- Home

- / Insights

- / Newsletters

- / LATAM M&A Activity

LATAM M&A Activity

-

February 23, 2022

DownloadsDownload Newsletter

-

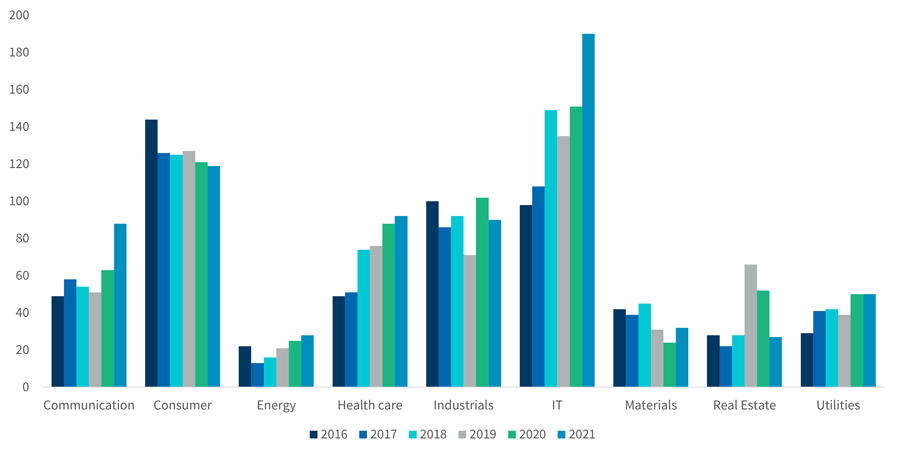

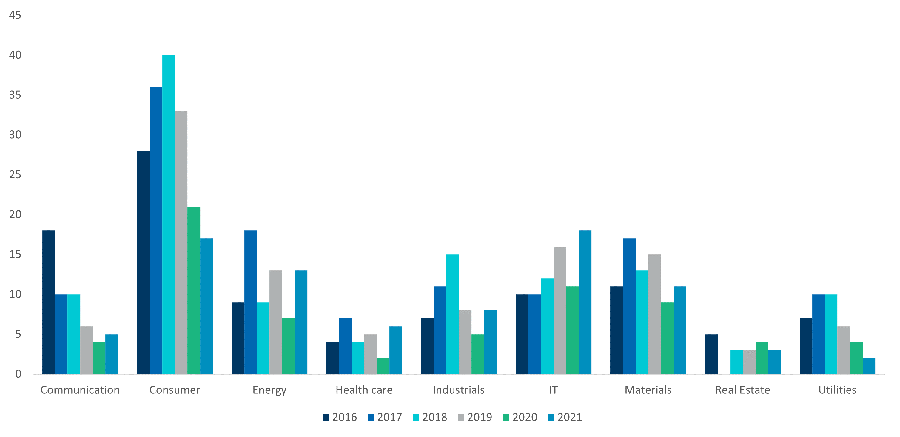

Exhibit 1 - Deals by Country

The M&A rebound of the latter half of FY20 continued its strong momentum in FY21, with deal activity (based on deal count) 15% higher than FY20 and representing the most active M&A year on record in the last five years (total deal count of 1,218). An abundance of liquidity coupled with increased risk appetite overshadowed potential social and political challenges across several markets in Latin America1.

A significant M&A recovery is noted in Mexico and Chile, where transaction activity in FY21 exceeded FY20’s levels by 53% and 34%, respectively. Mexico’s deal activity in FY21 reached 174 deals, which is above FY16 levels, the second highest for Mexico in the analyzed periods (160). Chile transaction levels (121) in FY21 eclipsed M&A activity over the last three years and hit levels not seen since 2017 (124). Both countries have benefited from significant activity in the Telecommunications, Media & Technology (“TMT”) and consumer sectors, which have benefited from an acceleration in digital transformation spurred by the pandemic.

While there has been investor concern about recent and expected election cycles around the region (particularly in Peru and Brazil, respectively)2, we note a significant level of M&A activity in Brazil as the deal count in FY21 reached the highest level in the last five years. Since 2016, Brazil has represented approximately 60% of total transactions across the countries included in our analysis.

Due to favorable demographics, increased digital adoption and supply chain opportunities, we expect deal activity to be robust in 2022 in spite of potential risks from the ongoing pandemic, tightening monetary policy in the United States and a potential economic slowdown in China3. We share more insight into each of the geographies in our coverage in the following pages.

