- Home

- / Insights

- / White Papers

- / A Quantifiable Approach To Price Volume Mix Analysis

A Quantifiable Approach To Price Volume Mix Analysis

How Is Price Volume Mix Calculated and How Can FP&A Interpret and Analyze the Results?

-

May 03, 2024

-

Quantifying and explaining key drivers of revenue is critical for performance management. Sales growth is typically analyzed by explaining changes in volume and pricing. However, sales mix is often overlooked, misunderstood, and not calculated correctly as a key component of sales growth.

A properly structured price volume mix (“PVM”) analysis enables FP&A leaders to provide a comprehensive perspective on historical results as well as actionable intelligence to prescribe key business improvements.

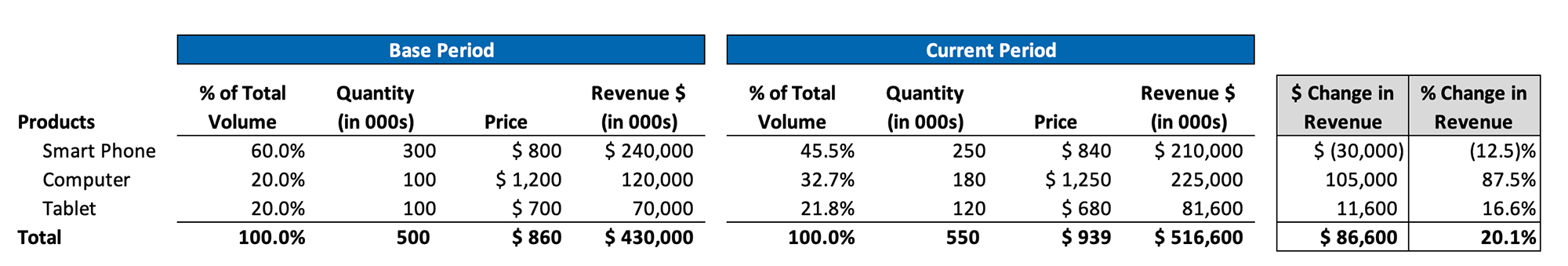

Below is a simple illustration of how to calculate PVM analysis by product category:

Situation

- A small electronics company sells three types of products: smart phones, computers, and tablets.

- After reviewing the annual financials, the Board was pleased with the 20.1% YoY revenue increase. However, they asked the CFO to explain how such strong growth was achieved despite its highest demand product category, Smart Phones, having a large sales decline of -12.5% over the period.

- The Company’s VP FP&A created a PVM analysis that fully explains the sales growth over the period while also quantifying the impact of price, volume, and mix.

Straightforward 3-Step Process to Calculate PVM Analysis:

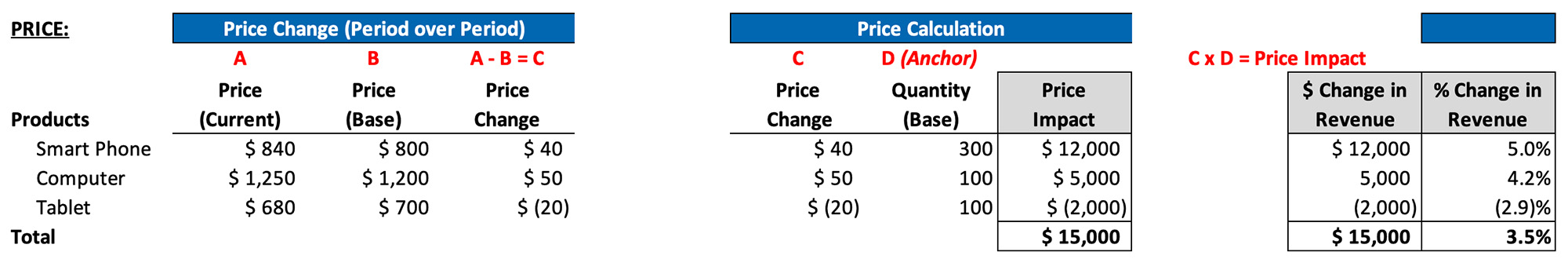

Step 1: Price Calculation = Change in average selling price multiplied by prior period volume.

