By mobilizing private expertise and investment, Public-Private Partnerships (PPPs) can accelerate the development of a public asset or service. This model is enjoying continued success on the African continent, particularly in the energy sector.

Despite the popularity of the PPP model, it contains various pitfalls in its economic design, which States can guard against by relying on adequate preparation, especially to harmonize the incentives of the parties, to ensure consistency between the risk carried and the remuneration expected by the private partner, and to promote competition and transparency around the PPP.

FTI Consulting has carried out numerous assignments with public agencies and African governments on all phases of PPPs in the gas, power and renewable energy sectors, on greenfield and brownfield projects. We summarize here some of our experience, mainly for public entities, in order to support a better understanding of the economic regulation issues applicable to PPPs.

Definition and objectives of the PPP

A Public-Private Partnership is a long-term contract between a private party and a government (or governmental entity) for the development of a public asset or service, in which the private party bears a significant portion of the risk and responsibility, in return for a performance-based fee.1

In the case of infrastructure PPPs, the private party is generally responsible for the construction, operation and maintenance of the assets.

The PPP model is a way for African States to attract (i) the expertise of private companies specializing in infrastructure, and (ii) the capital needed to carry out large-scale projects.

Status of PPPs in Africa

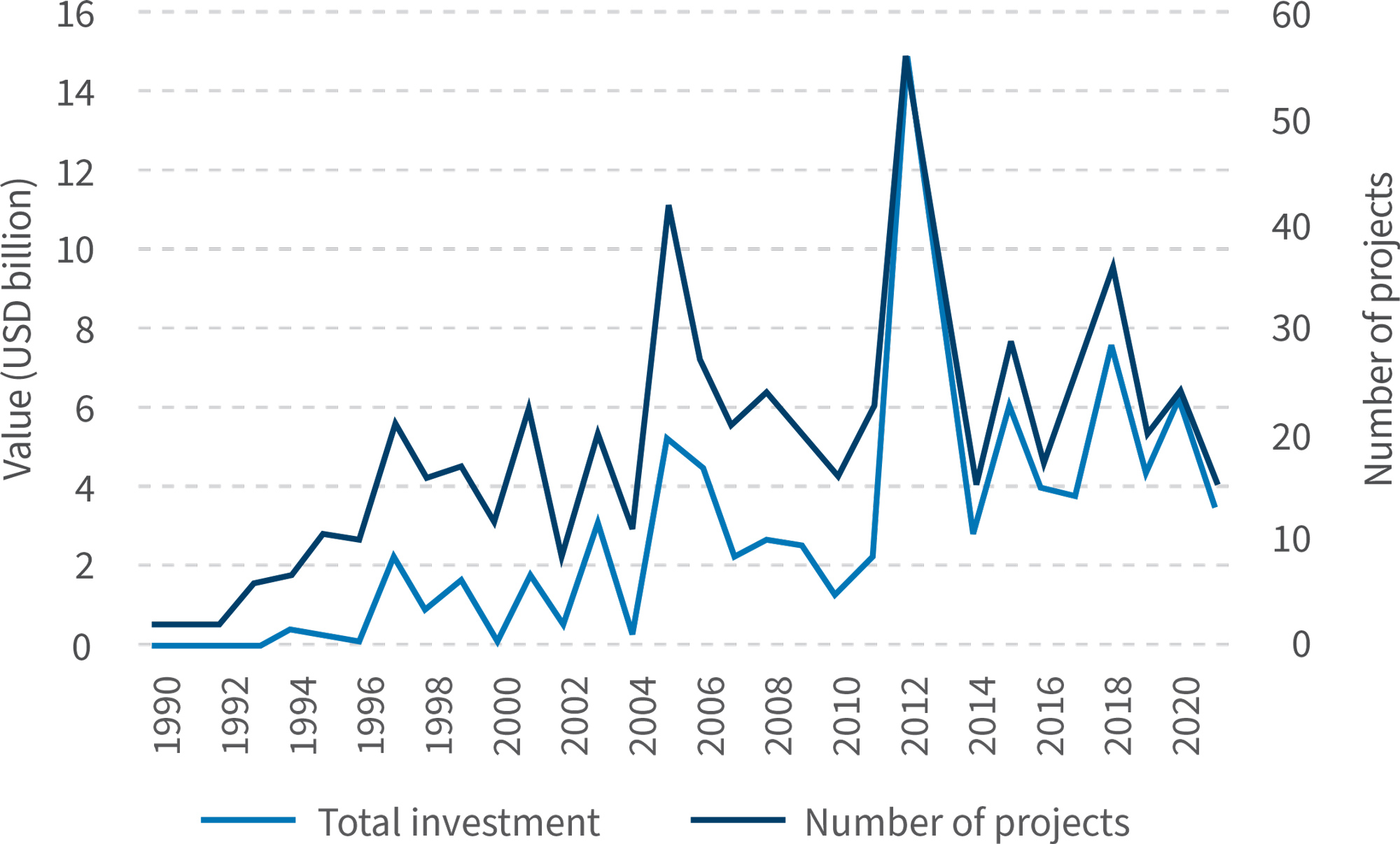

The number of PPP projects and the amounts invested in Africa have been growing, with an irregular acceleration since the late 1990s, especially in sub-Saharan Africa (see Figure 1). By 2021, 45 out of 48 sub-Saharan countries had already implemented at least one PPP. However, the number and total investment in PPPs remain heavily concentrated in the most advanced economies.

