The Halftime Report: Not a Barnburner, But Plenty of First-Half Action

-

August 12, 2024

DownloadsDownload Article

-

This year was set up for disappointment in restructuring activity, given high levels of Chapter 11 filings and debt defaults in 2023 — especially in 1H23 — as well as the resurgence of leverage credit issuance since late 2023 that has allowed many distressed companies to address near-term debt maturities or liquidity challenges without a formal restructuring event. Restructuring activity in 2024 is almost certain to come up short of last year’s high bar; the only question is by how much.

As it turns out, not by much — at least through the first half of this year. It was a busy first-half, despite the occasional snide remark from Petition that restructuring advisors have had ample time to shave a couple of strokes off their golf handicaps in recent months. But it hasn’t been crazy busy, and perhaps that has set off some discussion among various professionals about how to best describe the current state of activity in our market and the likelihood of a more subdued second half. Considering the torrid performance of financial markets and huge volumes of speculative-grade debt issuance in 1H24, the restructuring community should be more than satisfied with what it got, but enthusiasm seems to be lacking.

Relevant stats on restructuring activity in 1H24 consistently tell the same story across the board, indicating that such activity decreased moderately compared to a very active 1H23 but, all told, mostly showed improvement over 2H23, when restructuring activity slowed. To that point:

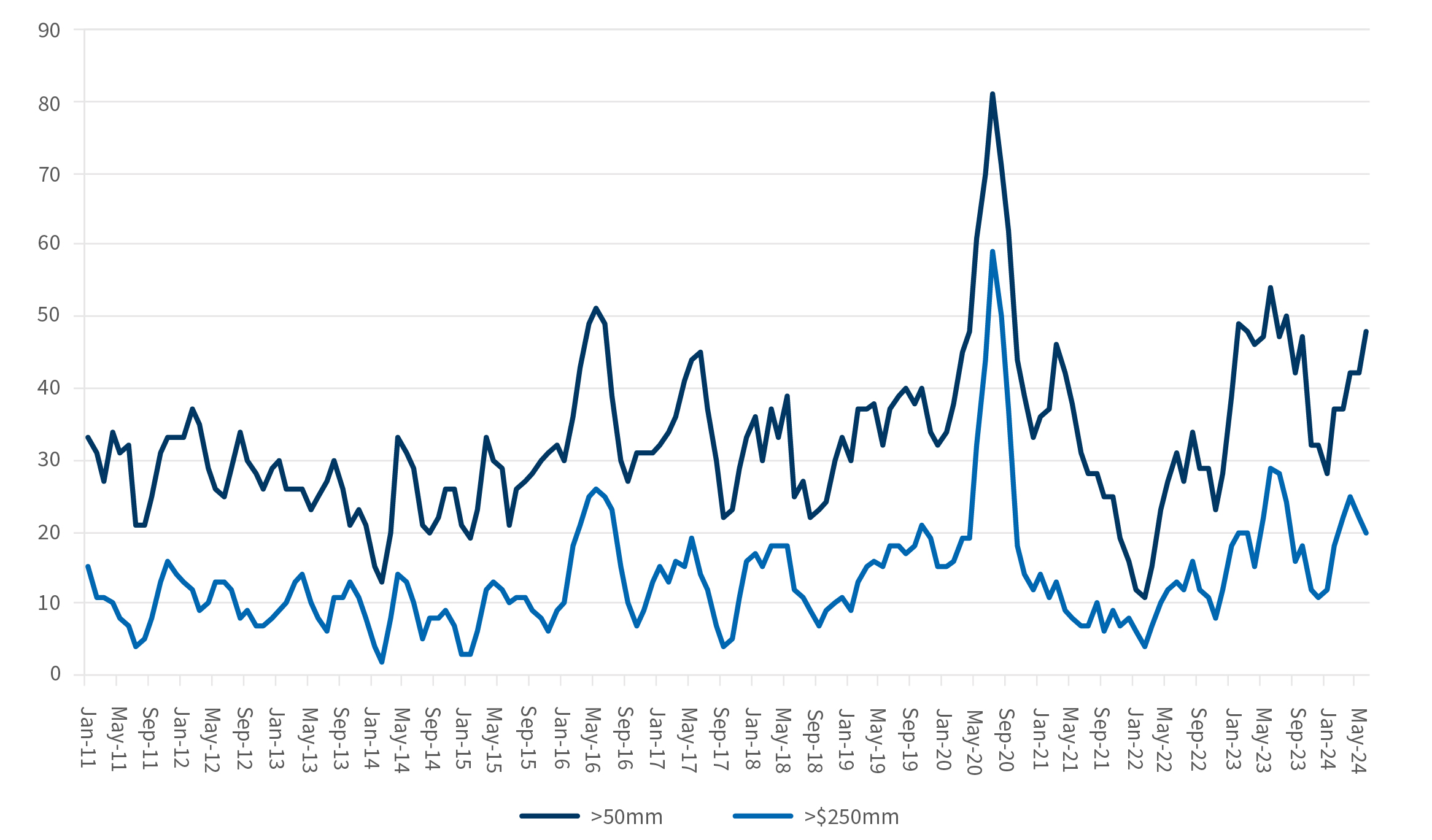

Figure 1 - Three-Month Rolling Chapter 11 Filings (Liabilities at Filing)

Source: The Deal and FTI Consulting analysis

- There were 85 large (>$50 million) Chapter 11 filings in 1H24 vs. 102 in 1H23, a 17% decrease, and 76 filings in 2H23. This included 23 filings registering above $1 billion in 1H24 vs. 20 in 1H23.

- Filing activity strengthened sequentially in 1H24, with 48 filings in 2Q24 vs. 37 in 1Q24 and 32 in 4Q23 (Figure 1).

- The average size of filers in 1H24 was nearly unchanged from those in 1H23.

