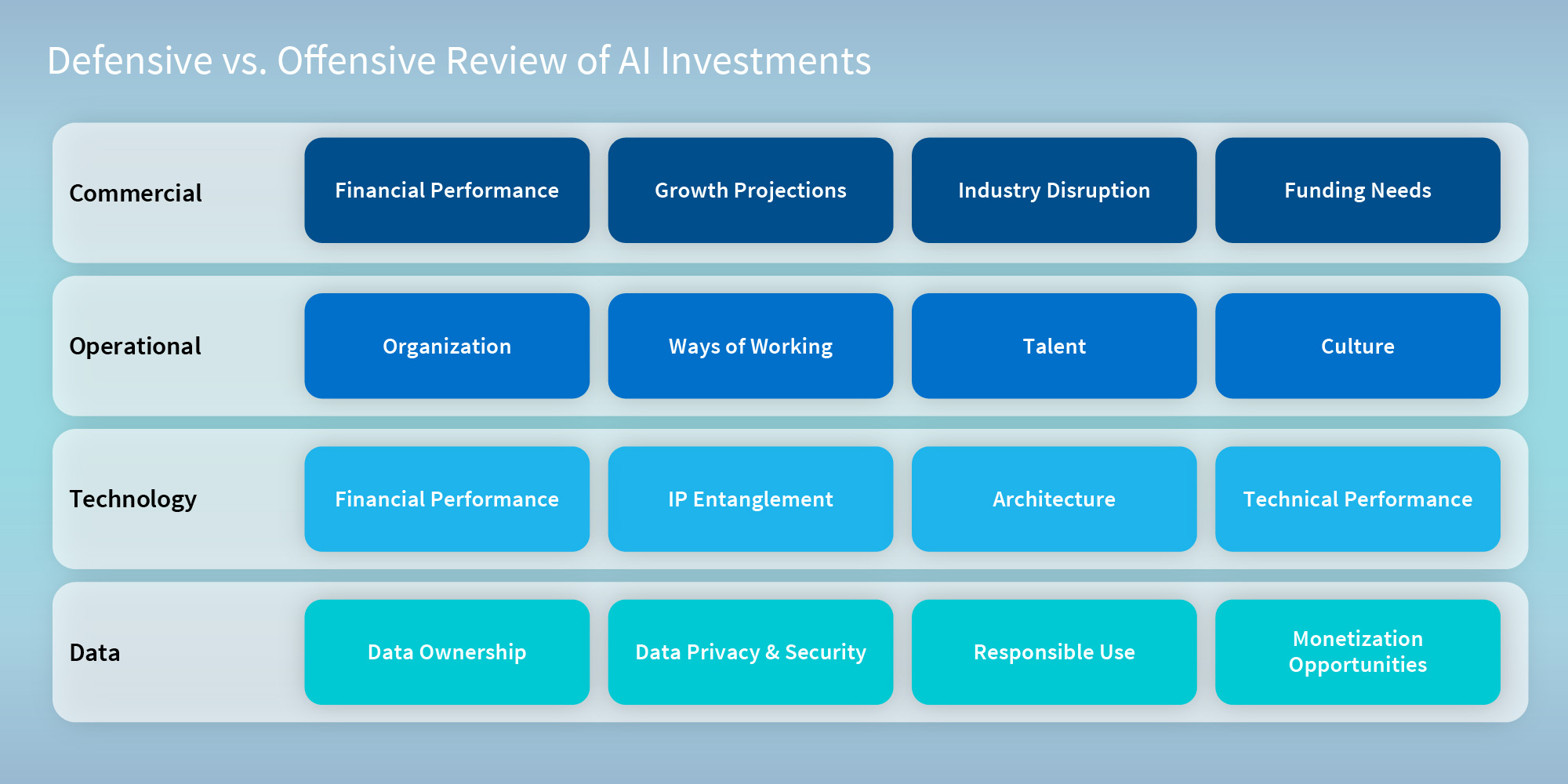

Defensive vs. Offensive Review of AI Investments

Given the rapid pace of AI evolution, potential investors would be wise to perform both offensive and defensive reviews of AI investments during a merger or acquisition process to drive optimal deal terms, synergies and mitigate risk.

- Defensive review focuses on protection and considering the downsides covers commercial, technical, data and operational risks that may need to be mitigated. Many investors are also concerned about other emerging AI technologies or scenarios disrupting their AI investments.

- Offensive review focuses on identifying opportunities, scrutinizing other potential growth factors, such as what other opportunities may exist with the asset or what other scenarios and industry evolutions could occur and be leveraged for driving growth.

