- Accueil

- / Publications

- / Articles

- / It’s La La Land Again in Financial Markets

It’s La La Land Again in Financial Markets

Leveraged Credit Markets Pretending DDEs/LMEs Aren’t Really Defaults

-

août 27, 2025

TéléchargezDownload Article

Subscribe Now

-

When kids begin to hear something they find really objectionable, such as a stern lecture from a parent, sometimes they will put their fingers in their ears and begin shouting “la, la, la” very loudly to drown out the imposing voice and make it go away. Grown-ups have their own ways of making unpleasant things go away, and fingers in ears come to mind as one observes what some data is signaling and how markets and investors are responding.

Monthly Insights from Michael Eisenband

Subscribe Now

Financial markets’ version of “la, la, la” in recent years has been to minimize or downplay facts or data points that might disrupt a favored narrative that investors have embraced or to revise the narrative as circumstances change. A good example is investors’ embrace of Non-GAAP Adjusted EBITDA in recent years as the preferred proxy measure of corporate operating performance, despite the fact that management has wide discretion in deciding on addbacks to EBITDA, which often can be aggressive and are intended to present performance most favorably. Investors often do a lot of “la, la, la” when it comes to scrutinizing management’s calculation of Adjusted EBITDA.

Broad market narratives also have impacted investors’ behavior in recent years. The COVID-19 years were rife with popular investment themes tied to how modern lifestyles and work life would change forever due to the pandemic — very few of which persisted after 2021 and most of which punished investors who stayed with them. More recently, financial markets’ have done a complete about-face on the perceived impact of U.S. tariffs on the domestic and global economies compared to April. This change in sentiment around the tariffs’ impact arguably represents an optimistic narrative that might be pushing the boundaries of magical thinking.

How else can one explain what has happened in markets since April, when the fear of highly punitive reciprocal tariffs rates proposed by the Trump administration caused equity markets to tumble and leveraged credit markets to stall on new issuance. That month of fear-driven selloff has since given way to near euphoric sentiment across markets, with equity markets more than recovering all those April losses and making fresh all-time highs even as tariff impacts are only just beginning to be known and felt. Why is that? Because U.S. tariff rates announced in late July are going to be only 15%-25% for most major trading partners. Is that justification for the huge rally, given that these rates still would be the largest imposition of U.S. tariffs in many decades? It can be if the narrative is revised.

To that point, some recent talking points from market pundits opine that consumers and other end buyers of products subject to tariffs can handle likely price hikes because they will only have to bear a share of new import duties, maybe less than half, with foreign exporters into U.S. markets offering price concessions to help offset tariff hikes. However, this is mostly broad conjecture and any potential tariff offsets will vary greatly across companies, industries and countries. Some impacted companies, particularly those involved in apparel, home goods and other Asian-sourced products, already have warned about hefty tariff passthroughs to customers as well as tariff-related profitability hits in 2H25.1, 2 And, of course, another twist in the bullish narrative we hear more often of late is that AI-driven productivity gains will help companies offset tariff-related hits to profitability.3 Were potential AI-driven mitigations not known in April when markets were fiercely selling off? Voila, there you have it — a quickly evolving narrative that markets want to believe.

It’s all good — except there is no way to know with any high degree of confidence or historical reference how this favored scenario is most likely to play out in the year ahead. Accelerating inflation and stagflation? Fuhgeddaboudit. Could these “better than feared” final tariff rates still cause considerable consumer pain and reduced spending,4 global trade disruption and stalled corporate investment, triggering slower economic growth worldwide or recession? Could some trading partners decide to retaliate with matching tariffs on U.S. exports and set off a trade war? Certainly, these are also plausible outcomes, but such scenarios mostly have been minimized or dismissed by financial markets even as the global economy enters uncharted waters on this front and appears to be vulnerable to such disruption.