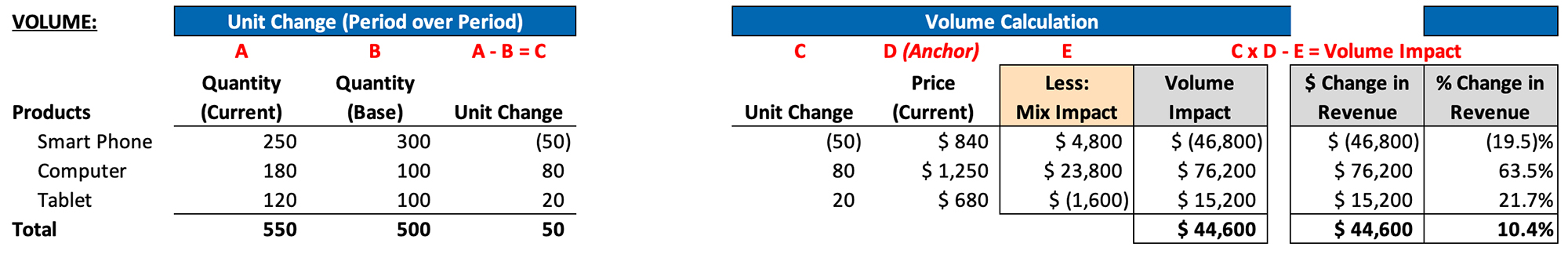

Step 2: Volume Calculation = Change in volume multiplied by current period price minus mix impact (see step 3).

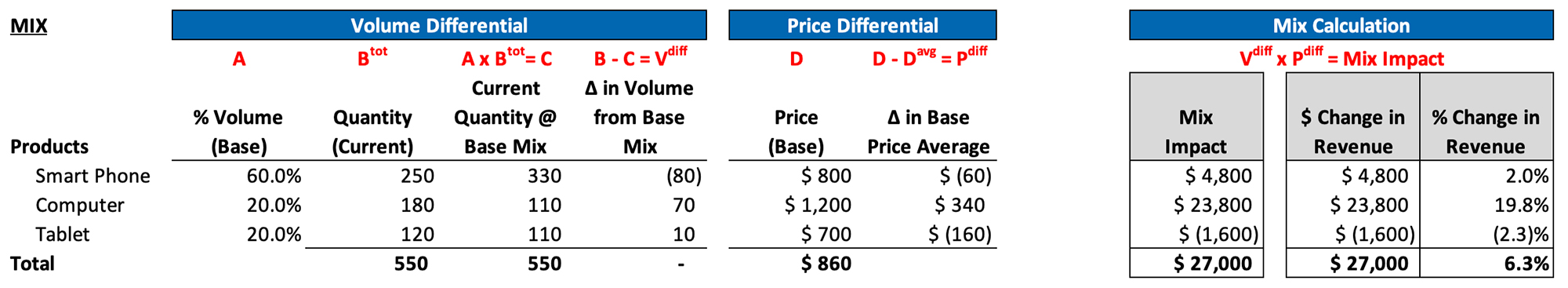

Step 3: Mix Calculation = Mix-weighted volume differential multiplied by price differential to total base average price.

How To Interpret and Analyze PVM Results by Price, Volume, and Mix

Overall, here is the story that the VP FP&A was able to provide from a price, volume, and mix perspective to explain the 20.1% revenue increase:

Price – The change in price between periods explains 3.5% of the 20.1% increase in sales growth, or $15M of the $86.6M total sales $ increase. Smart Phones and Computers realized higher average selling prices over the period, partially offset by an overall decrease in Tablets effective pricing.

Volume – The change in volume accounts for 10.4% of the 20.1% increase in sales, or $44.6M of the $86.6M total sales $ increase. The Company sold significantly more Computers and Tablets overall, while sell-through on Smart Phones decreased period-over-period.

Mix – Product sales mix accounted for 6.3% of the 20.1% increase in sales, or $27M of the $86.6M total sales $ increase. Growth in Computer sales represented most of the favorable mix impact as it grew from 20% to 33% of total volume (+ volume differential), while also selling through at a higher average selling price point as compared to other products (+ price differential). The sales mix impact for Smart Phones and Tablets mostly offset each other, as both product price points were below the portfolio average selling price (- price differential) but had opposing volume differentials.

How To Interpret and Analyze PVM Results by Product Category

Additionally, the VP FP&A was able to provide an explanation of the revenue increase from a product category perspective, as well as prescribe focus areas for the Company to continue improving its sales growth:

Smart Phones dragged on the Company’s revenue growth by ($30M) driven by an attempted price increase (5%) that resulted in a disproportional decline in volume. The Company’s marketing team should revisit its assumptions in areas that include market demand, brand strength, competition, and product quality concerns.