Figure 1: Evolution of PPP investments in sub-Saharan Africa (in value and volume)2

Some barriers to PPPs persist, such as a possible economic development fragility, political instability, and administrative capacity that can be limited. By 2021, 30 percent of Sub-Saharan African countries had concluded no more than three PPPs.

Of the $101 billion invested in PPPs in sub-Saharan Africa between 1990 and 2021, three countries together account for half: South Africa ($27 billion), Nigeria ($14 billion) and Ghana ($10 billion).3

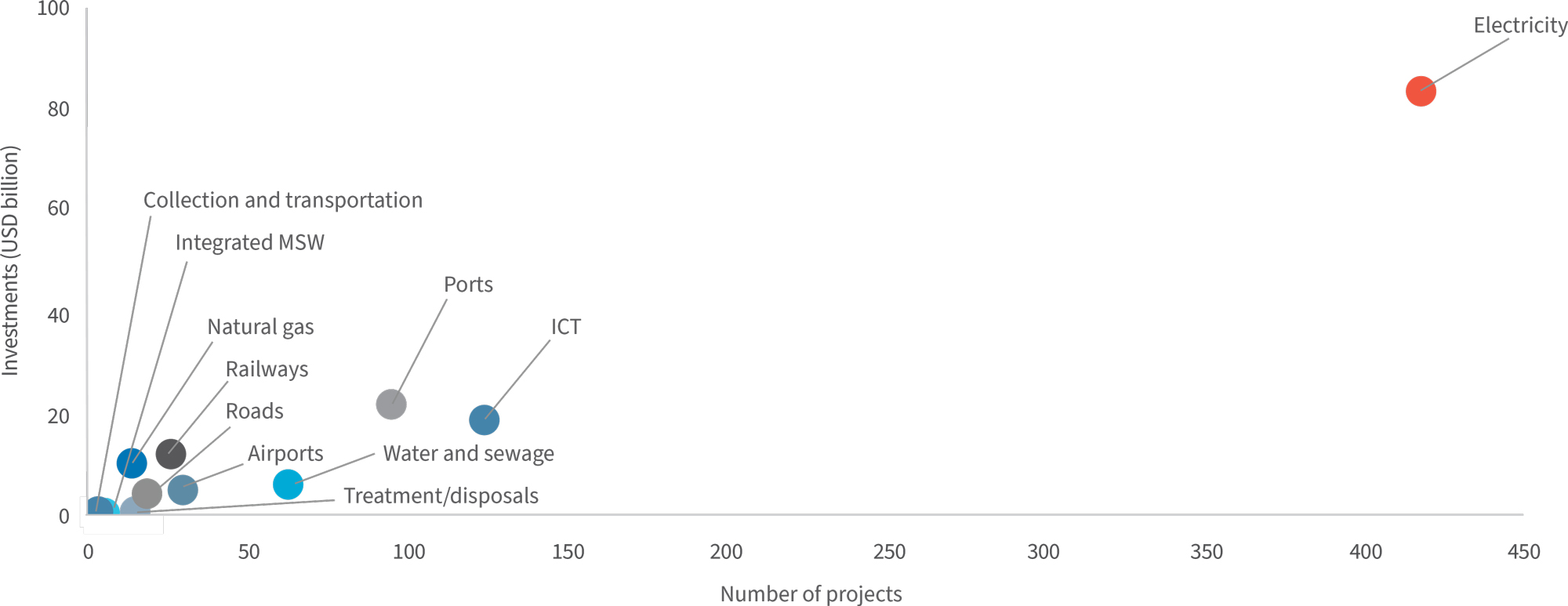

The energy sector has become a major one to the PPP market in sub-Saharan Africa, accounting for 52% of the number of PPPs completed since 1990 (see Figure 2).

Figure 2: PPPs in sub-Saharan Africa by sector since 1990

Despite efficiency gains, energy demand in African economies is expected to double by 2040 due to population growth and improved quality of life.4 As a result, household and industrial electricity demand on the continent is expected to increase from 679 TWh 2018 to 2,281 TWh in 2040, a growth of 236%.5

To meet projected demand, investment in the African energy system must, according to IRENA, double by 2030, from the current level of about $30 billion/year to $40 -65 billion/year. Investment levels should then continue to grow, reaching $120 billion/year from 2030 to 2050.6

Energy PPPs in Africa are already largely driven by the strong growth of renewable projects. Indeed, from 2010 to 2020, the African continent has attracted a total of nearly $55 billion in renewable energy investment, with average annual investment almost quadrupling from $1.3 billion in 2010 to $5.1 billion in 2020.7

Of all the continents, Africa has the most abundant renewable energy resources, with a theoretical onshore renewable energy generation potential of 2.4 million TWh/year from existing technologies, thus a potential more than 1,000 times the projected 2040 demand of 2,281 TWh. Solar photovoltaic forms more than half of the generation potential, with 1.4 million TWh/year possible in 2040.8

However, investments needed to meet the growing demand for renewable energy in Africa are far greater than the funds available from public sources. By creating stable and predictable frameworks, identifying a pipeline of viable projects, and providing targeted risk mitigation instruments, though African governments can attract financial partners and facilitate the implementation of PPP projects to capture the potential for energy generation and meet this future demand.

