Bahrain Introduce 15% Domestic Minimum Tax

From 1 January 2025, in Line With OECD’s Global Minimum Tax Rules

-

October 08, 2024

DownloadsDownload Article

-

The Kingdom of Bahrain recently released Decree Law 11 of 2024 (‘the Law’) introducing a 15% domestic minimum top-up tax (“DMTT”) on specified Bahrain entities which are part of large multinational enterprise (“MNE”) groups. The Law does not apply to foreign subsidiaries of a Bahraini headquartered group or other foreign group companies that are part of the same MNE Group. Such non-bahrain entities may well get covered under implementing Global Minimum Tax (“GMT”) legislations of other countries.

The DMTT Is Effective From 1 January 2025 Onwards

The Law is a complete legislation implementing DMTT, largely based on the OECD’s Model GMT Rules1 in terms of levy and computation of DMTT, certain exclusions and safe harbour reliefs. Additionally, the Law contains specific provisions on procedures, enforcement and anti-avoidance measures applicable in Bahrain. The Executive Regulations to the Law are expected to be issued to provide detailed guidance related to the implementation of the Law based on OECD Model rules and related commentary on the GMT Rules.

Key Aspects of the Law:

- DMTT applies a 15% tax (ie minimum rate of 15% less effective tax rate of Bahraini subsidiaries/ joint venture (“JV”) which is currently 0%) on the taxable income of a Bahrain entity (including permanent establishment, JV, and JV subsidiaries) which are part of a MNE group with annual consolidated revenue exceeding €750 million for at least two out of the four preceding fiscal years (‘Revenue test’).

- DMTT is not applicable to an ‘Excluded Entity’ as specified (i.e. a government, international organization, non-profit organsation, pension fund, investment fund that is the ultimate parent entity, or subsidiaries of the above in specific cases). Nevertheless, such an excluded entity’s revenue is counted for the Revenue test as discussed above.

- The taxable income is stated as the financial accounting net income or loss for the fiscal year before making any consolidation adjustments eliminating intra-group transactions, in accordance with the local accounting standards. Detailed rules on the computation of taxable income will be prescribed in line with the OECD Model GMT Rules.

