Direct-to-Employer Contracting Has Arrived

-

April 06, 2022

DownloadsDownload Article

-

Employer-sponsored insurance spending per enrollee is projected by the U.S. Centers for Medicare & Medicaid Services (CMS) to increase 4.6% per annum from 2021 to 20282. This figure may be somewhat understated, given the shortage of nurses and the rapid rise of supply costs, inclusive of medical devices and pharmaceuticals. The average worker premium contribution for family coverage was $5,969 in 2021; 29% of employees with single coverage had deductibles exceeding $2,0003,4. Additional cost shifting is no longer tenable given the already high costs borne by employees.

According to the 2021 Large Employers Health Care Strategy and Plan Design Survey from the Business Group on Health, currently 9% of large employers have directly contracted primary care models in select markets; another 17% are considering it for 2022-20235.

In this article, we discuss alternative provider-employer relationships and the considerations associated with DTE contracting.

Alternative Relationships

Alternative relationships may entail onsite, near site and virtual health clinics, centers of excellence or broad, value-based capitated arrangements.

Onsite, near site and virtual health clinics improve access (convenience), increase satisfaction and, potentially, reduce costs (via earlier intervention). Services may be narrowly defined to primary care or more broadly include occupational health, physical therapy, etc. Wellness offerings can be integrated to include health risk assessment (biometric screening), lifestyle management (fitness, nutrition) and behavior change6.

The Centers of Excellence (COE) program offered by a leading retailer provides access to world-class institutions for cardiac, spinal, hip/knee replacement and weight loss procedures and organ transplants, as well as medical record review, primarily cancer-related, to determine whether a site visit is appropriate7. 15 well-known and geographically disbursed institutions participate in the program8. Most conditions are covered at 100% (i.e., zero cost), including travel, before meeting the deductible. Hospitals are reimbursed via negotiated bundled payment agreements; a shorter length-of-stay and lower rehospitalization rates have been shown9. The COE program was launched in 201310.

In August 2018, a major health system in the Midwest signed a direct contract for the provision of a wide range of healthcare services with 24,000 employees and their families working for a leading automobile manufacturer11. Services include primary care, hospital, emergency care, behavioral health and pharmacy. The five-year contract includes 19 cost, quality and service utilization targets. Pricing was directly negotiated between health system and manufacturer; the third-party administrator network pricing was not used. Cost savings will be split.

A major chip manufacturer and health system “have established a custom Integrated Delivery System (IDS) model of shared risks and rewards—essentially an employer-sponsored Accountable Care Organization (ACO) based on a patient-centered medical home (PCMH) model—that aims to give employees more personalized, evidence-based, coordinated, and efficient care12.” Many other companies with direct provider contracts exist13.

In summary, the essence of a direct contract is a per member per month fee, combined with shared risk and cost savings.

Considerations

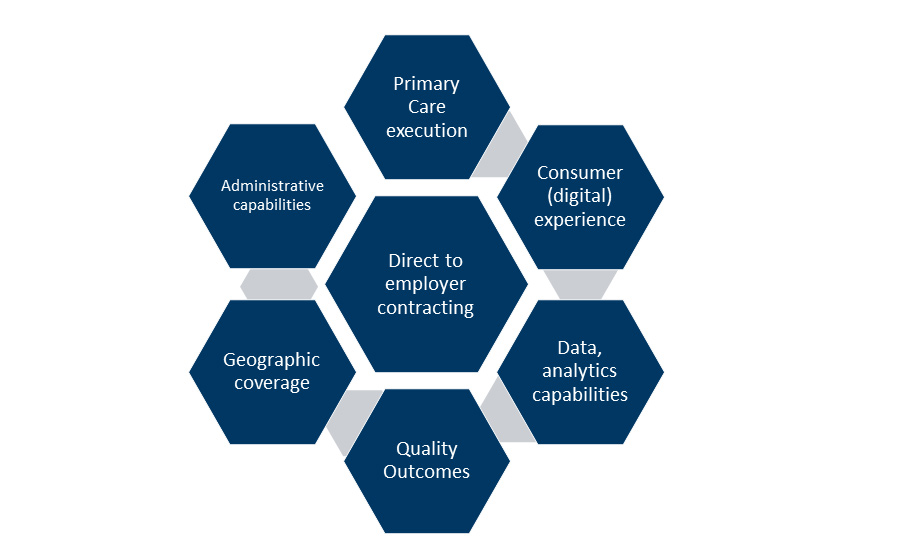

Direct-to-employer contracting requires primary care execution, the consumer (digital) experience; data, analytics and actuarial capabilities, quality outcomes, geographic coverage and administrative capabilities – the latter often outsourced to a third-party administrator.

