- Accueil

- / Publications

- / Articles

- / Few in the Oil Patch Want To “Drill, Baby, Drill” Despite the President’s Urging

Few in the Oil Patch Want To “Drill, Baby, Drill” Despite the President’s Urging

-

juillet 30, 2025

TéléchargezDownload Article

Subscribe Now

-

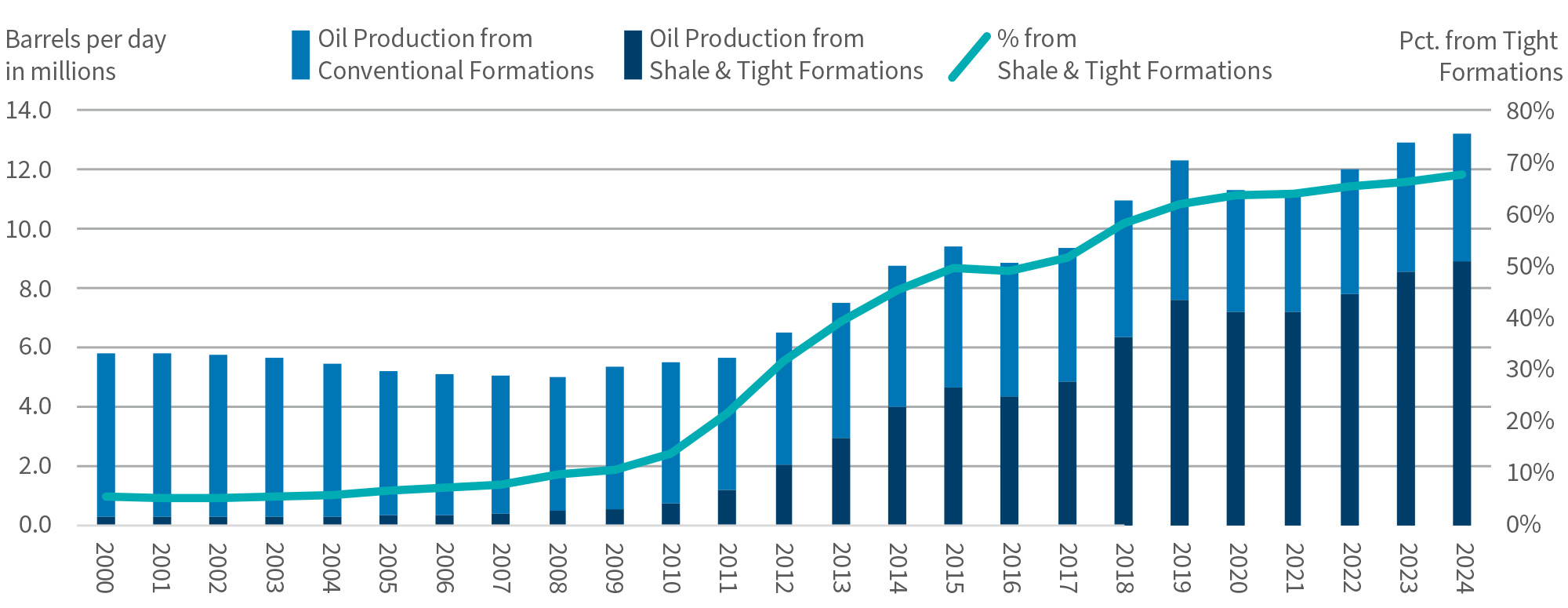

Former Alaska Governor and Vice-Presidential candidate Sarah Palin is credited with popularizing the familiar Republican slogan “Drill, Baby, Drill” during the 2008 presidential campaign.1 She didn’t just mean drilling more in Alaska, but opening up wide swathes of federal land across the country to oil and gas drilling by the private sector. Domestic oil production was approximately 5 million barrels per day at that time. So much has changed in the ensuing 17 years. America is the world’s largest oil producer today, averaging nearly 13.5 million barrels per day — and we didn’t have to compromise millions of acres of federally protected land to get it done, thanks to the “shale oil miracle,” which began in the first decade of this century and now accounts for a vast majority of drilling activity and energy production (Figure 1).

Monthly Insights from Michael Eisenband

Subscribe Now

It is a familiar story by now; developments in pad drilling, rig mobility, horizontal drilling and hydraulic fracking techniques allowed for more efficient drilling, improved rock porosity and hydrocarbon production from shale and other tight rock formations that were considered impermeable or unjustifiably costly just a decade earlier. Collectively, these breakthroughs were a gamechanger that effectively made the U.S. energy independent for the first time (we still import oil for other reasons) and propelled the U.S. to become the global leader in energy production within a few short years. U.S. oil production doubled between 2010 and 2018 as domestic output soared to an average of 11 million barrels per day. This transformative period also entailed major boom (2010-2014) and bust (2015-2017 and 2020) cycles for the U.S. energy sector that created huge fortunes, but then wiped out others and included a record number of energy-related bankruptcy filings after oil prices collapsed in 2015. Despite the turbulence, on balance it has been a prosperous two decades for energy producers and the industries that support them. However, the best shale basins have now been tapped and drained of their most easily extractable reserves, while further development has become increasingly expensive and more uncertain in terms of recoverable reserves, extraction costs and ROI.