As it has done now for several years, equity markets have doubled-down on a happy ending scenario, a strategy that has become more ingrained as it has been rewarded. But in fact, nobody — neither markets nor pundits — should have strong convictions about what the global economy will look like a year or so from now, because we have not traveled down this road in the post-War era. It is possible that a favorable outcome could materialize for the U.S. by 2026 and vindicate the bullish sentiment, but its likelihood does not seem high enough for financial markets to be throwing all caution to the wind. FOMO!

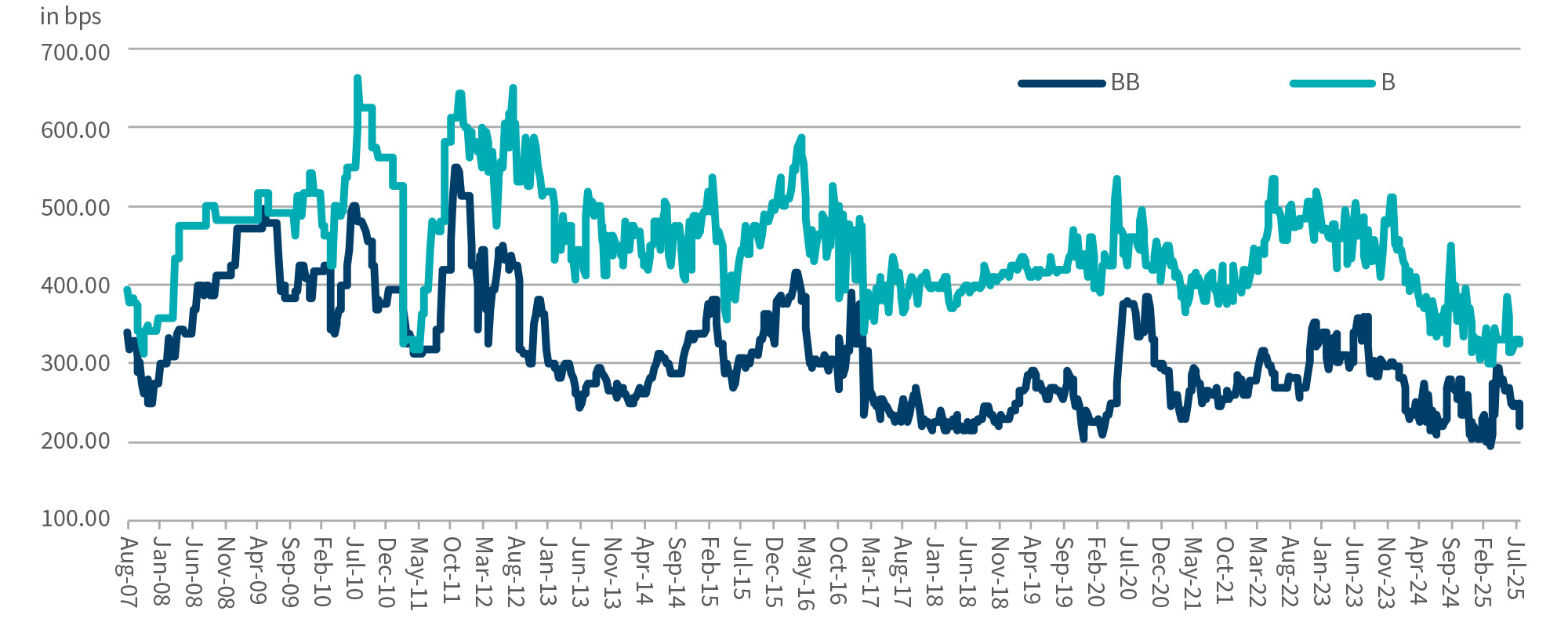

Figure 1 - U.S. Primary Market Term Loan B Spreads

Source: LSEG LPC

For leveraged credit markets, the year of magical thinking has resulted in huge amounts of new issuance and contracting spreads to date in 2025 even as base interest rates, debt default rates and restructuring activity all remain elevated and heightened economic uncertainties prevail. U.S. syndicated leveraged loan issuance is down modestly year-to-date compared to a year earlier due mostly to low issuance activity in April, but it has come roaring back since then with $200 billion of monthly new issuance in July, representing the strongest month of the year for issuance just as the tariff showdown was coming to a head. There’s no denying that there is tons of money earmarked for risky corporate lending that needs to be put to work both by institutional lenders and private credit. But how much nose-holding and rationalizing will be needed to make that happen? Leveraged loan spreads continue to edge lower and are at their narrowest levels since before the Global Financial Crisis, which is worth reflecting on for a moment.

