There Is a Corporate Vibecession Too

-

October 09, 2025

DownloadsDownload Article

-

The term “vibecession” entered the business lexicon in 2022 and has been used to describe the disconnection — and often sharp divergence — between strong U.S. macroeconomic data readings and the subdued or downcast sentiment of most consumers about the condition of domestic economy and their personal financial situations. For many Americans, it may not be a recession we are experiencing but it has the vibes of one to them every time they go grocery shopping for the family or struggle to make the monthly car payment, hence the name vibecession, which was coined by business blogger Kyla Scanlon.

The vibecession was a notable contributing factor in the November election victory of President Trump, with the Biden/Harris campaign insisting on playing up the strength of the domestic economy in early-to-mid 2024 (“Bidenomics”) even as most Americans repeatedly told pollsters they weren’t feeling it or participating in its prosperity. The Bidenomics theme felt tone deaf to a lot of voters who were struggling financially, and it was subsequently downplayed by the Biden campaign by early summer 2024, but the messaging damage was done. Too many Americans weren’t buying into the premise of a strong economy despite the headline numbers. Claims on how badly the economy was doing during the campaign were surely exaggerated, but they rang truer for many voters than the happy talk on the economy coming from the Biden/Harris camp. Three years after the term was introduced, vibecession remains a widely used and understood shorthand reference for our disjointed and uneven economic performance, though it remains vaguely defined at best.