Design of the regulatory framework

Monopoly inefficiency

Through PPP, the infrastructure operator is often a quasi-monoply, de facto (natural monopoly)9 or de jure (exclusivity granted by the State). The operator therefore has significant market power, which is generally associated with suboptimal results for consumers. Indeed, since the producing company is in a situation without competition, the incentive to innovate and optimize the costs and quality of its product is reduced. These approaches require investments and risk-taking, which are superfluous for the monopoly in the absence of a competitive threat or substitution.

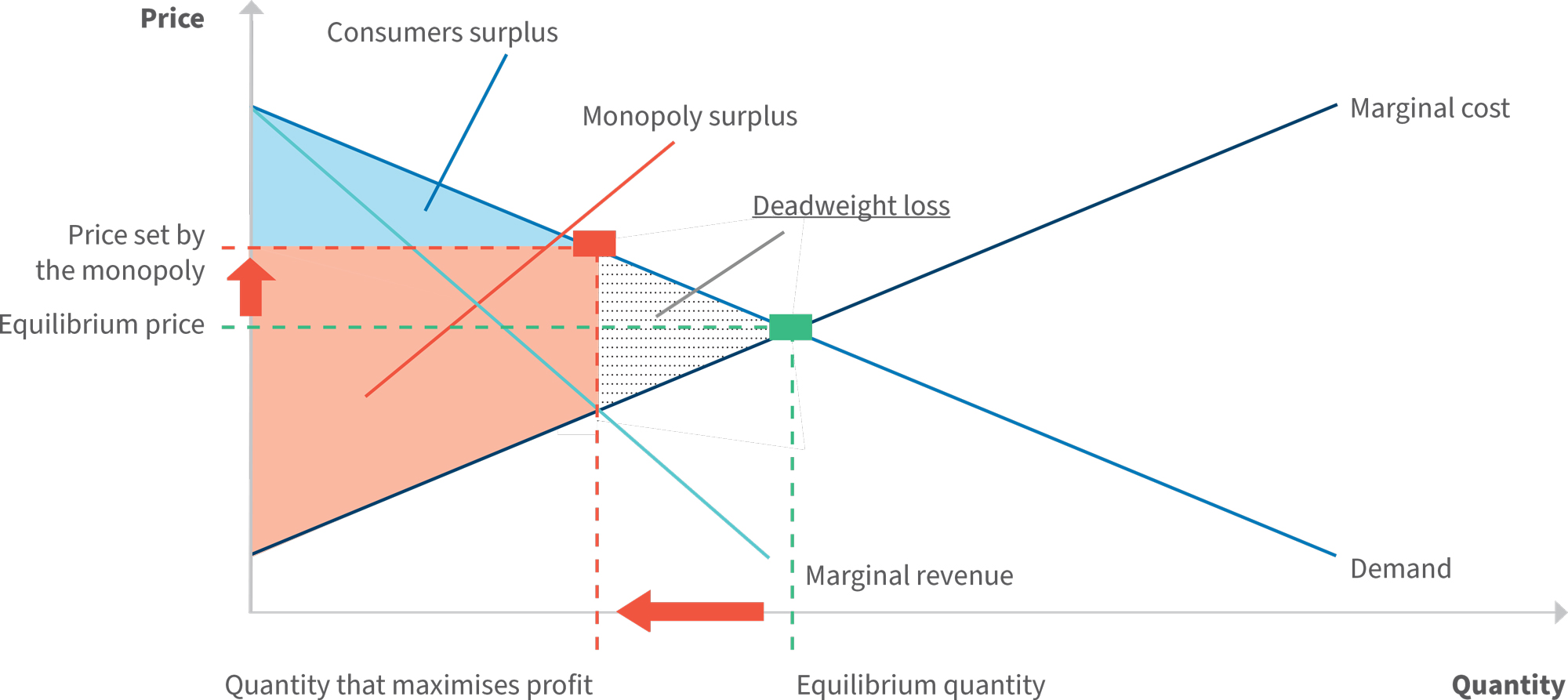

Moreover, without regulation, the profit-maximizing producer firm will tend to set a price higher than the price of the product that would have resulted from a competitive market. Indeed, compared to a competitive market situation, consumers would overpay the product, and a part of the consumers do not buy it because of the high price. These consumers are therefore excluded from the market, leading to a deadweight loss, i.e., a reduction of the combined surplus of the firm and the consumers, and therefore in economic efficiency (see Figure 3).

Whereas in a situation of perfect competition, the quantity sold corresponds to that which equals the price to the marginal cost of production. This equilibrium price, lower than the monopoly price, allows more consumers to have access to the product or service, increasing their surplus,10 but reducing the firm’s surplus, i.e., its profit. Despite this decrease in earnings, perfect competition maximizes the combined surplus of the firm and consumers, while allowing the maximum number of consumers to be served, without creating a loss for the firm.

Figure 3: Monopolistic situation leading to a deadweight loss of benefit11

Solutions provided by economic regulation

Economic regulation aims to replicate the benefits of competition and align operator incentives with those of the consumer in markets where competition is lacking, as is generally the case for energy producers, network and infrastructure operators, which are often natural monopolies in Africa.

To achieve these objectives, regulations typically focus on (1) price controls and/or (2) service performance criteria.

In the first case, to replicate market efficiency, the costs paid by consumers should represent the operator’s efficient costs plus a margin reflecting the remuneration demanded by investors for the risk-taking and know-how actually engaged (without monopolistic over-profit). Indeed, in a competitive market, a supplier who charges a higher price would lose his customers to other suppliers who would align themselves with the standard remuneration conditions.

