How Tariffs Accelerated Brazil’s Export Diversification

-

enero 29, 2026

-

U.S. tariffs on Brazil escalated sharply from mid-2025, starting with global and reciprocal measures evolving into targeted trade actions driven by political and economic disputes. Successive executive orders raised duties on key sectors—most notably steel, iron, coffee, and processed foods—pressuring supply chains and reshaping Brazil’s trade flows.

Key Occurrences:

- February 10, 2025: Announcement of a 25% tariff on Brazilian iron and steel1 imports, under Section 232, to protect the domestic industry, effective March 12, 2025.

- April 2, 2025: Implementation2 of a reciprocal 10% tariff on all Brazilian products, dubbed “Liberation Day,” due to alleged lack of commercial reciprocity.

- May 30, 2025: Increase of the tariff on iron and steel to 50% through Executive Order,3 interpreted as retaliation against Brazilian policies.

- July 9, 2025: Announcement of a general 50% tariff on Brazilian products through a letter4 from President Trump to President Lula, citing unfair trade relations and political issues such as “continued attacks on the digital trade activities of American companies” and the trial of former President Bolsonaro.

- July 30, 2025: Executive Order3 and fact sheet5 issued imposing a 40% IEEPA (International Emergency Economic Powers Act) tariff on imports from Brazil. Both the 40% Brazil tariff and 10% reciprocal tariff apply, totaling 50% for goods from Brazil. Applicable Section 232 tariffs do not stack. Including a list of 694 exempt products (e.g., oil, aircraft, orange juice).

- August 6, 2025: 40% tariffs on Brazilian goods entered into force3 for non-exempt products, impacting meats, coffee, and footwear, part of broader reciprocal and IEEPA actions.

- November 20, 2025: Executive Order6 modified the July 30 tariffs’ scope after U.S.-Brazil negotiations exempting 238 tariffs covering agricultural products from the 40% tariff, narrowing application to specific agricultural and other imports while keeping broader duties in place.

- January 13, 2026: Trump announces on Truth Social7 that any Country doing business with the Islamic Republic of Iran will be subject to 25% tariff on all business conducted with the U.S. According to Comex Stat,8 Brazil-Iran bilateral trade represents 0.84% of Brazil’s total exports. However, to date, the White House has not yet implemented this announcement.

