- Accueil

- / Publications

- / Articles

- / Deals in Motion

Deals in Motion

How Investment Bankers See the 2025 M&A Market Shaping Up

-

mai 20, 2025

-

As we move through the second quarter of 2025, investment bankers remain cautious about the M&A market. According to FTI Consulting’s latest survey of leading bankers across sectors, deal activity is expected to increase in the remainder of the year if we continue to see greater clarity on global tariffs, continued momentum and advancements in Generative AI (“Gen AI”), and a closing of the gap on asset valuations. While geopolitical uncertainty and uneven market confidence remain, bankers report that investors are signaling an appetite to re-engage on paused processes while prioritizing transactions that offer clear strategic value and long-term growth potential.

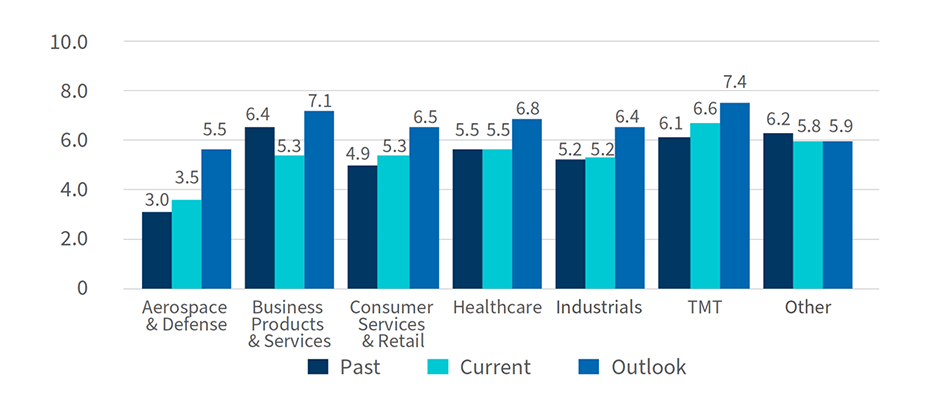

Sector Views | Tailwinds Emerging, but Selectivity Prevails

While deal volume is marginally expected to rise in the remainder of 2025, investor sentiment varies significantly by sector. Bankers noted that dealmakers and investment committees remain highly selective, favoring industries with visible growth drivers, stable fundamentals and clear strategic relevance. Tariff developments, AI integration and sector-specific regulatory shifts are shaping divergent expectations. Sectors like Industrials, Business Products & Services and Telecom, Media and Technology (“TMT”) are seeing momentum, while others, such as Healthcare and Aerospace & Defense, will need further clarity before activity meaningfully accelerates. Businesses directly impacted by tariffs (such as retail) remain quiet, with some notable exceptions.

- Aerospace & Defense – Expectations for the sector did not materialize in 2024. Aerospace & Defense remains capital-intensive and requires a favorable regulatory outlook to support robust deal flow. Respondents anticipate improved access to financing and express optimism about regulation and deal volumes in 2025.

- Business Products & Services – Respondents report strong backlogs and pipelines entering 2025, supporting a more bullish outlook. Sub-sectors such as automation, cloud computing and other technology-driven businesses are expected to fuel growth, spurred in part by recent advancements in Gen AI.

- Consumer Services & Retail – The impact of tariffs has delayed investor entry into discretionary categories due to mixed consumer sentiment. At the same time, investors have been reluctant to exit existing positions, given compressed valuations. In 2025, high-quality assets (rated A to A+) are expected to be in demand, commanding premium valuations. Some financial sponsors in the sector also reported substantial dry powder available for deployment.

- Healthcare – M&A activity has been slow to start in 2025, driven by investor hesitation around the new administration and elevated interest rates. Respondents expect activity to accelerate as perceived regulatory pressure eases. Consumer health platforms continue to anchor deal flow and are expected to remain a key driver of M&A volume.

- Industrials – Ongoing tariff uncertainty has created a challenging climate, with higher expected input costs weighing on forecasts. A lack of clarity on manufacturing economics is currently pausing M&A processes. Near-term activity is primarily driven by carve-outs, debt maturities and private equity portfolio companies approaching the ends of their hold periods. Respondents expect a rebound in the second half of 2025 as visibility improves.

- TMT – Persistent interest rate pressures, tariff policy uncertainty and rapid shifts in the Gen AI landscape are contributing to cautious sentiment. Despite this, investor interest in AI-driven businesses is increasing, helping to support deal flow. The data center sub-sector continues to experience notable activity, particularly among larger, platform-scale transactions.

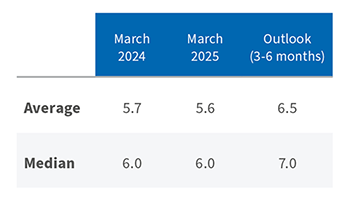

Rating Scores | Outlook Brightens Across Sectors

Overall sentiment among investment bankers has improved heading into mid-2025. The average sector outlook score rose to 6.5 from a current-state average of 5.6, reflecting increased confidence in near-term deal activity. Industrials, Business Products & Services and TMT scored the highest in the 3- to 6-month outlook, driven by strong pipelines and strategic buyer interest. While Aerospace & Defense remains subdued, most sectors are showing positive momentum as investors re-engage and market clarity improves.

(0 = Dead; 10 = Red Hot)

Note: “Other” includes sector ratings outside the categories presented above, including “Generalist.” Past refers to ratings as of March 2024. Current refers to ratings as of March 2025. The rating scores are averaged from all respondents and the sample size for each sector varies.

