- Home

- / Insights

- / FTI Journal

Investors, Start Your Engines

-

August 11, 2020

-

The FTI Journal’s series looking at opportunities for private equity in distressed M&A in the COVID-19 era continues with a snapshot of the automotive industry.

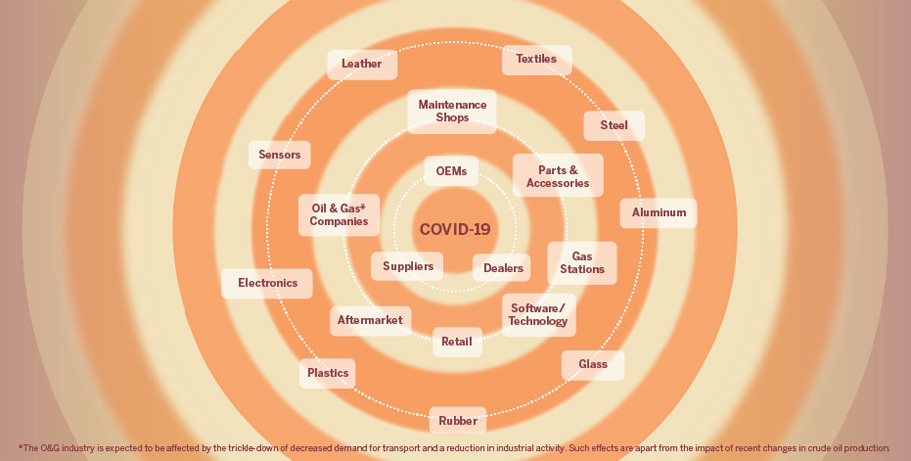

An automotive industry in the midst of COVID-19 has found itself stuck in a figurative traffic jam. Car manufacturing has been put on hold. Gas prices are low, small-to-mid-size automotive dealers and aftermarket providers are struggling; and the need to preserve cash has put the freeze on new product launches.

Eventually, the industry will be back in motion. In the meantime, investors will find attractive opportunities along the automotive industry’s road to recovery. Distressed supply chain segments — particularly smaller suppliers and dealers — will experience continued consolidation through M&A deals. So, too, will be the electric vehicle supply chain.

The economic effects of COVID-19 are rippling through segments of the automotive industry within the industrialized world.

The winners include independent aftermarket providers and direct-to-consumer sellers. New safety-related technologies and smart manufacturers will grow in demand. Capital-intensive segments that don’t rely on special technology for processes like stamping, casting, and injection molding will trend downward.

What’s happening with the development and sales of electric vehicles? Cheap gas will slow the market. But the cost of producing components will drop and so will sticker prices, making EVs more affordable for consumers.

Where is this all headed? As the automotive industry heads towards risk management and digitization efforts, many companies will be in need of cash. The companies with strong balance sheets and compelling assets will grab the eyes of investors who will be looking to acquire assets around growth technologies and underperforming suppliers.

Eventually, business in the automotive industry will be back in motion, and investors will be in the driver’s seat.

Read the full introduction to the series "Creative Destruction vs. Created Destruction." To learn more about specific distressed M&A opportunities in the automotive industry, visit our Distressed M&A Outlook Series.

© Copyright 2020. The views expressed herein are those of the authors and do not necessarily represent the views of FTI Consulting, Inc. or its other professionals.

About The Journal

The FTI Journal publication offers deep and engaging insights to contextualize the issues that matter, and explores topics that will impact the risks your business faces and its reputation.

Related Insights

Related Information

Published

August 11, 2020

Key Contacts

Key Contacts

Senior Managing Director