In the second case, the company’s remuneration should be partially linked to the quality of service. In a competitive market, a decrease in service quality would lead to a drop in price to reflect the lower value of the product for the consumer (propensity to pay) compared to what the competitors offer.

Lastly, the PPP regulation framework determining the allocation of risk between government and investor can significantly influence the total price paid by the consumer. The valuation of risks may indeed differ between the State (as representative of consumers) and the investor, given their different risk management leverages, but also because of different valuation approaches, particularly for risks whose carrying cost would not be determined in competitive markets such as insurance or financial products.

As a result, it is generally considered more efficient to have investors bear risks that they can manage, and that are likely to be quantifiable or limited, limiting a possible drift upward in the price of risks between (i) the operator and (ii) the State or the consumers, that would increase the total costs carried by the taxpayers or consumers. Finally, for emerging countries, it is generally necessary to match the sophistication of the regulatory framework to the resources and expertise of the regulator expected in the medium term, in order to ensure effective and balanced management of the PPP.

According to the African Development Bank, 79% of the African countries studied have a low or intermediate level of regulatory development in the electricity sector, indicating that the regulation of the electricity sector has yet to be further developed.12

Economic regulation models

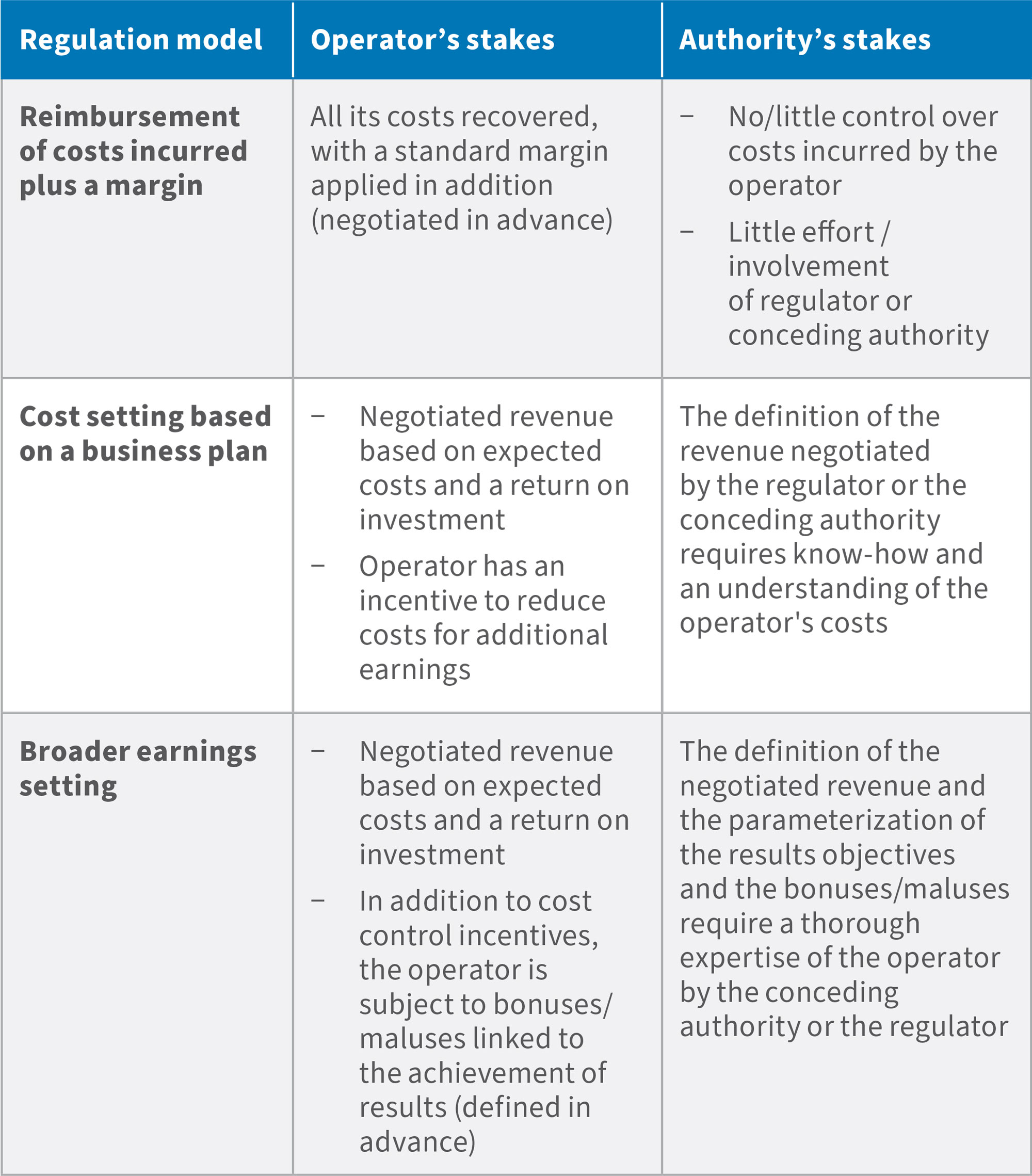

The existence of different levels of regulatory sophistication may involve a calibration between the level of sophistication possible and the human resources available to the government to apply the regulation. Three typical models of regulation for energy and infrastructure companies can be applied, with different properties, different challenges for the operator and the regulator, and different levels of sophistication: (i) reimbursement of costs incurred plus a margin (the so-called “cost-plus” model), (ii) cost setting based on a business plan, and (iii) broader earnings setting.

