Operational Resilience: A Cornerstone for Value Creation in Private Equity

-

febrero 24, 2025

-

The private equity (“PE”) industry is known for driving global economic growth and business transformation. However, the value of an intentional, conscious focus on investing in operational resilience is a vital yet often overlooked factor in PE success. In this “Mastering Crises” article, Lars Faeste shares a few thoughts on readiness and response considerations to demonstrate their criticality to the value creation process.

Private equity investors are masters of commercial and operational due diligence, leaving no stone unturned when it comes to the assessment of a potential portfolio company. However, even the most promising company’s performance can be derailed if it is unable to absorb the inevitable adverse operational events it will face, affecting its ability to operate, win the market and protect its value.

Despite this reality, gaps in operational resilience preparedness do occur and can undermine operational stability in turbulent times. Here are three actions that private equity firms can take to better protect portfolio performance and value and maintain operational resilience:

Adopt a Resilience Mindset

In an Economist Impact survey of primary legal decision-makers sponsored by FTI Consulting, respondents cited operational and reputational events as the crises that pose the greatest risk to their organization.

The world’s most successful companies adopt a resilience mindset and understand that operational resilience is the outcome realized by implementing multiple critical measures. From cybersecurity preparedness, business continuity and disaster recovery planning to threat-driven risk management, truly resilient companies will acknowledge that operational resilience is a differentiator in an increasingly turbulent world. Ensuring that operational resilience is a board-level concern in portfolio companies can drive better outcomes in terms of both operational stability and asset performance.

Get a Grip on Operational Resilience

The EU Digital Operational Resilience Act (“DORA”), the UK Financial Services and Markets regime and new regulation proposed by U.S. authorities highlight increased global regulatory oversight of operational resilience. Financial services firms and other industries will need to embed resilience into the fabric of their operations. These new rules are unlikely to stop there. Ultimately, compliance is another outcome of achieving operational resilience and ensuring that your resilience arrangements are proportionate to the scale, nature and complexity of PE portfolio companies. A true resilience mindset will ensure that investments are driven based on the uplift in stability that a portfolio company will realize, and as such, demonstrate a return on resilience investment and contribute to the value creation process.

Enhance Responsiveness

Even those companies who plan well will inevitably suffer crises from time to time. According to surveyed GCs, around 70% of organizations lack a dedicated crisis team or a ready-to-go list of external advisors, severely impacting their ability to respond quickly and decisively when things go wrong. Private equity firms should ensure a consistent ability to respond in this way across their portfolio. Crisis response teams should have cross-functional representation and be supported by a pre-approved list of external specialists for optimal performance so that the internal team can focus on business as usual.