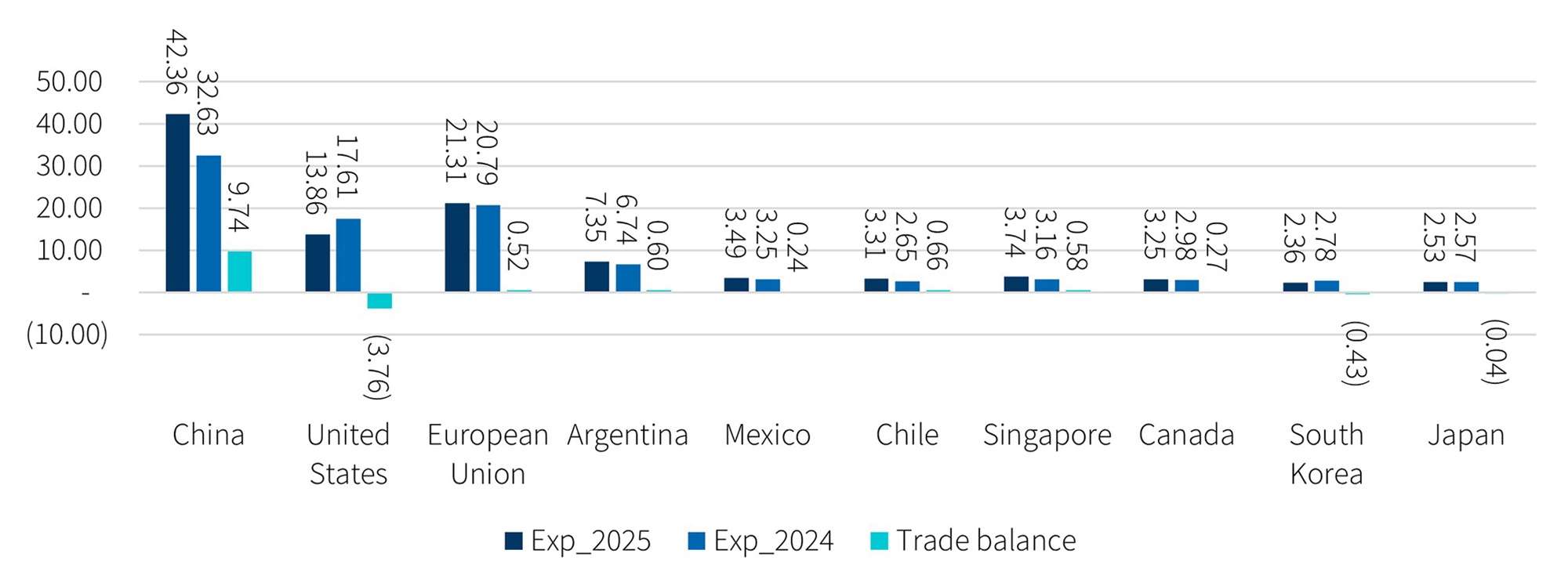

Despite these measures, Brazil closed 2025 with record exports, up US$11.6 billion from 2024, even as shipments to the United States fell US$2.6 billion, as shown in the chart below. The turning point came in August 2025, when tariffs took full effect and exports to the U.S. plunged. Brazilian producers rapidly redirected volumes toward China and other Asian markets, with China alone absorbing 37% of trade between August and December. In less than a year, Brazil’s export map has shifted. Nonetheless, from January through July exports to the U.S. were US$784.7 million higher than in the same period in 2024. Beginning in August, when the tariffs came into full effect, exports fell to US$3.7 billion below the level recorded in the previous year. The result was from redirected volumes to China. The result is a new pattern of exports where the U.S. maintains its role as a major supplier to Brazil, but no longer absorbs the same share of Brazilian output, forcing Brazilian companies to rethink pricing, logistics, and political risk across their value chains.

Figure 1 - Exports US$ Billions (Aug-Dec)