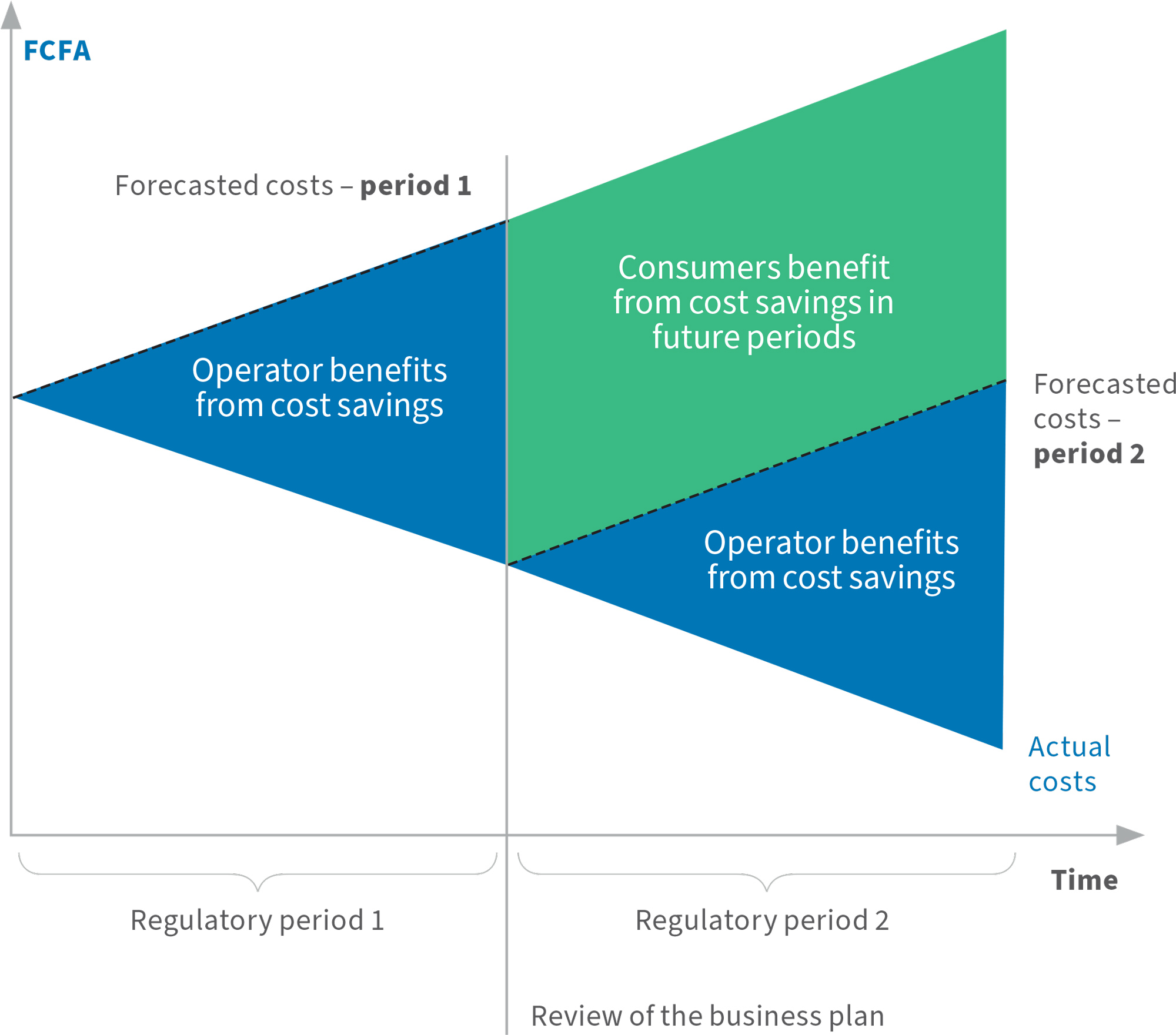

Periodic recalibration of the remuneration allows for savings to be made and for the objectives and incentives to be redefined as best as possible. Incentive regulation is based on the definition of an ex-ante tariff income and implies a dynamic vision allowing regular cost reductions.

Based on a review of the costs actually incurred by the operator and their comparison with previous business plans, the State may propose revisions to the new business plan covering the next period. This system creates a virtuous circle: the operator has an incentive to reduce its costs in the short or medium term to improve its financial performance by spending less than the business plan and thus receive a bonus corresponding to a percentage of the savings achieved (see Figure 4).

Figure 4: Revision of the business plan between the three-year regulatory periods in Ivory Coast13

To implement this periodic regulation, the authority must be willing to forego short-term gains in order to gather the most detailed information possible. In the first regulatory period, the operator benefits from cost savings while the authority receives information, allowing it to get greater future gains through the revision of the operator’s business plan and incentives. Regulation must be calibrated accordingly to help reduce information asymmetry and protect long-term gains.

However, a regulation imposing a heavy administrative burden, including the requirement for transparent and detailed accounting and projections, is inappropriate in situations where the regulator’s capacity and resources are limited.

Thus, intermediate sophistication may be more appropriate than a broader focus, reducing the risk of poor implementation while achieving the main benefits of regulation for consumers.