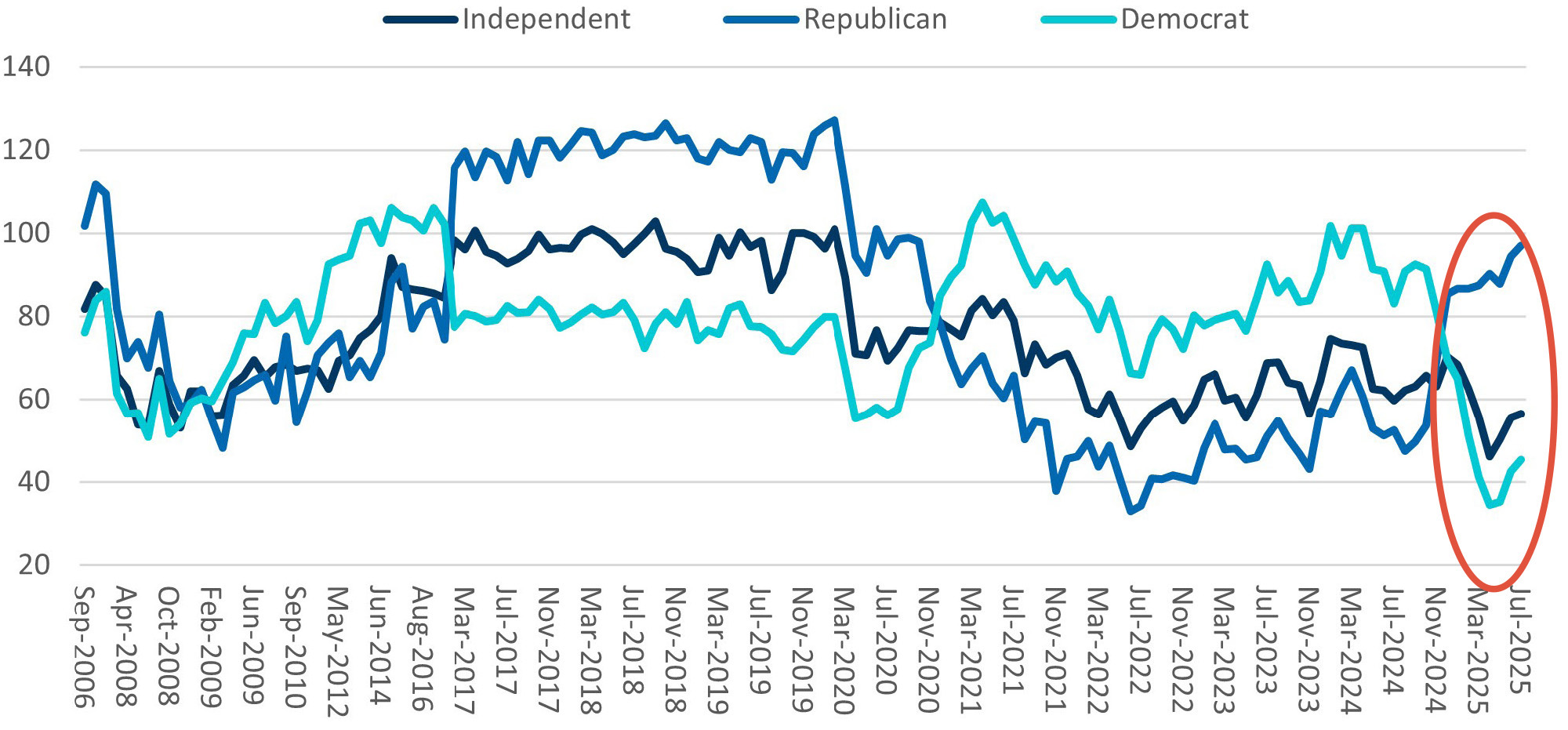

Even today, with the COVID-19 episode long behind us, inflation mostly under control, low unemployment and interest rates poised to move lower, most Americans remain downbeat on the condition of the U.S. economy, except for self-identifying Republicans (Figure 1). Consumer sentiment among those identifying as politically independent (and presumably unbiased) is near its lowest level in more than two decades even as high inflation has been subdued, economic growth has defied expectations of stalling out and equity markets are at all-time highs. Politically Independent respondents have nearly evenly split the difference between the widely divergent responses of self-identifying Democrats and Republicans over the prior eight years, but in 2025 their responses align more closely to Democrats’ view of the economy (Figure 1), which is decidedly negative.

The recent sharp downward revision to previous monthly job creation totals by the Bureau of Labor Statistics (“BLS”) goes a good way towards bridging the gap between the data and the vibes. The annual BLS payrolls revision for new jobs created in the previous 12 months through March 2025 was reduced by 911,000,1 the largest revision on record, which is approximately one-half of the 1.8 million jobs estimated to have been created in that year prior to the revision — taking average month new jobs from 149,000 (as originally reported) to approximately 75,000. This revision comes on top of a downward revision of 818,000 jobs in the prior year. All told, these negative revisions indicate that the labor market has been considerably weaker since mid-2023 than previously estimated and has weakened further in recent months outside the revision period, with new jobs created and available job openings both slowing further. Maybe the vibes had it right all along, with the data just now catching up to them.

Substantial revisions to previously reported payrolls data on a monthly and annual basis are not unusual and mostly reflect time delays in getting more accurate data from various sources. (There are also annual revisions to GDP growth and retail sales, which also can be material.) There is nothing underhanded about this imperfect and delayed process of data collection and analysis, as some have suggested, but nonetheless it can serve to weaken trust in the accuracy of reported labor market data, which financial markets anxiously await each month, or other key macroeconomic data compiled and reported by BLS, the Bureau of Economic Analysis or the U.S. Census Bureau. We have not heard the last on this topic of economic data accuracy and timeliness from the Trump administration, which seems determined to improve the surveying and data collection processes in order to reduce the size of subsequent revisions, though some attribute other motives to tinkering with long-standing data gathering and reporting methods by these federal agencies.

