- Accueil

- / Publications

- / Service Sheets

- / Real Estate: Transaction Tax Advisory Service Sheet

Real Estate: Transaction Tax Advisory Service Sheet

-

janvier 19, 2024

TéléchargezDownload Service Sheet

-

FTI Consulting’s Transaction Tax Advisory team adds value across the real estate investment lifecycle. The evolving complexities of global tax law have a critical impact on business decisions impacting your real estate transactions. Whether you are a sponsor or investor, you must navigate the ever-changing landscape of the real estate sector in order to protect and enhance the after-tax return on your investments.

Our Strategic Differentiators

- Dedicated team of professionals free from audit-based conflicts of interest and focused exclusively on transaction support

- Senior led teams with deep experience across the sector and the capacity to focus on serving clients when we are needed most

- Practical, collaborative and solution-oriented approach to client service with a track record of delivering the highest-quality results

- Client advocates capable of navigating complex situations and disruptive events with an unwavering focus on service and delivery

- Commercial approach, which is flexible and tailored, to address each unique client and the applicable situation at hand

- Diverse team with unique perspectives resulting from experience working in management consulting, accounting, law and industry

Specialized Focus Beyond Transaction Tax Advisory

- Global Tax Consulting & Compliance

- State & Local Tax

- Tax Workflow Automation

- Transfer Pricing

- Private Client Services

- Bankruptcy & Financial Restructuring

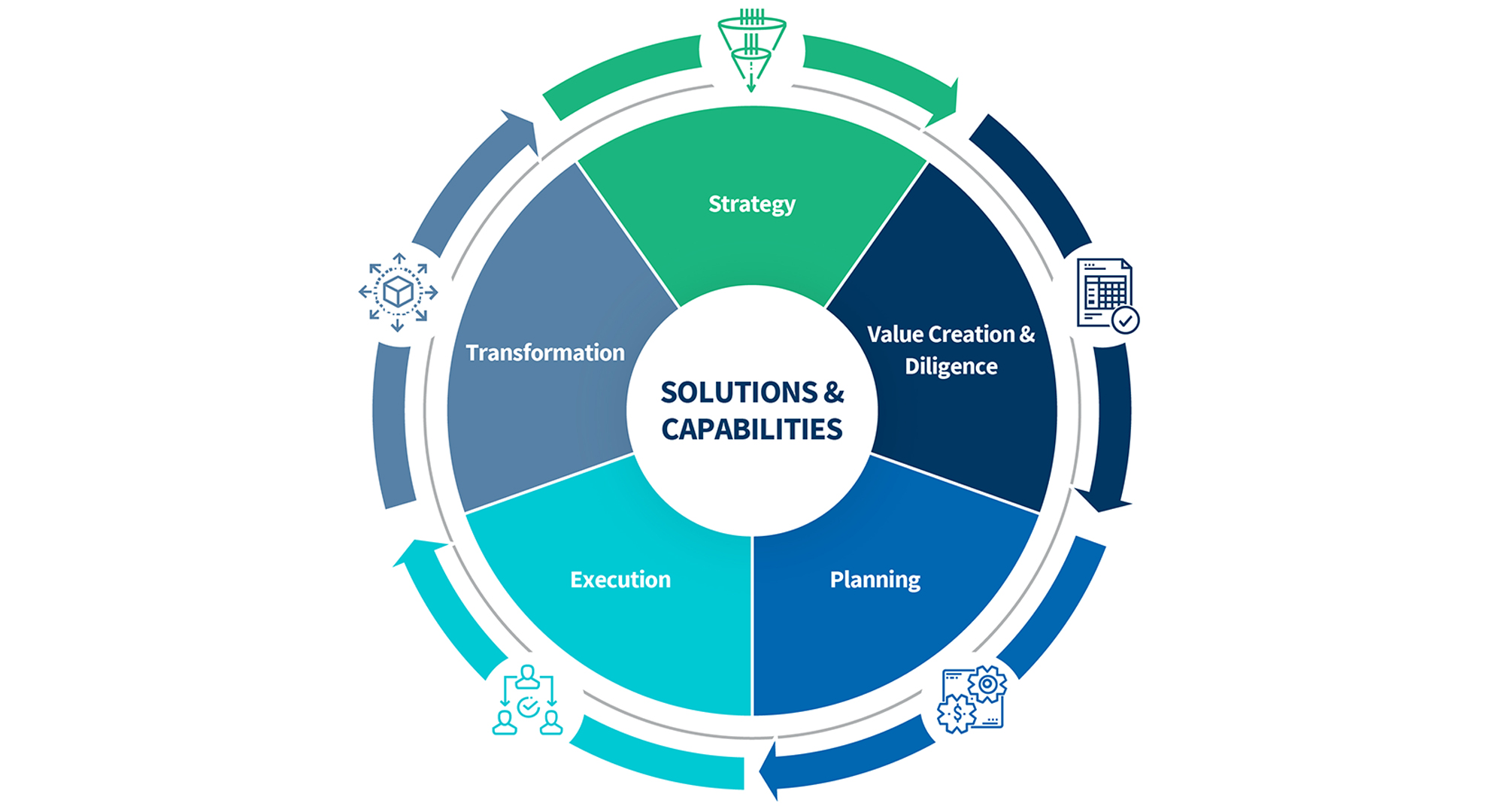

Solutions & Capabilities

Strategy

- Investment Vehicle Structuring

- Tax Leakage Impact Modeling

- Investor After Tax IRR Modeling

- Investor Side Letter Support

- Tax Underwriting Strategy

- Tax Due Diligence Readiness

Value Creation & Diligence

- Buy-Side Tax Due Diligence

- Sell-Side Tax Due Diligence

- Transaction Structuring, Including Steps

- Tax Purchase Price Adjustment Valuation and Negotiation Support

- Purchase and Sale Agreement Drafting and Negotiation Support

- Transition Services Agreement Drafting and Negotiation Support

Planning

- Pre-Closing Steps Design and Execution

- Taxable Income Modeling, Including Investor Allocations

- Tax Basis and Recovery Modeling, Including Basis Adjustments

- Transfer Tax Planning and Reporting

- Indirect Tax Planning and Reporting

- Withholding Tax Holdback Quantification

- Documentation of Key Tax Issues

- Tax Function/Process Assessment

- Tax Compliance Calendar Design

- Interim Tax Function Management and

- Transaction Resources Support

Execution

- Post-Closing Steps Execution

- Post-Closing Tax Reporting

- Post-Closing Tax Purchase Price Adjustment Finalization

- Tax Purchase Price Allocations

- Tax Withholding/Reporting

- Tax Data Transfer/Integration

Transformation

- Restructuring Steps Execution

- Legal Entity Rationalization

- Tax Function Process Improvement

- Cash Tax Recycling Strategies

- Tax Investor Relations Support

- Ongoing Tax Planning

Related Insights

Related Information

Date

janvier 19, 2024

Contacts

Contacts

Senior Managing Director, Leader of Real Estate Tax Advisory

Senior Managing Director, Leader of Real Estate Tax Compliance