Source: Comex Stat, 2026

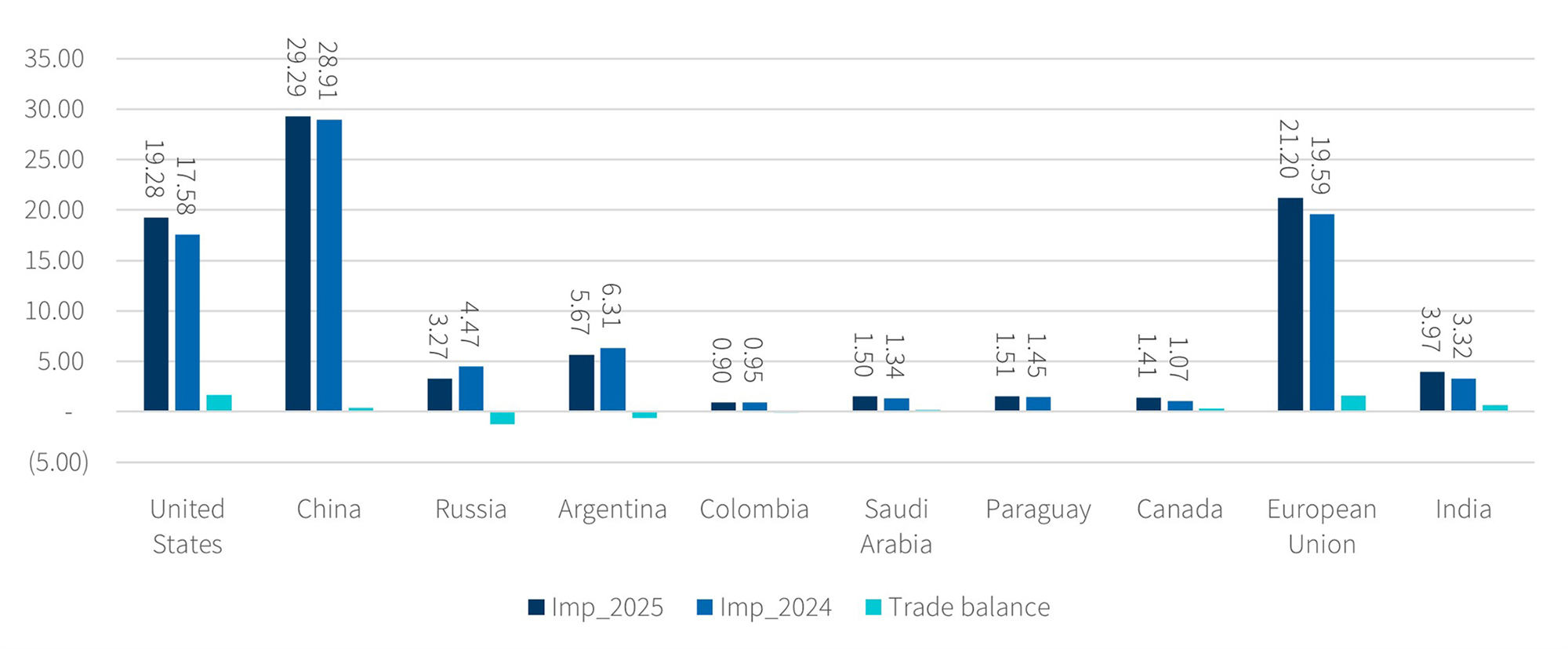

This asymmetry matters for corporate strategy. While Brazilian exporters now face higher costs and steeper compliance hurdles to reach U.S. buyers, U.S. goods continue flowing to Brazil with far fewer disruptions, deepening a dependence in critical inputs, technology, and capital goods and eroding competitiveness but also accelerating Brazil’s search for new markets, digital distribution, and financing routes. U.S. exports to Brazil rose US$4.5 billion in 2025, as shown in the chart below.

At the same time, the accelerated pivot to China – which already absorbs the largest share of Brazilian exports – increases exposure to Beijing’s own tariff, quota, and sanitary decisions, creating a more complex, volatile risk matrix for sectors from agribusiness and mining to manufacturing and energy. In this environment, companies that treat tariffs as a “bad headline” rather than a structural shift will lose market share to those that move early.

Figure 2 - Imports US$ Billions (Aug-Dec)