“Vibes,” however they are defined and measured, are the unarticulated feelings of individuals that often fail to resonate with economic decisionmakers or financial markets the way hard data does, but collectively should not be ignored, as evidenced by what we have seen in the last couple of years. The signaling value of vibes can provide insight or nuance that reported statistical data, particularly aggregated topline data and its coverage by the business media, might miss or mischaracterize, especially as broad economic gains become more disproportionately shared among households. A recent report by Moody’s Analytics estimates that the top 10% of U.S. households by income account for nearly 50% of total consumer spending in 2025 compared to 35% in the mid-1990’s, so a reading of “the vibes” provides some of that needed context.2

Figure 1 – Index of Consumer Sentiment

Source: University of Michigan Survey of Consumers

The Corporate Vibecession

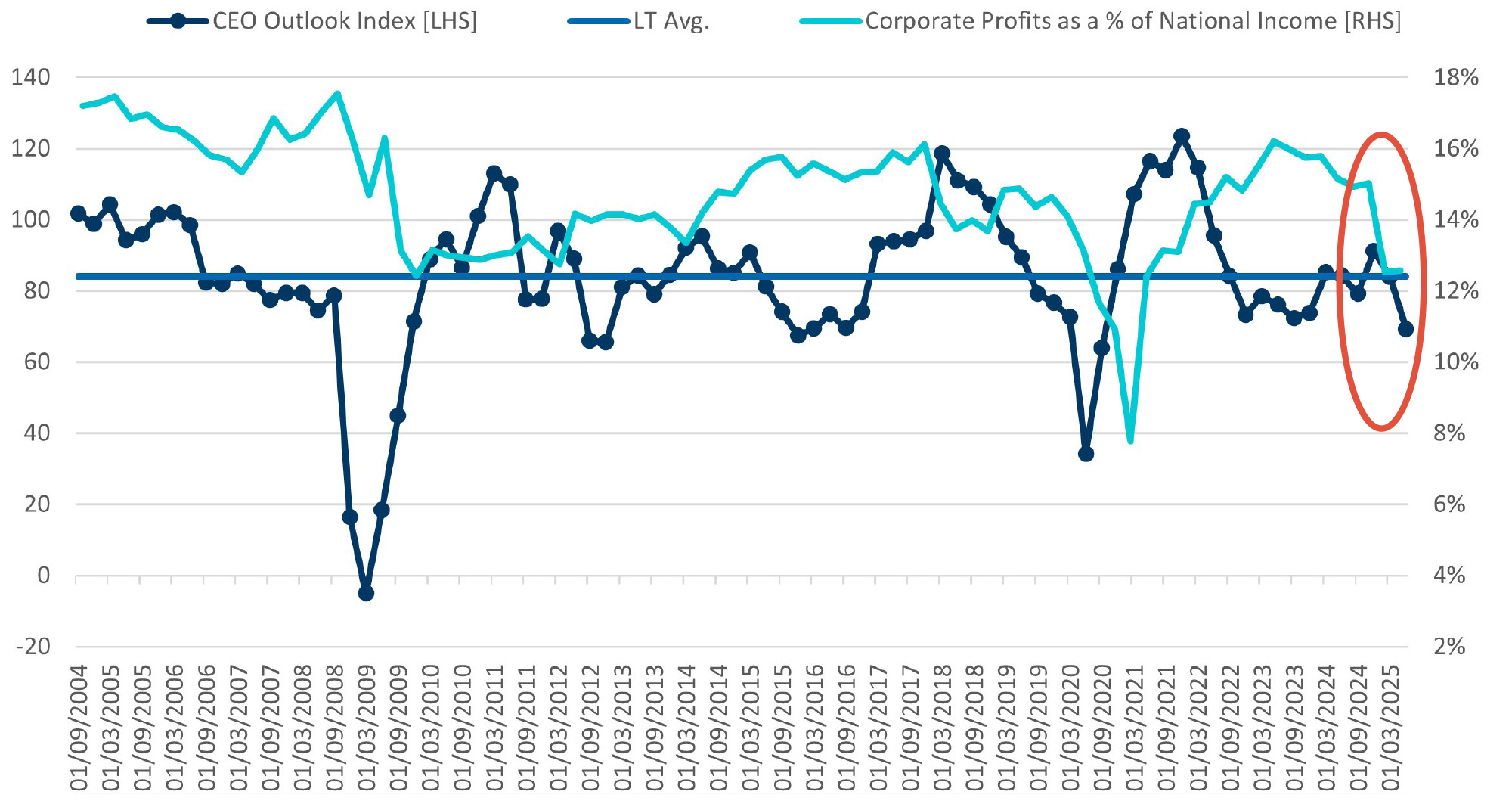

The vibecession phenomenon can also be seen in the corporate realm, where CEOs and other C-suite executives continue to indicate caution in their business outlooks that doesn’t align with the unchecked optimism expressed by financial markets, investors and market pundits. Tariff-related uncertainties have negatively impacted survey respondents since 1Q25, but most CEOs had muted outlooks before Liberation Day. The Business Roundtable CEO Economic Outlook Index took a big hit in 2Q25,3 with all three index components registering sharp declines, mostly due to lingering trade policy uncertainties as of June. But even prior to the Trump administration’s announcement of aggressive reciprocal tariffs in early April, the CEO Economic Outlook Index was tracking well below levels in 2017 through mid-2019, in 2021 coming out of the COVID-19 pandemic, and in 2011 as the domestic economy shook off the last vestiges of the Great Recession (Figure 2).

Similarly, the Conference Board’s most recent Measure of CEO Confidence, published in August after most final tariff rates were announced by the Trump administration, registered a rebound after plummeting in 2Q25 but remained slightly below a neutral reading of 50 and “…fell short of signaling a return to optimism.”4 Geopolitical instability, cyber threats and trade/tariffs remain the top concerns of CEO respondents, with approximately 36% expecting a recession within the next 12-18 months. Just 30% of respondents expect general economic conditions or conditions in their own industry to improve over the next six months. Despite the recent rebound in CEO confidence following the April tariff scare, the CEO Confidence Index remains well below levels reached over extended stretches of time during the last decade, most recently in 2017-2018 and in 2021, when the index hit a 25-year high of 82 coming out of COVID-19, but prior to the onset of high inflation.

