M&A Market Status and Deal Outlook: March 2024

-

April 16, 2024

DownloadsDownload Article

-

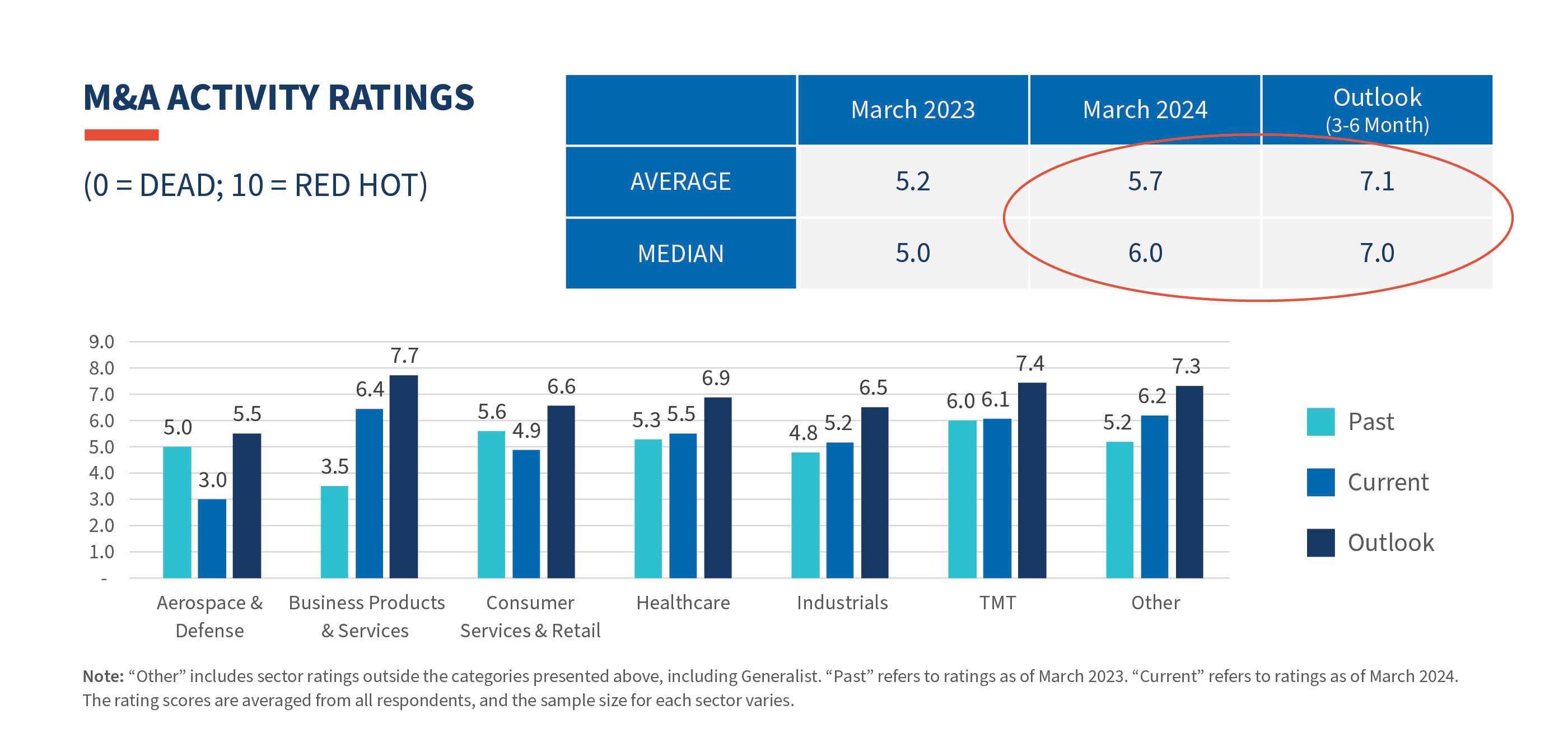

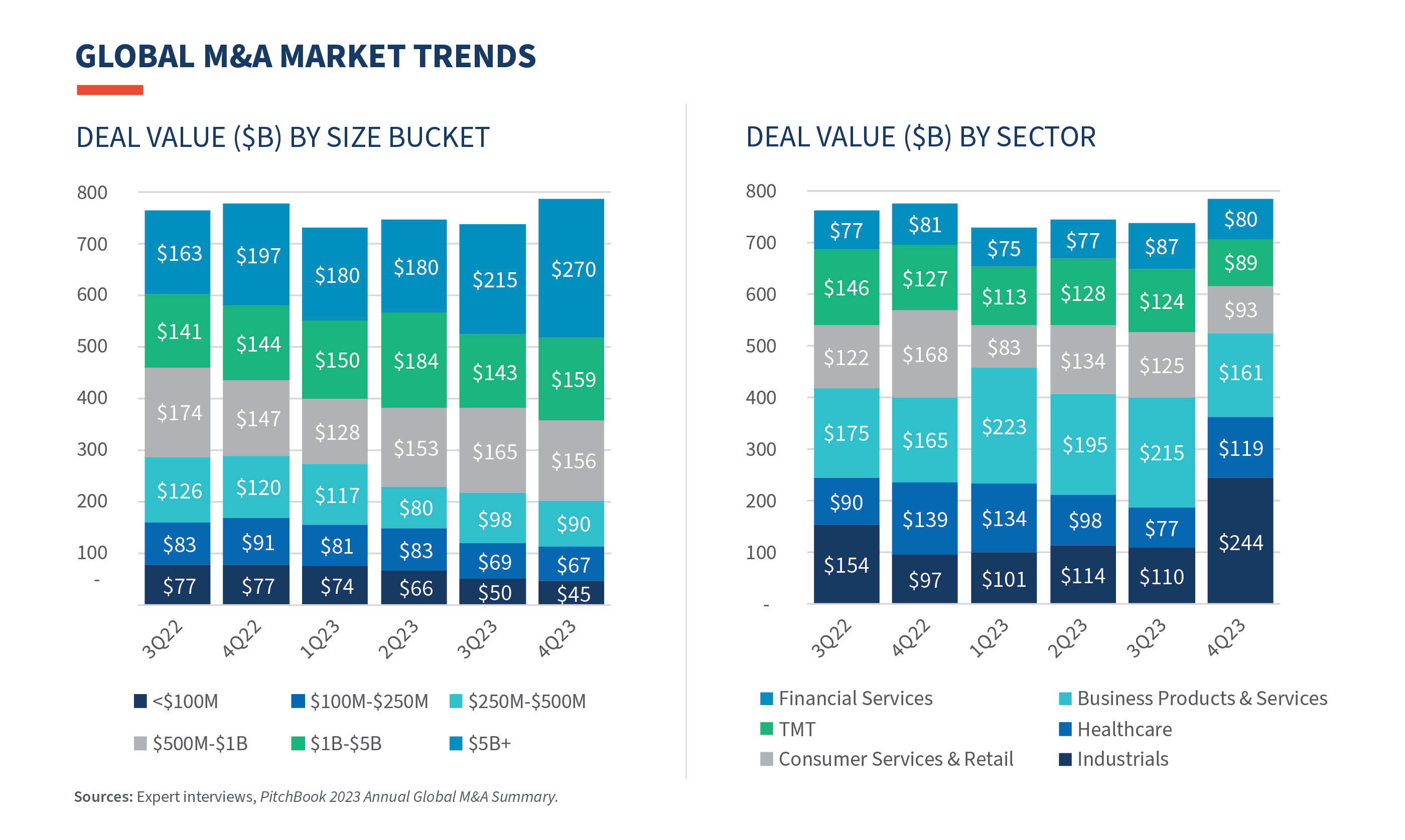

FTI Consulting’s M&A survey results indicate that deal activity in all sectors is expected to increase over the next three to six months. The overall outlook is cautious yet optimistic, with deal activity expected to increase in 2024 relative to 2023. Driving expectations of increased deal volume are the significant amount of private equity (PE) dry powder needing to be invested, the backlog of 2023 transactions, and a convergence of buyer/seller valuation expectations. Concerns about the presidential election as well as lower-quality assets remain as potential headwinds throughout 2024.

Respondents’ Views By Sector

Aerospace & Defense

While off to a slow start at the beginning of 2024, the A&D sector is steadily gaining momentum. Cooling valuations, coupled with a high level of PE dry powder, are expected to drive M&A activity. Bringing aerospace technologies to market takes capital, which we expect to drive deal volume. Supply chain challenges, high fuel costs, skilled labor challenges and the regulatory environment are obstacles for this sector. A&D companies will likely look to acquire smaller companies to drive growth.

Business Products & Services

The year is off to a fast start, and respondents are optimistic that activity will increase throughout 2024 as the lending market stabilizes.

Consumer Services & Retail

Companies in the discretionary category are hesitant to initiate M&A processes. The macroeconomic environment has hindered deal activity; however, the optimism surrounding stabilizing rates should increase deal volume. While off to a slow start in 2024, the consumer services & retail sector is expected to gain momentum from the substantial amount of PE dry powder requiring deployment, coupled with a backlog of 2023 transactions targeting 2024 completion. Companies are also looking to divest certain categories to focus on core categories, which is expected to further drive M&A opportunities in this sector.

Healthcare

Credit markets, along with sensitive institutional owners, hindered healthcare M&A in early 2024. Activity is expected to pick up as PE dry powder and strategically improved balance sheets act as catalysts. Sellers are motivated by longer-than-average hold periods and the convergence of buyer/seller valuation expectations.

Industrials

Activity has picked up since mid-2023 and is expected to continue to increase leading up to the presidential election, at which point there may be some market uncertainty. Deal volume/quality is expected to be more aligned with pre-COVID levels, driven by the velocity of sponsor exits and the improving financial performance of industrial businesses. In the energy subsector, government regulation continues to drive M&A activity.

TMT

The technology, media and telecommunications (TMT) pending deal pipeline built in 2023 is expected to increase further in the first half of 2024 with more sellers as seller/buyer valuations converge. There are several TMT PE portfolio companies nearing the end of their hold periods, which should result in increased deal volume. The TMT M&A outlook is positive and tends to be resilient in periods of economic downturn, with timing being the big uncertainty (i.e., finding the right time between optimal business performance and market conditions).

Related Insights

Related Information

Published

April 16, 2024

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About