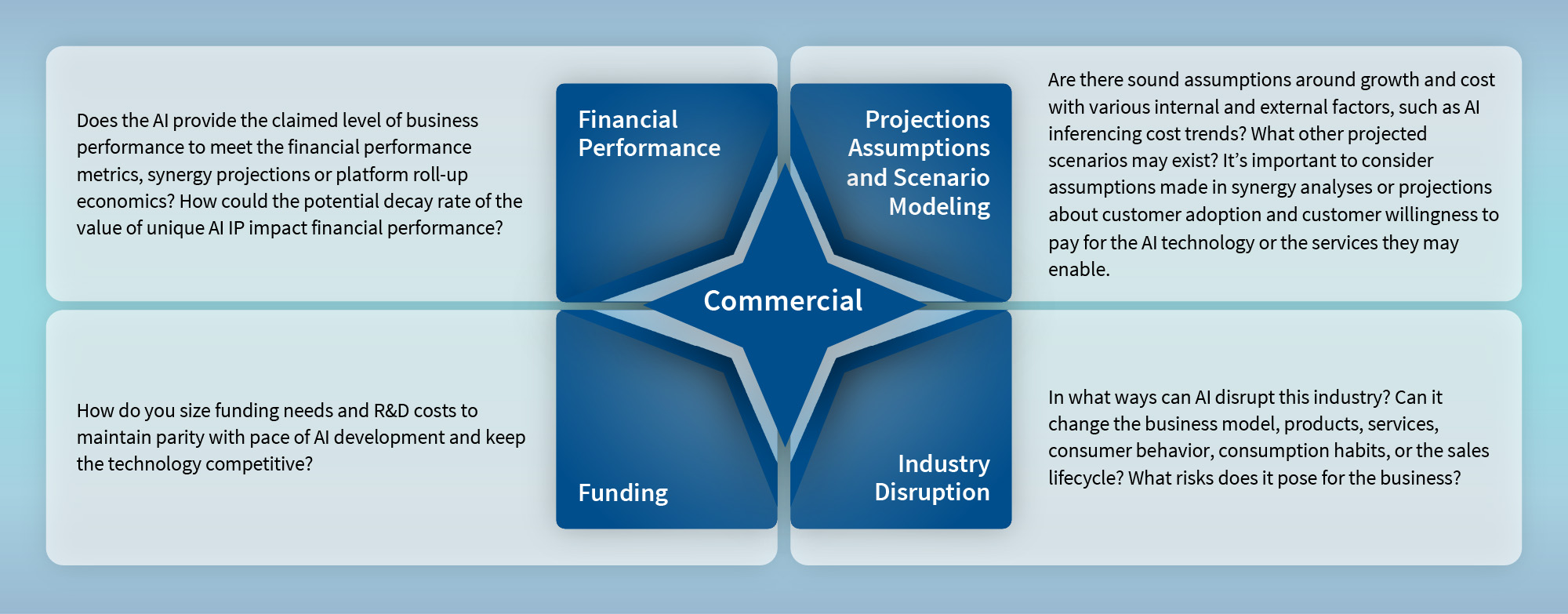

A Comprehensive Framework for Analyzing AI Assets

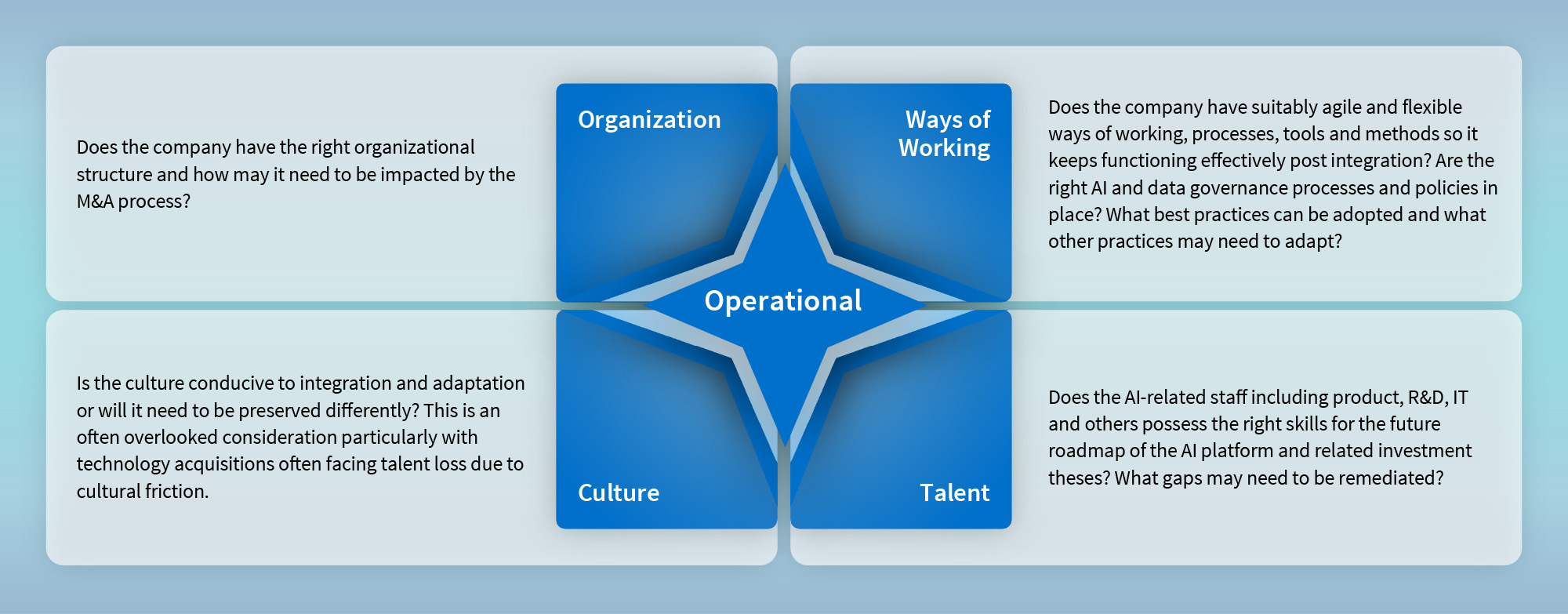

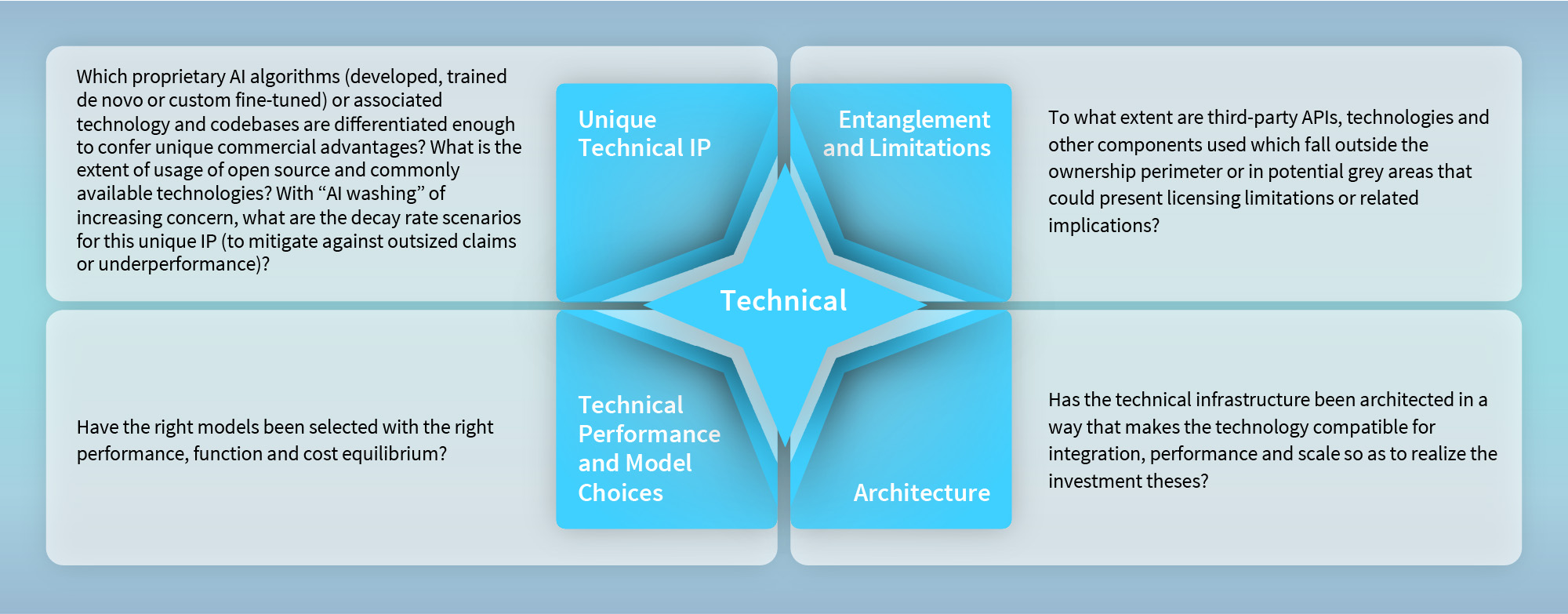

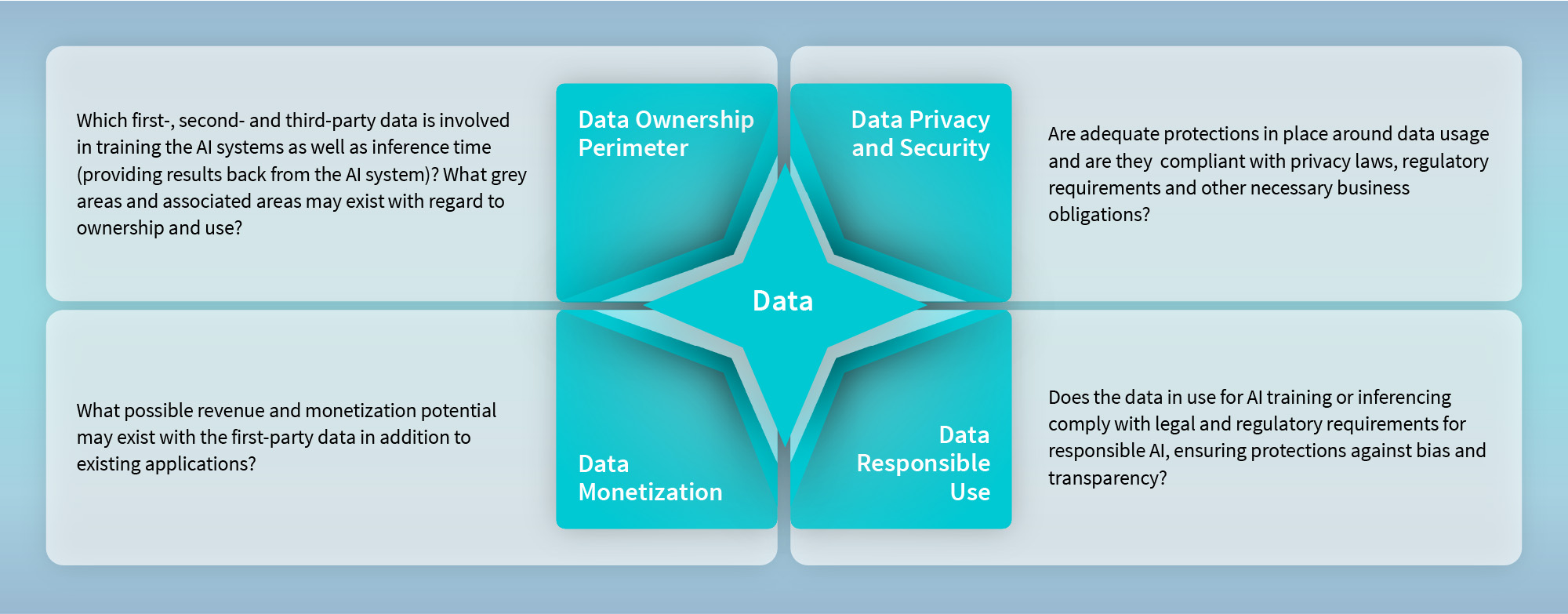

Rather than traditional check-the-box or scripted diligence, a comprehensive strategic review should include some mix of four key categories, with varying intensity across and within each depending on the investment strategies and value creation theses. Below are key questions that may need to be answered:

Conclusion

With AI increasingly becoming a primary driver of enterprise value creation and competitive differentiation, AI investments have never been higher stakes. As investment