Figure 1 - U.S. Oil Production

Figure 1: Source: Energy Information Administration (EIA) and FTI Consulting analysis

The shale miracle is ongoing, but seems more arduous and less awe inspiring these days as oil prices languish well below the “sweet spot” for producers despite escalating geopolitical tensions.

President Trump revived Palin’s slogan during the 2024 presidential campaign season and it remains a popular chant at Republican rallies. Upon his reelection, Trump continues to urge the energy sector to “Drill, Baby, Drill” while supporting policies intended to deregulate the industry and encourage fossil fuel production, while removing key tax incentives and other financial support for alternative energy producers. Interestingly, to date, such efforts to spur more drilling have fallen on deaf ears in the oil patch.

Global oil prices have been mostly range bound between $65-$75 per barrel for the last 24 months, occasionally flaring at the prospect of heightened global turmoil, but retreating when hostilities deescalate. The recent confrontation between Israel and Iran is such an example, with oil prices spiking to $74 per barrel when bomb and missile exchanges between the two countries increased concerns of a prolonged or widening conflict, only to quickly fall back to $65 two trading days after the U.S. bombed Iran’s nuclear facilities. U.S. energy producers don’t make drilling and other capex decisions on the basis of near-term price movements or momentary spikes — and trending oil prices in the $60-$70 per barrel range under benign geopolitical conditions doesn’t get them fired up to embark on a drilling spree.

Moreover, the economics of shale drilling have changed in recent years, as the most profitable tight oil plays are well past peak production and reserves are harder to replace and more costly to extract. Most shale oil wells have notably higher decline rates in their first few years than conventional oil wells,2 and have shorter productive lives, with most of a typical shale well’s recoverable reserves being produced within 3-5 years of drilling completion. This pressures independent producers to replace reserves that are depleting more rapidly than expected, leading to more expensive exploration and production (E&D) efforts. This dynamic added to the severity of the energy bust in 2015-2017.

