Unlocking Success in Healthcare Mergers

Preparing Your Organization for Integration Prior to Deal Close

-

May 16, 2024

-

While the conventional focus for organizations planning to integrate is often on closing the deal, for the most financially and operationally successful integrations, the real work begins much earlier. Leaders must anticipate and plan for value creation before (pre-close) and after (the first 100 days of integration).1 Organizations pending a deal close face legal restrictions in multiple areas such as data sharing, contract negotiations (payer and vendors), collaboration and integration activities. Despite these impediments, leadership must still address critical decisions, including: Which services, supplies and technology can be consolidated, eliminated, or standardized, and in what order? How will this impact the target operating model design, reduction and repurposing of staff, technology optimization, overall cost structure and revenue growth initiatives?

By engaging a third party to conduct a review of each organization’s operations, healthcare providers or financial sponsors can accelerate the integration process by driving value beyond the required due diligence. This pre-deal close operational review enables both organizations to share data to identify synergies and newly identified risks, and to facilitate the development of an integration plan. With numerous legal constraints at this stage of the process, organizations can rely on a third party to oversee data sharing, decision-making and future partnering for contract negotiations — all of which are off the table for the organizations until the closing date. Additionally, a third party can facilitate an approved “clean room” structure to exchange sensitive and confidential information and accelerate the planning process.

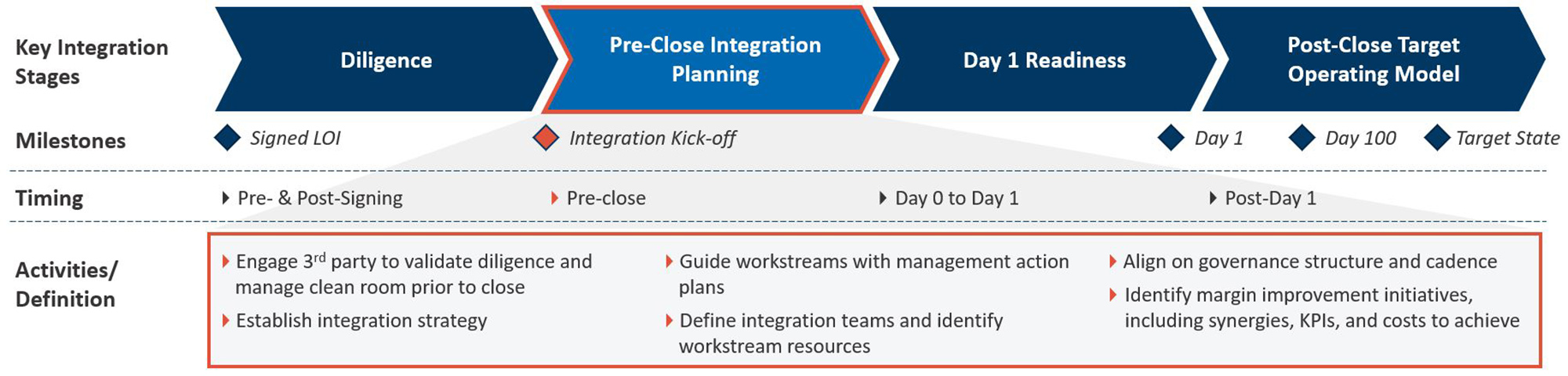

Integration Terminology and Timeline

Key Early Integration Considerations

Laying the groundwork for a successful integration requires a comprehensive analysis of each organization to identify potential synergies and capitalize on improved efficiency and cost savings. Key areas of focus primarily include shared service departments (human resources, supply chain/purchased services, pharmacy, IT, revenue cycle, finance, IT, legal, etc.), clinical operations, and medical groups.

Private Equity Consulting Learn more

By assessing labor productivity, span of control, current policies and procedures, digital platforms (Electronic Health Records – EHR, Enterprise Resource Planning – ERP Systems, etc.), vendor contracts, etc., organizations can proactively identify and quantify opportunities. The pre-deal close operational review enables the early identification of elements of the target operating model that are misaligned with the strategic objectives of the new entity post-merger (NewCo). For example, if the combined company is transitioning from public to private, a third party would assess the updated reporting requirements for the new ownership structure. The pre-deal close operational review is structured to provide actionable insights that will inform the post-close integration plan, prioritizing initiatives that can be achieved quickly and efficiently.

Workstream Focus Areas

Prior to deal close, the third-party review should include the evaluation of the following workstreams, including productivity, process changes, technology consolidation and implementation complexity. Additionally, a workforce management review is critical to ensuring the alignment of roles and responsibilities and identifying opportunities to reduce redundancy through a methodical and efficient process.