Direct-to-Employer Contracting Considerations

Primary Care Execution

In a value-based healthcare delivery system, physicians are required to reinvent themselves from independent, acute interventionists focused on fee-for-service (volume) performance to integrated team leaders who are prevention-oriented, proactive and focused on value (quality/ cost). Physician compensation requires alignment to organizational goals and objectives.

Workflow integration for chronic disease management requires real-time data, proactive management and clearly defined roles for care team members.

Transitional care management may require additional support staff (i.e., a case manager) closely monitoring patient progress. Patient bundles include the immediate post-operative period. Post-acute care and hospital-at-home services provide emergent opportunities for non-facility care.

Capital investment in new technologies may be required. Platforms have applications (a) at the front end to enhance access and patient satisfaction (i.e., contact centers); (b) as an analytic engine to facilitate population health; (c) to facilitate care management — the identification of patient-specific tasks, goals and assessments; (d) to integrate remote monitoring data; and (e) telehealth.

Consumer (Digital) Experience

The Institute for Healthcare Improvement’s (IHI) framework for optimizing health system performance, known as the Triple Aim, includes improving the health of populations and the patient’s experience of care (quality, satisfaction) and reducing the per capita cost of care14. “Patient experience encompasses the range of interactions that patients have with the health care system15.” As technology evolves and patients pay a higher proportion of out-of-pocket costs, their experiences increasingly parallel those of retail consumers.

Patient access increasingly matters to patient choice; dissatisfaction may lead to an alternative provider and loss of market share. An omnichannel “digital front door” is being implemented in contact centers that utilizes technology to maximize self-service capabilities, generate insights via customer relationship management systems and optimize use of staff resources.

Data, Analytic and Actuarial Capabilities

Data and analytics are essential for (1) risk/cost stratification/predictions, (2) care management, (3) identification of gaps in care, (4) utilization management, (5) population health, (6) outcomes measurement and (7) benchmarking and other areas. Claims data, though retrospective and associated with a lag, is readily available and particularly useful at the aggregate level. Providers also have access to extensive, quantitative and timely electronic medical records focused on individual patients.

Quality Outcomes

Employers increasingly focused on value-based care emphasize the quality rather than the volume of delivered services. Gaps in care, such as those relating to prevention and chronic disease management (e.g., diabetes) are emphasized. Commonly used metrics include the rate of hospital admission, re-admissions and emergency department visits relative to benchmarks. Centers of Excellence require the outcome metrics to support its designation.

Geographic Coverage

Principles of network adequacy include timely access, sufficient choice of providers, affordability, quality and transparency16. Geographic accessibility, short appointment waiting times and access to emergency care are essential to customer satisfaction. A sufficient choice of providers includes specialists; gaps in care may necessitate use of other providers contracted at rates under existing third-party administrators (TPAs) or insurer contracts. Affordability remains a challenge for many Americans17. Value-oriented networks have the potential for delivering higher quality at lower costs. And transparency begets an informed consumer.

Administrative Capabilities

A provider may not have the ability to provide services such as claims adjudication, customer service, eligibility maintenance, and ID card production that are necessary to ensure customer satisfaction. These services are typically provided by third-party administrators. TPAs may also assist with plan design, manage enrollment, facilitate network access and ensure compliance with federal regulations18. It is estimated that “60 percent of U.S. workers with non-federal benefits are in health plans using third-party administrator services19.”

In addition, contracting and negotiating directly with employers will likely require providers to inform and educate their employer counterparts regarding the nuances of value-based contracts such as capitation, quality scores, shared savings and bonus/incentives components with contract terms beneficial to both parties.

Bottom Line

As employers continue to look for ways to reduce healthcare costs, providers can expect direct contracting opportunities to emerge. Relationships often exist in the community between providers and employers, potentially serving as the basis for a “win-win” direct contracting proposition.

