Colombia’s Rejection of the Status Quo

-

April 08, 2022

DownloadsDownload Article

-

13 March 2022 was a key date in setting up Colombia’s political panorama for the next four years. Not only did the Colombian population elect new representatives to the Senate and the House of Representatives, it also voted in inter-party consultations to elect the three main presidential candidates.

The first round of the presidential elections will take place on 29 May 2022. The results of the presidential candidate consultations and the legislative elections indicate that the Colombian voting population is not merely seeking a change in government, rather it is actively voting against the political status quo.

Colombia’s longstanding ailments of inequality, violent crime and inadequate state control, all of which were exacerbated by Covid-19, have contributed to the electorate seeking a shift in the political direction of the nation in the upcoming elections. Colombia has suffered historically from socioeconomic inequality; it is the country with the second highest Gini coefficient in South America and one of the highest in the world1. This situation has only worsened due to the effects of the Covid-19 pandemic. Even though some indicators have improved in 2022 compared to 2021, inequality is felt keenly in the Colombian population.

According to Colombia’s National Administrative Department of Statistics (Departamento Administrativo Nacional de Estadística), unemployment in the country reached 12.9% in February 2022, compared to 15.5% in February 20212. Yet, according to a poll conducted by the United Nations Development Program in December 2021, 85% of those surveyed believe that the distribution of wealth in Colombia is unfair3. In spite of recent improvements, socioeconomic inequality remains a vital social and electoral issue. It is therefore not a surprise that the Colombian population wants change. As many voters say on the streets: how could things get worse. According to the OECD, it would take 11 generations for the descendant of a poor Colombian family to attain “average income” levels in the country4.

Based on the presidential candidate consultations results, Gustavo Petro and Federico Gutierrez are currently the two leading candidates for the May elections. While concern has been raised by the private sector and foreign investors regarding the new president’s possible impacts on Colombia’s business environment, in particular in the energy, mining, infrastructure and pension fund sectors, we believe that Colombian institutions will continue to be independent and robust regardless of which candidate wins the elections. Likewise, irrespective of who actually wins the election, the new president will not have a majority in congress as both chambers in the legislative branch are fragmented, as depicted in Figure 1 below. It is, therefore, improbable that radical reforms in these and other sectors are likely to pass in the next four years. As such, the legislature will serve as an important check and balance on the new president’s more radical proposals. This same trend has been seen with newly formed leftist governments in Peru and Chile where fragmented congresses have curbed more extreme electoral promises.