Mind The Gap

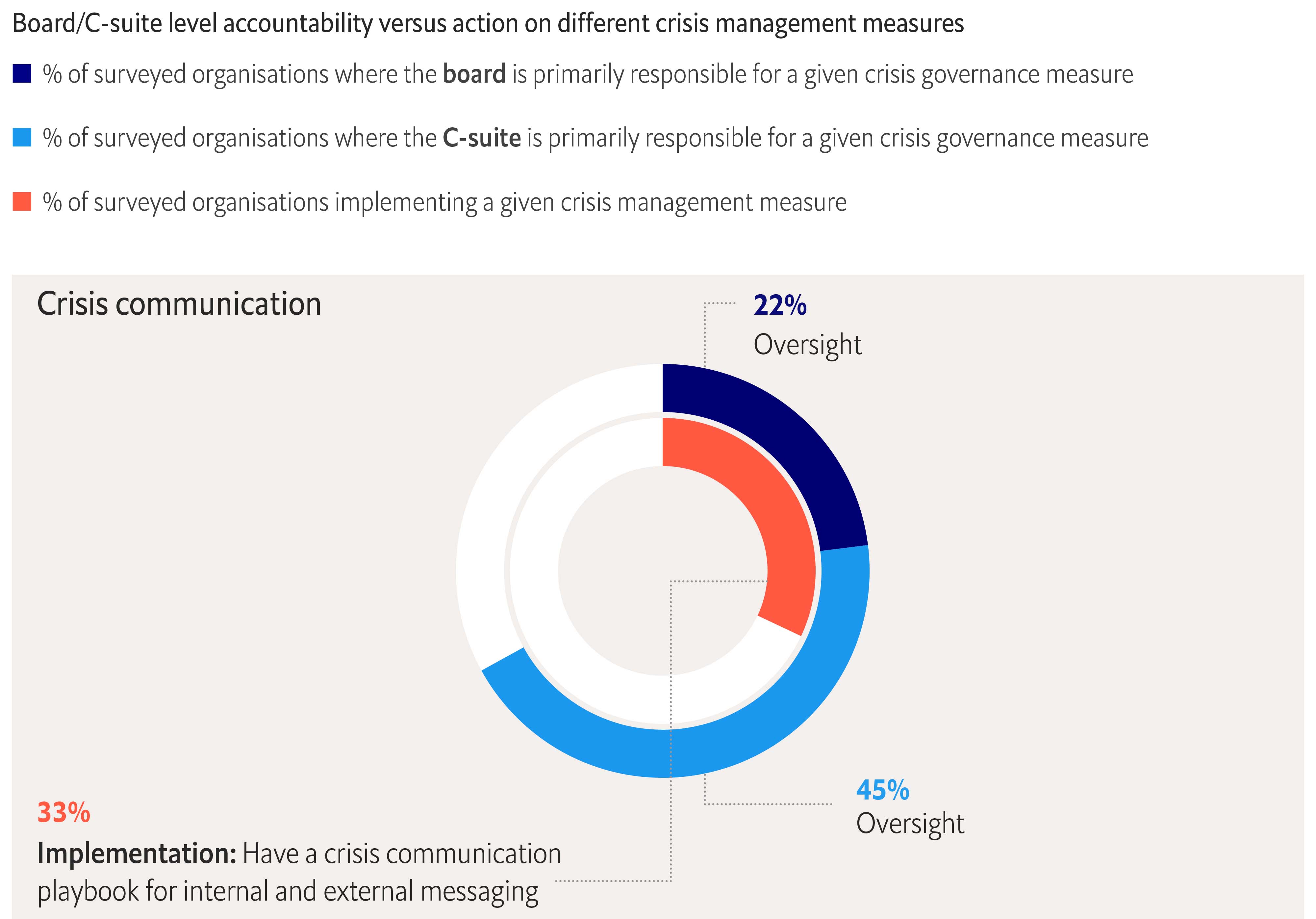

Source: Economist Impact’s Role of the General Counsel in a crisis survey, 2024

Ultimately, value is created in portfolio companies when they can absorb operational events and continue to serve their markets when others cannot.

Strengthening operational resilience through the actions outlined above will sharpen leadership priorities and improve outcomes, ensuring stronger value creation even during the toughest times.

This article is part of the “Mastering Crises” series, a collection of insights on crisis management, featuring thought leadership from Lars Faeste. Explore the other articles in this series below.

The Role of Law Firms in Crisis Management

Crisis prevention is a priority for organizations. We sponsored a global Economist Impact survey of 600 legal decision-makers to assess progress in this area.

Click here to read the full article.

How Boards Can Navigate Crises in an Era of Upheaval

How Boards must lead crisis management, ensuring resilience, agility and strategic oversight that strengthens governance in uncertain times.

Click here to read the full article.

Beyond Crisis Management: General Counsel Takeaways in a Changing World

Key crisis management takeaways for General Counsel, who play a vital role in helping organisations navigate fast-changing geopolitical and economic risks.

Click here to read the full article.

Turbulent Waters, Trusted Anchors: The General Counsel’s Evolving Role in Navigating Crises

As the general counsel role evolves into crisis leadership, what measures can organizations take to prepare for more severe events in today’s environment?

Click here to read the full report.

Publicado

febrero 24, 2025

Contactos clave

Contactos clave

Senior Advisor

Senior Managing Director, Head of Cybersecurity, EMEA & APAC

Insights más visitados

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About