Source: Comex Stat, 2026

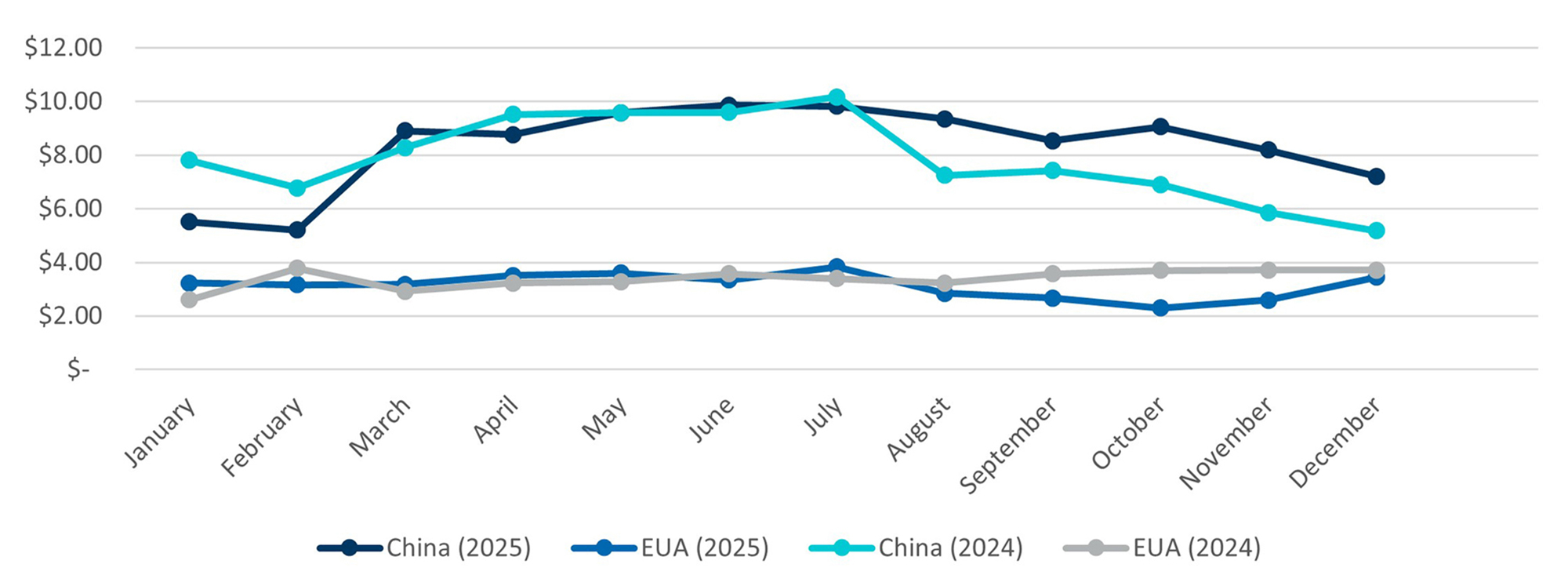

Even so, the volume of trade with China between August and December followed the same pattern observed in the same period in 2024. Pushed by the U.S. tariffs as well as Global South political alignment, this scenario should keep on expanding throughout the next years regardless of who wins in the upcoming election in Brazil - President Lula has a favorable political alignment but the opposition is market oriented and will not reduce business initiatives with China. This trade reconfiguration yields mixed business impacts: export revenue resilience via China offsets U.S. losses, but it widens the U.S.-Brazil trade deficit and introduces China dependency risks.

Figure 3 - China vs U.S. (2025)