Sample workstream focus areas are summarized below:

Supply Chain Management

- Evaluate the Group Purchasing Organization (“GPO”) contracts and relationships. Determine current commitments, contract term and financial benefits.

- Review of the Medical/Surgical Distribution agreements to evaluate the current scope of this service and determine financial benefits and consolidation opportunities.

- Review key vendor contracts and complete a detailed spend analytics exercise.

- Evaluate in-sourcing and outsourcing strategies for key clinical and non-clinical services within the organization.

- Assess strategic sourcing capability and evidence-based decision-making processes used to manage high-dollar supply items, purchased services, critical equipment, and instrumentation.

Pharmacy

- Complete an evaluation of pharmacy distribution practices. Compare the current contract, and evaluate financial benefits and commitments.

- Evaluate the impact of rebates, cost-minus structure, 340B, WAC and other added benefits (e.g., prompt pay discounts).

- Evaluate current pharmacy operations and patient accessibility.

Information Technology

- Review the current EMR and systems in place at each organization.

- Evaluate the current IT standards and policies in place and the process for documentation during integration.

- Determine the communication and security aspects that need to be implemented on Day 1 vs. the target future state.

- Review active projects and determine path forward (renew, remove, or pause).

- Evaluate how and where data definitions are documented. Establish ongoing tracking of key metrics (clinical growth metrics, financial and operating metrics).

- Develop a plan for the consolidation of similar systems/tools, “best in breed” vs. “best of suite” solutions; in-sourced vs. managed service IT provider.

Revenue Cycle Management

- Evaluate vendor management, including in-sourced vs. out-sourced functions and strategy for leveraging vendors within each organization’s operating model.

- Review key performance indicators (“KPIs”) to determine comprehensiveness and effectiveness of KPIs and targets.

- Evaluate effectiveness of governance and operating models in supporting denial management, cash collections, coding, and billing functions.

- Review current EMR billing functionality and/or billing systems in place, including approach to bolt-on and additional technology components. This includes evaluating the approach to workflow prioritization and allocation, automation, eligibility, clearinghouse, edits, etc.

- Evaluate the processes in place to communicate key trends, progress, and risks to applicable stakeholders (i.e., understand physician concerns and the process for specific performance requests).

Clinical Operations

- Conduct a review of the current leadership and governance structures, including identifying span-of-control opportunities.

- Assess roles and responsibilities, job descriptions and scope of practice.

- Evaluate and identify opportunities within patient assignment practices, clinical staffing models, and daily operations.

- Review current practices for patient throughput and care progression.

- Identify operational and clinical care delivery efficiencies and/or opportunities for improvement.

- Complete a comprehensive review of each organization's current policies, procedures and guidelines. Document plan for integration after deal close.

- Highlight and prioritize risks and dependencies related to clinical quality and safety.

- Review clinical growth strategies by completing a market assessment.

- Review current performance metrics and KPIs benchmarked to best practices.

Ambulatory Services/Medical Group

- Conduct a comparative provider performance analysis to industry benchmarks, including net investment per provider, identifying opportunities for cost containment and service rationalization.

- Perform a provider compensation review to align organizational philosophies and compensation structure, including plan administration, incentive structures, and fringe and retirement benefits.

- Review ambulatory patient access standards, scheduling practices (including contact center performance) and available scheduling data to identify incremental capacity by provider, specialty and location.

- Assess current medical group governance structures, job descriptions, ambulatory staffing models and span of control.

- Review finance and business intelligence framework to integrate a standard chart of accounts, operational and financial KPIs, and other relevant metrics to support leadership in making operational business decisions.

- Evaluate available market data and referral migration patterns to identify service-line growth and expansion opportunities.

Bottom Line

By prioritizing synergies across key functional areas early on, organizations can take a proactive approach to their 100-day integration plan prior to deal close. Partnering with a skilled third-party advisor empowers leadership to make difficult decisions with confidence, accelerate the planning process and establish clear timelines. This proactive, unbiased healthcare expert approach not only accelerates value creation but also mitigates potential risks, setting the stage for a smooth and successful integration positioned to achieve the strategic objectives of the combined company.

Additional Contributors: Jason Kron, Kristen Mansur, Hannah Philip, Ashton Collins, David Mazzariello.

Footnote:

1: John Reese and Karthik Patange, "Driving Profitability through Sustainable 100-Day Plans," FTI Consulting (January 26, 2023).

Published

May 16, 2024

Key Contacts

Key Contacts

Senior Managing Director, Leader of Healthcare Business Transformation

Senior Managing Director, Leader of Merger Integration & Carve-Outs

Senior Managing Director

Managing Director

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About