Deal Activity by Country

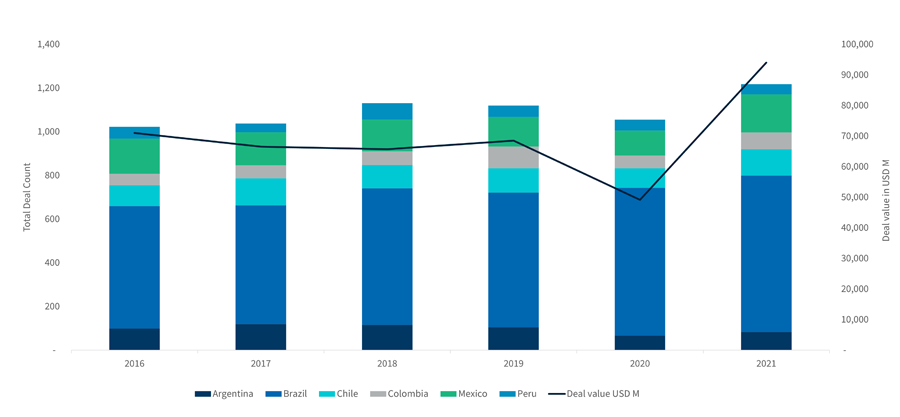

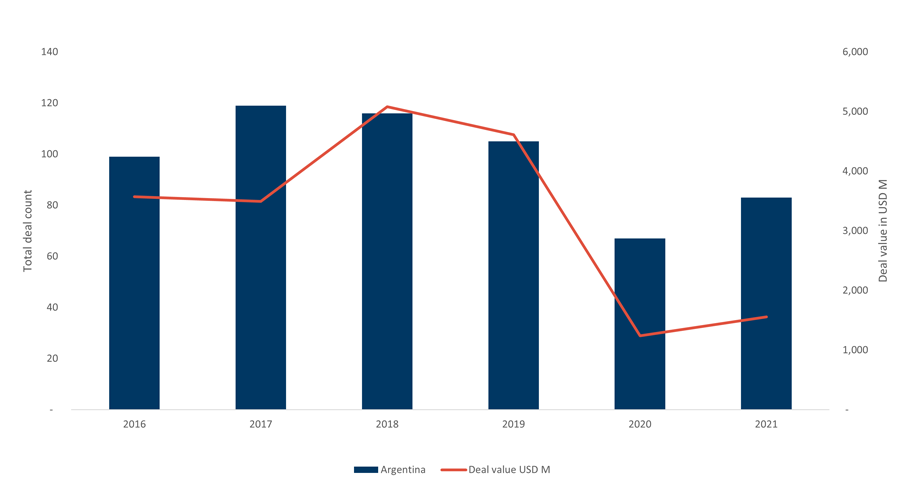

Argentina

Exhibit 2.1 - Deals Argentina

Exhibit 2.2 - Deals by Industry Argentina

Argentina’s transaction activity has been adversely affected by ongoing macroeconomic headwinds and debt restructuring. The country has experienced a significant contraction in deal activity over the analyzed periods. A prevalent trend over the last few years has been divestiture activity, which included the sale of Walmart’s in-country operations to Grupo de Narvaez in November 2020.