Computers drove significant revenue growth of $105M and was the primary driver of the Company’s sales growth. Computers demonstrated positive momentum in all three categories of price, volume, and mix due to a boom in sales volume while also capturing a marginal price increase and being the Company’s highest priced product. Product management can revisit the various product categories to determine the optimal sales mix for future growth and to identify additional opportunities for taking market share.

Tablets grew revenue by $12M due to its favorable price elasticity, capturing higher volume by moving to a lower price point. Management can assess areas where product innovation or brand investment can enable further differentiation for these products, as compared to continuing to sell these products at a lower price point.

Here Are a Few Real-World Considerations for Applying Price, Volume, Mix Analysis:

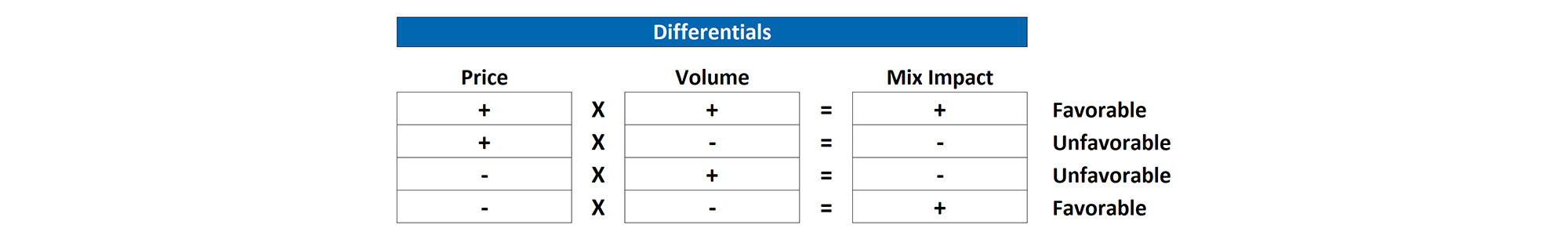

How do you interpret sales mix? The following table can be utilized to better understand if a product will have a positive or negative impact on revenue based on its price and volume differentials:

Do I need to perform Price Volume Mix calculations at a SKU Level? For optimal results, PVM should be calculated at the SKU level to isolate an accurate Price impact. If calculated at a product group level, the Price variable will likely have a layer of unquantified sales mix embedded within the resulting output. This is because there may be a shift in the sales mix of higher/lowerpriced SKUs underneath the product group, which will change the average product group price without any real change to the SKU-level prices.

How do unit of measure differences impact Price Volume Mix analysis? The traditional PVM calculation as outlined in this document should only be utilized when there is a consistent unit of measure across product categories. Mixing multiple units of measure, such as quantity sold and pounds sold, can skew the Mix calculation due to non-comparable volume and price/unit metrics. A common solution is to modify the Mix calculation, at an individual line level, to be the product of the price and volume changes (i.e., Change in Price x Change in Volume). For this alternative, the Volume calculation also needs to be modified to be the following: change in volume multiplied by prior period price.

When working with big data, what filters should I apply before calculating Price Volume Mix? Large datasets may have SKUs with zero volume in one period or periods with zero/negative revenue, which will skew the PVM calculations. Best practice is to filter out this data prior to calculating PVM and categorize them separately for your revenue bridge. Common filtered categories are the following:

- New Products introduced within the period

- Discontinued Products within the period

- Discounts and Returns for products that result in zero or negative revenue over a period

Can Price Volume Mix analysis be applied to non-product categories? PVM can be applied to any revenue category (e.g., customer, sales channel, region, etc.). The PVM calculation works the same for any category and can be applied to multiple categories at once, although Mix becomes more difficult to interpret with each added category.

Can Price Volume Mix analysis be applied to analyze Gross Margin? PVM analysis can be applied to Cost of Goods Sold (COGS) in the same way as Revenue. You can combine a Revenue PVM and a COGS PVM analysis to create a Gross Margin bridge. This application explains both changes in revenue and COGS and isolates the impact of volume, price/inflation, and sales/cost mix.

FTI Consulting’s Office of the CFO Solutions practice has the proven expertise and available resources to assist CFOs on an enterprise-wide scale with performance management. Our Analytics and Insights capabilities can enable your companies’ objectives to grow revenue profitability and optimize costs. If you have any questions on the concepts or solutions discussed above, please reach out and let us have a conversation about how best to apply Price Volume Mix within your company.

Published

May 03, 2024

Key Contacts

Key Contacts

Senior Managing Director

Senior Managing Director

Managing Director

Senior Director

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About