Source: Comex Stat, 2026

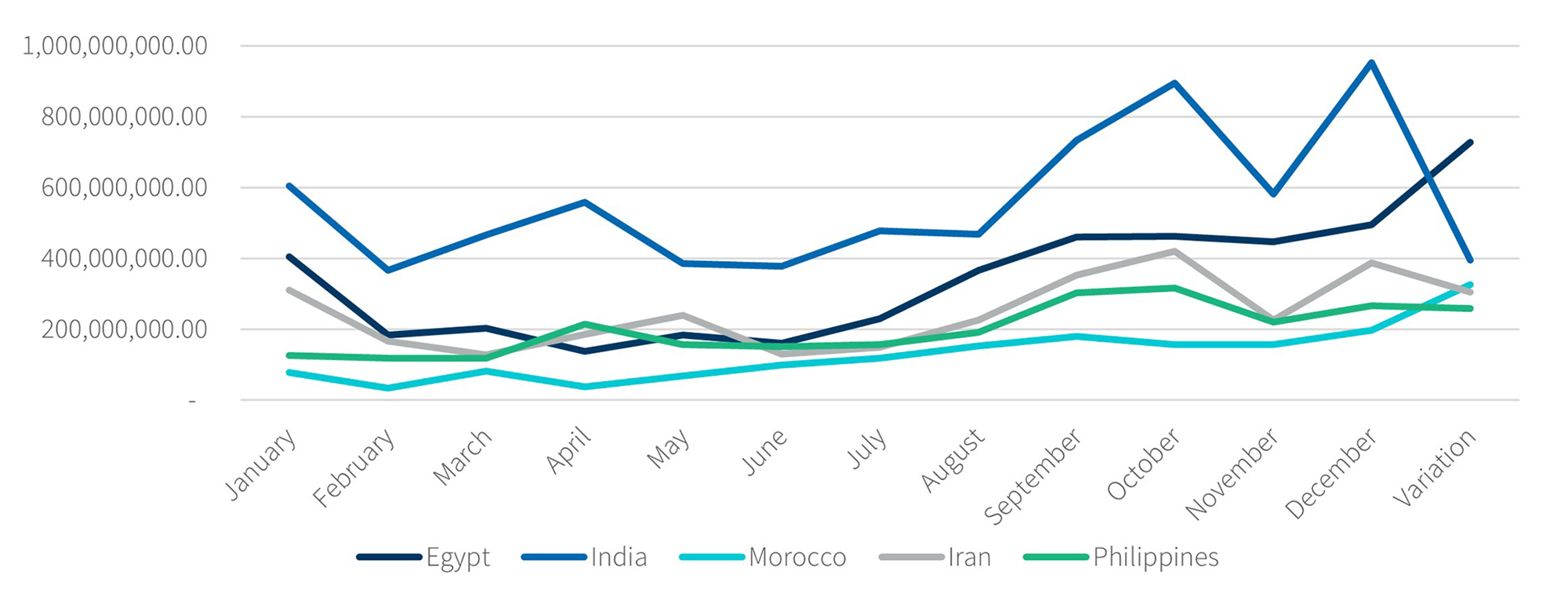

A point that stands out is the significant growth in Brazilian exports to Asian, African, and Middle Eastern countries. Morocco, for example, recorded a 62% increase in trade in 2025 following the implementation of the tariffs. India, in turn, saw a 52.9% increase in Brazilian exports during the period, accounting for 2.4% of total export value. These developments reflect export diversification beyond China, but the volumes remain small when compared to China and U.S. At the same time, the increase in exports to Iran should be viewed with caution, as U.S. signals the imposition of additional tariffs on countries that continue to trade with Iran. This, once again, may have an impact on Brazilian companies.

Figure 4 - Countries With the Higher Trade Increase After Tariffs

Source: Comex Stat, 2026

Looking ahead, Brazil’s commercial diversification is set to deepen, signalling early diversification beyond the China-U.S. axis. Yet rising trade with Iran introduces fresh uncertainty given potential U.S. enforcement risks. The takeaway for companies is clear: Brazil’s export geography is undergoing structural realignment, not just a temporary tariff reaction.

As U.S.-Brazil friction persists, we believe that Asia-oriented investment platforms, processing capacity, and joint ventures are positioned to capture the next growth cycle of Brazil’s trade transformation. In this shifting landscape, proactive stakeholder management and engagement and scenario planning are no longer optional - they are essential tools for anticipating policy shifts, managing risk, and positioning businesses ahead of market disruption.

Footnotes:

1: “Adjusting Imports of Steel Into the United States.” February 2025, Federal Register: The Daily Journal of the United States Government.

2: “Fact Sheet: President Donald J. Trump Declares National Emergency to Increase our Competitive Edge, Protect our Sovereignty, and Strengthen our National and Economic Security.” April 2025, The White House.

3: “Addressing Threats to the United States by the Government of Brazil.” July 2025, The White House.

4: Trump, D. 2025, July, A letter from President Trump to President Lula, Truth Social.

5: “Fact Sheet: President Donald J. Trump Addresses Threats to the United States from the Government of Brazil.” July 2025, The White House.

6: “Modifying the Scope of Tariffs on the Government of Brazil.” November 2025, The White House.

7: Trump, D. 2026, January, “Effective immediately, any Country doing business with the Islamic Republic of Iran will pay a Tariff of 25% on any […]” Truth Social.

8: ComexVis – Brasil: Países Parceiros. Jan 2026. Comex Stat.

Publicado

enero 29, 2026

Contactos clave

Contactos clave

Managing Director

Senior Director

Senior Director

Insights más visitados

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About