activity accelerates, the technology continues to rapidly evolve and the market approaches a period of inevitable consolidation, investors will need to be able to rigorously evaluate, integrate and scale AI assets to drive real enterprise value.

Doing so will require assessing assets offensively and defensively while applying commercial, operational, technical and data-focused lenses to perform a comprehensive strategic review beyond that of standard diligences. This will ensure alignment of the transaction with investment theses and drive optimal deal terms and value creation.

Footnotes:

1: Sumeet Gupta, “The Shape of the Fourth AI Inflection in 2025”, FTI Consulting (January 27, 2025).

2: Sumeet Gupta, “Frontiers of AI Research in 2025”, FTI Consulting (February 28, 2025).

3: Sumeet Gupta, “AI Investment Landscape in 2025: Opportunities in a Volatile Market”, FTI Consulting (April 17, 2025).

4: Itay Sagie, “Strategic, Not Speculative: The New Shape Of AI Acquisitions”, Crunchbase News (August 4, 2025).

5: Emma-Victoria Farr, Amy-Jo Crowley, “Global M&A hits $2.6 trillion peak year-to-date, boosted by AI and quest for growth”, Reuters (August 5, 2025).

Related Insights

Related Information

Published

August 26, 2025

Key Contacts

Key Contacts

Senior Managing Director, Leader of AI & Digital Transformation

Managing Director

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About