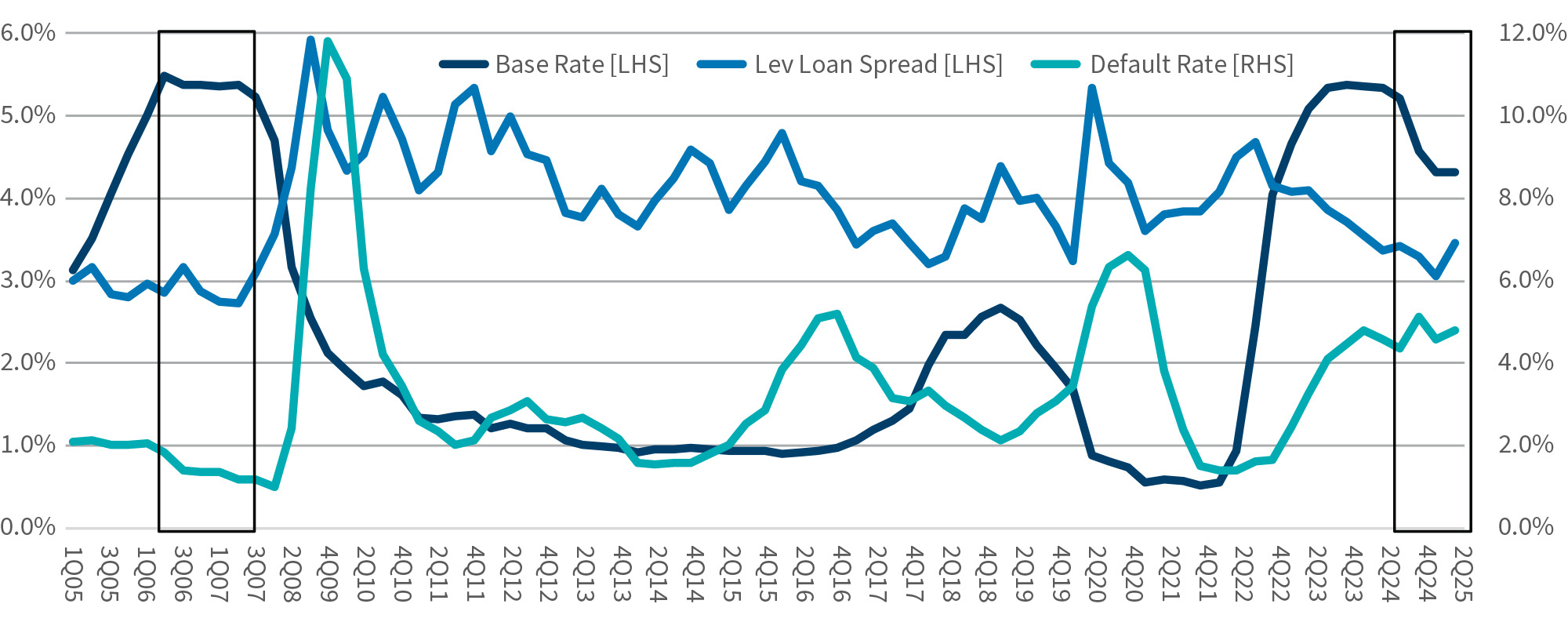

Figure 2 - Leveraged Loan Spread vs. Spec-Grade Default Rate

Source: LSEG LPC

Spreads on B-rated loans, for instance, touched 300 bps in February-March prior to Liberation Day (Figure 1), more than 100 bps below its long-term average and the lowest level in the nearly 20 years that LSEG LPC has compiled this monthly data, only to pop in April following the announcement of reciprocal tariff rates by President Trump. B-rated loan spreads have since retreated, however, and again are retesting the 300 bps level — as if the entire tariff episode and its financial implications for the domestic and global economies and the corporate sector was just one big head-fake or will be inconsequential. Similarly, BB-rated loan spreads briefly moved inside 200 bps in early 2025 and again are testing record-low levels.

Near-record low loan spreads are even more head-scratching considering the robust level of restructuring and workout activity amid a backdrop of mounting economic uncertainty. Compared to 2006-2007, when average leveraged loan spreads last visited the 300 bps range (Figure 2), the U.S. speculative-grade default rate is much higher currently (4.8%) than it was then (1.0%), with strong economic performance prevailing prior to the housing bubble bursting. The distressed debt ratio was also considerably lower (1%-2%) than it is currently (5.5%), though both are indicative of tame default expectations. The earlier benign backdrop changed abruptly in early 2008 when the fissures in the financial system began to crack open. We’re not suggesting that something as ominous is in the offing, but the similarity of market complacency in the current period compared with 2006-2007 is hard to miss.

Are leveraged credit markets blithely ignoring the potholes on the road they are traversing? That’s debatable — and depends largely on what one considers a default event to be. Distressed debt exchanges (“DDEs”) accounted for 57% of S&P rated default events in 1H25, an all-time high that topped the previous high of 54% in 2024. Missed payments and bankruptcies (i.e., conventional defaults) collectively have accounted for a minority share of default events since 2021. Moreover, Liability Management Exercise (“LMEs”), which can be considered distressed debt exchanges but aren’t necessarily so (depending on permitted provisions of the underlying loan documents), are steadily growing in number and share of loan defaults.

