September 2024 Perspective: Key Trends in Healthcare M&A Activity

-

October 08, 2024

-

Deal activity remains lethargic in 2024, weighed down by stubbornly high cost of capital, and high seller price expectations.1 Additionally, risk-averse buyers remain on the sidelines due to an increase in regulatory scrutiny, especially at the state level, which continues to play a significant role in shaping the healthcare transaction landscape. 2 On a positive note, pharma services platforms have shown encouraging growth, with several deals announced in recent months.3 Data presented at the 2024 Healthcare Capital Markets & Innovation Summit projects 2024 dealmaking to progressively increase, picking up in 2025 and 2026 due to pricing resets.4 This projection is even more promising after the Federal Reserve lowered its benchmark interest rate in September for the first time since March 2020.5

Here’s a closer look at the latest trends and transaction activities across various sectors:

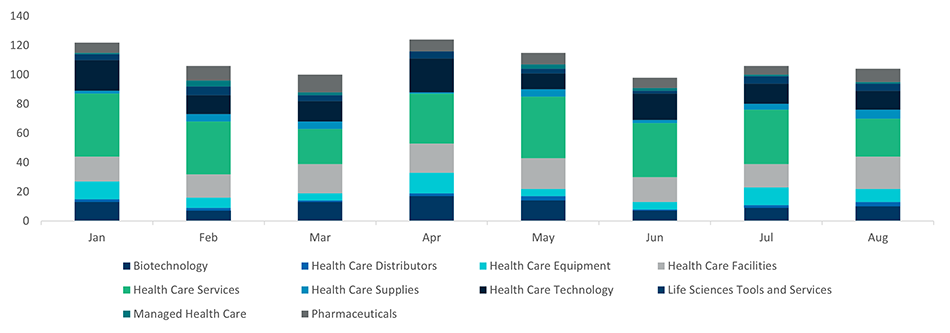

- June marked the lowest month of transaction activity cross healthcare sectors, likely due to summer seasonality, but rebounded in July and August to near-year averages.6

- Health Care Technology and Services sectors saw strong activity earlier in the year but declined from June to August, with Health Care Services hitting its 2024 monthly low in August.7

- Biotechnology and Health Care Facilities showed strong recoveries from their June dips, with Biotechnology steadily improving through the summer and Health Care Facilities experiencing a significant jump in August.8

Announced Healthcare Transactions By Month

Investment Insights for Healthcare and Life Sciences in 2024

- VC healthcare specialist fundraising has seen a notable decline as a share of total VC fundraising, signaling a significant shift from the trends of 2023.9 In 2023, healthcare and life sciences fundraising performed relatively well compared to other sectors in the asset class.10 However, the recent downturn reflects a change in investor sentiment or broader market conditions, indicating new challenges for healthcare-focused venture capital. Conversely, PE healthcare specialists are outperforming the broader asset class in fundraising efforts.11

- Despite Physician Practice Management (PPM) deals decelerating, Dental and Veterinary sectors are attracting the most investor interest. This is primarily driven by add-on activity and strong sponsor interest in creating new platforms.12

Despite the current hurdles of high capital costs and regulatory scrutiny, the resilience shown by sectors like pharma services and the projected easing of pricing pressures signal a potential uptick in healthcare M&A activity as we move into 2025 and beyond.

Revenue recognition is a crucial accounting practice that ensures accurate financial reporting, especially in healthcare, where it plays a vital role in assessing the value of services provided. This case study highlights the benefits of an optimized revenue recognition model, focusing on its impact on financial performance and enhancing operations to centralize and streamline the process.

Spotlight: Implementing a Dynamic and Scalable Revenue Recognition Model

Following a significant and rapid acquisition, a leading full-service medical equipment company with $2 billion in annual revenue and operations spanning 47 U.S. states found its revenue recognition reporting tools and processes no longer provided adequate visibility across its various regions and product lines. FTI Consulting was engaged to implement a more optimized revenue recognition process and scalable model for the rapidly growing business.

Our Impact

- FTI Consulting implemented a scalable, flexible, best practice revenue recognition model that leveraged data from across the company’s 30-plus legacy revenue databases. The tool tracks cash collections with precision, predicts future cash collections on remaining accounts receivable and informs decisions that impact bad debt expense provisions.

- Our experts collaborated with the company to use the model to drive timely financial decisions in support of monthly and quarterly reporting.

- The team ensured that new tools and processes were easily adaptable to future acquisitions and product lines.

Our Role

- FTI Consulting reviewed the company’s existing revenue recognition tools and processes, as well as built and implemented new tools and processes that provided accurate, timely, customizable and scalable insights into cash collections performance.

- The team synthesized vast amounts of transactional data from the company’s disparate systems to create a single repository of detailed revenue information.

- In collaboration with the company’s finance team, FTI Consulting customized an efficient and scalable revenue recognition model to report individualized results for each of the key business units and regions. We presented and defended the model’s functionality to external auditors.

- Working with finance and revenue cycle management leaders, FTI Consulting developed a playbook with recommended roles, policies and procedures for employing the model to drive monthly and quarterly revenue reporting.

Footnotes:

1: “Takeaways From the 2024 Healthcare Capital Markets & Innovation Summit”, Pitchbook (June 18, 2024).

2: Ibid.

3: Ibid.

4: Ibid.

5: “The Fed cut rates for the first time in 4 years. What does that mean for your money?”, CBS News (September 19, 2024).

6: “S&P Capital IQ,” FTI analysis, Capital IQ, September 2024.

7: Ibid.

8: Ibid.

9: “Healthcare Services Public Comp Sheet and Valuation Guide”, Pitchbook (July 10, 2024).

10: Ibid.

11: Ibid.

12: Ibid.

Published

October 08, 2024