Footnotes:

1: Mike Burns. “Is direct-to-employer contracting right for your organization?” Puget Sound Business Journal (November 11, 2021). https://www.bizjournals.com/seattle/news/2021/11/11/is-direct-to-employer-contracting-right-for-your.html#

2: National Health Expenditures, Projected. U.S. Centers for Medicare & Medicaid Services, Table 17 (last modified December 1, 2021). https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsProjected

3: 2021 Employer Health Benefits Survey, Figure A, Average Annual Worker and Employer Premium Contributions for Family Coverage, 2011, 2016 and 2021. Kaiser Family Foundation (November 10, 2021). https://www.kff.org/report-section/ehbs-2021-summary-of-findings/#figurea

4: 2021 Employer Health Benefits Survey, Figure E, Percentage of Covered Workers Enrolled in a Plan With a General Annual Deductible of $2,000 or More For Single Coverage, by Firm Size, 2009-2021. Kaiser Family Foundation (November 10, 2021). https://www.kff.org/report-section/ehbs-2021-summary-of-findings/#figurea

5: Chad Mulvany. “Business Group on Health’s Annual Survey: Large employers ready to take the reins on healthcare cost.” Healthcare Financial Management Association (September 2, 2020). https://www.hfma.org/topics/payment-reimbursement-and-managed-care/article/business-group-on-health-s-annual-survey--large-employers-ready-.html

6: Healthier Workforce Healthier Bottom Line. QuadMed (last visited February 22, 2022). https://www.quadmedical.com/onsite-health-solutions.

7: 2021 Walmart Centers of Excellence. Walmart Inc. (2021). https://one.walmart.com/content/dam/themepage/pdfs/centers-of-excellence-overview-2021.pdf

8: Ibid.

9: Jonathan R. Slotkin, MD, Olivia A. Ross, M. Ruth Coleman, Jaewon Ryu. 2017. “Why GE, Boeing, Lowe’s, and Walmart Are Directly Buying Health Care for Employees. Harvard Business Review. https://hbr.org/2017/06/why-ge-boeing-lowes-and-walmart-are-directly-buying-health-care-for-employees

10: Ibid.

11: Jay Greene. “In a first for Michigan, Henry Ford Health signs direct contract with GM.” Modern Healthcare (August 6, 2018). https://www.modernhealthcare.com/article/20180806/NEWS/180809937/in-a-first-for-michigan-henry-ford-health-signs-direct-contract-with-gm#

12: Brian L. DeVore, Ben Wilson, JJ Parsons. “Employer-Led Innovation for Healthcare Delivery and Payment Reform: Intel Corporation and Presbyterian Healthcare Services.” Intel white paper (2013). https://www.intel.com/content/dam/www/public/us/en/documents/white-papers/healthcare-presbyterian-healthcare-services-whitepaper.pdf

13: Jay Greene. “In a first for Michigan, Henry Ford Health signs direct contract with GM.” Modern Healthcare (August 6, 2018). https://www.modernhealthcare.com/article/20180806/NEWS/180809937/in-a-first-for-michigan-henry-ford-health-signs-direct-contract-with-gm#

14: IHI Triple Aim Initiative. Institute for Healthcare Improvement (last visited February 18, 2022). https://www.ihi.org/Engage/Initiatives/TripleAim/Pages/default.aspx

15: What is Patient Experience? Agency for Healthcare Research and Quality, U.S. Department of Health and Human Services (last modified June 2021). https://www.ahrq.gov/cahps/about-cahps/patient-experience/index.html

16: Quynh Chi Nguyen. “Finding Common Ground: Network Adequacy Principles.” Community Catalyst (April 21, 2016). https://www.communitycatalyst.org/resources/publications/document/Principles-for-Network-Adequacy-FINAL-4-21-16.pdf

17: Audrey Kearney, Liz Hamel, Mellisha Stokes, Mollyanne Brodie. Americans’ Challenges with Health Care Costs. Kaiser Family Foundation (KFF) (December 14, 2021). https://www. kff.org/health-costs/issue-brief/americans-challenges-with-health-care-costs

18: Role of a TPA. Health Now Administrative Services (last visited February 20, 2022). https://www.hnas.com/content/hnas/self-funding/role-of-tpa.html

19: Kev Coleman. “What Is a Third-Party Administrator (TPA)? Understanding TPA Services.” Association Health Plans (November 18, 2020). https://www.associationhealthplans.com/group-health/what-is-tpa/

Related Information

Published

April 06, 2022

Key Contacts

Key Contacts

Senior Managing Director

Downloads

Most Popular Insights

- Beyond Cost Metrics: Recognizing the True Value of Nuclear Energy

- Finally, Pundits Are Talking About Rising Consumer Loan Delinquencies

- A New Era of Medicaid Reform

- Turning Vision and Strategy Into Action: The Role of Operating Model Design

- The Hidden Risk for Data Centers That No One is Talking About