Contracting and risk allocation

Risk types and allocation

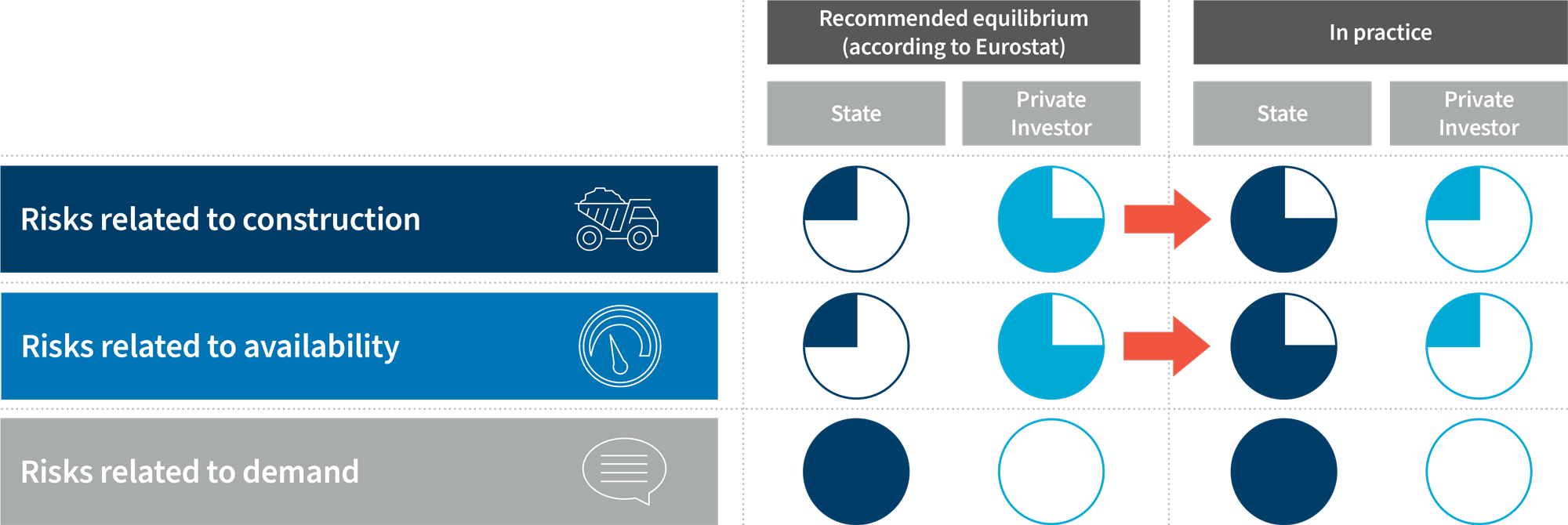

Three main categories of generally co-existing risks of infrastructure projects:

- Risks related to construction: events related to possible difficulties encountered during the construction phase and due to the state of the property(ies) concerned;

- Risks related to availability: events where the operator’s responsibility is called into question because of poor management (“poor performance”); and

- Risks related to demand: the variability of demand, regardless of the operator’s performance.

In our experience, the distribution of risks between the State and private investors is often unbalanced, to the detriment of the State (see Figure 5).

Figure 5: Risks allocation for an infrastructure project14

These project risks are shared between the parties, operator/investor and State, who accept and manage them or transfer them to third parties (insurers, financial derivatives, etc.).

Remuneration

In a PPP, the State and the private investor maximize their divergent economic benefits, a remuneration for the investor and the economic and social benefits of the project for the population.

Indeed, for the State, PPPs are usually launched to achieve public goals and the government mainly measures the performance of the PPP via the fiscal benefits and the positive social and economic externalities (jobs, economic development of a region, energy security, etc.).

For the private investor, a PPP represents a remuneration opportunity for the risk taken by equity investment in the project.

For both the government and the private investor, the benefits and remuneration should reflect the residual risks (i.e., the risks that have not been transferred to third parties) that they bear. And, all other things being equal, an increase in residual risk should lead to a mechanical increase in benefits or remuneration.

The Internal Rate of Return (IRR)15 is an indicator of the financial profitability of the investment and therefore reflects the return expected by the private investor.

It must reflect the economic context of the project, particularly the risks carried by the parties. In the case of public investment in the project, the State also measures the financial performance of the project via the IRR, that should also reflect its level of residual risk.

The definition of the IRR of a project before the investment execution is a key negotiation parameter that allows the relationship between the risks and the remuneration of the parties to be calibrated. As explained, the financial remuneration should in principle be positively correlated to the level of risk. A high IRR should therefore reflect a high level of risk-taking.

In practice, the public authority can estimate the impact of risk allocation on the IRR using an empirical approach. The authority can perform benchmarks of comparable projects, selecting them for their operational similarities and for similar risks allocation. For each comparable project in the sample, it is theoretically possible to determine an IRR adjusted to the economic conditions of the country of the target project, allowing to produce an average IRR adjusted to the countries’ economical conditions from an international benchmark.