Source: Expert interviews, PitchBook 2024 Annual Global M&A Summary

Market Study Feedback | A Growing Tool for Competitive Positioning

FTI Consulting asked participants how frequently they engage third-party providers to conduct market studies as part of their go-to-market strategies. Responses varied: 20.5 percent of respondents reported using market studies in 76 to 100 percent of deals, while 34.2 percent indicated they rarely incorporate them.

Respondents noted that market studies are most effective when the investment thesis depends on validating a company’s core business, including customer and end-user perspectives, competitive differentiation or overall market positioning. They are particularly valuable in assessing the size and growth potential of existing or adjacent markets, whether for organic expansion or strategic exit planning. Market studies also play a critical role in sub-sectors where limited transaction volume makes traditional benchmarking difficult.

Overall, investment bankers increasingly view market studies as a high-impact tool to sharpen positioning and accelerate decision-making in competitive processes.

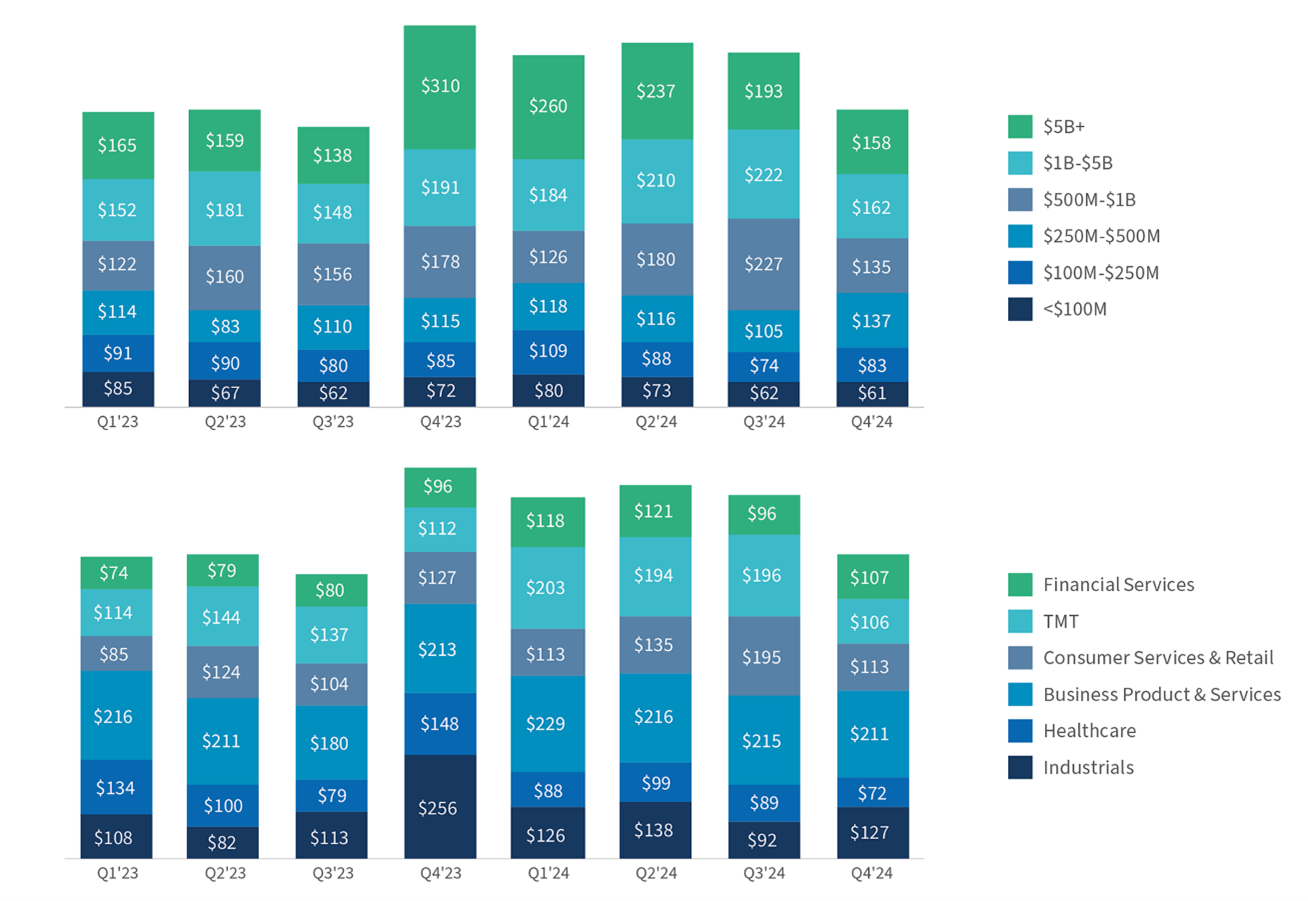

Global M&A Market Trends | A Reset in Scale, with Stable Sector Demand

Following a surge in large-cap transactions in mid-2023, global M&A deal values moderated through 2024. The data shows a rebalancing toward mid-market deals, with a noticeable decline in the $5 billion-plus segment and steadier activity across the $100 million to $1 billion range. By Q4 2024, deal values by size were more evenly distributed, reflecting investor preference for right-sized transactions that align with evolving risk thresholds and capital availability.

From a sector perspective, Industrials and Business Products & Services continued to anchor global deal flow throughout 2024, supported by structural demand and strategic transformation agendas. While TMT and Financial Services saw some softening in Q3 and Q4, Consumer Services & Retail held steady, and Healthcare remained resilient. Deal values in Q4 2024 suggest that buyers are leaning into sectors with long-term tailwinds, proven operating models and opportunities for scale through consolidation.

Source: Expert interviews, PitchBook 2024 Annual Global M&A Summary

Note: Some participant responses were received prior to “Liberation Day” tariffs announcement on April 2, 2025.

Date

mai 20, 2025

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About