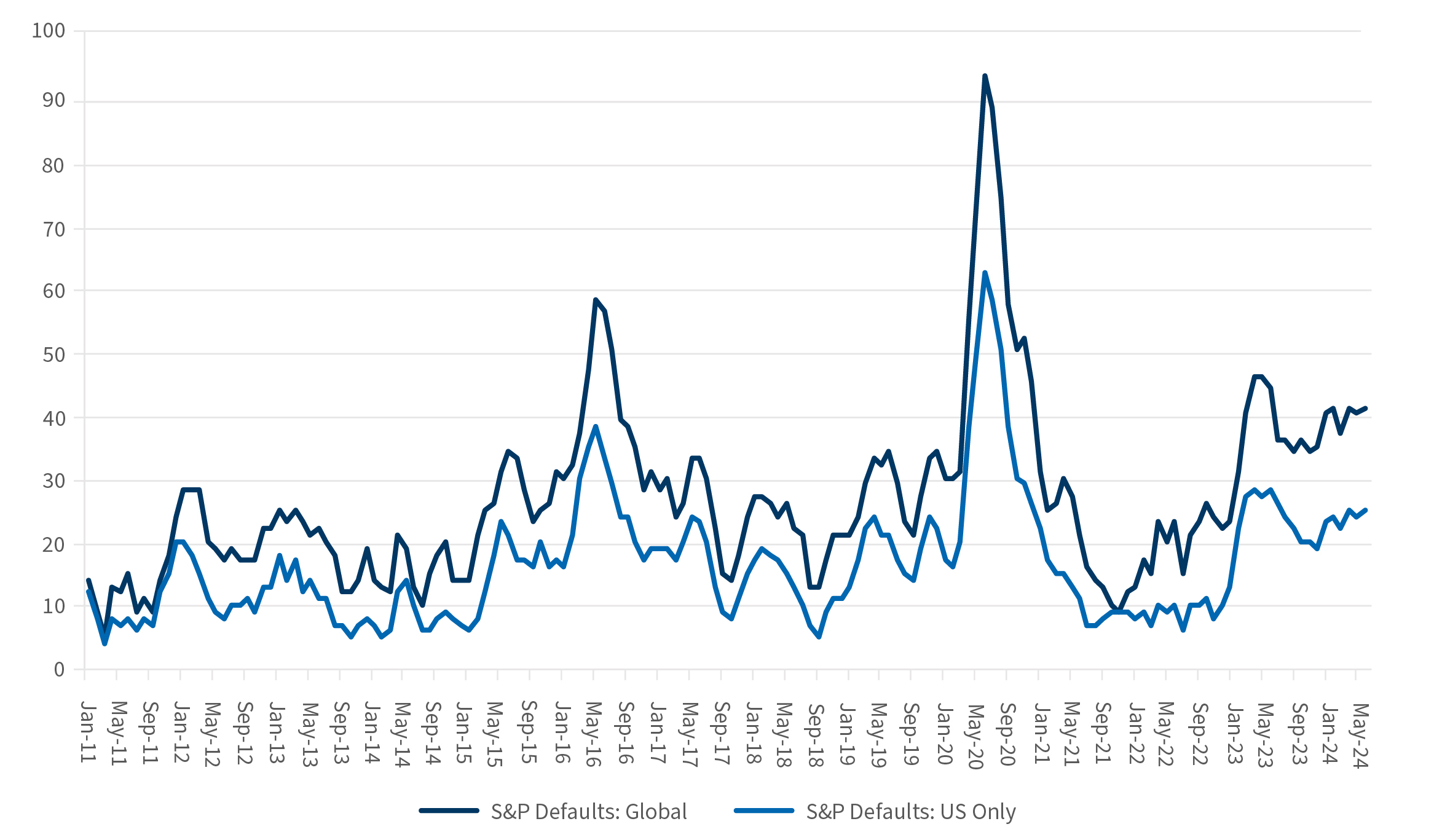

- There were 78 S&P-rated global debt defaults in 1H24 vs. 84 defaults in 1H23, a 7% decrease, and 69 defaults in 2H23.

- Default activity also improved sequentially, with 41 S&P-rated defaults in 2Q24 vs. 37 in 1Q24 and 35 in 4Q23 (Figure 2).

- Distressed debt exchanges accounted for one-half of all default events in 1H24, a trend that has continued since 2022, as bankruptcies and other types of formal restructuring events now account for less than a majority of total defaults.

- There were 47 S&P-rated U.S.-based debt defaults in 1H24 vs. 55 in 1H23, a 15% decrease, and 41 in 2H23.

- There were 261 new financial advisor mandates per Debtwire in 1H24 vs. 323 in 1H23, a 19% decrease, and 271 mandates in 2H23.

- Approximately 72% of all FA mandates in 1H24 were in-court cases and 63% were company-side representation vs. 85% and 66%, respectively, in 1H23.

Figure 2 - S&P Rated Spec-Grade Debt Defaults 3-Month Rolling Totals

Source: S&P Global Ratings Credit Research & Insights

All told, this was a respectably strong performance, with those 85 Chapter 11 filings in 1H24 representing the fourth-best first-half of the year since 2010, trailing only 2020, 2023 and 2016. Yet the mood seems more sober than celebratory these days among many restructuring professionals, who are skipping the high-fives, keeping their heads down and plowing ahead in search of deals with the expectation of slower times ahead. The rating agencies generally agree on that; they believe the speculative-grade default rate is peaking and expect it to moderate next year, but not dramatically. Should these forecasts prove accurate, a peak default rate of 5.0% or so would be disappointing news, but a prolonged and sustainable default rate modestly south of that mark, which is a reasonable expectation in this business environment, is hardly reason to be downbeat. A modest slowing of activity in 2H23 would still position 2024 as a solid year for restructuring.