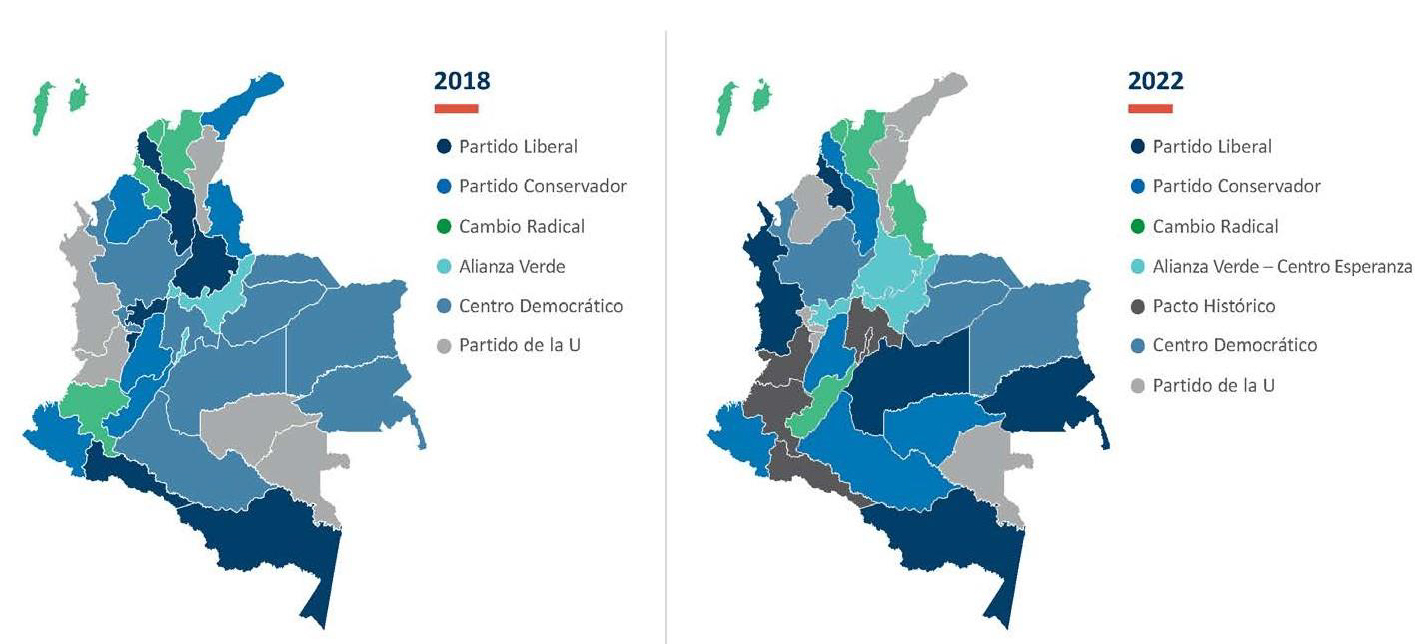

Figure 1: Congressional Results by Region

Presidential Consultations

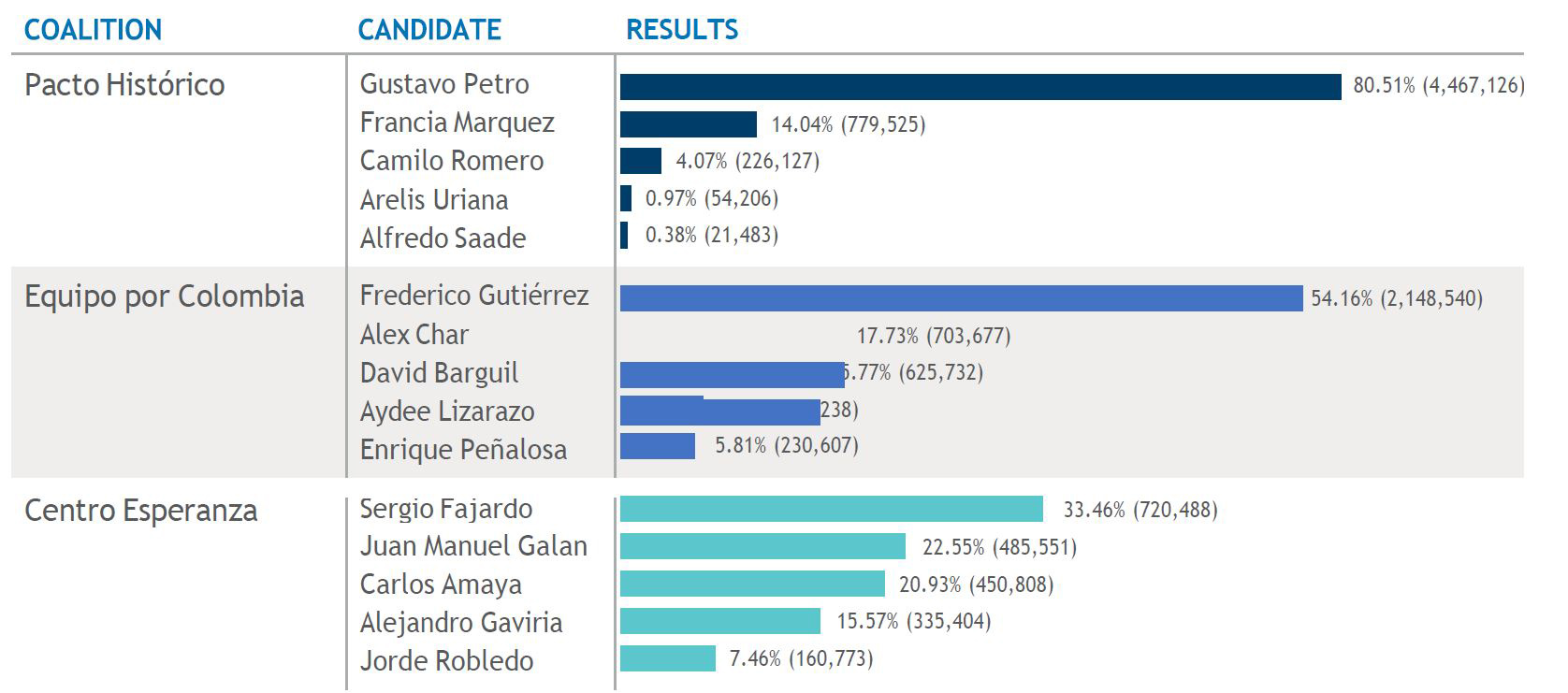

Presidential consultations were held by three political coalitions: 1) Pacto Histórico (left coalition), 2) Centro Esperanza (center coalition), and 3) Equipo por Colombia (right coalition)5. The victors for each were Gustavo Petro (“Petro”) from Pacto Histórico, who obtained the most votes (4.5 million), Federico Gutierrez (“Gutierrez”) from Equipo por Colombia, who received 2.1 million votes, and Sergio Fajardo (“Fajardo”) from Centro Esperanza, who collected a little over 720,000 votes6. While the dust still needs to settle, this result would appear to position both Petro and Gutierrez as the front runners for the first round of Presidential elections in May.

Figure 2: Presidential Candidate Consultation Results7

The results of the presidential consultations clearly demonstrate that the left will be a considerable political force in the first round of presidential elections. Indeed, Petro is the clear favorite to lead the first round of voting in May. On the other hand, the center coalition, Centro Esperanza, had a much lower voter turnout compared to the right. The victor, Fajardo, obtained much lower voting numbers than his counterparts. This was a surprise as, prior to the March elections, Fajardo was one of the presidential favorites and many polls had positioned him as the most likely candidate to beat Petro for the Colombian presidency. Even though Petro is the clear leader in the leadup to the presidential elections, we do not believe that Petro or any other candidate will have enough support to win in the first round in May. We consider a run-off in June between Petro and Gutierrez to be the most probable outcome.

The right coalition winner, Gutierrez, did better than expected, indicating that he could be a unifying leader who coalesces the electoral right while, at the same time, attracting elements of the center. He clearly is well positioned to be Petro’s biggest contender. Notwithstanding, Gutierrez will need considerable support from the center to assure victory, which will be challenging. The day after the elections, the candidate from Alvaro Uribe’s Centro Democratico political party, Oscar Ivan Zuluaga (“Zuluaga”), announced his withdrawal from the presidential race and pledged his support to Gutierrez. Zuluaga’s decision shows that Colombia’s electoral right will most likely support Gutierrez’s presidential campaign8. However, the centrist sentiment against Uribe and his party has been growing steadily in recent years. As such, Gutierrez will have to leverage his political network and somehow appeal to the center if he wants to have a real chance at beating Petro in the second round of the presidential elections.