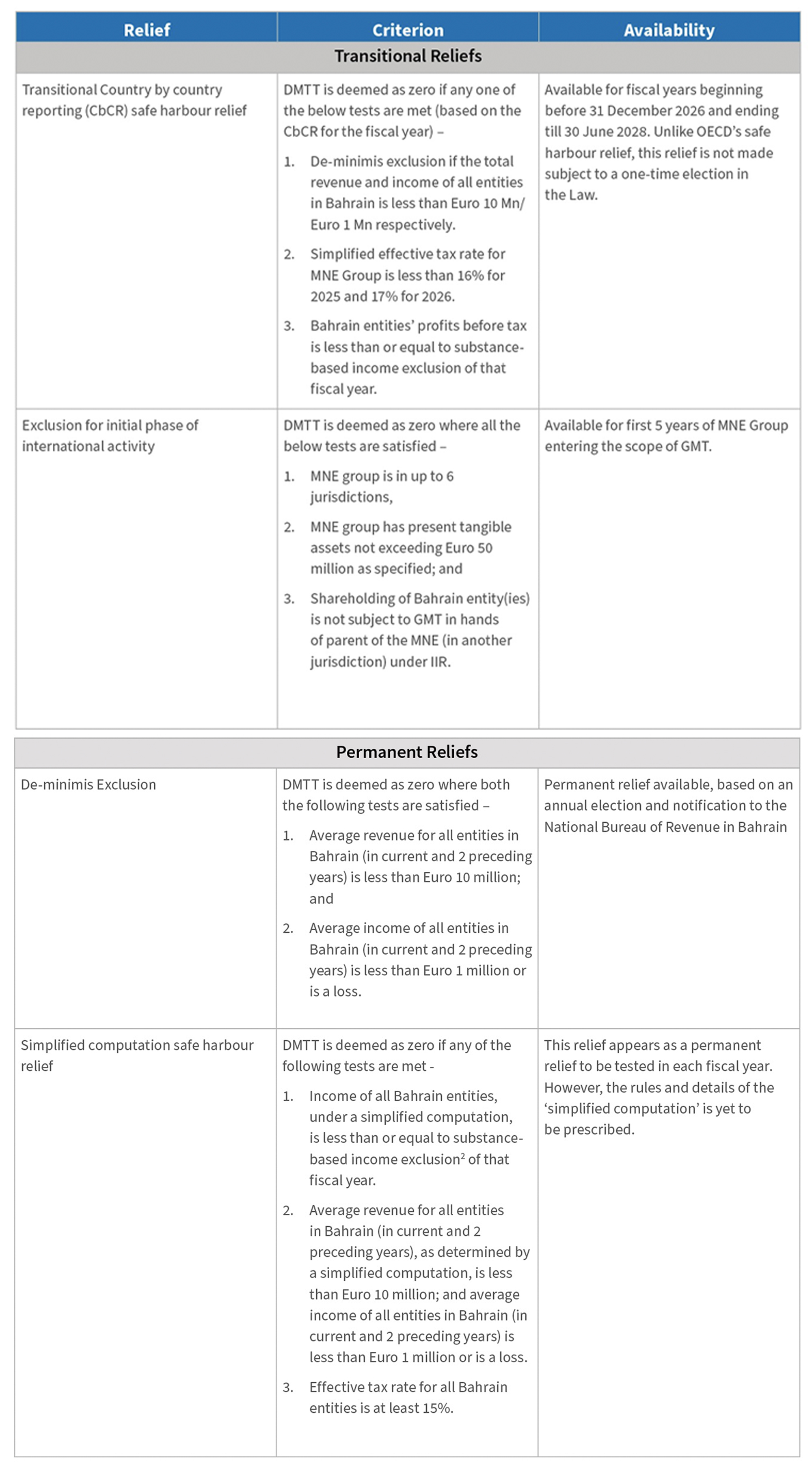

- Specific reliefs from the levy of DMTT are as below:

- Several compliance obligations are specified including obtaining a registration, filing of annual tax return, payment of tax in advance over the relevant fiscal year. These compliances are expected to be in addition to the notifications/ filings as required under the OECD Model GMT Rules as maybe applicable to the MNE Group on an overall basis.

- The Law provides for specific provisions on enforcement via conduct of tax audits, assessments and procedure in relation to litigation and appeals. A Tax Objection Committee will be formed for the purpose.

- Specific penal consequences are laid out in case of defaults like failure of obtain registration/ filing tax return/ submitting incorrect data/ payment of tax. Such default may trigger stringent administrative fines (without prejudice to criminal liability).

- A General Anti-avoidance Rule empowers the National Bureau of Revenue from disregarding any transaction/ arrangement if it’s not genuine or its primary purpose is to obtain a tax advantage against the objective of the Law. Further, the Law specifies certain acts to qualify as ‘tax evasion’ resulting in onerous consequences including criminal liability for the management of legal persons, if held responsible for such evasion. Dispute resolution through a settlement process is acknowledged.

- Detailed rules, controls and manner of calculation and application of DMTT will be prescribed in the Executive Regulations (yet to be issued), in a manner consistent with OECD Model GMT Rules, guidance and commentary therein.

Key Takeaways

The new DMTT is a significant milestone in the middle east with Bahrain emerging as front runner to implement the GMT on large MNEs (though partially by taxing its local entities only). This tax underscores Bahrain’s commitment as part of BEPS inclusive framework (“IF”) to address base erosion and profit shifting by MNE.

Since the Law is effective from 1 January 2025, one may expect the detailed rules to be published in the coming months. It now becomes imperative for MNEs to assess the impact of the DMTT on the Bahrain presence, evaluate availability of any reliefs and prepare for the compliances to be undertaken, based on the Law/ read with the OECD Model GMT Rules which forms the foundation and basis of Bahrain’s DMTT.

The UAE had introduced GMT in the Corporate Tax law in December 2023 via Cabinet Decision No 60 of 2023, followed by a public consultation process undertaken in early 2024 for further implementation, but detailed rules are still forthcoming. With the Bahrain development, it will be interesting to see if other GCC countries, all of which are part of IF, will look to fast track the implementation of GMT rules in their jurisdictions.

It may be noted that the Law is published in Arabic and this update is based on an English translation of the law available in the public domain.

Footnotes:

1: Tax Challenges Arising from Digitalisation of the Economy – Global Anti-Base Erosion Model Rules (Pillar Two) (2021)

2: Substance based income exclusion is a deduction for routine profits that is computed by way of specific formula based on cost on tangible assets and payroll, as specified in the OECD rules.

Published

October 08, 2024

Key Contacts

Key Contacts

Senior Managing Director

Managing Director

Senior Managing Director

Senior Director

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About