Brazil

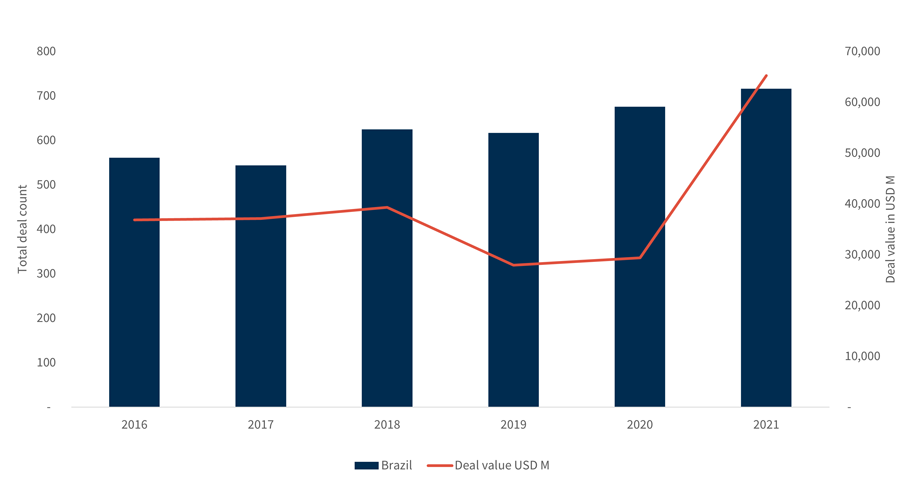

Exhibit 3.1 - Deals Brazil

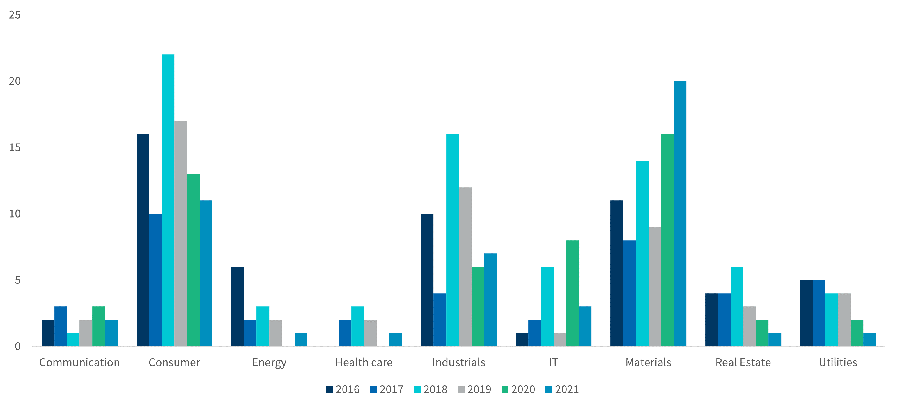

Exhibit 3.2 - Deals by Industry Brazil

Brazil enjoys the most developed capital markets in the region, which supports relatively elevated M&A levels. Brazil saw an increase in the number of transactions in FY21 driven by the IT, consumer, communication, health care, and industrials sectors. The relatively strong activity levels suggest investor appetite for the country has not been significantly affected by the looming election cycle.

Chile

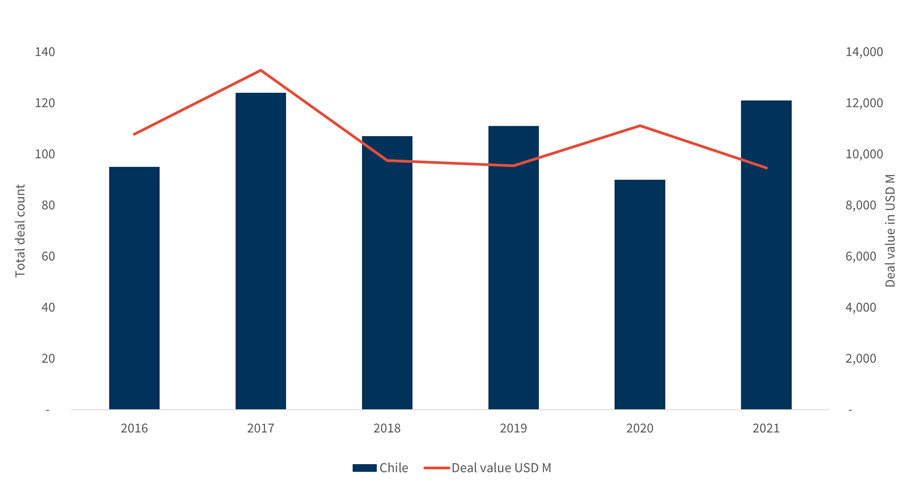

Exhibit 4.1 - Deals Chile

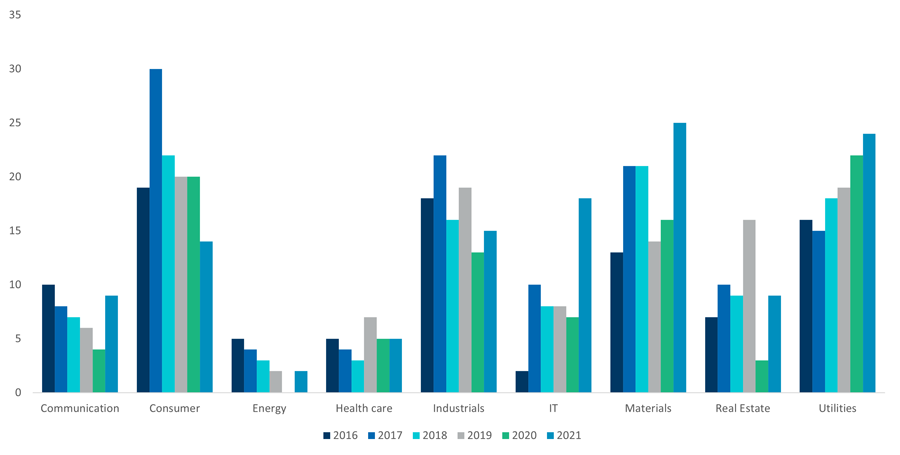

Exhibit 4.2 - Deals by Industry Chile

While Chile is one of the more stable economies in the region, this stability has been masked by social unrest over the last two years4, which impacted investor appetite and M&A activity. The pick-up in transactions in FY21 translates into the strongest volume since FY17. The higher number of deals in FY21 was largely driven by the utilities, materials and IT sectors.