Ironically, muted CEO confidence comes at a time of record-high levels of corporate profitability, with corporate profits expressed as a percentage of national income consistently trending higher since early 2023 and making all-time highs of approximately 17.5% in recent quarters (Figure 2) compared to a 50-year average of 12.0% and 13.7% since 2000. Aggregate corporate profits have increased by 86% since 2019, or a CAGR of 11%. Consistently strong growth in corporate earnings has been a cornerstone of this unprecedented bull market for equities, but most CEOs aren’t nearly as ebullient aside from the AI and high-tech crowd. Arguably, this is the corporate sector version of a vibecession, and observers are left to wonder why this glaring disconnect persists and what is holding back CEO respondents from jumping on the bandwagon other than a penchant for conservatism.

Much like the consumer economy, the corporate sector is hardly monolithic; it is a mixed bag of high, low and middling performers who view the economic landscape quite differently — including a relatively small (in number) cadre of big tech companies benefitting enormously from the digital and AI revolutions and dominating markets and headlines, along with many, many more mundane low-tech businesses trying to navigate unprecedented global challenges in an increasingly unpredictable geopolitical environment. Restructuring professionals recognize that this recent period hasn’t been smooth sailing for much of the corporate sector and apparently that sentiment is shared by many of the captains steering these ships.

Figure 2 – Business Roundtable CEO Outlook

Source: Business Roundtable and FRED (Federal Reserve Bank of St. Louis)

Footnotes:

1: Saraiva, Augusta, “US Payrolls Marked Down a Record 911,000 in Preliminary Estimate,” Bloomberg News, (9 Sept. 2025).

2: Marte, Jonnelle, “Top 10% of Earners Drive a Growing Share of US Consumer Spending,” Bloomberg News, (16 Sept. 2025).

3: “Business Roundtable CEO Economic Outlook Index Declines Further in Q2,” Business Roundtable, (18 Jun. 2025).

4: “Confidence Revived in Q3 but CEOs Remain Cautious,” The Conference Board, (7 Aug. 2025).

Related Insights

Related Information

Published

October 09, 2025

Key Contacts

Key Contacts

Global Chairman of Corporate Finance

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About