The selection of the private partner

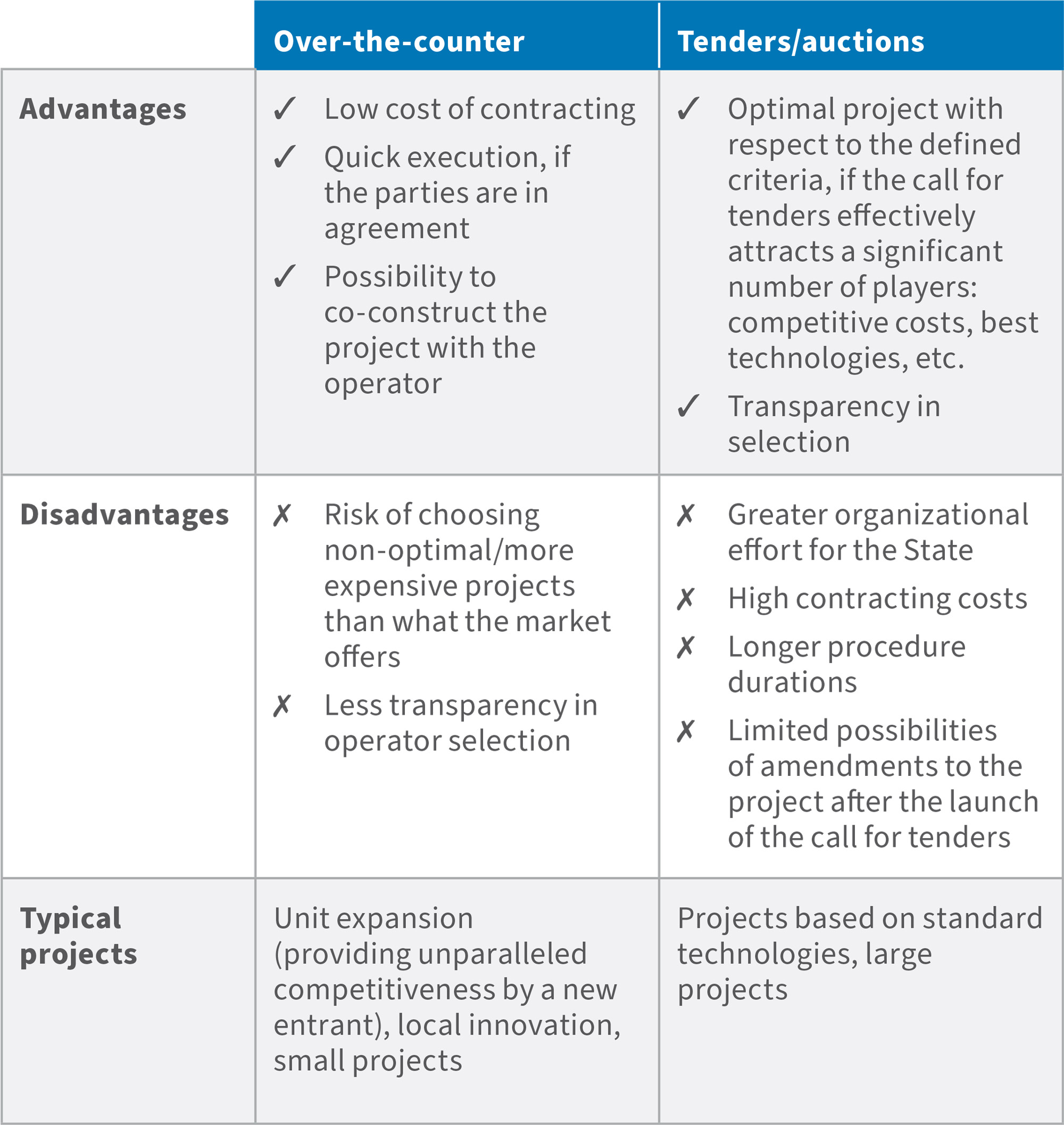

There are two ways of contracting for a PPP: over-the-counter (direct contracting) and tenders, each of which has advantages and disadvantages that make it suitable for different circumstances.

An over-the-counter contract is made by negotiation between the two parties, the government and the operator, to reach an agreement.

In contrast, a tender is a contracting procedure with little negotiation, where, through a competitive bidding process, the State selects the most suitable offer, based criteria and objectives defined beforehand.

The tender follows a structured and transparent process that leads to the selection of the supplier. The process requires establishing a team dedicated to managing the tender. Supplier selection is, a priori, based on transparent, impartial and quantifiable criteria, following a two-step process: evaluation of the technical proposal and evaluation of the financial proposal. Each evaluation criterion should be based on a systematic and transparent approach through which each bidder is treated equally.

Organizing tenders is generally more efficient contracting over-the-counter for selecting optimal projects but implies a more time-consuming and costly contracting process for the State party. The bidding and auction process is therefore best suited for projects based on standard and large-scale technologies, while the direct contracting process should be preferred for unit extensions, local innovations, and small projects.