Colombia

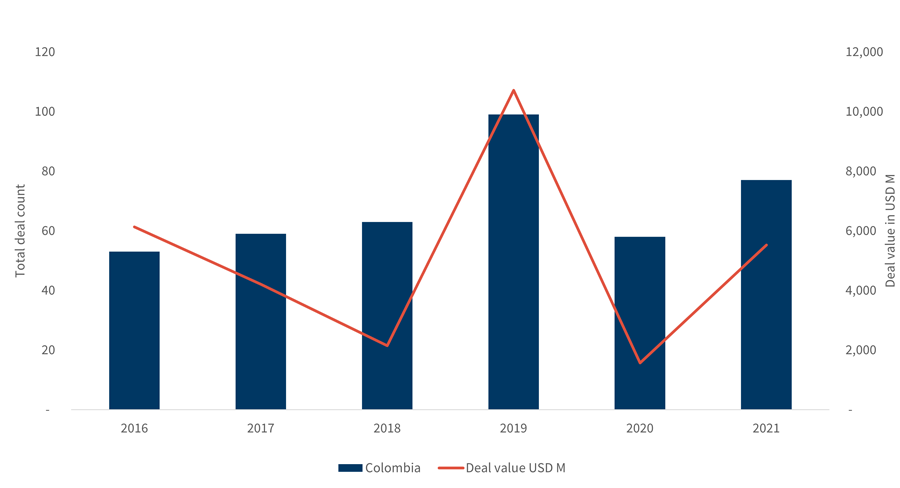

Exhibit 5.1 - Deals Colombia

Exhibit 5.2 - Deals by Industry Colombia

M&A activity slightly improved in FY21 but remains below historical levels. Earlier in the year, the country experienced a wide range of protests5, which may have affected transaction activity. Elections in the latter half of 2022 could provide some optimism. FY21 activity has been driven by deals in the industrials and consumer sectors.