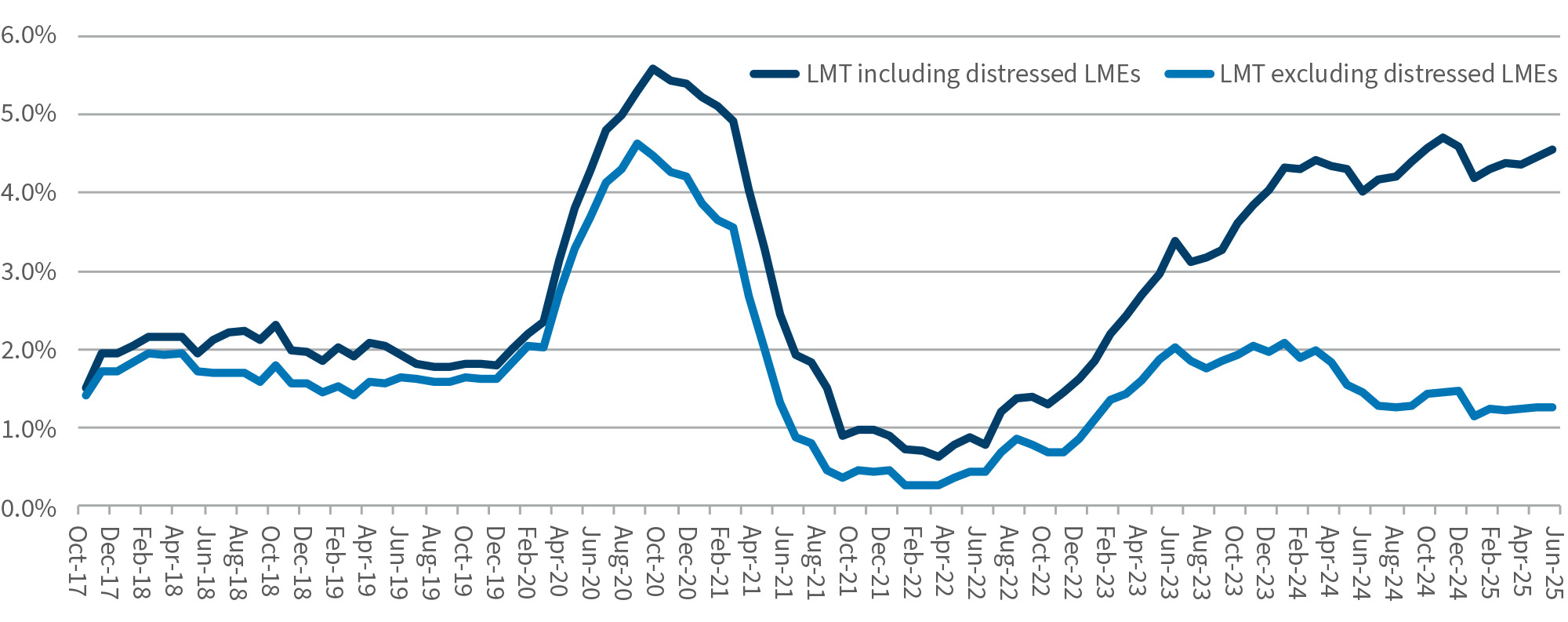

Figure 3 - U.S. Leveraged Loan Default Rates

Source: PitchBook/LCD

PitchBook/LCD recently published an attention-grabbing report that indicates a sizeable and widening divide between U.S. leveraged loan default rates with and without LMEs since 2023 (Figure 3), with the former at 4.56% and the latter at 1.25% currently — its widest gap to date.5 PitchBook/LCD noted there were 37 LMEs done by mid-2025 (“LTM”) compared to just 5 by mid-2022 (“LTM”). Perhaps more concerning, PitchBook/LCD reported that a growing share of LMEs done in recent years have resulted in subsequent payment defaults or Chapter 11 filings, with nearly one-quarter of LMEs done in 2023 having already subsequently defaulted — a percentage that can only increase with time (LifeScan and Maverick Gaming are two examples of relatively recent LMEs that have since filed for bankruptcy). This finding generally is consistent with similar studies of re-default rates by companies that completed DDEs.6 Such negative outcomes are unsurprising to many restructuring advisors who have long viewed these improvised financial solutions with suspicion in terms of their ability to provide a lasting fix.