Congressional Results

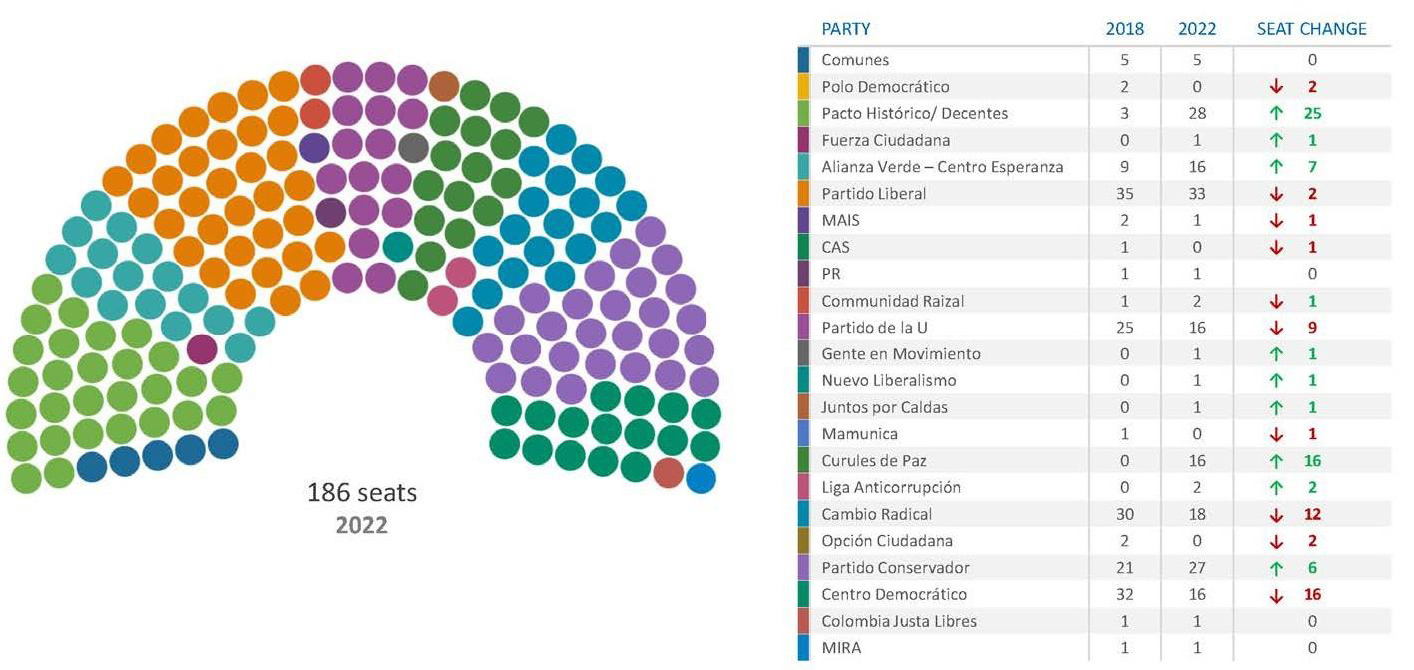

The results of both the Senate and the House of Representatives (graphically displayed below) shows Petro’s left coalition as a force to be reckoned with in the Senate and in the House of Representatives. His Pacto Histórico is the movement that took the most seats in the Senate, as depicted on Figure 2. In the event that Petro wins the Presidency in the mid-year elections, these gains in Congress will allow him to explore more controversial policies around core issues such as taxation and reducing Colombia’s reliance on carbon-based fuels, as well as empowering local communities over commercial projects. However, the results also indicate that despite having the most seats, Petro’s movement does not hold a clear majority. As such, he will have to make his proposed reforms more palatable during his negotiations with the center for their support.

Figure 3: Senate Results9

Figure 4: House of Representatives Results10

Considering the makeup of the new Congress, radical policy changes are improbable as no candidate can count on having a clear majority in the legislative branch. Moreover, Colombia’s central bank and judicial system will robustly defend their hard-fought independence11. The new executive branch will have important checks and balances from other branches of government which should serve as comfort to foreign investors.

Impact on Business

Taking into account the upcoming elections and the impact that they could have on Colombia’s business environment, it is vital to analyze the upcoming panorama for the energy, mining, infrastructure, and pension funds sectors – amongst others. As shown in the chart below, each candidate will have a significantly divergent impact on major industries if they win the Colombian presidency. FTI Consulting has done extensive research on each of these sectors, as well as extensive scenario mapping and likely impacts. Please contact Daniela Cuellar daniela.cuellar@fticonsulting.com if your company would like to access to this analysis.

Figure 5: Leading Candidates Views on Key Policy Matters12

Conclusion

The March 2022 elections indicate that Colombia is following a similar electoral pattern recently seen in other Latin American nations. The later term Covid environment has promoted a widespread backlash against the political status quo, as has been seen in Argentina (with the congressional victory of the opposition coalition), Ecuador (with the election of Guillermo Lasso), Peru (with the election of Pedro Castillo), and Chile (with the election of Gabriel Boric), and Costa Rica (with the election of Rodrigo Chaves).

The notable gains of Petro and his coalition in Congress is a clarion call to Gutierrez and his supporters that they must plan to gather significant support from the center for the second round of elections in June 2022. If he cannot gather this support, it is likely that the Colombian executive government could shift to the left under Petro. Nevertheless, what will serve as a comfort to foreign investors and the business community is that, regardless of who wins the presidency, Colombia’s institutional strength and rule of law appear sufficiently robust for the country to maintain economic stability and protect its vital foreign investors. In addition, to further appease investors, according to Fitch Ratings, “the five largest Colombian commercial banks’ key operating, growth and capital metrics are at or above pre-pandemic levels, positioning them well for the heightened uncertainty and macroeconomic risk environment13”. Moreover, the fact that no candidate will have a clear majority in Congress means that whoever governs will need to seek more moderate reforms to obtain the much-needed support from the center, which indicates that the implementation of radical proposals is improbable.

Footnotes:

2: https://www.dane.gov.co/index.php/estadisticas-por-tema/mercado-laboral/empleo-y-desempleo

6: https://resultados.registraduria.gov.co/

10: https://resultados.registraduria.gov.co/camara/0/colombia

12: Elaborated by FTI Consulting

Published

April 08, 2022

Key Contacts

Key Contacts

Senior Managing Director, Leader of Asia and Latin America Forensic & Litigation Consulting