Mexico

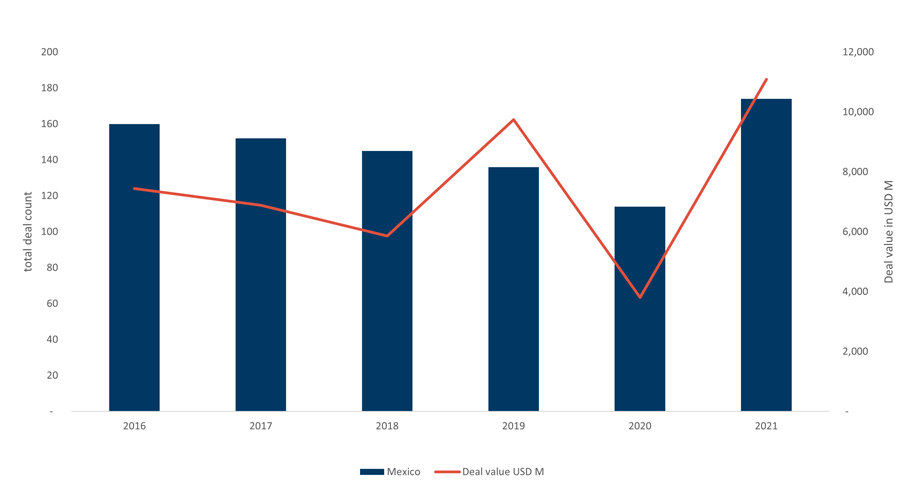

Exhibit 6.1 - Deals Mexico

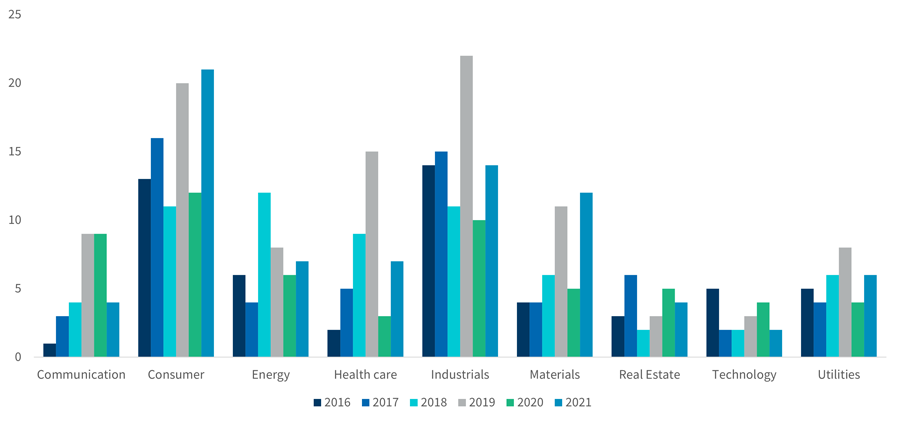

Exhibit 6.2 - Deals by Industry Mexico

FY21 represents the highest M&A activity levels in the analyzed periods. Most deals occurred in the consumer, materials, industrials, and IT industries. These sectors have more than offset a slowdown in the energy sector, which has been adversely affected by policies from the current administration6.

Peru

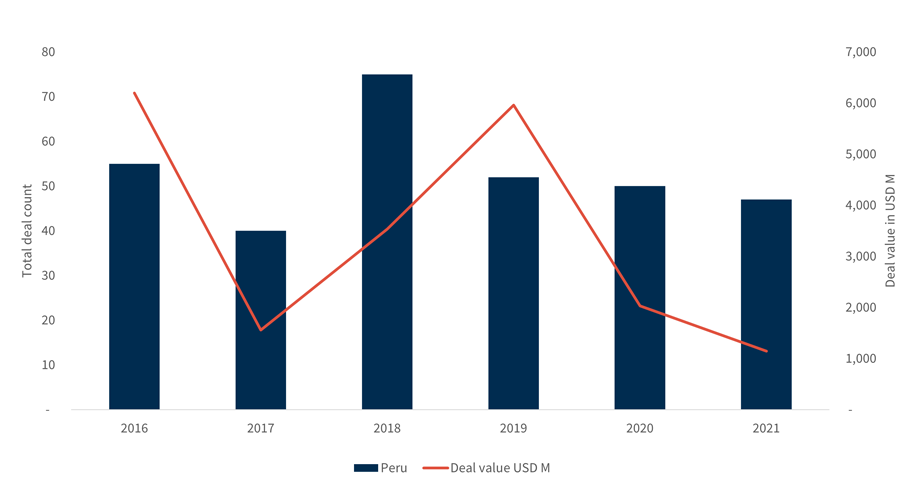

Exhibit 7.1 - Deals Peru

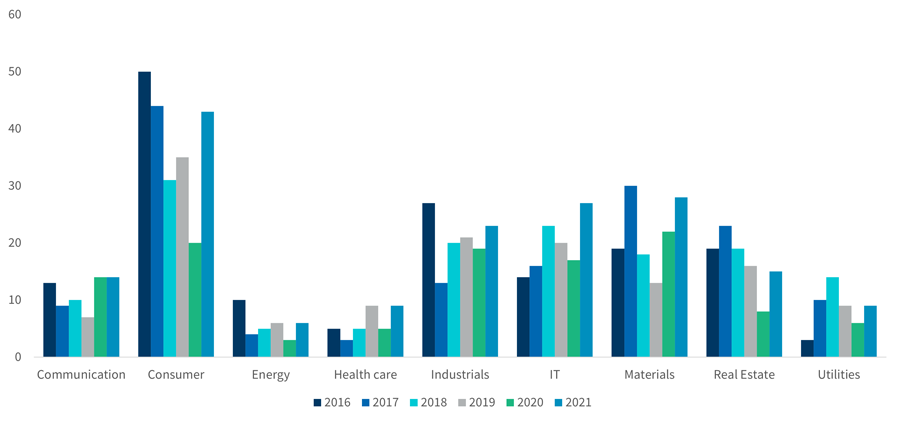

Exhibit 7.2 - Deals by Industry Peru

Political instability and 2021 elections appear to have affected M&A activity in Peru7. Of the analyzed countries, Peru is the only one to record fewer deals in FY21 versus the prior period. During FY21 most of the deals have been concentrated around the materials and consumer sectors.

Related Insights

Related Information

Published

February 23, 2022

Key Contacts

Key Contacts

Senior Managing Director