However, given the breakneck pace of lending since 2024, tightening spreads and wide-open access to credit for B-rated borrowers, it seems that leveraged loan markets are effectively ignoring DDEs and LMEs in their assessment of the corporate credit environment — essentially viewing them as non-events when evaluating lending market conditions and default likelihood. Focusing only on conventional default events would put corporate default activity on par with 2006-2007 and perhaps justify the optimism, but there’s a lot of la, la, la in doing that.

Footnotes:

1: Meier, Lily. “Under Armour’s Turnaround Takes Hit after Weak Sales Outlook,” Bloomberg (8 Aug. 2025).

2: Meier, Lily. “Crocs Shares Drop as Company Cites Cost-Cutting amid Sales Pressure,” Bloomberg (7 Aug. 2025).

3: Bendeich, Mark. “Just in Time? Manufacturers Turn to AI to Weather Tariff Storm,” Reuters (13 Aug. 2025).

4: Ember, Sydney. “After a Lag, Consumers Begin to Feel the Pinch of Tariffs,” The New York Times (2 Aug. 2025).

5: Kakouris, Rachelle. “Leveraged Loan Default Rate Holds at 1.11% in July; Distress Ratio Plumbs Three-Year Low,” PitchBook (1 Aug. 2025).

6: Carroll, Chuck, and John Yozzo. “Are DDEs More Likely to Avert or Delay a Bankruptcy?,” American Bankruptcy Institute Journal (Aug. 2024).

Related Insights

Related Information

Date

août 27, 2025

Contacts

Contacts

Global Chairman of Corporate Finance

Téléchargez

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About