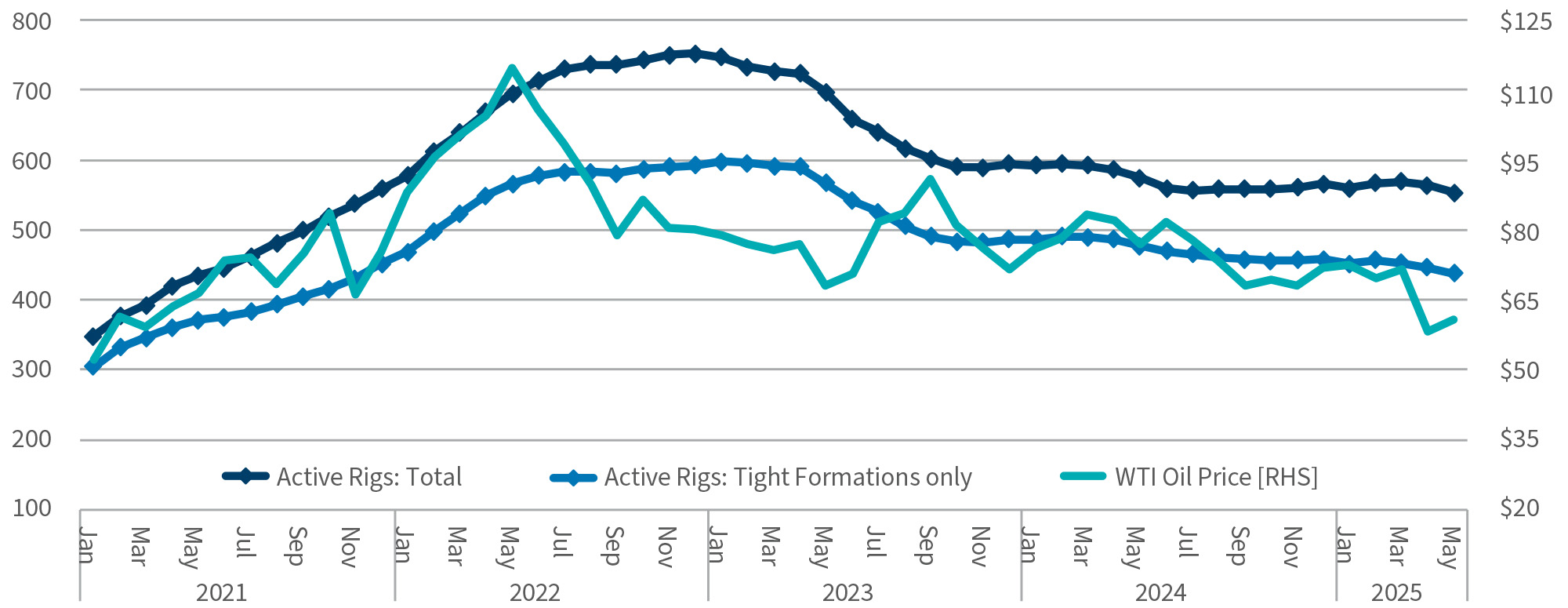

Currently, domestic oil and gas production in the aggregate has been stalled in a tight range (albeit near record high levels) for nearly two years, as production from newly drilled wells slightly exceeds production declines from existing wells. The long running “peak oil” debate continues. The active U.S. rig count peaked this decade in late 2022 and has trended lower since then, coinciding with lower oil prices (Figure 2), while the active rig count in tight-oil formations currently sits at a three-year low. Harold Hamm, a pioneer of shale drilling in North Dakota’s Williston basin and arguably the most visible face of independent energy producers, recently commented that materially increasing domestic energy production is a challenge with notable output declines in several mature shale basins.3 Hamm believes most oil producers outside the prolific plays in the Permian basin need an oil price closer to $80 per barrel these days to cover drilling and development costs,4 while other energy analysts peg a breakeven oil cost for new shale wells at $60-65 per barrel, close to current market prices. It’s summertime, but the living ain’t easy in the oil patch these days.

The enduring popularity of the “Drill, Baby, Drill” refrain coming from President Trump and his supporters is most curious considering that U.S. energy production today is near an all-time high and gasoline prices remain tame at around $3 per gallon. Most Americans aren’t complaining about high gas prices these days, though they continue to express frustration about most other prices. The Biden administration did impose a heavier regulatory hand on the fossil fuel industry than the Trump administration has (or will) but such regulatory restraints hardly held back U.S. oil & gas production, which was higher under President Biden than in President Trump’s first term.

The Trump administration’s bias for fossil fuels and its intended energy policy goals don’t seem to take into account that making it easier to drill via less regulation, favorable tax policy and lots of cheerleading won’t necessarily encourage that outcome if sustainable energy prices don’t justify more drilling. Advocating for more domestic energy supply as the global economy stalls will more than likely weaken energy prices, hurt producers and be self-defeating. Fewer regulatory hurdles may make it less time consuming and slightly cheaper to undertake E&D activity but higher steel prices from Trump-imposed tariffs will add to the cost of drilling new wells.

Most U.S. energy producers today recognize that “Drill, Baby, Drill” in this fragile economic environment likely means that oil prices will fall, baby, fall, given the collective impact that additional U.S. supply can have on global energy markets. Recollections of the 2015-2017 energy bust, when global oil prices plummeted while U.S. producers continued to drill aggressively in an oversupplied global oil market to generate needed cash flow, have not receded from the industry’s collective memory.

At its core, the slogan “Drill, Baby, Drill” implies that regulatory, environmental and other oversight forces are impeding or discouraging energy production efforts in the private sector and needlessly keeping energy prices high for U.S. consumers. That might have been a more defensible viewpoint in 2008 when oil prices topped $100 per barrel before the U.S. emerged as the global leader in energy production. However, in 2025 E&P companies are making disciplined decisions not to drill aggressively based on solid geological and economic analyses of copious amounts of formation and well-level data, as well as hard lessons learned from past mistakes. Consequently, today the slogan “Drill, Baby, Drill” sounds about as relevant as I Like Ike.

Figure 2 - U.S. Energy Drilling

Figure 2: Source: Energy Information Administration (EIA) and FTI Consulting analysis

Footnotes:

1: Brian Montopoli, “Sarah Palin Says ‘Drill, Baby, Drill’ Was Right, Backs Alaska Senate Challenger,” CBS News (June 2, 2010).

2: Trent Jacobs, “Life After 5: How Tight Oil Wells Grow Old,” Journal of Petroleum Technology (January 31, 2020).

3: Chris Mathews, Hart Energy, “Harold Hamm: ‘Drill, Baby, Drill’ Faces Geology Barriers, Even Under Trump,” Hart Energy (November 18, 2024).

4: Tsvetlana Paraskova, “Harold Hamm: ‘Drill, Baby, Drill’ Needs $80 Oil,” OilPrice.com (March 17, 2025).

Date

juillet 30, 2025

Contacts

Contacts

Global Chairman of Corporate Finance

Téléchargez

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About