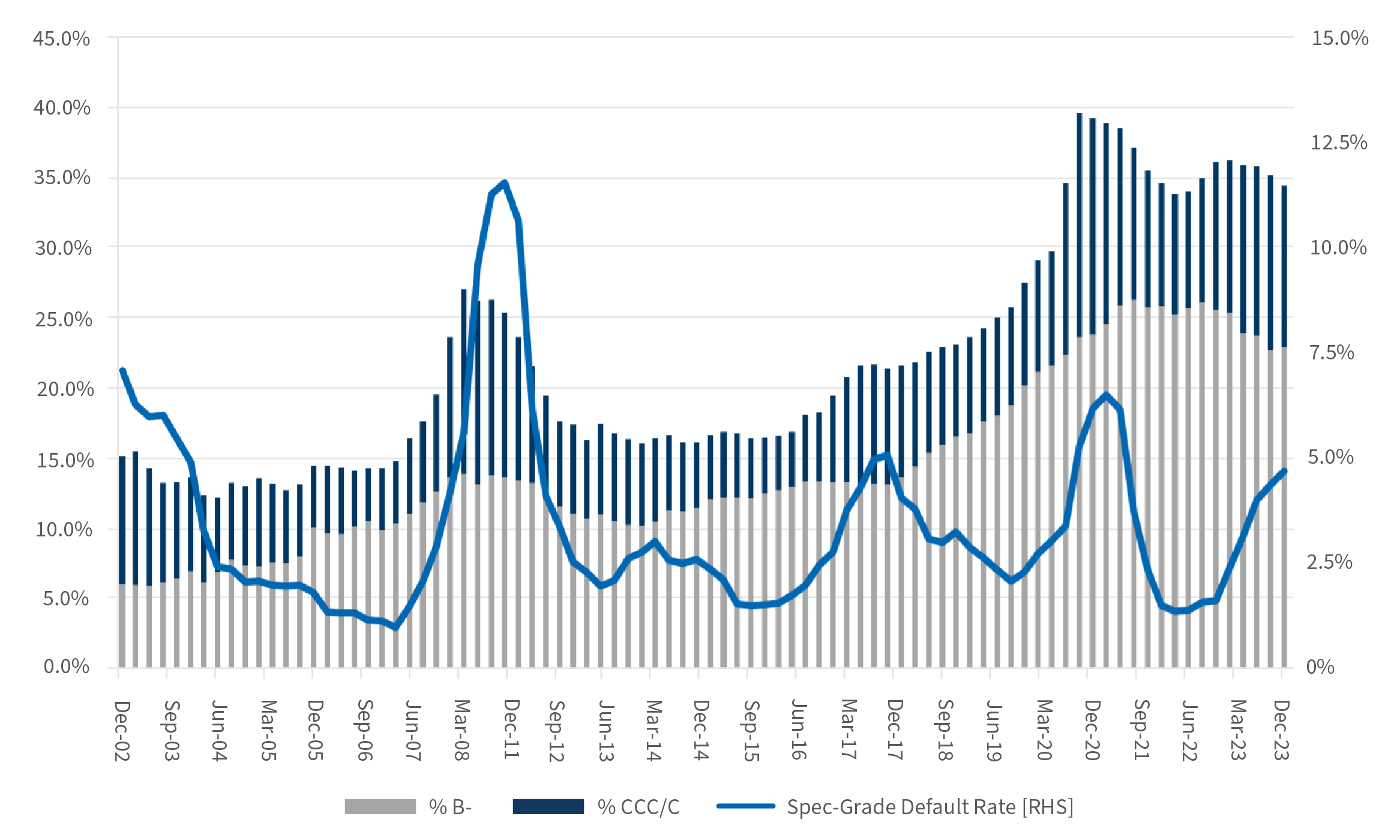

Surely the reopening of leveraged credit markets and the large number of distressed exchanges and liability management exercises (“LMEs”) done since mid-2023 has dampened formal restructuring activity and likely will continue to do so. But this reprieve has been extended mostly to BB/B issuers, while most deep junk (B- or worse) issuers still are challenged to raise capital or create financial runway. This is a large cohort, with some 35% of all U.S.-based speculative-grade issuers, or about 600 issuers, rated B- or worse by S&P, including nearly 120 issuers with ratings in the CCC/C bucket. The relative size of this deep junk cohort has shrunk slightly since the height of COVID-19 in 2020-2021 but, aside from that high-water mark, it remains far larger than at any other time this century (Figure 3) and represents a large pipeline of potential restructuring work.

Figure 3 - Distribution of U.S. Speculative-Grade Issuers (% of Spec-Grade Issuers)

Source: S&P Global Ratings Credit Research & Insights

“Slow and steady wins the race” is a proverb that nobody really believes anymore. We’re not quite sure what race it is that “slow and steady” wins these days — not even a marathon for seniors. It effectively has been replaced by Mark Zuckerberg’s mantra, “Move fast and break things.” Collectively, we have less patience than previous generations had for gradualism or slower change. There’s a greater sense of urgency to effect change in many business-related matters — just consider the AI arms race, not just among developers but potential users too. We have become conditioned to prefer rapid movement, perhaps upheaval, if it facilitates a desired outcome, even if that path is hastier and riskier than deliberative change. However, sometimes you have little choice but to take it as it comes.

Veteran restructuring professionals are accustomed to long stretches of modest or meandering default activity punctuated by infrequent but intense default spikes that peak at levels far higher than what we have experienced since 2023, but then typically unwind within 12 months or so. That paradigm may be broken. Given the explosive growth of leveraged credit markets over the last decade, the ascendance of private credit, the extreme lengths that PE sponsors will resort to in their efforts to protect teetering investments, and the reluctance of traditional lenders to foreclose on failing credits, the days of intense but short-lived default cycles might be over, barring a cataclysmic event. Not even COVID-19 was up to that task. Instead, we might have to get used to a “slower and steadier” version of default cycles, and that’s okay. There are nascent signs the domestic economy is slowing, interest rates won’t be returning to the QE days, and it is still a target-rich environment of vulnerable companies out there — but it won’t happen as quickly or intensely as many of us would prefer. Ultimately, that may be a good thing.

Related Insights

Published

August 12, 2024

Key Contacts

Key Contacts

Global Chairman of Corporate Finance

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About