Best Foot Forward: Changing Regulations Could Facilitate New Investment in the Brazilian Football Market

-

August 11, 2022

DownloadsDownload Article

-

With the approval of Law 14,193/2021 1 last August, Brazil wants to ensure that the “Beautiful Game” continues to grow and expand in one of the leading football countries in the world. The new law allows Brazilian football clubs to be organized according to the investor-friendly SAF regime (“Sociedade Anônima do Futebol”).

Under SAF, football clubs that were previously not-for-profit entities can be transformed into limited companies, creating new avenues of growth through capital investment. While some clubs have resisted the SAF model, others have embraced it to revitalize a club struggling with debt. Investors aiming to enter the Brazilian football business should watch closely for new opportunities over the remainder of 2022 and early 2023.

Restructuring Brazil’s professional Football market

Unlike in Europe where football clubs are companies – some are traded on stock exchanges, such as Tottenham and Manchester United in England, and Rome and Juventus in Italy – most Brazilian clubs are structured as not-for-profit associations. Although the not-for-profit model has certain advantages, especially from a tax perspective, it does not encourage governance standards or professionalization of the clubs. Also, it puts certain restrictions on access to capital markets that limits investment options in one of the country’s leading entertainment sectors. 2

The new SAF regime 3 opens doors to investors by providing a series of significant changes in the sector, including:

- Allowing clubs to transfer assets into a new entity free of liability, making it attractive to potential investment from debt and equity investors;

- Establishing administrative governance standards, including making club managers legally responsible for financial decisions;

- Permitting the issuance of private bonds as a capital raising alternative;

- Introducing potential avenues for judicial reorganization, bankruptcy proceedings or other alternative forms of restructuring; and

- Defining a special tax regime with certain advantages compared to a typical limited company.

Football clubs structured as not-for-profit organizations may lack some of the corporate structures and controls required of publicly traded companies, so this represents an opportunity for local clubs to establish more professional standards. For clubs that adopt the SAF model, this should lead to significant improvements of internal processes and management standards to meet the required governance standards, including the establishment of formal Boards of Directors and Audit Committees.

The Global Passion for Football

Football is the world’s most popular sport with an estimated 3.5 billion fans. 4 The Brazilian football market is a well-positioned segment with several growth avenues to continue expanding over the long term. Brazil’s large population combined with widespread passion for football has generated several relevant local clubs with millions of fans. 5 In addition to the SAF investment possibilities, the local football industry could see several changes that will generate new opportunities for incremental revenue.

Following the lead of some European leagues, Brazil’s clubs are moving toward the creation of an independent league that will be managed directly by the teams. 6 Growth opportunities also exist in the digital streaming services segment, alternative broadcasting vehicles, and fan base engagement and monetization. 7 With new capital, Brazil’s clubs can increase investments to explore alternative sources of revenue such as social media, fan-tokens commercialization, and others.

Lastly, the country is known as a producer of talented young players who routinely attract interest from international clubs. 8 Investing in player development infrastructure and in youth categories should factor into the market investment thesis.

Overcoming Challenges in an Entrenched Market

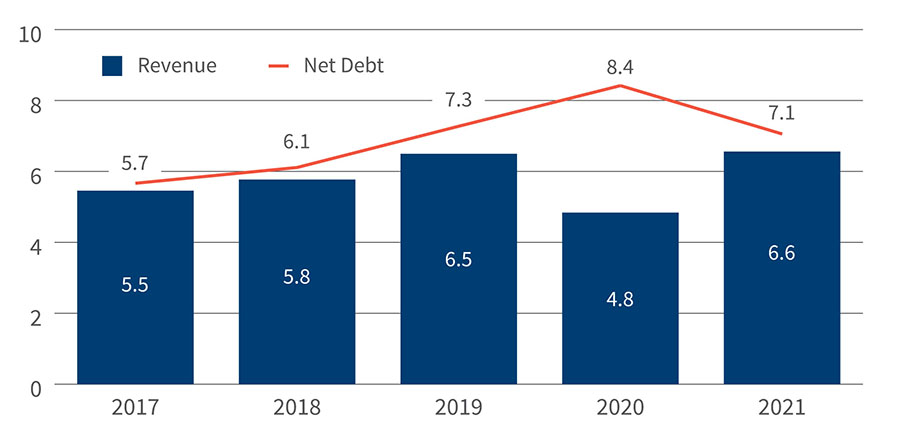

Except for a pandemic-impacted 2020, the revenue of Brazilian clubs has shown solid growth in recent years, although debt-to-equity ratios remain high in general.

Historically, broadcasting rights and prize money correspond to the largest source of revenue, followed by the transfer of players, sponsorship and product sales and matchday revenues, which include tickets and merchandising, and food and beverage sales.

Figure 1 – Financials of Serie A Clubs (BRL billion)

Concovados and XP Investimentos - “Relatório Convocados”, Convocados Website, (2022, last accessed July 20, 2022. https://convocados.net)

However, clubs’ indebtedness has accelerated in recent years, not only due to the recent effects of the pandemic but also due to the lack of professional management in the local football industry. 9 In general, tax liabilities constitute the largest part of a club’s indebtedness. The other relevant liabilities usually include suppliers, agents and employee and player payroll.

Investment Opportunities Still Exist

The prevalence of highly leveraged football clubs has accelerated equity deals in Brazil. Investments in Brazilian soccer were initially concentrated in controlling equity deals, targeting clubs with tough financial conditions and poor sports results, but also possessing a significant fan base and strong brand awareness. As clubs evaluate the pros and cons of adopting the SAF model and how it can help them compete with other clubs, there will continue to be a steady supply of investment opportunities from clubs waiting for the right offer to appear. 10

How Can FTI Consulting Help?

FTI Consulting delivers strategic advice with its global reach, and with its local office in Sao Paulo, Brazil, FTI Consulting can provide local insights to the latest international sports trends through a senior experienced team and network. FTI Consulting covers the full spectrum of services to all leading players shaping the future of the sports industry. FTI Consulting is well-positioned to assist in all the steps of a potential transaction through its FTI Capital Advisors 11 team.

FTI Consulting also has an experienced team to assist in the transaction process including, but not limited to the following: due diligence of targets, post-acquisition integration and improvement, liability management, ticketing optimization, overhead and stadium costs, relegation planning or multi-year business plans for the club.

If you are interested in exploring investment opportunities involving the evolving Brazilian football market, FTI Consulting would welcome the chance to start a conversation.

Published

August 11, 2022

Key Contacts

Key Contacts

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About