Economic regulation

FTI Consulting’s areas of expertise

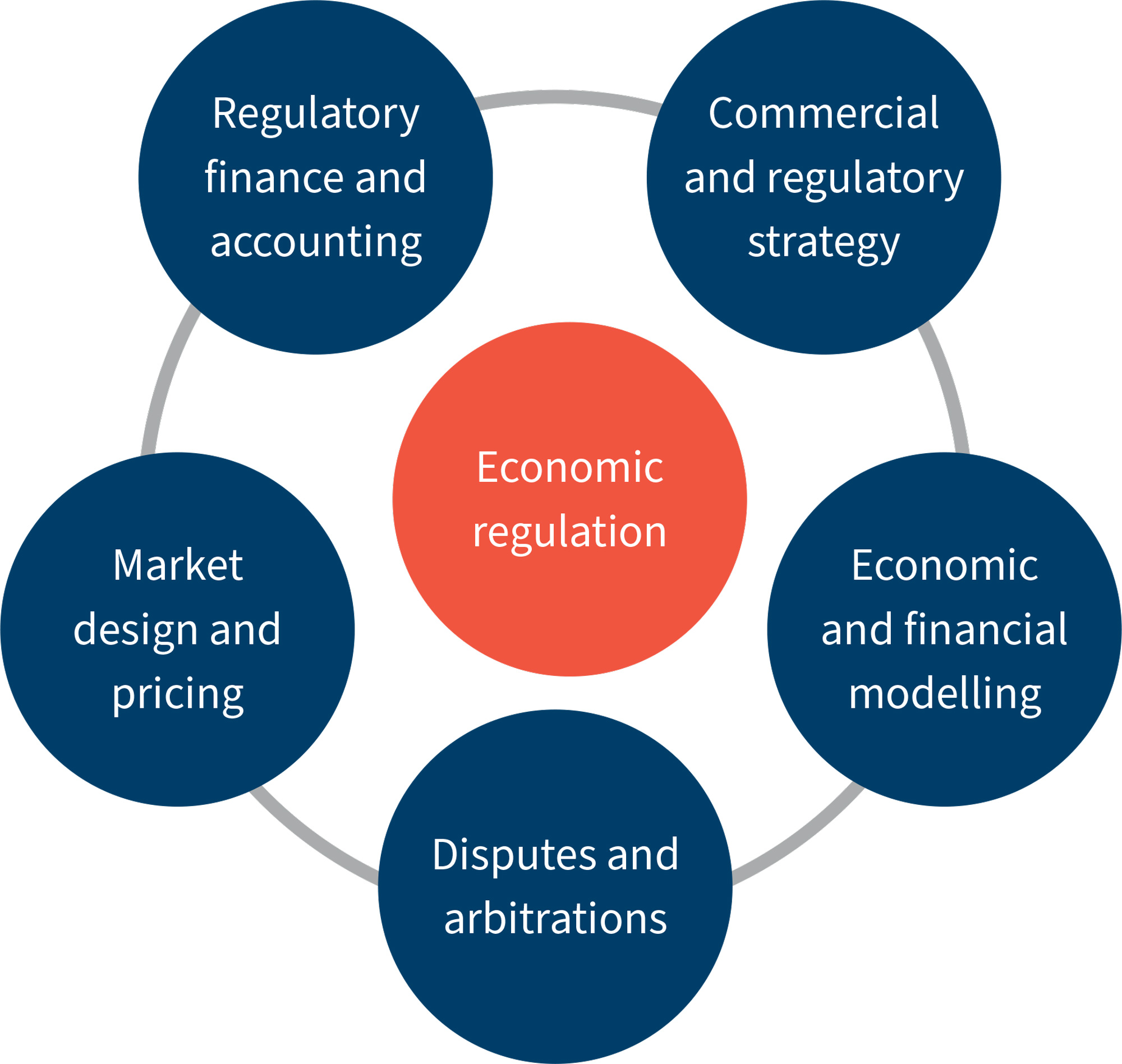

FTI Consulting’s economic regulation experts bring their know-how to governments, regulators, as well as companies and their investors in building economic regulation schemes that provide operational efficiency, investment incentives, competition, investment and quality of service.

FTI Consulting’s economic regulation experts bring their know-how to governments, regulators, as well as companies and their investors in building economic regulation schemes that provide operational efficiency, investment incentives, competition, investment and quality of service.

Our team is composed of a diverse mix of experts (former regulators, regulatory economists, engineers, and highly qualified academics who have conducted leading research in their fields) bringing many years of sector expertise. Our economic regulation team offers unparalleled academic rigor, combined with extensive practical experience in multiple languages, to drive regulatory innovation, particularly in Africa.

Footnotes:

1: https://www.sciencespo.fr/executive-education/partenariats-public-prive-definition-et-mise-en-oeuvre

2: World Bank PPI Database. Across the African continent, $155 billion was invested in PPPs between 1990 and 2021.

3: World Bank PPI Database.

4: Sub-Saharan Africa is expected to see its population increase by 1 billion while North Africa by 100 million.

5: The Renewable Energy Transition in Africa, IRENA, 2020.

6: Five-year rolling average.

7: World Bank PPI Database.

8: The Renewable Energy Transition in Africa, IRENA, 2020.

9: The size of some markets and the necessary infrastructure investments may lead to a situation where it is more advantageous for production to be carried out by a single company, without duplication of infrastructure and with significant economies of scale, leading to the “natural” appearance of a monopoly.

10: Gain realized by the consumer in case of purchase of competitively priced product.

11: FTI analysis.

12: African Development Bank Group, Electricity Regulatory Index for Africa 2021.

13: Triennial Review Program implemented by the Ministry of Energy of Côte d’Ivoire and the Ivorian Electricity Company.

14: Manual on Government Deficit and Debt - Implementation of ESA 2010, Eurostat, FTI analysis. The area of the sphere represents the proportion of risk borne by each party. In practice, the government bears the majority of the risk, although the recommended balance is reversed for construction and availability risks.

15: The Internal Rate of Return (IRR) is the discount rate that leads to a zero net present value of the project, and is one of the main tools for investment decisions, indicating its expected profitability.

Published

October 14, 2022

Key Contacts

Key Contacts

Senior Managing Director